Disclosure: This post contains affiliate links and we may receive a referral fee (at no extra cost to you) if you sign up or purchase products or services mentioned. As an Amazon Associate, I earn from qualifying purchases.

Expat health insurance – the one piece of retirement unique to those living in another country.

One of the biggest struggles for folks wanting to pull the trigger on early retirement in the U.S. tends to revolve around healthcare. Unfortunately, I can’t help you with that one except to say to plan for the worse. You have to build the unknown into your FIRE number because it can be the one wildcard that can throw off anyone’s plans.

That sucks, but it’s our fault as a country for letting the healthcare industry get as powerful as it has. Unfortunately, that puts most of us in the U.S. in a tough spot where medical care costs more here than any other place in the world.

While I can’t help you with that, I can shed a little light for those that have dreamed of retiring to another country. In our case, that other country is Panama.

Our family will be moving there in the summer of 2019 and, like many countries outside of the U.S., the medical care can be both solid in quality and a fraction of what we pay here. And because of that, your options like expat health insurance can be like a pot of gold at the end of the rainbow.

The U.S. insurance system at work

My good friend Fritz at The Retirement Manifesto retired early in June of 2018 at the age of 55. He’s currently relying on COBRA for his insurance coverage for both him and his wife, Jackie. Although he has the ridiculous costs of insurance budgeted into his plan, he’s starting to get more detailed numbers for when he comes off COBRA.

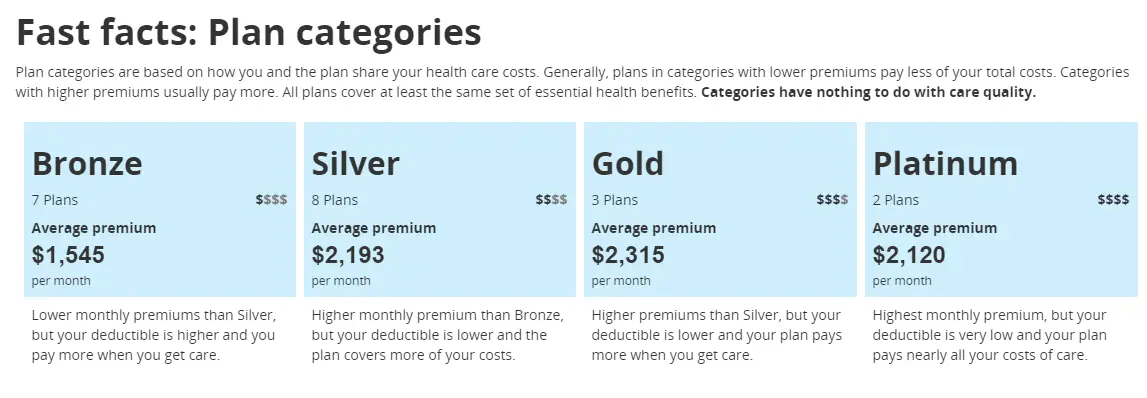

He recently posted on Facebook what the costs of insurance were looking like for 2019…

These were the numbers for what it would cost for just him and his wife through the Health Insurance Marketplace (aka HealthCare.gov). Through some extremely complex math, I was able to multiply these numbers by twelve and determine that their annual insurance costs would be between $18,540 and $27,780, depending on the plan they select. Note that the Gold plan is more expensive than the Platinum plan for some reason.

That’s a lot of dough, but it’s also, unfortunately, the way the cookie crumbles around here. This is a big reason why many folks continue at their regular jobs for years longer than they want to – their employer helps subsidize a good portion of these insurance costs.

Now, let’s not forget that there are other options. They could look at the health care sharing ministries for instance. These can be a viable alternative for many folks.

But the point is that health care isn’t as cheap as it really should be in this country so you definitely need a game plan if you’re planning to retire early.

Healthcare in Panama

You might think that the quality of healthcare in other countries wouldn’t be good. However, you might also be wrong.

There tends to be a stigma in the U.S. that we’re the best at everything and other countries pale in comparison. Nevertheless, if you’re a worldly traveler, you quickly learn that that’s not always the case.

In fact, the healthcare in a number of other countries can be just as good (and sometimes better) than what you might receive here in the U.S. Between the quality you’ll generally receive and the low costs, that’s why medical tourism exists.

I haven’t had the “opportunity” to experience medical service while in Panama. Hopefully, I’ll never have the need to go to the doctor ever again, but I’m going to guess that at some point, I’ll end up there regardless.

However, based on the conversations we had with expats living in the country, I think we’ll be in pretty good shape with the facilities and care. There are also some familiar, quality hospitals there that make me feel even more comfortable. They have a Cleveland Clinic affiliated hospital as well as a John Hopkins affiliated hospital.

No insurance – what?! Are the costs that low?

When we made our visit to Panama in 2017, we made it a recon mission. The objective wasn’t just to hang out at the beach the whole time (though we did do our fair share of that!).

No, the real mission was to learn more about what it’s like to live there. So we visited a lot of places and talked to a lot of expats. And I spent time asking those expats a lot of questions.

One of the subjects I tended to inquire about several times was healthcare. I wanted to get the scoop on what it’s really like and what the costs were.

I was actually surprised to learn that a number of expats living there don’t even have insurance. That’s right – they just pay out-of-pocket for their healthcare.

That might sound crazy at first, but for some situations, it actually makes sense. If you have no plans to leave the country and you have a solid emergency fund in place, it can be a suitable plan.

One guy told us that he had a big problem with his leg. I can’t tell you exactly what it was because I had been drinking quite a bit and don’t remember… leave me alone – I was on vacation!

But he told us that he needed to take an ambulance to the hospital for the problem. They then ran several tests on him and kept him overnight.

The next day, they told him what they thought was going on and that he needed to see a specialist. The doctor gave him the cell phone number of the specialist and told him to call to make the appointment. Yeah, you heard that right – they gave him the cell phone number of the doctor. That’s not an oddity there… imagine trying that here in the U.S.!

He went to see the specialist and they ran more tests on him. They figured out what was going on and took care of the problem.

Total cost for everything – ambulance visit, tests, overnight visit, specialist visit, more tests, and treatment… around $1,500.

Yes, you read that correctly – $1,500 out-of-pocket with no insurance! That might seem incredible, but that’s not unusual in Panama or many other countries around the world.

A typical cost for a doctor’s visit in Panama will run you about $25 – and that’s the cost (not a copay) and with no insurance in the picture. Astonishing, right?

So, that’s an option for some folks. But it still has some holes in it.

One problem with going bareback is that if you come back to the U.S. to visit and have an issue – say a car accident – you’re in some real trouble. It definitely ain’t gonna run you $1,500 with no insurance here! You’ll probably be in even more dire straits after you have a heart attack from looking at your bill from the accident!

Expat health insurance to the rescue!

So, here’s something pretty cool. There are a number of health insurance companies that offer another kind of insurance – expat health insurance.

First off, if you’re unfamiliar with the term expat (I wasn’t until a couple of years ago), it’s short for expatriate. An expat is someone that’s living in a country (either temporarily or permanently) other than his or her native country.

So when it comes to expat health insurance, that’s good for the insurance companies. The reason is that if you planning on living in another country, the cost of your medical care will likely be a lot cheaper than it would be here in the U.S.

Because of that, they offer cheaper prices for health insurance – significantly cheaper! And that’s great for you as an expat!

Cigna seems to be one of the go-to companies that expats tend to gravitate toward. When I submitted a quote online for their expat health insurance, here’s basically what I received:

These prices obviously are much nicer to look at than the ACA prices Fritz got, but then I dug a little more into it. I realized one very important detail… the area of coverage was listed as “WorldWide Excluding USA.”

Hmm, that’s a big problem. With us planning to come back periodically to the U.S. to visit, particularly, in that first year before we get our Visas, we need to make sure we’re covered in the U.S. as well.

So I called and talked to them. They do offer coverage that includes the U.S. as well, but the catch is that you’re only covered in the U.S. for 180 days of the year. And those days can be used however you want throughout the year.

This seemed a little weird to me. They don’t require any proof (like a Visa) that you’re living in another country. Why wouldn’t folks just look at this as an option instead of the ACA? How often do you need 180 days of healthcare per year… is this some loophole I just discovered?

If you’re looking for some healthcare options as an early retiree, maybe this is worth digging into a little more.

Regardless, I got the hookup on some updated pricing. It seemed like we would most likely be looking at their Gold or Platinum plans, so I’ll give you an idea of what we’re talking about on those.

The Gold plan would run us $590.17 per month for the three of us. The Platinum plan would be $776.55 per month.

So our annual costs would be between $7,082.04 and $9,318.60.

Yeah, that’s right…

The cost of insurance for all three of us is $18,461.40 cheaper per year for the Gold plan than it would be for Fritz and Jackie. And it would be $16,121.40 cheaper per year for the Platinum plan – it’s funny that the Platinum plan is cheaper for them than the Gold plan.

And sure, there are other variables that come into play – the levels of the plans likely have some differences in them in deductibles and coverage. Then, there’s the difference in our ages and other possible factors, but the point is that it’s still a shocking variance nonetheless.

Living in a country outside of the U.S. can have a dramatic effect on your healthcare costs.

Another option

I’m a big fan of Jackie from Panama Relocation Tours. She’s lived in Panama for close to a decade now and runs a company that gives tours of the country to folks considering moving and possibly retiring there.

We might have signed up for one of her tours, but I only found out about her after we had already booked our trip. Funny enough, we had unknowingly mapped out a course throughout the country similar to her tour. Then we actually met her in Nueva Gorgona and, funny enough, ran into her again a few days later across the country in Boquete… how’s that for strange?

Even though we already have our plans in place, I still listen to her Q&A conference calls on a regular basis. I’ve even chimed in and asked a few questions on some things I wanted some clarification on.

On her most recent call, she talked about expat health insurance, but she also talked about an alternative – Pan-American Life. They offer an interesting medical reimbursement plan that covers 85% of your costs. There’s no deductible and they even cover pre-existing conditions (after the first year).

She mentions on an old post of hers (it’s a couple of years old now) that a 68-year-old woman she knows moved to Boquete and was paying only $82 a month for the plan. This can be an interesting idea for those looking to stay in Panama or one of the other twenty or so countries they list on their site.

As a disclaimer, I haven’t dug into the Pan-American plans. I’m going strictly off what Jackie was saying and thought it was worth mentioning for those who want to investigate it further.

Our plan

Starting in January when I leave my job, we’ll be switching to Liberty HealthShare to cover us for the seven months while we’re still here in the States.

However, when we fly to Panama in August of 2018, we’ll be switching over to expat health insurance – most likely the Cigna coverage I talked about earlier. I like the idea of having coverage wherever we’re located.

I think the odds are in our favor that we wouldn’t have health problems while we’re in the States or something that can’t wait until we get back to Panama. But, let’s be honest – @#$% happens. If we’re in the States visiting for a short bit of time and a serious accident happens, that could really put us up a creek. I want to have some insurance in place just in case.

As an added bonus, the expat health insurance will cover us wherever we’re at in the world. So if we decide to head to St. Maarten for a few months down the line (we actually just talked about that!), we’re still good on our health coverage.

In about nine more months, we’ll be on our way to Panama. Too bad we have to think about all the stupid details like health insurance. But I guess we’ll have time to focus on the fun once we get there!

UPDATE 11/15/18: Jackie from Panama Relocation Tours reached out to me on this post with some good info. She let me know that Cigna is can be one of the most expensive companies for expat health insurance. To think I was already happy with the prices I was seeing!

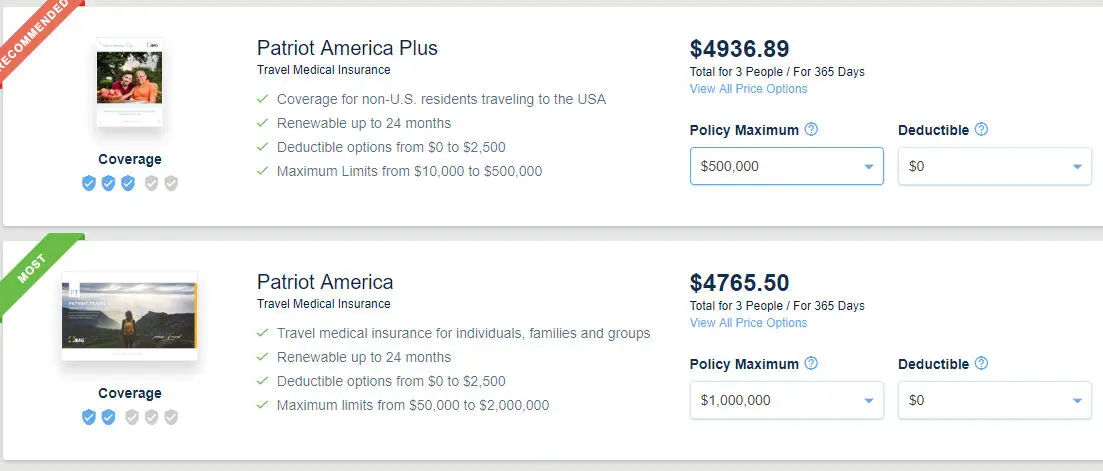

She recommended going to https://www.imglobal.com/ for better pricing and let me know that this is actually United Healthcare. Just running our family through a quick quote with them, here are the numbers I’m seeing for us for a year:

So, yeah, these costs are dramatically less expensive for sure. These also include the option for coverage in the U.S. and a deductible of $0! I’ll have to dig into the coverage of all of the providers, but it’s crazy how much cheaper healthcare is outside of the U.S.

Do you think the cost of healthcare in the U.S. makes the idea of retiring to another country more appealing?

Thanks for reading!!

— Jim

Thanks for sharing! This was something that seemed really overwhelming when we were talking about spending 9 months in Costa Rica!

It’s interesting to see some of the options available if you start digging into it. Expat health insurance seems to be a really good option for folks planning on going to another country if they plan to come back and forth to the U.S. Cigna offers an evacuation rider that will cover you in an instance where you need to be transported to another country for treatment if something isn’t available in the country you’re in. They then cover getting you back into the country you’re living or back to the U.S. It was an extra $50/mo. but could be worth it if it gives some peace of mind.

— Jim

This is the most informative post on health care coverage options (other than health sharing ministries) that I have read. As a physician, I do not trust that health sharing ministries will come through when a health crisis comes to fruition…think cancer and major car accident, etc. Loopholes galore! I would need to read more about the details of what is and isn’t covered by this expat “plus” stateside insurance, but it certainly is intriguing. Great post!

Thanks, Kristin – much appreciated! Yeah, I didn’t want to go into the pros and cons of health sharing ministries with this post, but that’s probably a good post for a later date. 🙂

— Jim

You just HAD to multiply that by 12, didn’t you Jim. Ouch.

We’ll definitely be looking at health sharing ministries when my COBRA expires. One concern I have, what if you come down with something major while on health share (e.g,. Cancer)? If the health share decides to decline coverage (something they’re free to do), are your ACA options (or ExPat insurance, in your case) limited by a pre-existing condition?

Your plan sounds solid. Almost makes me want to move to Panama…. 🙂

Good question, Fritz – here’s what Cigna says in their FAQs:

Will pre-existing conditions be covered by my plan?

If you’ve sought advice or experienced symptoms before the start date of your plan – whether you have been diagnosed or not – we may decide to add special exclusions to your plan. So it’s important that you complete the medical questionnaire as accurately as possible when applying.

In other words, if that should happen, we’d need to figure out our best strategy at that point. But most likely, we’d head to Panama anyway and leverage the inexpensive medical care there even without the insurance. We’d probably have to get our Visas right off the rip though so we wouldn’t be forced to leave the country every 180 days, which wouldn’t be a big deal.

— Jim

Hmmmm….. I wonder if that is a loophole with that Cigna plan? Looks very interesting, there’s got to be a catch or you think someone would have figured that out and told the world. Or maybe you just did 😉

You heard it here first, folks! 🙂

Yeah, I’m not sure what the catch is – maybe if you have something where you’re going to need more than 180 days a year of medical treatment, you could be up a creek. Or maybe there’s more to it. Either way, I just found that to be pretty interesting.

— Jim

Thanks for the info. We plan to live abroad for a few years at some point so this is very relevant. My wife needs coverage so we can put her on the expat plan. I’m pretty good so I probably can pay as I go. Your plan sounds good.

I never thought about the idea of only doing coverage for those in the family that maybe have some health issues and then just paying out of pocket for anyone else. That could be a good option for some situations like yours!

— Jim

Fascinating! I do this stuff for a living and we are always looking for new options. I’ve directed a lot of people to traveler’s insurance but haven’t had the need to study expat insurance. Thanks for the valuable information. I am fairly certain there is some kind of provision to prevent someone from buying it while living in the US but I’d love to be proven wrong. As a broker, we have a relationship with Cigna so maybe I’ll dig…

I find medical tourism very intriguing. On a small scale, we teach our clients how to take a tourist trip from the hospital to a stand-alone imaging center and pay a fraction of the cost for big tests. 😉

I forgot that insurance is the fun stuff you deal with, Deanna. I just updated this post with some information I got from Jackie last night. She was telling me that Cigna is actually one of the more expensive providers out there.

It is insane how you can pay for the costs of leaving a country and staying there for a week to get the same medical treatment and it can still cost a ridiculous amount less than it would here in the U.S. 🙂

— Jim

It’s super crazy!!

I will read your edits.

The one thing I noticed by your sample Cigna quote – as I have gone through the same activity with the Cigna plans – is that the quote you shared, I believe, only includes in-patient coverage. Cigna breaks out their outpatient coverage and preventive care options as adders to the core policy that you are choosing. It won’t be an issue for you when you are in Panama as you will pay outpatient or preventative care out of pocket (cash). However, if you are in the US, it may be an issue if you have an outpatient illness. Just some food for thought.

Additionally, I was also wondering about the “proof” that Cigna maybe looking for in the context of their 180 day limit in the US. I have spoken with them as well and received the same answer as you so that is good from a consistency perspective. I expect, as you mentioned, they don’t worry about it unless you have a protracted illness that causes you to be in the US for more than 180 days of care. My wife and I are right in the middle of deciding if we want to live outside the US for 180 days per year in order to take advantage of the international health insurance options – I would rather do that than pay the crazy ACA premiums. We will see.

Nice catch on the inpatient coverage, Dave, and you’re right that it would come into play more in the U.S. than Panama. I’ll have to consider that point more. That also might be part of the reason why they’re not as worried about people living in the U.S. just trying to use that as their regular coverage.

Good luck on figuring out your game plan!

— Jim

At some point I think the cost of health insurance in the US will be fixed, but it’s going to take some significant legislation to do that. Given the current political environment that could take awhile.

Living outside the US to save on medical costs has definitely been an option on my mind the last couple of years. Liberty Healthshares is our working plan if we end up staying in the U.S.

Even though the health sharing ministries aren’t a perfect solution, at least they’re a viable option until things get fixed here. I’m with you that it’ll probably get rectified at some point, but not any time in the near future, unfortunately.

— Jim

I’ve been researching US healthcare alternatives since rates started skyrocketing last year. Our rate for a family of four will be over $2000 a month this year and that’s for a $14,000 deductible with CIGNA in Virginia. The policy itself actually similar to the CIGNA international plan you described except you get 365 days of US coverage instead of 180 days of US coverage with International. So I was thinking what if I could hack this. Purchase the CIGNA plan at $575/mo and then supplement it with something like Liberty Health share. The reason I would need Liberty Health Share at all is that we are in the US for over 10 months per year. Based on the quotes I got last year the two plans combined CIGNA Silver international at $542 a month family of four and Liberty Health Share Complete at $550/month. The reason I would like CIGNA is for access to their US hospital network to cover major illnesses on a traditional plan that is fully deductible for small business. We can have two plans save 45% and be covered both internationally and in the US with full catastrophic protection. Does that sound crazy?

I could put that thousand hour month savings towards a real Mexican address.

I like the idea of exploring different possibilities, but I think one concern would be the question of whether Cigna or another expat insurance actually checks if you’re out of the country for 180 days. Cigna told me no, but I haven’t gone down the path yet to know if that’s true or not. You might be paving the way for the rest of us! 🙂

— Jim

Thanks for sharing! I left my job almost 2 years ago and have been enrolled in Cobra from my old employer. In New York state you can keep Cobra for 3 years, so I have 13 months to go – VERY expensive. When that ends, it coincides with our empty nest and plans to travel much more, with a good part of it outside the country (partially at our own vacation rental in Costa Rica!), so we’ll be digging deeper into this same sort of thing in the next year…

I’ve heard that COBRA’s extremely expensive – just out of curiosity, have you dug into the health sharing ministries or even the ACA for the time being? I would think both would cheaper or is there something keeping you from going that route?

Congrats on leaving the job 2 years ago – that’s fantastic!

— Jim

We were going to go ACA, and while the premiums were much less, they were still expensive and with high deductibles (paying the deductibles over the year essentially made the cost equivalent to my Cobra), but very restrictive in which doctors take them. Around the same time I started dealing with a health issue and decided to go Cobra so I could continue to see my doctors and anyone they referred me to.

Makes total sense, Scott! Have a great Thanksgiving!

— Jim

People here in the USA are afraid of the quality of doctors and hospitals in other countries if they have not traveled much. But realistically, the majority of doctors, at least here in California, are foreign. I’ve also heard stories that many countries actually have superior care to ours at a fraction of the cost. It will interesting to follow your story as you settle in over there and live and learn. Thanks for a great post.

That’s a great point, Susan – I’ll definitely post about my experiences as we start to utilize any facilities down there!

— Jim

Is the main reason for having the Expat Health Insurance for coverage when you are outside of Panama? Say when on vacation to US? If so, would buying travel health insurance for the vacation time period be a cheaper viable option? Or buying a short term medical plan (ie ehealthinsurance shows a bunch). Ive often bought the travel health insurance while living in the US for use on vacations outside of the US.

Hi Riley – I haven’t dug into that option. I like the idea and I’ll look to see if that’s a viable option next year. For this year, since we don’t have residency, we’ll be bouncing back and forth to the U.S. quite a bit. For whatever reason, I feel a little more comfortable with the expat insurance right now. Plus, if something long-term like cancer should happen, we’ll be glad we have that coverage even in Panama.