Disclosure: This page contains affiliate links and we may receive a referral fee (at no extra cost to you) if you sign up or purchase products or services mentioned. As an Amazon Associate, I earn from qualifying purchases.

I thought it would be good to have a place to point out some of the resources and tools that I’ve found to be both impressive and considerably helpful to me. I hope that you’ll find them useful in your life as well!

Tools and resources I use and love

Financial Tools

Empower (formerly Personal Capital)

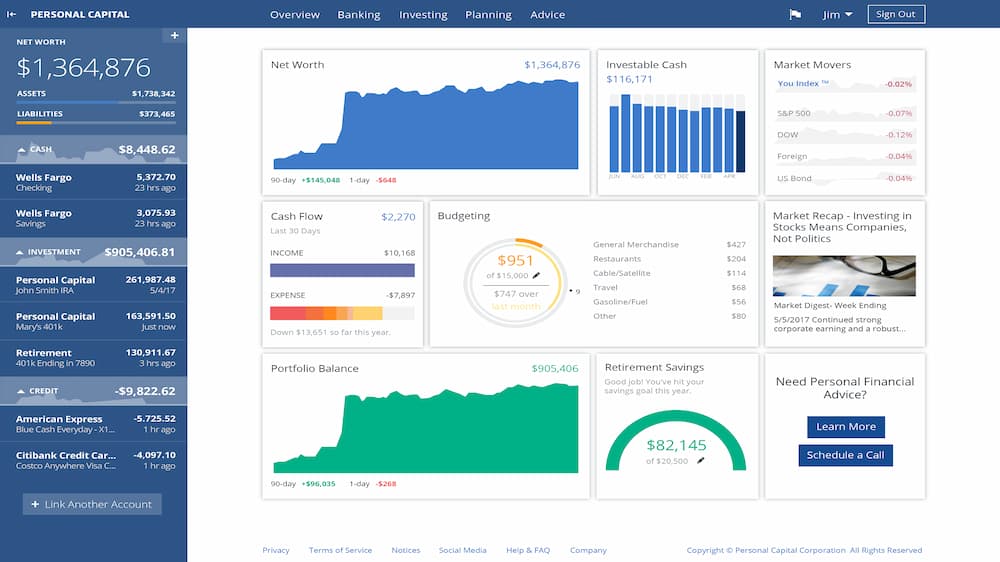

Without a doubt, Empower (formerly Personal Capital) has been the best app to help me manage my investments in one place. If you’re unfamiliar, Empower is a free account aggregator with some amazing tools to boot.

You connect all your banking, credit card, and brokerage accounts to it and then just let it do its magic. You can now see at a glance everything in your accounts, your net worth, asset allocations, and more.

The Retirement Planner tool is fantastic and the Retirement Fee Analyzer easily saved me over $50,000. And being able to see my asset allocation aggregated together has made re-balancing my portfolio so much easier.

Empower is a free tool and one of the most useful I have for managing my investments. If you’re not using this for yours, you’re missing out on something great.

Sign up for Empower here: https://www.routetoretire.com/go/empower

Be aware that they might contact you for a free advisory session. You’re welcome to take them up on that offer or you can politely decline and still continue to use their awesome app.

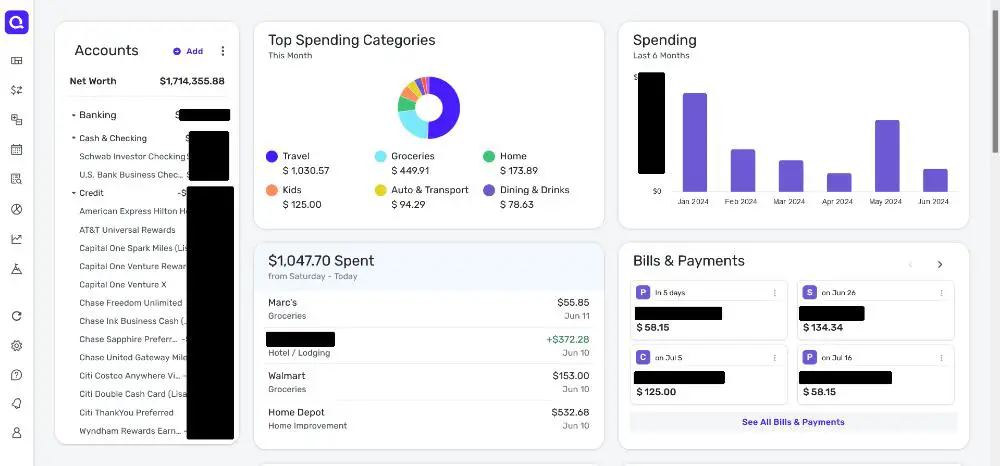

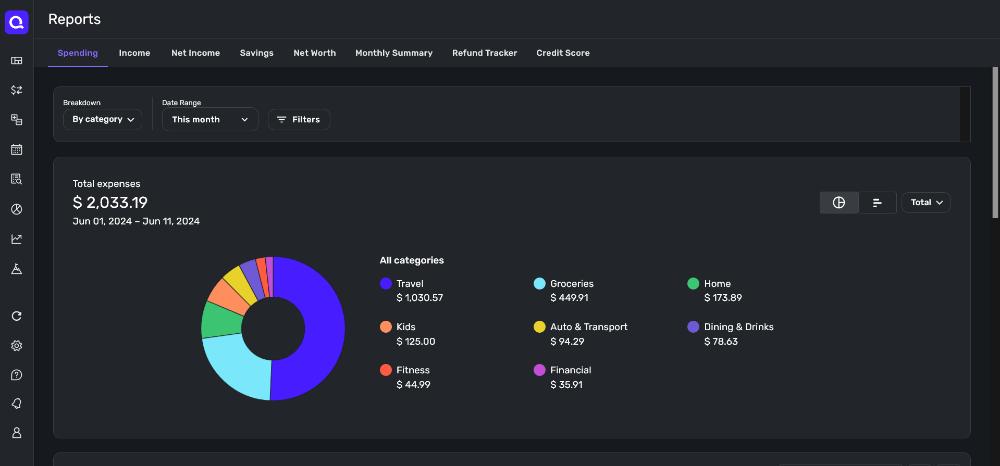

Quicken Simplifi

I was a dedicated Quicken (now called “Quicken Classic”) user for 20 years! But I also spent way too much time with my nose in my laptop. I wanted something a little simpler that I could use from the web or on my phone without needing to be sitting in front of a particular computer.

I tried several different programs, but in the end, Quicken Simplifi turned out to be the right answer for me. It’s actually much more powerful than I thought I was looking for but still impressively easy to work with.

Sure, it takes some time to get all your accounts linked up (like it would with any personal finance software), but after some initial setup, this works great. I now spend less than 5 minutes every evening usually on my phone just checking and clearing transactions that have posted… that’s beautiful! And then, at the beginning of each month, I check my spending for the previous month just to see how we did.

It’s easy, the reporting is great, and it works extremely well. In case you haven’t guessed, I’ve been extremely satisfied with this one. You can read more about how I found my way to Quicken Simplifi here.

Check out Quicken Simplifi (and Quicken Classic) here: https://www.routetoretire.com/go/simplifi

Fastmail

If you’re not paying for the product, you are the product. I’ve heard that a million times over the years, but it didn’t bother me… until recently. Learning how far Google goes into learning everything about you finally got to me. Learning that their AI is now scanning your email and that engineers can review this information as needed was just too much.

So I left.

After digging into and trying a lot of services to replace email, calendar, and contacts services for me, my wife, and our daughter, I decided on Fastmail. I moved us over to their services at the end of 2024. I have to tell you – I thought it would be a difficult transition and that there would be some things I would miss… I haven’t at all. I’m so happy that we’ve moved over and wish we had done this sooner.

You can read more about my thoughts on the Fastmail service in my post Privacy and Security: The Essential Guide to Reclaiming Your Digital Life.

Try Fastmail here: https://www.routetoretire.com/go/fastmail

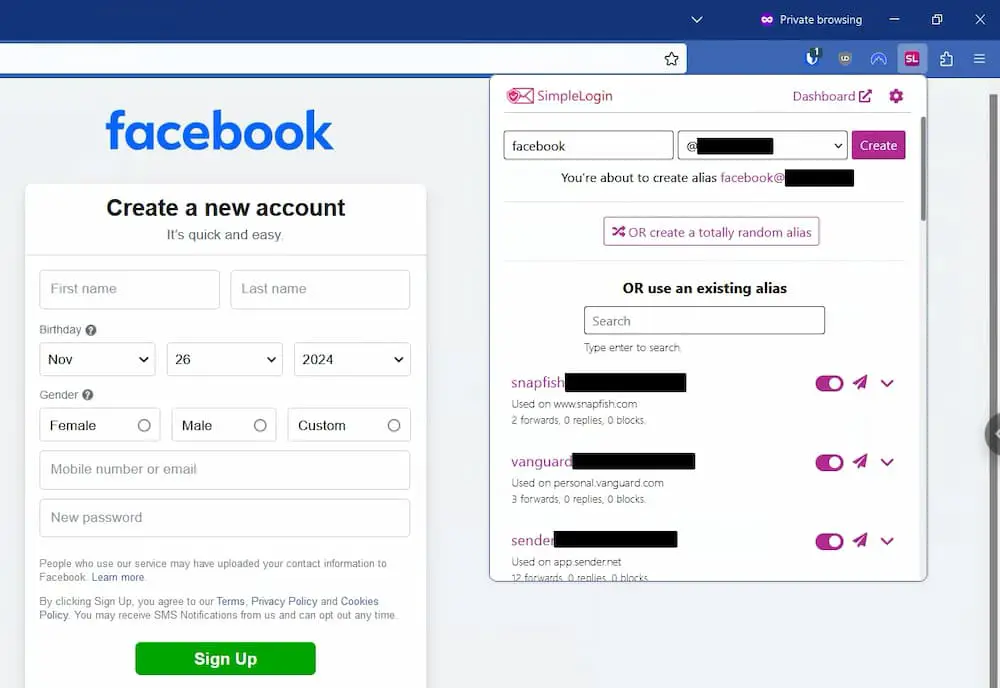

SimpleLogin

Similar to switching from Gmail to Fastmail, I wanted a better way to maintain privacy and also to help eliminate spam (yes, it’s possible, people!). The answer was to use email aliases. I actually use a different email alias with every single service I use. That way, if the company sells off my email address or I start getting spam on it, I just delete the alias and life is good again.

If you switch to a service like Fastmail, they provide you with the ability to spin off email aliases easily. I take it a step further, though, and use SimpleLogin. This gives me a lot more control over generating the aliases on the fly and works amazingly well. Throw in that it’s also open source and based in Switzerland, and that’s a winner in my book.

You can read more about how I use SimpleLogin and aliases in my post Privacy and Security: The Essential Guide to Reclaiming Your Digital Life.

Try SimpleLogin here: https://www.routetoretire.com/go/simplelogin

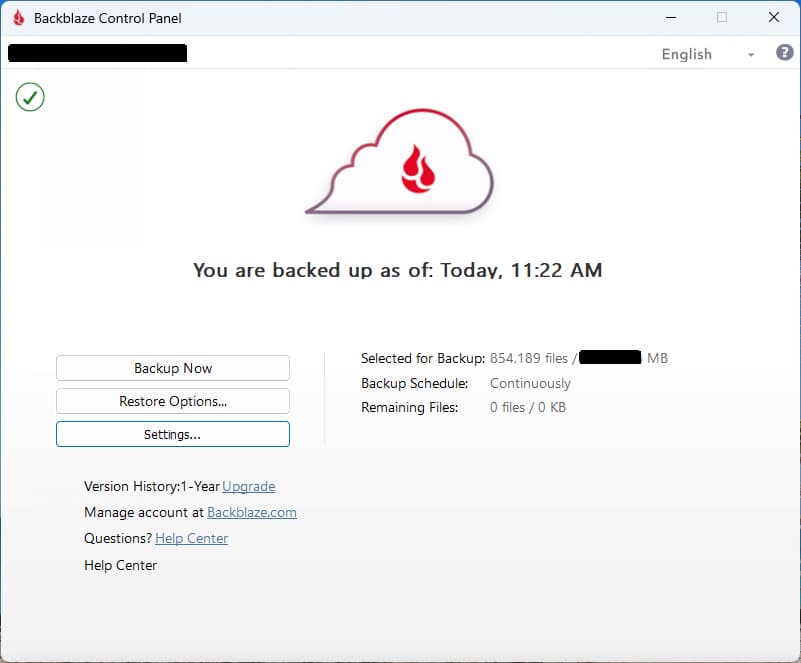

Backup software

In some of the early days of personal computing (I started as a Systems Engineer in 1999), backing up data on your computer was tedious and not great. You could copy files to an Iomega Zip drive periodically and hope nothing happened to your Zip drive at the same time as your hard drive died. If your home went up in flames and you had them both there, you were just up a creek.

Plus, it was clunky, and you needed to connect it up anytime you wanted to back up files. Let’s be honest, most people would do that once a month – if that!

Times have changed and I think cloud backups are the best thing since sliced bread. I’ve been using Backbaze since around 2017. The software is fantastic and one of the best deals around! Here’s what I love:

- Securely backs up your data to encrypted storage across the internet – eliminates the concerns about having your backup in the same place as your computer

- Automatic backups for computers & external drives – it just runs in the background, ensuring you’re always up-to-date on files. Plus, it saves different versions so you can restore files from different timelines.

- Unlimited backup, file size, and speed – yup, unlimited – no worries about staying under a certain limit. You also don’t get limited on the size of files that can be backed up.

- Always secure and encrypted – some folks are concerned about backing up to “the cloud,” but you can be the only one holding the keys to decrypting your data, which should alleviate that worry.

- Restoring data is easy – You can easily download the files you need to restore from their website. Or, if you need to restore a lot of data and don’t have a great internet connection, you can order a USB drive with your data to be shipped to you and then ship it back to them once done to get your money back.

- Windows or Mac – whether you’re a Windows or Mac user, you’re covered (sorry, Linux users! 🙁).

Anyway, I just can’t express to you how valuable Backblaze has been for me. You don’t think you need it until you do. It’s simple and easy to use, and it works amazingly well. And it’s ridiculously inexpensive to be able to back up unlimited data making it a real steal.

Try it out for free and I bet you’ll agree!

Try Backblaze here: https://www.routetoretire.com/go/backblaze

The importance of a VPN

One of the first things I did when we moved to Panama was to invest in a VPN service.

A VPN is an easy-to-use software app that masks your internet traffic from your ISP through encryption. It also tunnels you to another location in the world, which for all intents and purposes makes it seem as if you are in that location.

Because of the encryption, it keeps your ISP or other prying eyes from spying on your traffic (and possibly your usernames, passwords, credit card info, etc.). Ever connect to an open WiFi access point at a cafe, store, hotel, or airport? Yeah, that’s just asking for problems unless you have a VPN running to protect yourself.

And for travelers and folks living in other countries, it’s fantastic to help you get around geographic restrictions when streaming movies and shows. Without it, you probably won’t have access to the same Netflix or Amazon media you’d have in your home country. And with some streaming services, you won’t have access at all.

VPN services are inexpensive and help provide peace of mind. They have apps for computers, routers, cell phones, and more. Even though we’re back in the U.S., still use a VPN for the security and privacy side of things.

NordVPN

I spent a lot of time comparing the different VPN services and I went with NordVPN though there was a close contender which I’ll mention shortly.

NordVPN worked wonderfully for us as I discuss in my post, How We Use a VPN for Streaming & More While Abroad. Being able to just toggle it on and off as needed is great and we’re able to use it on all our devices.

If you’re not using a VPN for protection on the internet or while traveling, you’ll want to check out NordVPN.

Get NordVPN here: https://www.routetoretire.com/go/nordvpn

ExpressVPN

Whenever you hear folks talking about VPNs, both NordVPN and ExpressVPN tend to rise to the top as the most popular. And for good reason, too, as they both are excellent options in regards to security, the number of available servers across the world, and that they’re both extremely easy to use.

Although I chose NordVPN, I could have easily gone with ExpressVPN. It’s another great choice for a VPN service.

I’d recommend that you look at both options and ensure that they provide any specific features you might want. If they both seem to fit the bill, see which one is less expensive. They both offer some great deals almost all the time, so you should be able to get one of these at a great price.

Get ExpressVPN here: https://www.routetoretire.com/go/expressvpn

International Travel eSIMs

When traveling out of the country, you have a few options for your cell phone:

- If you have a service like Google FI or certain T-Mobile plans, you might automatically have coverage in other countries… nice!

- You can buy a local SIM card when you get to your destination – probably for pretty cheap. However, that means you’re without cell coverage until you find a place to get that.

- Your cell phone provider might offer international coverage… usually for a price, which might be a little pricey for more than a few days.

- You could skip coverage altogether and rely on public WiFi. However, you won’t have coverage when you’re out and about.

- Get an international travel eSIM.

These are all valid options and you need to find the right option for yourself. When we lived in Panama and continue to visit there, we just buy a local SIM card. We know where to go, we know the cost, and it’s easy for us because we know the area.

But for other trips, like our big 38-day trip to Europe, where we don’t know what to expect, I like to make life easy… and cheap. So the international travel eSIM fits the bill perfectly.

You can buy it online before your trip, choose the duration you need and how much data you want, and even activate it before you leave. Almost all modern phones support eSIM technology so you don’t even need to install anything on your phone. You scan a QR code after your purchase and you’re ready to go. Once you get into the country you’re visiting, it will hit the towers there and you’re rocking and rolling.

After a lot of research, the three I would recommend are:

- Airalo

- Saily

- aloSIM

They all cost roughly the same amount and have slight differences depending on your needs. Take a look at all of them to see which service would be best for your next international trip. Bear in mind, that these SIMs focus on data – you’re regular phone number won’t work elsewhere (unless you use a VOIP service like Google Voice). So phone calls back home would need to be done via services like WhatsApp, Signal, or Facebook Messenger.

Check our Airalo here: https://www.routetoretire.com/go/airalo

Check our Saily here: https://www.routetoretire.com/go/saily

Check our aloSIM here: https://www.routetoretire.com/go/alosim

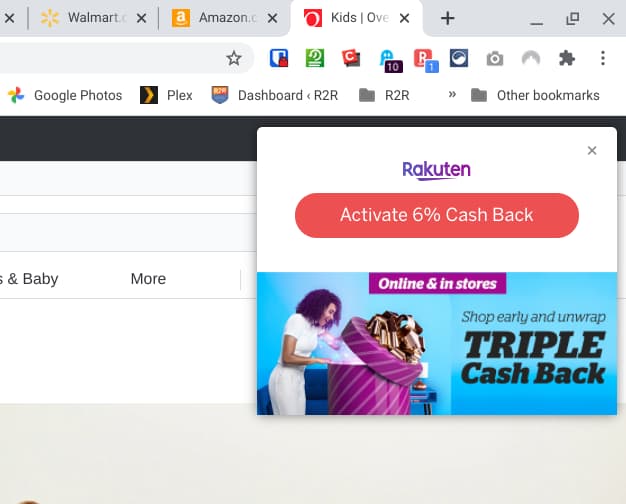

Rakuten

If you like free money, it’s hard to go wrong with Rakuten!

Formerly known as Ebates, Rakuten is a simple and free browser extension available for Chrome, Safari, Firefox, Edge, Brave, etc. It just sits in the background until you start shopping at one of the thousands of supported shopping sites. When you’re on one of those, it’ll let you know to activate it…

Click the button and you’re done. Make your purchase and Rakuten shares a piece of referral revenue with you. Easy, right?

As a bonus, when you go to check out, it’ll also prompt you to have it check for applicable coupon codes. Click it then and it’ll try different codes to try to get you additional discounts, free shipping, etc.

If you shop online, there’s no doubt you should have the Rakuten extension installed. It’s hard to beat free money for nothing!

Sign up for Rakuten free here: https://www.routetoretire.com/go/rakuten

Excellent books you need to read!

Rich Dad, Poor Dad

Without a doubt, Robert Kiyosaki changed my thinking on money more than anyone else. Although not the first book I read from him, this is the defining book of his career. Critics are quick to complain that it’s not a step-by-step guide, but the key is the understanding of concepts such as buying assets instead of liabilities. I highly recommend you read (or re-read) this book to put your mind on the right track.

Amazon link: Rich Dad, Poor Dad

The Simple Path to Wealth

If the stock market is just one big, random guess of what to buy, you need this book. Somehow JL was able to write a book that is wonderfully easy to understand, yet provides such an eye-opener on the stock market.

Quit trying to beat the stock market. You’re extremely unlikely to do it consistently and you’ll likely pay enough in fees to wipe out your gains. Instead, look at buying the whole market and investing in low-cost index funds. It’s truly the simple path to wealth.

Amazon link: The Simple Path to Wealth

The Bogleheads’ Guide to Investing

Once I finished this book, I thought, “Man, do I wish I had this book when I first started investing. This would have saved me tens to hundreds of thousands of dollars easily!”

This book’s a little more advanced than JL’s “The Simple Path to Wealth.” And you might even be done and happy after reading that book. But if you want to go deeper into some other areas of the stock market, this book’s absolutely worth the read. Even if you’re an experienced investor, you’d find some good information in it.

Amazon link: The Bogleheads’ Guide to Investing

The F.I.R.E. Planner

This is a great book for those new to the FIRE (financial independence / retire early) community. Michael takes you through what FIRE is, how to get there, and what to do once you’re there. It’s not too complex to read but he still does a nice job in guiding you through so many different areas.

You can check out my full review here: The FIRE Planner – A Solid Start in the Quest for FI

Amazon link: The F.I.R.E. Planner

How To Engineer Your Layoff

Sam Dogen found an interesting niche with this book. If you’re a good employee looking to move on to either another company or to retire, you should definitely consider this book.

It’s not cheap, but you could easily find your way into some big money in a severance package if you play your cards right. I wish I had used the strategies in this book when I retire – I hate to think about the money I left on the table!

You can check out my full review here: Get Paid to Get Laid Off – How to Engineer Your Layoff

Amazon link: How To Engineer Your Layoff

The Millionaire Next Door

I heard this book mentioned over and over but was a little late to the game in finally reading it. It’s a great book and very interesting.

The gist of this is that a very large number of millionaires were extensively surveyed to determine trends. The results would probably surprise some people. The things we typically picture as millionaires (big houses, fancy cars, etc.) are not the way most millionaires live. It’s the folks who don’t have the big money who are generally living that way.

It’s truly an interesting read and might help you rethink some of the direction of your own life.

Amazon link: The Millionaire Next Door

Choose FI: Your Blueprint to Financial Independence

This might be the most thorough book on working your way to financial independence I’ve ever read. You’ll find great information on how to get started, spend less, earn more, invest better, and how to enjoy the journey.

Anyone on the path to FI should read this book.

You can check out my full review here: Choose FI: Your Blueprint to Financial Independence

Amazon link: Choose FI: Your Blueprint to Financial Independence

The Psychology of Money

This book was truly fascinating. And for a book that doesn’t deal specifically with the numbers side of the equation so much, it’s interesting to me that I consider this to be one of the best money books I’ve read.

Housel does a fantastic job of helping you to understand the “why” side of financial decisions. He makes you realize that there’s a lot more to personal finance than what we perceive. We only know what we know and fill in the blanks from there.

I loved this book… a great read!

You can check out my review here: One of the Best Money Books I’ve Ever Read

Amazon link: Choose FI: Your Blueprint to Financial Independence

Your Money or Your Life

I heard a lot about this book once I became a little more engrossed in the FIRE community. People love this book.

It was written by Vicki Robin with the original edition being published in 1992, well before the FIRE movement. The book aims to change how you think about money and what your time is worth. The goal is to help you get out of any debt you might be in and work your way to financial independence.

It’s not your typical get-rich book though. The idea is to separate your life from your work so you can find happiness.

I wasn’t as blown away by this book as a lot of folks are, but it was an interesting read nonetheless. Check it out and see what you think.

Amazon link: Your Money or Your Life

Rich Dad’s CASHFLOW Quadrant

Another Robert Kiyosaki book? That’s right and a darn good one!

This book helps you to understand why employees or small business owners get crushed from every angle and large business owners and investors have all the advantages. Realizing these differences may help motivate you to move to the right side of the quadrant where you can work less, earn more, and pay less in taxes.

This is a fantastic book!

Amazon link: Rich Dad’s CASHFLOW Quadrant

The Automatic Millionaire

Have you ever heard the phrase “pay yourself first”? That’s what this book by David Bach is all about. I received a copy of this at a FinCon conference several ago and loved it.

He points you into doing exactly what I had ended up doing with our finances – everything was automated. Money goes into different accounts (banks/brokerage) as you get paid. You pay your bills and what’s left is yours to enjoy. Once set up, you’re now paying yourself first and you’ll be a millionaire before you know it!

Amazon link: The Automatic Millionaire

Keys to a Successful Retirement

Ok, you’re getting closer to retiring… now what?

That’s where Fritz Gilbert’s book comes into play. This is a realistic guide to help you prepare for a lot of the non-money factors of retirement (though he does address some of those as well).

What will you do in retirement, how will you stay fit, or handle healthcare?

Then there are the mental effects – are you prepared for the challenges that await?

There are many money books out there to help guide you to financial independence. However, there aren’t as many ready to help take you through what to do as you get closer and actually reach it. This book can help.

Amazon link: Keys to a Successful Retirement

Estate Planning 101

One of the headaches that comes with growing up is that you need to start getting all your affairs in order. Unfortunately, it’s highly unlikely you’ll know when death is going to come a-knocking. Hopefully, it’s many years from now, but you just never know.

Because of that, you need to start planning for the worst. This can be a little bit of a headache to do, but if you want to ensure that your wishes are followed, you need to take action. Structuring your affairs in certain ways can also help you avoid probate, which is something you don’t want your loved ones to have to go through.

Between health directives and powers of attorney should you become incapacitated, to wills, trusts, and more, there is a lot of planning involved. Don’t put this off – this is extremely important!

“Estate Planning 101” is a great book to help guide you through what will be necessary to get your affairs in order. I wrote more about our planning as well as this book in my post, Estate Planning 101 – Getting Your Affairs in Order.

Amazon link: Estate Planning 101

The Purpose Code: How to Unlock Meaning, Maximize Happiness, and Leave a Lasting Legacy

This was the second book written by my friend, Jordan Grumet. His first book, “Taking Stock“, was really good and gave a unique perspective on the path to financial independence.

“The Purpose Code”, however, was on a different level. One of the things that I was struggling with was defining purpose in my life. I felt I should be doing something grand but couldn’t figure out what it was. Apparently, I’m not alone in that struggle.

But Jordan was able to help define this struggle better as well as why it’s so hard to overcome. But the real meat of the book is redefining what “purpose” really is. I had read a lot of books on this subject previously, but Jordan’s book is the only one that helped me. This was an excellent read that I’d recommend to anyone feeling lost in their quest to find their purpose.

You can read more of my thoughts on this book in my post, 2 Helpful Books That Are Great in Completely Different Ways.

Amazon link: The Purpose Code: How to Unlock Meaning, Maximize Happiness, and Leave a Lasting Legacy

Atomic Habits: An Easy & Proven Way to Build Good Habits & Break Bad Ones

Though not directly a personal finance book, James Clear’s Atomic Habits is a fantastic book that can help you build better financial habits among other things.

Usually, these sorts of books have a lot of hype and then up being all fluff and a big letdown. Atomic Habits though is not like that – it’s got a ton of great takeaways and instruction. Throw in that it’s a great read with some cool stories and this book should be on everyone’s reading list.

You can read my thoughts on Clear’s book in my post, Atomic Habits – The Powerful Keys to Making Changes That Stick.

Amazon link: Atomic Habits: An Easy & Proven Way to Build Good Habits & Break Bad Ones

Wool

I can’t just list all personal finance types of books… we need something a little more fun!

I stumbled across “Wool” when it first came out. I wasn’t even a big science fiction fan… but I was blown away. This book is awesome!

If you’re looking for something fun to read, check this one out. The best part is that it’s the first in a 3-part series (called the “Silo” series): “Wool”, then “Shift”, and then “Dust” – they’re all fantastic!

Amazon links: Wool, Shift, and Dust

Killing Floor (and the rest of the Jack Reacher book series)

“Killing Floor” is the first book of the Jack Reacher book series. There are a lot of books in this series – we’re talking around 30 books plus a bunch of short stories and novellas.

The series was recommended by some good friends of mine and I’m hooked. I keep churning through these books and will likely be done with them soon. They’re fantastic.

They follow an ex-military major (Jack Reacher) who now just wanders as a drifter… and, of course, he always seems to find trouble. Extremely well-written – the books just suck you into the world. I wrote more about the series in my post, 2 Helpful Books That Are Great in Completely Different Ways.

As a bonus, the “Reacher” TV series on Amazon is awesome, too, and worth checking out.

Amazon links: Killing Floor (Book 1) or see the whole series here

Personal finance sites I enjoy

❖ Retire by 40 – This is a blog from a guy named Joe who I credit for waking me up to the reality of early retirement. I found his site a few years after my daughter was born and I hated having to go to work instead of being with her. I found a lot of similarities in his path in life with mine and realized that FIRE was indeed possible. His posts are very thought-provoking and open and honest. I respect him immensely and appreciate that he was the catalyst for our financial freedom.

❖ JL Collins – JL has been blogging for several years, but I only recently happened across his site and was hooked immediately. He is an extremely smart guy and from the minute I started reading his articles, I couldn’t stop and needed to feed on more of his knowledge. I probably read 20 of his articles alone on my first visit to his site.

❖ Mr. Money Mustache – A lot of great information can be found on this site. Written by a guy in his thirties, he was able to retire by simply cutting back and being more frugal in life. He has some ingenious thoughts that really make you think. If you’re not someone who feels the need to always own the latest and the greatest, this is a great site to check out.

❖ Root of Good – Justin’s a smart guy who was able to retire early (33 years old!). That was years ago but he continues to share tons of great information. He’s also very active in the financial independence community helping others in their quest to get there as well. His comments on X tend to give me a good chuckle as well!

❖ Early Retirement Now – “Big ERN” is crazy smart when it comes to numbers. If you want to deep-dive into understanding if your numbers will help you make it in early retirement, this is the site for you!

❖ The Retirement Manifesto

❖ Mad Fientist

❖ ESI Money

❖ Financially Alert

Podcasts I listen to

I don’t listen to podcasts as much as I used to. When I was on the path to financial independence, I lived and breathed these things. But now that I’m there, learning how to get there isn’t as relevant in my life anymore.

However, there are still episodes that I listen to on occasion. These are the podcasts I stay subscribed to on my Plex server so I can listen to episodes I have an interest in…

❖ The Clark Howard Podcast – Clark’s been around helping folks with personal finance since 1989! Lisa and I used to watch his TV show years ago. You can tell he’s just a great guy and really cares about what he’s talking about. His mission is to show you ways to save more, spend less, and avoid getting ripped off. This is the one podcast I still listen to each and every episode – 5 days a week! I wrote more about the Clark Howard Podcast in my post One of My Favorite Ways To Learn How To Save Money.

❖ Radical Personal Finance – Joshua Sheats hosts this show. He’s one of those people who are just ultra-smart so it’s good to have his take on everything from personal finance to ex-pat living.

❖ Earn & Invest – Doc G. hosts this show and it’s usually a roundtable with a few guests focusing on a single topic. It’s cool to get different perspectives on each subject instead of just one person’s opinion.

❖ Marriage Kids and Money – Andy’s a great guy who’s out to help the average Joe get their financial picture in good shape. He’s as down-to-earth as can be and seems to have a sincere interest in what he does.

❖ The Stacking Benjamins Show – Joe Saul-Sehy has my sense of humor. This is supposed to be the show where you don’t learn anything, but I’ll let you in on a secret… you probably will! Joe hosts the show “in his mom’s basement” along with O.G and Joe’s mom’s neighbor, Doug. Then he usually has Len Penzo and Paula Pant around or brings in some other guests. Very entertaining.

❖ Planet Money – Ok, this one’s not always about money, but Joe from Retire by 40 turned me on to this one and I really enjoy it. They’re much shorter than the other podcasts I listen to and they generally just take on one topic each show. A unique show and I’m always learning something new.

❖ The Pete The Planner Show – I love Pete’s show! Peter Dunn a.k.a. Pete the Planner knows his stuff when it comes to personal finance. But he’s also fun to listen to – it doesn’t hurt that he was also a comedian. Even when topics come up that I’m well-versed in, I continue to listen just because I enjoy his take.

❖ Afford Anything – Paula Pant is smart and full of energy which makes her show worthwhile in my book. She has fun, but at the same time addresses a ton of different subjects. Topics range from budgeting and student loans to real estate and running your own business… she covers it all!

❖ ChooseFI Podcast – Brad hosts this ultra-popular personal finance podcast. It came out in 2016 and like a bat out of hell, it garnered a huge following. It might be the biggest personal finance podcast out there. It’s a great way to get educated on how to reach financial independence.

❖ Financial Independence Podcast – Brandon (aka the Mad Fientist) doesn’t put out a ton of episodes, but when he does, they’re almost always worth a listen. Brandon’s one of those really smart guys (he read the tax code one time just to get a better understanding of it!) so it’s good to get his take on things. He also brings in some great guests for the show.

As a bonus, I don’t own rental properties any longer and don’t have the desire to anymore. But if that’s up your alley, I used to love listening to this one…

❖ BiggerPockets Real Estate Podcast – If you’re considering adding real estate to your portfolio, this is the podcast for you. I learned a tremendous amount of applicable information that makes real estate investing more about understanding the numbers and less of a guessing game.

Working out

Money isn’t the only thing important to your future. Your health is just as important, if not more important than the numbers. I’ve been working out consistently now since reaching early retirement years ago. I should have started earlier but I just never gave it the priority it should have had.

When I got started, I didn’t know what I was doing. Fortunately, there are now fitness apps that can help guide you through artificial intelligence. They utilize the equipment you tell it you have when they generate workouts and they show you how to do each exercise properly. They also keep track of what you do and can slowly increase the weight to help you continue to build strength and muscle.

Here are a couple that I like:

❖ Fitbod – I’ve been using Fitbod since 2020. I was a complete novice and Fitbod helped me to understand how to work out properly. It’s inexpensive and such an investment for your body and health. I can’t recommend this enough.

❖ Alpha Progression – AP is another fitness app similar to Fitbod. The biggest difference that I saw was that Fitbod’s workouts are more ad-hoc and will give you a different workout and will work out different muscles each day. AP, on the other hand, does plan-focused workout generation, which can provide better results in the mid to long term.

They’re both good apps and offer free trials so you’ve got nothing to lose. To try out Alpha Progression, use my link here or enter the code ROUTETORETIRE during checkout and you’ll get 20% off. How’s that for some incentive?!