After last week’s post on the breakdown of our net worth, I thought it might be a good follow-up to provide more detail on our drawdown plans… a part II, if you will.

“Why?”, you might ask.*

I realized that there aren’t a lot of folks in the trenches talking about this subject. Many FIRE sites talk about the strategies of getting to the point of early retirement. However, it seems like there aren’t too many that talk about actually drawing down on your investments.

So, why not share more of our own plans to help spur some discussion? Maybe this will help you come up with some ideas for your own strategy on drawing down your accounts. Or perhaps you’ll think our methods are not sound and will have some thoughts to add.

Regardless, having a solid drawdown strategy is critical in your retirement planning. How are you actually going to get your hands on your money? Just because you’ve saved a lot doesn’t mean you can access it without penalty or other problems.

You need to have a plan that plays by the rules and provides you with enough income to support your lifestyle. Not only that, but you want your money to not run out before you die and possibly have enough to pass on to posterity.

Here’s the quick disclaimer… everyone’s strategies will be different based on their own circumstances. Don’t try to copy what we’re doing as I’m not a financial advisor. Talk to an expert in the area that can cater to recommendations specific to your own situation.

So with that, let’s get into our drawdown plans…

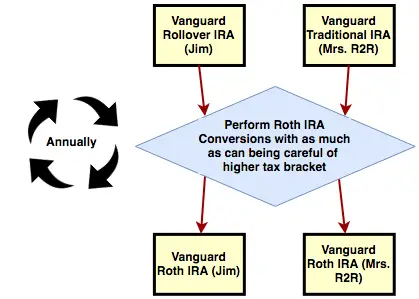

Secret ingredient… Roth conversions

This first part is more of a strategy in our FIRE plans than an actual drawdown, but it’s critical to let us get to our money. And that path is through the use of Roth conversions. If you’re not familiar with the idea, it’s a method of accessing your tax-deferred retirement money without penalty. It’s also possible to pay little to no taxes on the money depending on your circumstances and needs.

I wrote about Roth IRA conversions ladders in this post so I won’t go into the details of how it works. However, it’s important to know that you can’t touch the money in a Roth conversion for five years or you’ll pay a 10% penalty… and nobody wants that!

This isn’t the actual distribution in our plan, but it’s definitely a vital part of our drawdown strategy.

Initially, I planned to do a Roth IRA conversion ladder on a year’s worth of expenses (adjusted for inflation) each year. However, opportunity seems to be a-knockin’ as the 2017 tax law reduced tax rates for many taxpayers. That means we have some favorable circumstances to pay less in taxes on each conversion.

My financial planner thinks our situation is perfect to try to move over as much as we can each year while the tax laws are good. It’s also a time where we don’t anticipate a ton of side hustle income coming in (at least for a little while), so that makes it even more appealing.

Today got to be my first shot at making flowcharts for Route to Retire. Since I no longer have access to Visio, I tried an open source browser-based service called draw.io. Though there are a couple of add-ons you can purchase, it’s free with no registration required. More importantly, it’s pretty bad-ass.

For as easy as it is to work with, it can’t help make my flowcharts any better. Regardless, here’s my first one showing our Roth conversions that we’ll be doing every year until our rollover/traditional IRAs are emptied…

It’s tough to give a solid number on when the conversions will be done. That’s because we don’t know how the stock market’s going to be doing at the time of the conversions. If the market crashes, that’s a great opportunity for us to convert even more money in one shot!

There are also things like tax-law changes, us earning more money, etc. Different variables will determine how much we’ll be able to convert each year.

My guess though is that we’ll be optimistically be done in five years. And if things aren’t as favorable for the conversions, it could be years longer.

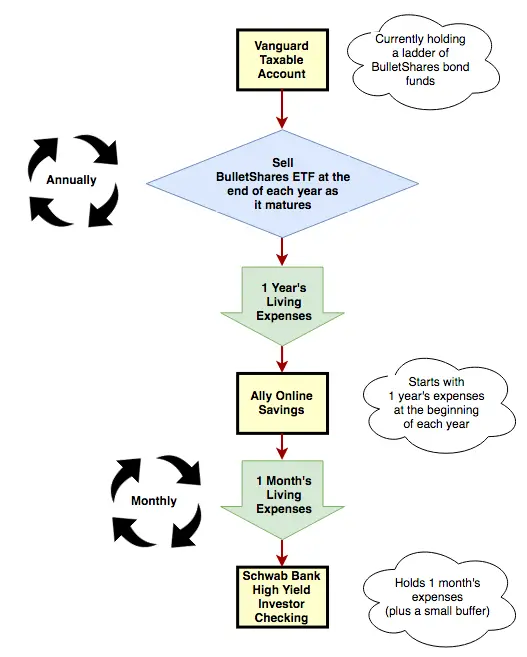

The first five years of our drawdown

Our drawdown in the first five years will be different than the latter years due to the Roth IRA conversions. It’ll take five years for each conversion to be qualified as a contribution by the IRS.

At that time, we can pull the money out penalty-free since you can always pull out contributions without any penalty. However, that means we’ll be living off cash in our savings and money in our taxable accounts in the meantime.

We have enough money in our online savings account at Ally to cover us for this year. It’s currently only earning 2.20%, but we know it’s safe and sound. I have a recurring transfer scheduled to move over a month’s worth of expenses on the first of every month. The transfer goes from Ally into our Schwab Bank Investor Checking Account to spend on our daily life.

This makes it like a monthly paycheck and will help us manage our money a little better as well.

After the first year, it becomes just slightly more complex. If you remember from last week’s post, we’re currently holding a few BulletShares ETFs in my taxable account at Vanguard. We own enough in each year’s ETF to cover our annual living expenses. The ETFs mature in consecutive years with the first one due at the end of this year.

As one matures at the end of the year, that will then become our living expenses for the following year. We’ll then move the entire lot of money into our online savings account at Ally. Then the money in our online savings account will move to our Schwab checking in monthly increments just like we’re doing now.

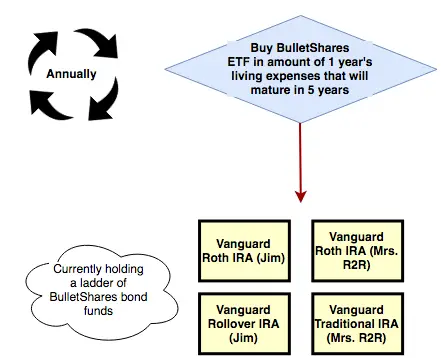

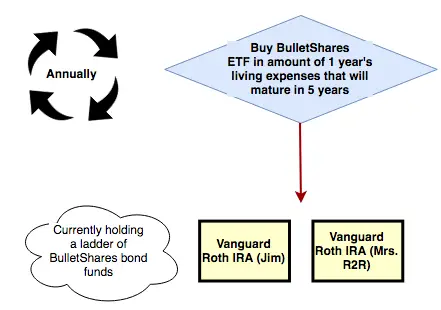

Be aware that along the way, we’re still going to be selling equities to buy some more stability. Every year as we cash in one of our BulletShares ETFs, we’ll buy another one to mature in another five years. In this case, we’ll buy them in one of our Roth or traditional IRAs. This ladder will ensure that we always have at least five years of safer money.

Here are my skills at work on a couple even fancier flowcharts to show you how the next few years of money in our drawdown will work…

If you’re really good at scrutinizing things, you might notice that we have one year of cash in our online savings and three years of BulletShares ETFs ready to go. You might also realize that we need to cover five years of expenses before we can start withdrawing from our Roth conversions.

If you caught that, you get a gold star! Yes, we have four years of living expenses with that plan I just mentioned and that could really suck if that was all we had to roll with.

We have two things helping us with that last year though…

- We’re moving to Panama this summer, remember? We budgeted our expenses for living here in the U.S. For as long as we’re in Panama, our cost of living will be significantly lower. That means we’ll likely have a surplus of money each year we’re there that can carry-over for that last year before the Roth conversions are ready.

- We also have our current Roth IRA accounts that we’re not doing conversions into. We’ll create separate Roth accounts for the conversions to make life simpler for the tax man. But with our current Roth accounts, we can pull out any of our contributions (not earnings) we’ve made over the years penalty and tax-free (another benefit of Roth IRAs).

Although we’ve actually planned on bullet #2, I’m hoping bullet #1 will carry us most or all the way for that last year.

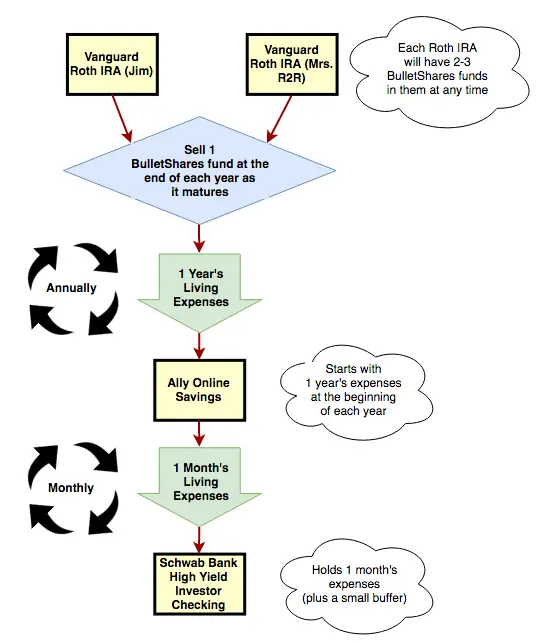

“Probation” period over… yay!

Good news! Those first five years of our Roth IRA conversions are done so now we get yet another new flowchart to look at – woot, woot!

The five-year mark now puts us at the point where most of our drawdown plans should be pretty consistent for at least another decade. If you noticed, each phase seems to be just a small change from the previous one. In this case, we should have all (or at least most) of our money sitting in our Roth IRAs.

Additionally, the five-year “baking” from the earliest conversions should be done or close to it. So now we’re ready to start drawing down from our Roth accounts. We’ve already paid taxes as part of the conversions so any withdrawals are now tax-free.

We’ll just continue the process of cashing in a BulletShares ETF each year when it matures and moving the money into our Ally account. We’ll also continue to sell equities in our Roth accounts to buy a year’s worth of BulletShares for each one that we cash in to perpetuate our ladder.

The rest of the flow will continue as normal with a month’s worth of living expenses being automatically transferred to our Schwab account. Here’s your last pretty flowcharts to look at in this post…

The fuzziness of our plans…

In theory, this is plan will be great for us. We’ll go by the 4% rule, nothing’s going to change along the way, and according to three savvy financial guys and tons of Monte Carlo simulations, we’ll live happily ever after.

However, shit happens. It just does. The moment you’re sure something’s going to remain constant, it’ll change.

So with that, we can’t plan for things we don’t know. Here are just some of the variables that could creep up along the way – some good and some bad…

First off, there’s the business income. Nothing we’ve talked about or counted on is money from fun projects. But I can’t imagine that we’ll start seeing some decent income along the way for some of the ideas I have in mind. That’s a good thing but it could also change tax strategies we need to use along the way.

Another part of this facet is rental income. This isn’t even counted as a drawdown in my book because I look at that more like a periodic paycheck. Sometimes repairs need to take place and sometimes they don’t. Sometimes there are vacant units, sometimes there aren’t.

The property management company handles most of this for me and excess funds are direct-deposited into the business checking account of our real estate LLC. I leave a few thousand in that account as a buffer, but over time it builds up. A few times a year, I shave off the excess and move it to our personal bank account.

Then there’s Panama. If we love it, we live like royalty for the rest of our lives with a lot of excess cash building up along the way. But if we decide to come back to the States – whenever that may be – that changes things. We planned our numbers for living in the U.S., but if it’s during that first five years during the conversions, it’s gonna be a little tight for sure.

And what about college? Will our daughter go to college? If so, will it be in Panama or in the U.S.? State school, community school, or both? We have a 529 plan for her, but it doesn’t have more than probably a year’s worth of tuition in it. And that’s on purpose because I want her to have some skin in the game. But what if down the line, my sentiment changes and we want to help her more?

There’s also the later years that we didn’t even discuss for our drawdown plans. We still have my Health Savings Account (HSA). For the past few years, we’ve been following some thoughts I had read on a Mad Fientist post titled HSA – The Ultimate Retirement Account.

In essence, we’re paying for medical bills out of pocket, holding onto receipts, and delaying distributions. This should help us get the most bang for our buck out of that account. Hopefully, as that continues to grow, it’ll leave us with another nest egg to play with down the line.

Then there’s Social Security. I imagine there will be something there, but I’m sure it’ll be a lot different than it is today… we’ll just have to wait and see.

In other words, we have a strategy for our drawdown all the way until we kick it, but things change. You can’t be too rigid or you risk failure in your retirement plans. We plan to be flexible and adapt along the way as needed.

Go ahead, friends – give me some feedback or questions on our drawdown plans. Does this spark any ideas for your own plans?

And, of course, thanks for reading!!

— Jim

* I spent waaaaay too long looking up the correct grammatical way to write this sentence. I actually couldn’t find a place that answered it to my satisfaction. This was what I decided to go with, so let me know if you think I’m off base on it.

Sounds like a very reasonable drawdown strategy Jim. I originally started my drawdown plan thinking we’d use Roth conversions, but so far we haven’t needed to.

We simply take cash from our taxable brokerage accounts when necessary. I thought this might mean a slow drawdown of those accounts over time, but the accounts have continued to grow in recent years.

It’s worked out rather well! 😉

That’s fantastic, Mr. Tako – can’t ask for a plan working out better than that!

— Jim

Good stuff. I use the Bulletshares ETFs too, for the same reason. (I’ve been FIRE for 3 years now) Have you considered using the high yield funds for part of your bond etf ladder as a supplement to the corporate funds you currently hold? For example adding BSJM alongside BSCM. Thoughts?

I like hearing that this is working for someone else that’s been doing this for a while! It took a lot for my financial advisor to push me out of the safety of keeping my 5 years in Ally. But the corporate funds gave a better return without adding too much risk into things. I might consider doing high yield funds down the line once we get past that initial 5-year hurdle of the Roth conversions or if we start to bring in more income from projects I’m hoping to do. But until then, I need my comfort of low-risk so I can sleep at night. 🙂

— Jim

Glad our shared journey gives you some sense of confidence:)

Your response sounds rather “all or none”. We learn best by trying things. Maybe do a very small investment so the risk is trivial?

That’s a good point – I’ll have to consider that… but I’m not ready to just yet. 😉

— Jim

It looks like a good plan. Let’s get through the first few years and then you can evaluate the withdrawal plan again. We’ll do something similar when Mrs. RB40 retires. Although, I’m hoping to withdraw around 2% as long as I make some side income. It’s great that the tax cut is in effect now. You guys can do more conversion.

Yeah, now’s definitely a good time to do the conversions. I’d love to be able to get down to the 2% like you’re planning. Hopefully, I can get to that same side income level as well to make that happen! 😉

— Jim

Have you ever tried peer-to-peer lending? If not you might want to take a look at my blog. I document my progress while investing in European peer-to-peer lending platforms. Check my blog and let me know what you think: https://p2pincome.eu/

I haven’t done the P2P lending, but only because it’s not legal in the state of Ohio here in the U.S. But I may toy with that a little bit once we change our residence later this year.

— Jim

Why would you want to convert all of the traditional money in 5 years? I think the minimum you need to convert is 1 year of expenses at a time. You can take advantage of the standard deduction every year converting money for free. If you have a year with “no income” because it has all been converted you are losing that tax free conversion gift each year.

That’s a good point, Rob. The goal is to try to take advantage of the here and now while the standard deduction is higher since the future is pretty much an unknown. I agree that we’ll do what we can to make the conversions tax-free as much as we can. With some of the paper losses for our real estate, we should just be able to bring over more each year than we need without paying much if anything in taxes.

We don’t know what the future holds, however, for some of the projects I want to keep doing. If those start bringing in some good income, that can create problem on the conversions… that’d be a good problem to have, but still a problem. Plus, the tax laws can change at anytime so for now, we figure we’ll just deal with what we know and play it that way.

— Jim

Hey Jim, interesting post. With Bulletshares you mentioned they are all in bonds? Those would likely erode in value in real terms? There’s likely income and growth below inflation?

I watched my bond ladder erode, but it was not a big deal as I was in the accumulation stage and the bond income was being directed to equities.

In your current stage I’d imagine you have equities to add a growth component, somewhere. Sorry, it’s hard to tell from your post.

That said, I’d think that we’d need the stocks and bonds together in each bucket to manage the risks. IMHO we don’t want the stocks or bonds alone swimming naked in any account type bucket. ? I would not call bonds safe on their own in a retirement funding scenario. Very little yield and with price risks.

Thanks for your thoughts and clarifications 🙂

Dale

Dale, you are correct – the plan is to have five years of expenses in a bond-fund ladder some time. Very true that I won’t get the growth that I would over the long-term with the stock market. However, it does buy me the security I need to help mitigate sequence of returns risk, which is a real concern of mine. While the rest of my portfolio should continue to grow over the long run, the BulletShares should hopefully at least cover inflation. But if they don’t, that’s Ok with me in that I’ll be able to sleep at night knowing we should be able to get through a bad bear market a little easier.

Once the sequence of returns risk starts to diminish (5-10 years down the road), I’ll likely start to scale the ladder back a little and put more into the stock market with the rest of our portfolio.