Disclosure: This post contains affiliate links and we may receive a referral fee (at no extra cost to you) if you sign up or purchase products or services mentioned. As an Amazon Associate, I earn from qualifying purchases.

I’ve been using the Empower (formerly Personal Capital) financial software now for the past few years. However, I’ve only been dipping my toes in with it… until now.

I’ve been using the Empower (formerly Personal Capital) financial software now for the past few years. However, I’ve only been dipping my toes in with it… until now.

Quicken’s been my go-to software for just over 20 years. I stumbled on it back in 1999 when I first started at the career I just retired from. I was hired in as an engineer to fight the scary Y2K bug and Intuit was giving away their Quicken 98 software for free as a fix to anyone running older versions.

I decided to install the software just to toy with it. I entered in all my accounts and ended up being appalled at what I saw. I owed about $30k in credit card debt and just had no idea it was that much.

I credit Quicken’s Debt Reduction Planner feature with giving me the guidance on getting out of this mess. It was such a great asset and helped motivate me to pay off the credit card debt, my student loans, and my car loans.

If it wasn’t for Quicken, I don’t know if I’d be where I am today.

I became so attached to the software and it helped run my world for two decades. I would ensure I got a receipt for everything I did – dinner, gas, shopping, whatever. And then, I would enter those receipts into Quicken once I got home.

Yes, the software links your accounts so you can download your transactions and I also had that in place. Because I would enter each receipt in manually, the downloads would then match up the new transactions with the ones I had entered. It was a good way to check over my work.

Not only that, but that meant I always knew exactly where each of my accounts stood – to the penny. I probably opened the software to work with and review numbers at least five days a week.

You’re likely raising an eyebrow right now at how insanely crazy that is. Yes, I have a little bit of anal retentiveness with some things… I’m not sure how Mrs. R2R has stuck with me for the past 18 years, but I’m glad she has. She doesn’t have this craziness bouncing around in her head.

So, if it ain’t broke, why fix it?

Quicken has been probably the best tool for me to use over the years to help eliminate all debt. It’s also been vital in planning and reviewing the growth of our net worth.

Here’s the thing though – times have changed dramatically over the past 20 years since I started using it. There have been a number of competitors to Quicken over the years – Microsoft Money, GnuCash, YNAB, and Moneydance are just a few that I remember out there. Some survived and some didn’t… RIP Microsoft Money!

But the Internet and technology have grown up and opened up a whole new world of different options. And one of the biggest changes was the birth of financial software that’s all online. That provides a number of benefits:

- Virtually eliminates potential installation or configuration problems

- No need to worry about running outdated software

- Provides the ability to access the software and your data from anywhere in the world

- Lighter on its feet – programs like Quicken have had to try to modify their software to accommodate the web. Online services are built from the ground up to work solely through the Internet. Additionally, it’s always better to build with security in mind than to try to add it into existing software.

- Makes development of mobile apps a logical and probably easier pursuit for developers

Quicken has tried to adapt and bring in mobile functionality and even web access to certain aspects of the software. However, let’s get real – it’s still a dinosaur that they’re trying to make work with the Internet… that’s a mammoth task! More importantly, I got to use dinosaur and mammoth in the same sentence – Mr. 1500 would be proud!

Intuit realized that this was a major uphill challenge as well and put their focus on Mint instead (as well as QuickBooks and TurboTax). They sold Quicken to another company a few years ago. The developers have made some good strides with the software including online access, but it’s still a tough battle.

I love Quicken, but I want to be less hands-on and I want the ability to just access everything from the web and mobile. This has become even more important as I no longer have a Windows laptop. When I retired from my employer, I purchased a Chromebook for my daily use.

First off, I absolutely love the Chromebook (a 14″ HP Chromebook x360). And for what it’s worth, I was able to get Quicken installed and working through the use of an Android app called CrossOver. Not only is that bad-ass, but it actually works pretty well, too.

But I don’t want to rely on this setup. Right now, CrossOver is free while it’s in beta. But if I become reliant on it, I’m at their mercy with whatever cost they decide to charge down the line. I don’t like that.

Additionally, my needs have changed over the years. Here are a few of the things that were on my mind…

1) I want simplicity.

I no longer need to spend five days a week staring at my screen. But if I want to check a balance real quick, I want to be able to just pull out my phone instead of my computer. Ten seconds on-the-fly wherever I’m at versus ten minutes of being tied to my laptop.

2) I need to focus more on my investments than my checking and savings.

I used to love overdrafting my checking because that meant I wasn’t leaving money sitting in there doing nothing. But now I don’t want to waste time with that. We now keep enough money in our checking to cover a month’s expenses with plenty of breathing room.

Instead, the spotlight for me now needs to be shining on our net worth and growing our investments. We’ve mastered the day-by-day so I’d rather focus on the bigger picture more.

3) I want to be able to see my balances and transactions in our checking account.

Yeah, yeah, I know what I just said above, but that doesn’t mean I want to write those type of accounts off completely. I still have to keep an eye on everything and need to be able to glance at them occasionally. I just won’t be spending an inordinate amount of time with those accounts.

The big problem I had previously was that our credit union didn’t support Quicken – or any online aggregator for that matter. I love my credit union, but we recently moved our accounts to a Schwab Bank High Yield Investor Checking Account in preparation for our move to Panama.

This gave us an opportunity to consolidate accounts. We actually had eight accounts there (a checking and savings each plus accounts for our trust). We now have just the single Schwab checking account since we already have our Ally accounts. Talk about simplifying!

The Schwab account syncs with Quicken, but it also works with online aggregators. That’s big because it opens up new possibilities of what software to use. With Quicken, I was manually entering those transactions in – something I couldn’t do with the online services. Now, this becomes irrelevant and I can still see everything and all my accounts in one view.

Enter Empower

I’ve been testing different services for years now alongside Quicken. However, the service that I keep coming back to has been Empower (formerly Personal Capital).

Yes, the same Empower that almost every financial blogger promotes (including me) because it has a nice payout.

But here’s the thing… it actually is really good. I won’t recommend something that I don’t use or believe in and Empower is no exception. And that’s the reason I actually do promote it (along with the kickback, of course!).

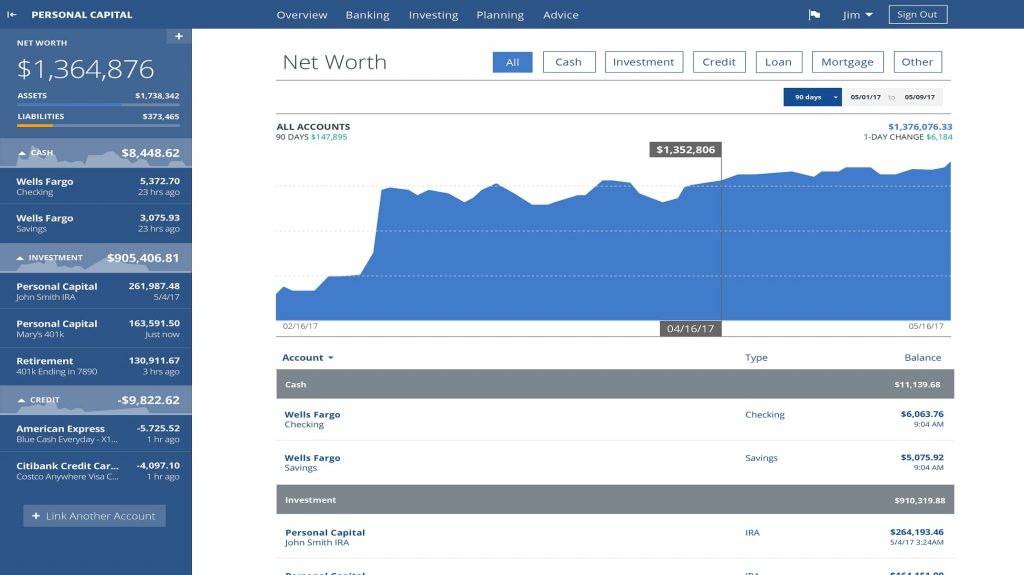

Like most aggregation services, it lets you link all your accounts to it – bank accounts, credit cards, investment and retirement accounts, etc. It then pulls all the transactions and numbers from your accounts and updates them once a day as well as when you log in.

What I like about Empower is the interface. It’s easy to see exactly where you stand with all your accounts and your net worth as a whole. That’s the main thing I want to be able to do – just check in periodically and see where we stand…

Additionally, you can still easily drill down into any account and look into individual transactions. But not only that, you’re able to look at transactions as a whole or filter by type (cash, investment, credit, loan, mortgage).

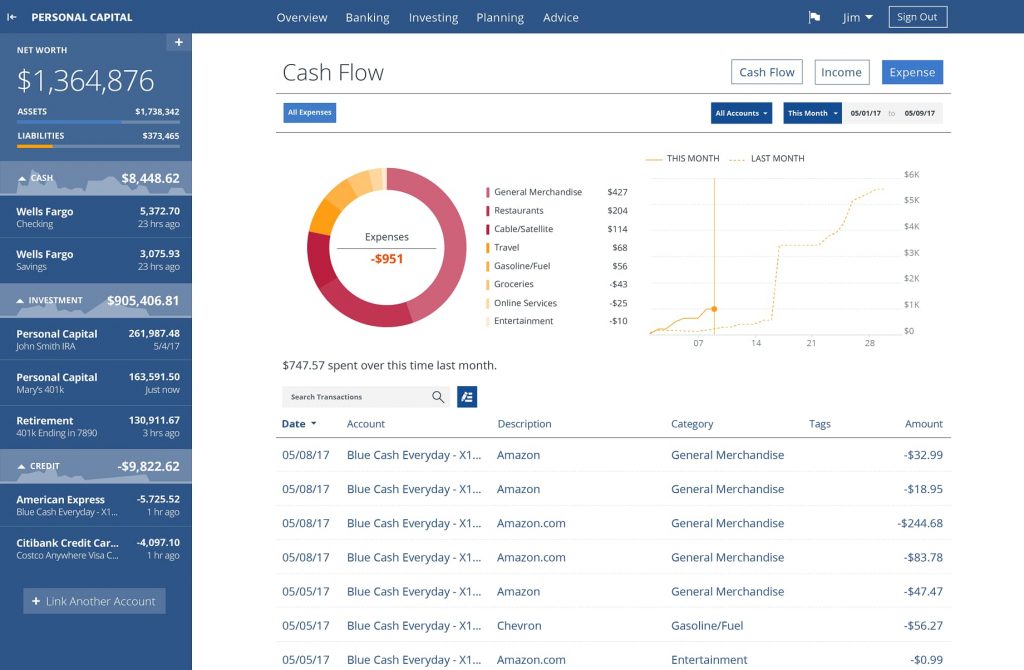

Empower also does its best to categorize everything while still giving the ability to modify it if it doesn’t get it right. It provides views to easily see where your money’s going…

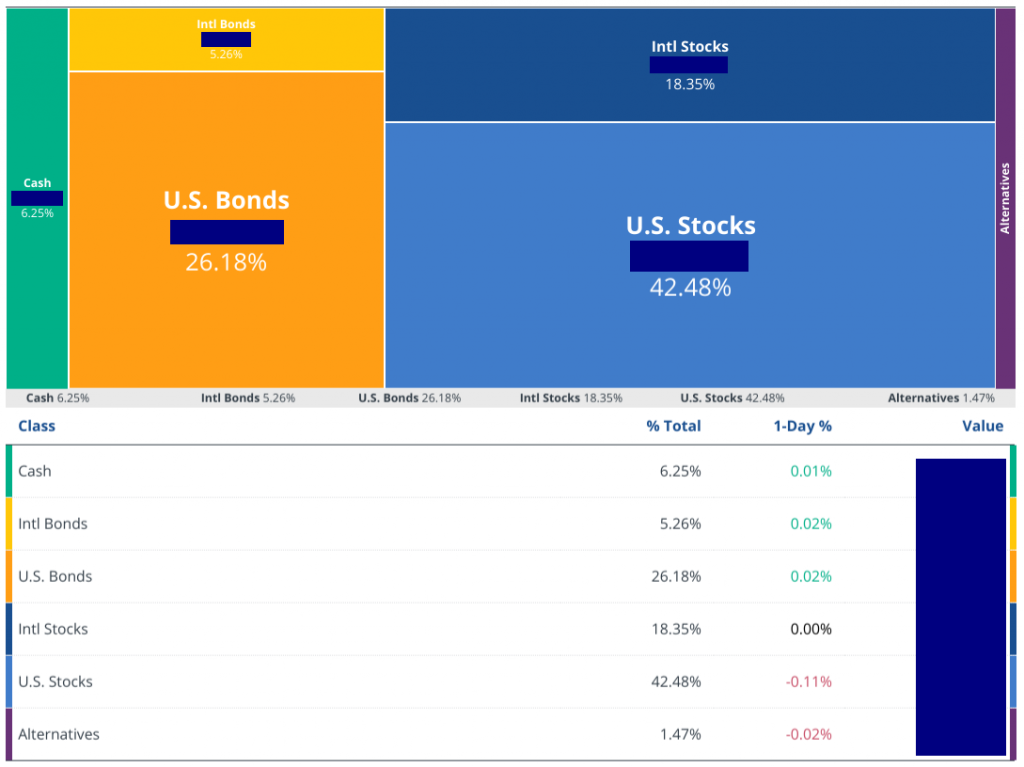

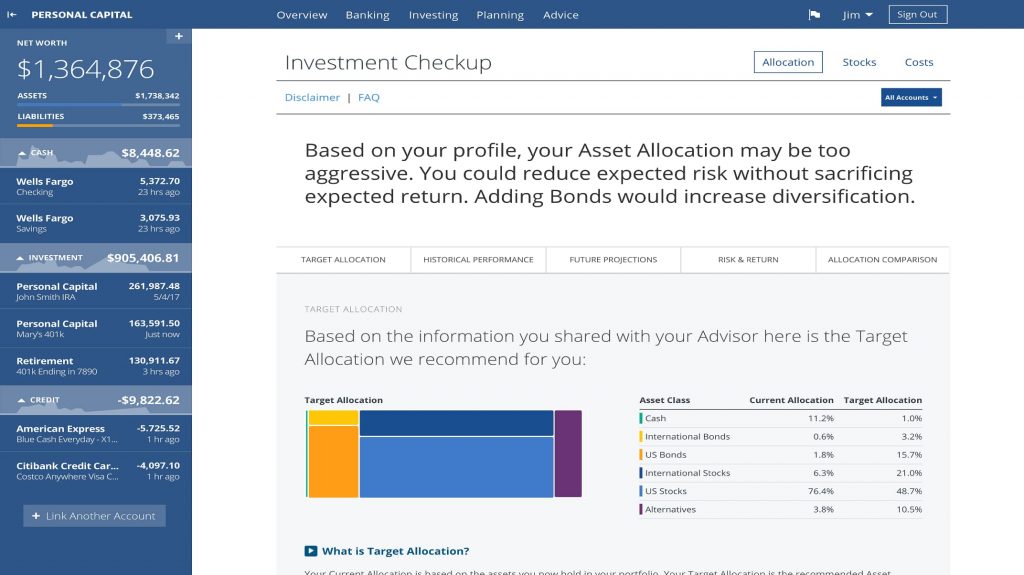

But where Empower stands out is the investment views and tools built in. I love that with one click, I can look at my asset allocations. This is the information that I want to keep an eye on and make reallocation adjustments once or twice a year if needed…

Quicken has some portfolio tools built in, but they’re clunky and I found that I rarely used them. This is simple and easy – I love simple and easy software!

Not only that, but the Investment Checkup tool can be helpful for a lot of folks. I won’t use that very much, but it’s still nice that they include this…

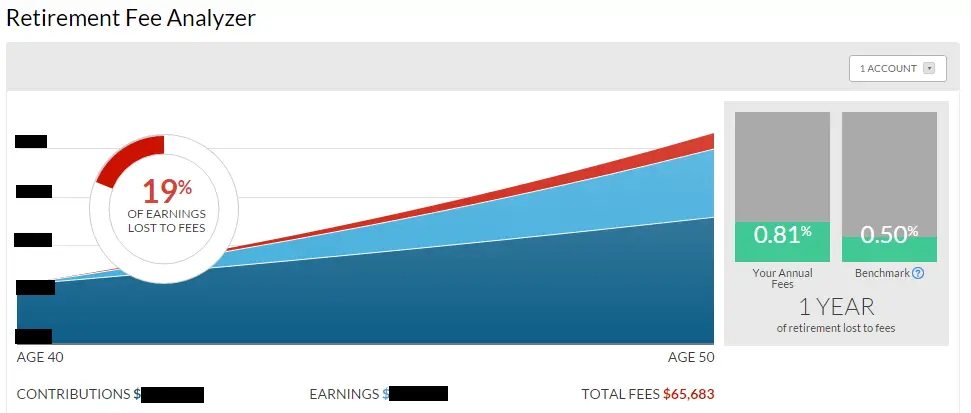

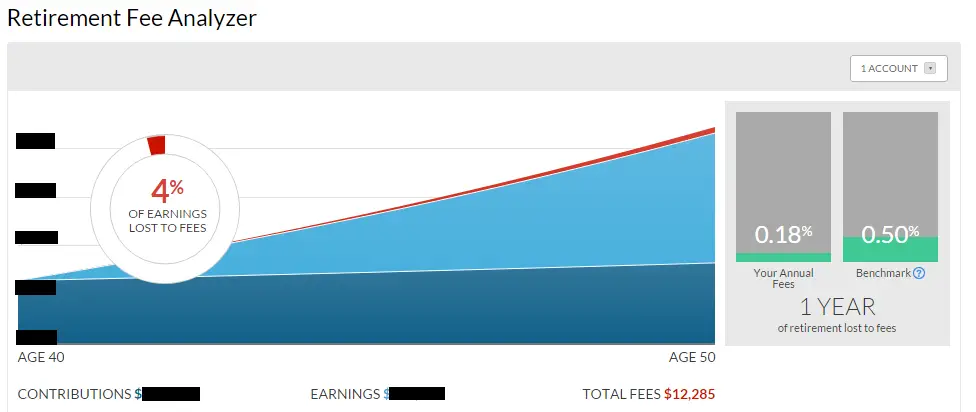

What really turned me on to the awesomeness of this service though was the Retirement Fee Analyzer. I’ve talked about how this saved me big money before – with the click of a button, I realized that I was paying way to much in fees in my 401(k). I made a couple of quick changes online on my 401(k) provider’s site and instantly shaved off about $50,000 in fees over ten years just like that! Amazing!

These couple of screenshots are from my account a few years ago…

Before:

And after…

Another thing that I liked is the built-in Retirement Planner. You already have all your info in Empower, so by adding in some details and goals, you can see and track your progress. It will let you know your projected chance of success and you can make changes as needed.

Even though I’m now technically retired, I’m guessing I’ll still use this for various planning. It’s very powerful – they didn’t half-ass this feature. It even lets you spin off different scenarios to help you figure out what path might be best for you.

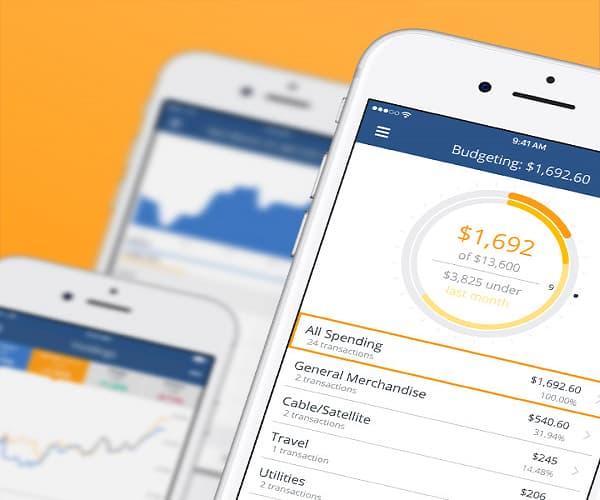

And finally, the mobile app is awesome. They did a nice job keeping everything just as easy to use as the website. Not only that, but most of the same functionality is there. This is exactly what I’ve been after.

As an added bonus, it’s 100% free with no limitations – that’s my favorite cost!

The reason they give away this service is that they’re hoping you’ll use their investment management services, which is where they make their money. Even a small percentage that uses their services makes this a worthwhile business model for the company.

Why not Mint?

The closest competitor to Empower would probably be Mint. I’ve tested Mint on and off over the past few years as well. It’s great financial software and similar to Empower in many ways.

However, Mint focuses on budget tracking and planning whereas Empower puts most of its efforts into the investment side of the fence.

That’s not to say that Mint isn’t good – far from it. It excels at what it’s built for and is actually a great Quicken alternative. However, it just doesn’t fit what I’m after.

My goal is to touch less on the transaction side and more on the side of tracking wealth and net worth. And that’s the area where Empower is a winner.

What’s nice is that you don’t have to just use one or the other. Just because it’s the best solution for me, doesn’t mean that wouldn’t be the case for you. Try ’em both out and figure out what works best for you.

Empower isn’t perfect

So, nothing’s ever perfect, but Empower does nail most everything I want. Here are a few items where the service falls short for me though…

- Can’t exclude accounts from net worth – I mentioned how I want everything in one place. With Quicken, I could add in my daughter’s savings account and 529 plan for instance. These are accounts I want to track, but I don’t consider them to be part of my net worth. Quicken gives you the ability to exclude accounts from your net worth and still track them – I love that. I don’t believe there’s a way to do this in Empower.

- No manual transactions – I’m no longer manually entering in receipts from everything we do. However, a routine that I liked to do with Quicken is to add in transactions (basically placeholders) for business income I’m expecting. That way, I don’t forget about it and can follow up if it doesn’t show up. Sorry, no manual transactions in Empower.

- 90-day history – To get a good snapshot of your finances, 90 days should be good most of the time. But I did like that I could see the growth of our net worth over the years. I also liked that I could do a quick search and see how much I paid for a product or service in the past before I made the same or similar purchase again. Not so much with Empower. You get a rolling three-month window.

- The assigned financial advisor – So, Empower is free, but like I mentioned, they’re hoping to talk to you and bring you under their umbrella of investment management. So when you sign up, if you have $100,000 in investable assets, a financial advisor from the company will call you. They want an opportunity to give you a free hour of consultation. I have no problem with that, but I already have a financial advisor I’m very confident in. You aren’t required to talk to them, but they will call periodically to check-in. I’ve never answered (they leave voicemails), but they will continue to call until they get to talk to you. In their defense, I have heard that the calls can actually be worthwhile. Sam from Financial Samurai decided to go through the consultation to see what it was all about. Here’s a link to his post taking you through the process.

All in all, I’m happy to make the change. However, this has been a big transition for me. 20 years is a long time with one piece of software. My entire financial history is there and I know the ins and the outs of the product.

But, it’s time for me to move on. The only way to grow is to adapt and managing your finances is no exception.

I’m not a Quicken hater. In fact, if you want intricate control over your finances, there is no better product for you than Quicken. It really is amazing.

But for simplicity and amazing functionality built for the web and mobile, Empower is the way to go.

Think I made the right move? Do you use Empower for your finances?

— Jim

Thanks for sharing. I started a Personal Capital Account and when the advisor called to talk I started to get worried about how they might market to me or what very detailed personal financial info they might use to market to me directly or through 3rd parties. Any knowledge or experience in those areas? In the past I used Mint but many accounts kept losing sync or couldn’t be connected and it didn’t have the investor tools I wanted. I’ve also done my own spreadsheets for years but would like to get more integration with accounts and have more automatic dashboards. Thanks

You always need to be cautious when you have any data stored any place other than a computer with no Internet access. That said, it becomes a matter of if you trust an organization and your tolerance of risk. As far as the data goes, their privacy policy says that they do allow your assigned financial advisor there to be able to use your info to provide personalized service (makes sense to me). With third parties, it seems to be pretty restricted from what I can tell, but that’s again a matter of trust. It’s too much to paste here, but you can find it under “What User information do we share?” in their policy.

I have seen where some of my accounts had goofy problems with Mint but not Personal Capital. For instance, I have two-factor authentication setup with Vanguard. Anytime Mint would sync, it would trigger my phone with a code to enter (very annoying). For whatever reason, Personal Capital doesn’t have this problem – I entered in the code once when I created the account and now we’re good.

— Jim

I have been on Quicken just about as long as you! Holy smokes that is a long time.

I have been thinking of bailing on Quicken but the breakup is hard. It’s like being in a long term relationship.

The one thing I am worried about is losing 20+ years of history of transactions. Especially for taxable gains/dividends. But then I thought about that more. I have our investment accounts with Fidelity. With all the tax law changes (even pre-2018), Fidelity takes until March to issue the 1099 for interest, dividends and gains. I think this is because when the tax laws were changed a while back you have to “declare” how the transaction will be treated up front. If that is the case maybe I should not worry about 20 years of historical transactions?

Any tax experts out there that can confirm my hunch?

We’re dating ourselves, Mr. r2e! 😉 The history is a hard thing for me to let go of as well, but I figure, I’ll still have the data and the old software (Quicken 2017). If I ever really need to, I can just get back into Quicken and open it up.

I’m not real sure about the tax question, but maybe someone smarter than me on that subject can jump in.

— Jim

Great article! My husband and I just recently set up our Personal Capital account as well. We love it and have already received the first phone call (which we didn’t answer). I’m going to check out the retirement fee analyzer and see how we’re doing. Good luck with your move to Panama!

Thanks, Lisa – good luck on on the fee analyzer! Hopefully, you find you’re already in good shape, but if not, better to find out now than later!

— Jim

I started with Quicken about 1988 (rather in 88 – Y2K and all) . But I abandoned it 3 years ago because I was tired of being forced to upgrade every 3 years or so. It helped me get spending under control, too.

I switched at the end of a year to minimize the disruption. I tried Moneydance, but then settled on Mint for bank and credit card accounts, and Personal Capital for investment accounts. I need the detailed spending on charities for tax purposes, and Mint seemed to be better at that. Mint is not as elegant as Quicken seemed to be for generating reports, but it does the job. The way Personal Capital does their asset allocations is very useful.

It took me a while to get comfortable with their access to my accounts. But I just change my passwords more often and occasionally change my usernames.

Still have not answered the Personal Capital call….

Wow, you’ve got me beat on running the software for so long! I hear about a lot of folks doing exactly what you’re doing – Mint for day-to-day and also using Personal Capital for investments. It’s hard to let go of everything Quicken provides, but I think the benefits outweigh the downsides (and the subscription cost!).

— Jim

Lately I noticed that some of my bank accounts now say that they can only be updated once a week on the Personal Capital site. Not sure if this is provider specific (Capital One) or a plan for PC to have people focus more on investments (and advisors) and less on transactions. While not necessarily a deal breaker it is something to be aware of with their service!

That’s interesting – I haven’t run into that one with any of our accounts, but we also don’t have any Capital One cards. I wonder if that’s something that Capital One is enforcing somehow?

— Jim

I may be the only blogger who gets nothing from Personal Capital but am a paying customer of theirs at the same time. I have a pretty large account they manage but since my blog is completely not monetized I do not get anything from them. They do have a unique smart beta investment strategy that appeals to me that provides a little diversity from a pure index fund approach by their fees are higher than the robo ‘s.

I like to hear that you’re liking them, Steveark, since I can’t really comment much on the management side of things with them. I wasn’t familiar with smart beta investing (other than the term) so I just looked that up. That’s really interesting – I’m going to dig into it some more when I get a chance.

— Jim

I started out with Microsoft Money and moved over to Quicken. I use a Mac but the Mac version is lacking. I now use an online server to run Quicken (Paperspace.com). l used both Mint and Personal Capital. What is missing in both of these is the extensive history I have with the other programs. With over 20 years of transactions and investment returns, there is no other program that I have found that will capture and hold all this data. I would hate to loose the ability to see my long term returns that Quicken calculates from the very beginning of my investment life. It is also useful to go back and find transactions from the past many years. Looks like for now, I am still a custom r for life!

That’s a creative idea on using Paperspace to run Quicken. I definitely hear you on the history – it’s nice to be able to see growth, changes, and even old transactions over the years.

— Jim

I started with Quicken in 1993 and I left it behind a few years ago. I went with kmymoney. It has similar characteristics as Quicken but it’s free software. It runs on Windows, Mac and Linux. I’ve found that kmymoney starts up faster than Quicken. It’s has the flexibility I need in personal finance software. As a matter of fact kmymoney convinced me to give Linux a try and now I’ve dumped Windows.

Man, I thought I was one of the few that used Quicken for so long, but that doesn’t seem to be the case! Hmmm, I never thought about running Linux software. I just got a higher-end Chromebook a few months ago (loving it) and it has the ability to run Linux apps, which I’ve been toying with. I’m really happy with Personal Capital and it’s web/mobile functionality, but maybe I’ll check out KMyMoney just for fun! Thanks for that idea, Michael!

— Jim

I really enjoy using Quicken to track my expenses as I can split bills into different categories and see a monthly trend by expense category. The Personal Capital investment tracking dashboard is nice, but I would like to be able to download the account balances into an excel summary, but I haven’t seen the ability to do that yet. If I can see a trend report and split expenses in Personal Capital, then I would definitely go all in on Personal Capital as I don’t want to pay for Quicken anymore when my term is up next year! 🙂

I just looked it up and Quicken’s been around for 36 years now! With that kind of longevity, it’s no wonder that it has the capabilities to satisfy so many users’ needs. I doubt Personal Capital will gain the category-splitting functionality anytime considering their focus is more on the the investment side, but who knows?

— Jim

I am an antique! And I have been using Quicken almost since it first came out – – at LEAST back to the early or mid 1980’s. I get annoyed every once in a while and do a search for a replacement, but there just is NOTHING that equals it.

And I am enough of a fuddy duddy that I do not WANT to get bank account information on a PHONE that someone else might be able to access. I want my phone to be a phone and my computer to be a computer.

And along the same lines, I want my data on MY PERSONAL COMPUTER with MY SECURITY; not on some cloud server that may get hacked!

Furthermore, since my children are signatures on my accounts, Quicken linked them in their version and my daughter gets an email when I make an unusual transfer – – which at my age is a great safety feature!!

Wonderful if it works for you, but just do NOT take away my Quicken!

Holy cow – you might be the winner! That’s a long time for sure!

Haha, don’t worry, I won’t be the guy taking away your Quicken. It’s definitely an awesome program and my choice isn’t what is best for everyone. Security’s a big deal and your thoughts are legit for sure.

Thanks for the great comment, Louise!

— Jim

Hello Jim,

Thanks for sharing your experiences. I too am a long time Quicken user looking for something better out there. I have been using PC in parallel since about July of 2018 and like it in many respects (not enough to quit Quicken yet). One thing from your post has caught my attention – the fee analyzer “after” screenshot. It is identical to what I am seeing with my account. Coincidence? Identical investment strategy, current investments, and amounts? 🙂 Doubtful. Makes me wonder how accurate their fee calculations are.

That is pretty funny that our numbers are similar, but I’m sure it’s a coincidence. I actually went through and verified all the fees as I made the changes. PC just updated itself automatically with the new info. In fact, I’m currently showing 0.02% for fees right now because I’m in the middle of a rollover with my old 401(k). Once that’s done, I’m anticipating that it should likely be less than 0.10%. If you’re already matching the “after” screenshot, congrats – that’s fantastic!

— Jim

I love PCap, but I’m not giving up Excel anytime soon. I enjoy going over our accounts at the end of the month and see what we spent money on. It keeps me grounded. If everything is automated, I’d probably spend quite a bit more. Also, I can grill Mrs. RB40 on various mysterious purchases. 🙂

That makes complete sense to me. Poor, Mrs. RB40! 😉

— Jim

I did some more digging around PC’s retirement fees calculations and came away with 2 thoughts – (a) their calculations are wrong and (b) I better get cracking on lowering my fees. The (a) I am basing on the fact that they calculate fees as a percentage of your total overall investments. Say I have 8 accounts but only 4 have fund expenses associated with them and the rest are individual stock accounts. PC calculates the fees of the 4 accounts as a % of what’s in all 8 accounts. So if I calculate the percentage of only the fund based accounts, I am no longer looking at 0.18% but rather 0.23% in my case. Can’t say I am happy about that *grumble-grumble*. Still I think PC is a nice tool to at least tell me the total fees for each of those fund accounts. If nothing else, I can do my own math 🙂

Haha, love the “grumble-grumble” – that’s still pretty low as far as expenses are concerned. On the website, they’ll let you filter which accounts it counts for the fee analyzing (it’s right above where it shows you your fees vs the benchmark). PC’s far from perfect and it might not be the best fit for everyone, but it’s nice to have another tool in the belt to see how things are looking.

— Jim

Quicken is the better choice. I use both and Personal Capital requires constant fixing of downloading balances and transactions. They have constant annoying calls wanting to be your financial advisors. I can spit out custom expense reports for not only budgeting but when doing taxes. Personal Capital is free for a reason. If you just passively manage your money then have at it

I definitely agree that Quicken has a lot more flexibility in what can do. However, the simplicity of the online services like PC can actually prove to be a major point in their favor (along with a fantastic mobile app). Everyone’s needs are different and, in my case, I’ve been more than pleased with the change-over.

— Jim

You’ve provided more insights on PC than Financial Samurai and others and I thank you.

I’ve been on Quicken since the early 1980s and I can forsee better, on the basis of spending patterns, how my actual future expenses change over time. 90 days is not enough, not even 365 days, you need decades of cumulative data. Why discard when you can roll over data in Quicken, year after year, and it only matters to you?

For example, has your non-discretionary expenses risen with inflation, as expected by the CPI? The national data is one thing, but at the personal level, its different just as the COL is different for various cities in the US. Healthcare costs have risen for me far more than CPI, and is due to where I live, so I am able to calculate my personal “CPI” and how this affects my cash flow :

https://thumbor.forbes.com/thumbor/960×0/https%3A%2F%2Fblogs-images.forbes.com%2Fmikepatton%2Ffiles%2F2015%2F06%2FCPI-Health-Care-Inflation-2005-2015.jpg

Naturally, you can change these costs by moving to a place like Panama with lower living costs, but you can then compare such change to your baseline, and project cash flow even more effectively.

Second, you didn’t touch terms of service of PC. PC is an aggregator, and they farm out many of their subfunctions to other entities, and create relationships with others, such as Facebook, where they can share data they collect on you. In regards to investments, the actual custodian is Pershing Advisor Solutions and you agree to a relationship with them through PC if you use their investment services embedded in PC. If an issue arises, you are bound to arbitrate with PC in California, but PAS in NY, and the same goes for the other relationships, with other services, in various legal jurisdictions.

https://www.personalcapital.com/terms-of-use/

Third, as for their ‘robust’ security, its no better than any web based facilities in terms of encryption. However, they are not a financial institution, and are not bound by requirements for security and confidentiality required by US law even if they say they exceed them, so they say.

https://info.townsendsecurity.com/encryption-requirements-banks-financial-podcast

This overall creates a complicated web of inter-relationships were who is responsible for some issue can be difficult to ascertain.

To summarize, PC is essential “Quicken Online” and any other subfunction other than reporting, graphing and software analysis on your accounts, are farmed to other services with different governing rules. The connection to other services are seamless, so users may not know immediately who is doing what. Quicken desktop is local on your PC, and you have control over which institution you choose to connect nor can be linked to one another without your expressed knowledge, and for those with IT skills, you can confirm the flow from your network to various IP address to confirm which goes were. But on PC relationships between financial institutions is based on trusting PC.. The institutions linked by Quicken are governed by US laws on financial institutions independently on its own, and you manage your own security, at least take full responsibility for it. So if one is hacked, the others aren’t. By using PC, there is the risk if PC is hacked, there is a domino effect, as if your Quicken data file was stolen in its entirety.

I agree the tools of PC are more friendly and Quicken’s are dated, but nothing in the review regarding your financial health can’t be done by Quicken > 2015 and elbow grease.

I am not sure risking losing large amounts of money by hackers is worth a slight increase in the ease of analyzing its flow.

Good luck.

Hi, Robert – thanks for the comment! I agree that switching to an all-online piece of financial management software isn’t for everyone. The good news is that a number of these tools and the banks have been working together to move to other authentication methods like OAuth. That allows for the aggregator to gain read-only access to your bank accounts without the software ever having your banking login credentials. It’s slick and definitely a step in the right direction.

Choosing personal finance software is always going to be a personal decision. I totally agree that Quicken is one of the best out there, but for my needs, I’ve been happy so far with moving to PC for the investment side of things and now Mint for the day-to-day transactions.

Hope your holidays are great!

Quicken for me… plus there is Quicken online and the app for your phone… everything you want is there, including the download. Don’t know why anybody would switch.

To each his/her own, Mark. 🙂 I loved Quicken for a long but I gotta say that the simplicity and insights of Personal Capital are really nice. It’s far from the powerful beast that Quicken is but it’s been great for being able to step back a little. I’m also happy not to be part of the subscription model either… free is a pretty nice price!

Have been using Quicken since the DOS version. Not sure when that was. Each time we needed to pay for another year (or three), we searched for a less expensive alternative.

Often looked for sites comparing Quicken to PC (or other options) but did not find many comparisons like this one. Thanks for the detail and your thoughtful evaluation.

One thing you may want to add is a note indicating PC is limited to USD$ only. We have accounts in other countries/currencies. With Quicken, currency management is not great (one exchange rate per account, rather than per transaction), but we understand PC has no support for other currencies.

Wow, you definitely had me beat going all the way back to the DOS days! 🙂 That’s good to know about being able to do USD-only in PC. I’ve never needed to deal with other currencies but I can see how that could be a deal-breaker for some folks. Thanks for the info!

Another long time Quicken user here. I can’t actually remember when I first used it but I have data back to 1998 and I think I removed an older account at some point. I am using it in a fairly basic way. My focus is only on check book balancing and credit card account management. I don’t bother tracking my investments in Quicken. You might be interested to know that I stopped bothering with Quicken updates in 2006 and have been running that version ever since. I also have a Chromebook that I am starting to really enjoy using and I am investigating using PC on that instead of Quicken on my Win10 machine.

So, I gather that there is no way to move my 23+ years of Quicken data into PC or any other practical solution. I am guessing that PC will not be interested in calling me to offer financial advice, but I wonder if they might invite me to leave since they won’t make any fees from me?

Currently I manually enter my transaction data from my paper receipts and use Quicken reconciliation to make sure I match with online data from bank or credit card company. Does PC have a way I can mark a transaction to show that I have matched it to a receipt?

Thanks for your article and for any info you have on my questions.

Quicken 2006? Impressive!

I don’t believe there’s any way to move your historical Quicken data into PC. I kept my data file as a just in case but have only needed to reference it once. I’m a Chromebook user as well but I have a Windows PC I was able to use for it. There is a product called CrossOver that will let you run Windows programs on Linux and Chrome. I used it while it was in beta (and free) and it worked pretty well with Quicken. Just another option.

I used to do what you did with matching receipts with transactions in Quicken. I don’t use PC for my tracking daily transactions (I’m using Mint for that because I have a lot more cash transactions in Panama). However, I don’t believe that PC offers that ability.

The nice part is that you can sign up for free and try it while still using Quicken since it’s not a one or the other type of deal. They might call you to offer you a free consultation but that’s up to you whether or not you want to take them up on it.

Good luck!

In 2023, Quicken has become web-based as well. I loved it when I had it locally only but it is long out of date and I have a new Mac that requires I update Quicken. The details about the alternative software mentioned in this blog make it less viable than quicken. What are people like me doing now?

Pity the Mac is insisting that you update Quicken. I guess there is no way around that?

I am still using my Quicken 2006 version with Windows 10 and I have a friend who has it running with Windows 11.

Hi Jim,

Thanks for the post. I too have been using Quicken since 1995 when I got it pre-installed on my HP hand-sized pocket PC thing, you remember those? I migrated it to my PC and I’ve used Quicken ever since, I’m currently on 2013 version. I like it and I don’t mind the manual updating – in fact I absolutely don’t want any syncing with banks etc, I use it to manage everything offline and check financial websites myself.

However, I’m currently using a Windows laptop and a couple of Android devices and I’d like something that I can use cross-platform on my Galaxy tab etc. I just came across Personal Capital and I wonder what your take is on it for purely record-keeping. I don’t need investment advice or to sync with anyone else, just to manage my accounts over different devices.

Would you recommend this or any other platform for a user like myself? Oh, and I would also like to retain my historical data but I understand it isn’t possible to import Quicken data into this. I guess I could suck that up.

Appreciate your comments.

Thanks again,

Gordon

Hey, Gordon – tough call on this. Personal Capital probably wouldn’t be a good choice for you if you do want to sync with financial institutions because that’s really your only option with it. The same goes for Mint. One option might be YNAB. I haven’t used it before but it’s an extremely popular software program. It does have a monthly or annual cost though. I’m also not sure how well it works without connecting to your financial institution.

If you decide to be ok with the bank syncing, you have a lot more flexibility. The nice thing about Personal Capital and Mint is that they’re basically read-only and can pull data from the financial institutions but don’t send info back to them. And with them both being free, it’s easy to try them and then just delete your account if it’s not what you’re looking for. I am using a combination of both PC and Mint right now since PC doesn’t allow you to add cash transactions and we have quite a bit of those while living in Panama. And then I use PC to keep track of everything else. Once we move back to the U.S., I may drop Mint and stick with PC only.

If you do decide to switch to something else, just hang onto your Quicken data file and your old Quicken software. That way you can pull up old data if you need it.

I have used Quicken for over 20 years and several times tried to migrate to some other program to avoid Quicken fees and to get off Windows. The main requirements for me were the import of the historical Quicken data and reliable downloading of transactions. I tried gnuCash, Moneydance and others that I have forgotten, The migration was always a mess. Not long ago I tried CountAbout and actually migrated the data very cleanly and simply. However, in the meantime, after the turnover from Intuit to current management, Quicken has really improved: less software update failures, more reliable downloading. So I stuck with Quicken on the subscription model. The main deficiency with Countabout was detail in the investment accounts.

Great information, Chris! I’m aware of some of the Quicken improvements but I haven’t heard of CountAbout – I’ll be curious to check that out. I’m still happy with Personal Capital but I always like knowing about other choices. 🙂