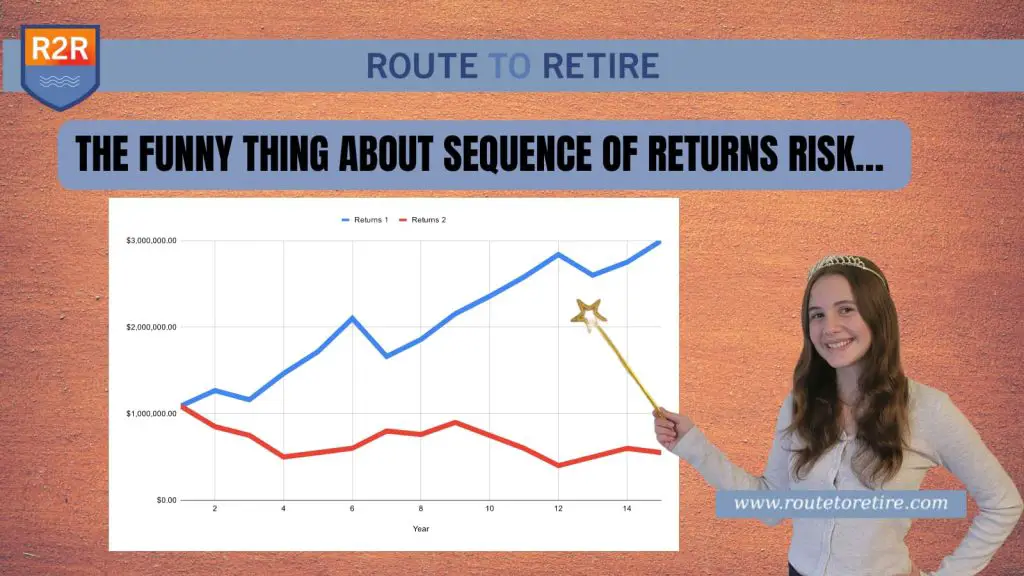

The Funny Thing About Sequence of Returns Risk…

If someone decides to retire and live off of their investment portfolio, an important detail called the sequence of returns risk can be one of the most critical components to comprehend. You might have an understanding or at least a notion of the 4% rule that helps give you some direction in retirement planning. The idea is that you likely can take out 4% from a given portfolio every year and never run out of money. There are several caveats […]

The Funny Thing About Sequence of Returns Risk… Read More »