Disclosure: This post contains affiliate links and we may receive a referral fee (at no extra cost to you) if you sign up or purchase products or services mentioned. As an Amazon Associate, I earn from qualifying purchases.

If you haven’t heard, Intuit decided to shut down the Mint personal finance site/app on January 1, 2024. They made this announcement on October 31, 2024, giving users only about 2 months to decide what they were going to do. All I can do is shake my head at how disrespectful this is to their loyal customer base.

UPDATE: I just I received an email from Intuit on 12/17/2023 stating that I can continue using Mint until March 23, 2024, so that does provide a little more time to make a decision.

But it is what it is and if you’re a Mint user, you don’t have a lot of time to take action. If you don’t download your transaction history, it’ll be gone once Mint shuts down.

They are giving you the option to move to Credit Karma (another Intuit-owned company) but this new app won’t have all the same features as Mint.

I have some mixed emotions on this. I’m disappointed in how Intuit has handled this but at the same time, I’ve never been thrilled with their app, so this was a good kick in the butt to find something better to use.

As always, I spent way too much time researching the various options out there. For my needs, PocketGuard ended up fitting the bill. I’ll explain why this was a good choice for me and tell you about some of the other options out there if PocketGuard doesn’t make sense for you.

What I needed in a Mint replacement

I essentially only use Mint to track my spending – I like to have a gauge on how much we spend each month and in what category.

But in reality, I’ve never been blown away by the Mint site/app. It works ok, but it’s not great. I did appreciate Quicken and used it for decades but Quicken was also kind of a dinosaur and their “mobile” version was essentially useless. It was also taking up too much of my time so I bailed on it in 2019 after 20 years.

I moved to Empower (formerly Personal Capital) and was amazed by how much more insightful it was at interpreting my investments. It’s free, easy to use, has a ton of great tools, and the mobile app works extremely well. If you’re looking for a Mint replacement, this is a great place to start. I love that once you get it set up, there’s really not much work to be done anymore.

But shortly after, I added Mint into the equation because I wanted something that focused on the individual transaction side of things better. We were living in the country of Panama and we had a lot of cash transactions since credit cards weren’t accepted in many places. Empower doesn’t allow manual cash transactions so Mint became the primary app for our expense tracking.

So I’ve been rolling with the two apps for a few years now. With Mint going bye-bye though, I needed an app that fulfilled the following requirements:

- Allows me to connect all my financial institutions. If that makes you uneasy, I respect that. But for me, I want something that does all the aggregation possible for me.

- Allows me to categorize transactions as I want. Better yet, it will remember the categories I choose and allow me to default to them for future transactions.

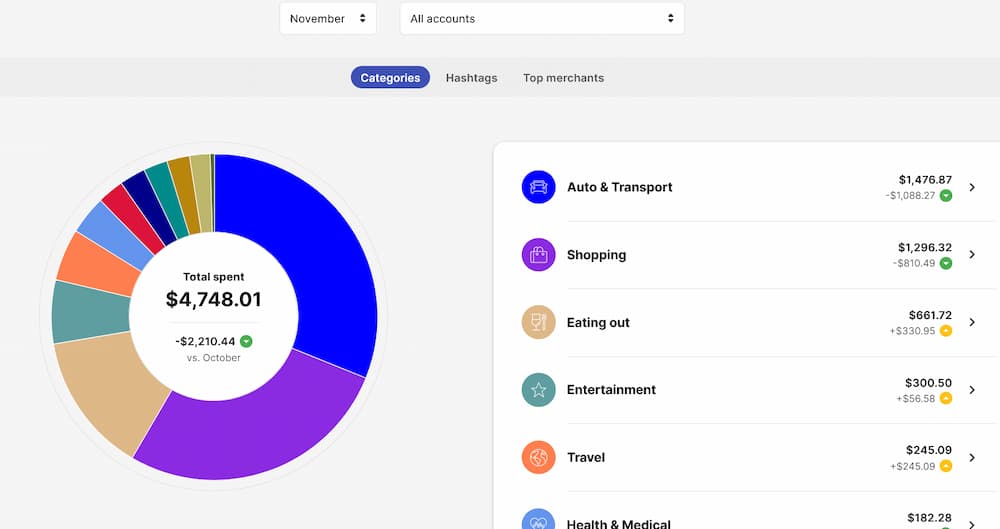

- Will let me see how much we’re currently spending in a month and view past months’ spending as well. It will also let me know how much was spent in each of the various categories… pie charts are even better!

- It needs to have both web software and an Android app. I like the ability to just check and do things on my phone whenever and wherever I want. But being able to do more involved tasks on a laptop can be much easier and since I use a Chromebook, a website is an easy way to go.

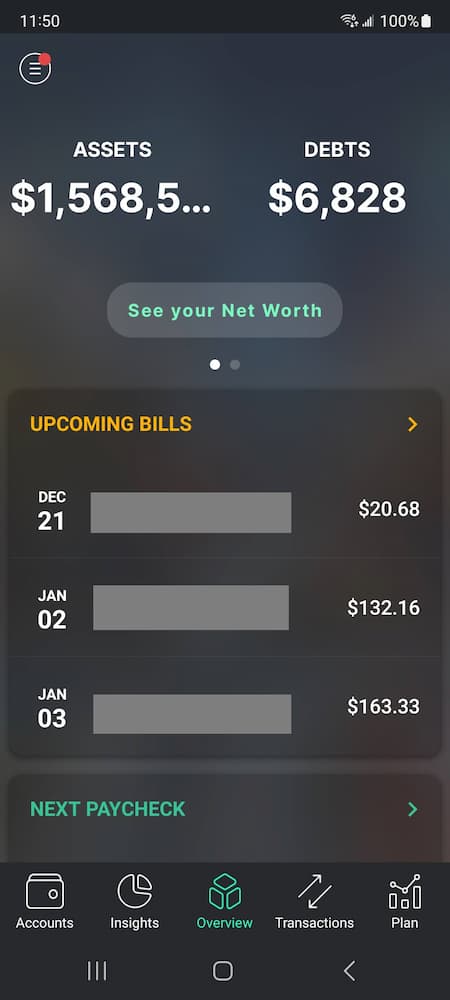

One nice thing Mint did was show me when my upcoming credit card bills are due and how much. Even though I have the full balance of each automatically paid out of our checking account each month, it’s nice to see all the upcoming payments at a glance. That would be a bonus to have that.

As you can see, my requirements for a Mint replacement aren’t huge. I essentially just want something simple to manage our monthly expenses.

The two big things I didn’t need in a Mint replacement

I already let the cat out of the bag, but I wasn’t using Mint for all of our personal finance management. Empower is the other half of my arsenal.

The two facets I rely on Empower for are:

- Investment tracking

- Net worth

Empower has proven that they know how to give you the right tools and information on your investments. I’m very happy on that front. The ability to easily see your asset allocations makes it well worth it to me alone.

And I grab my net worth every month (which you can find here) from Empower as well.

Again, I can’t recommend Empower enough. Although the budgeting side of things isn’t as good as a lot of other options, it might be enough for your needs. Or if you’re like me, you might find that using two apps with different strengths can be a better solution than one app that’s just fair across the board.

And with a cost of free, so it’s worth trying out regardless. You can check out Empower here.

What I liked about PocketGuard

So we’ve established what I needed and didn’t need in a Mint replacement. After a lot of digging, here’s why I settled on PocketGuard…

1) Doing one thing well – PocketGuard’s focus is tracking your money, which is exactly what I’m after. Right at the top of their homepage is the text “Always know where your money goes.” That’s what I want – something to focus on the expense tracking. I already have the investing side covered well with Empower.

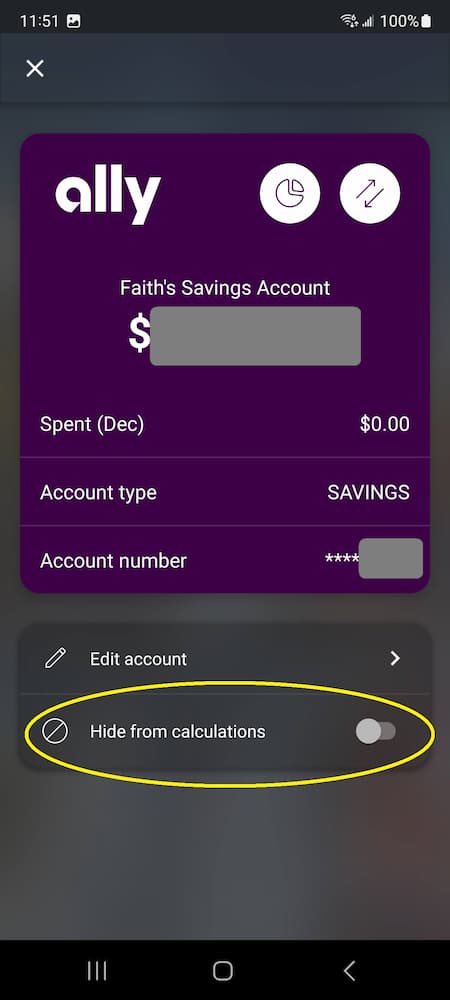

Seeing how much you’ve spent each month is right out in front of you. You can exclude accounts or transactions easily from your numbers. This was something that was sort of a pain with Mint.

2) Modern app/website – Both the app and website work very well. They both have a modern feel to them (unlike Mint) and a lot of things you might want to do are as simple as dragging and dropping.

3) Roadmap – They recently issued a roadmap of planned features. I appreciate knowing where a product is going and what I have to look forward to.

4) Easy to try out – I was able to easily test it before pulling the trigger. PocketGuard works as a “freemium” model. You can sign up and use most of the functionality for free for as long as you want. If you want access to additional features though, you need to ante up.

I knew that if I chose PocketGuard, I would be paying because the free functionality limits you to just two financial institution connections. But that was enough for me to tinker around with it and determine if it was what I was looking for in a Mint replacement.

5) The price is right. Yes, Mint was free but I’m ok with paying for a good product or service. With PocketGuard, you have your choice in how to pay (other than the free version). It’s currently $7.99 per month, $34.99 per year, or $79.99 for a lifetime purchase. I opted for one-and-done and went with the $80. Other choices I was looking at were more than that on an annual basis so this seems like a steal. And if I decide to change from PocketGuard sometime down the line, I won’t feel like it was a wasted purchase.

UPDATE (02/13/2024): It looks like the folks at PocketGuard changed their pricing to $12.99/month or $74.99/year. The option for a lifetime purchase is not there either. However, a commenter in a Reddit post about this mentioned that you might be able to do the trial and get offered the lifetime deal when the trial expires. I can’t comment if that works or not.

6) Import and export. I’ve learned over my career in IT that it’s important to always be thinking about your exit strategy when going into something new. That’s why I appreciate that PocketGuard will let you export all your transactions. They’ll let you import as well but I’ve been thinking about it and, although I’m still going to export my Mint data for safe-keeping, I think I’m ready for a fresh start so I likely won’t import these old transactions into PocketGuard.

7) Shared household. This wasn’t a requirement at all for me, but I noticed on their roadmap that they plan to allow you to invite collaborators and set permissions. So my wife could have her own separate account and be able to see where we’re at as well. This should be happening in the spring.

There’s definitely a learning curve to the app, but it’s nothing too steep. And, the more I’ve been using this app, the more I appreciate both the simplicity of it as well as the capabilities it provides.

PocketGuard isn’t perfect either. For example, even though I can easily see my spending for this month or a previous month, you can’t view the YTD numbers or the numbers for a previous year. I reached out to support via email to see if I was missing it, but they acknowledged (within an hour) that there is no such ability right now. He also said that this would be sent over to the feature request team to possibly be added later.

Regardless, I’m happy with my decision so far as it’s accomplishing everything else I’ve wanted it to do.

If PocketGuard sounds interesting to you, you can check it out here.

Other options for a Mint replacement

Although PocketGuard looks like it’s going to fit the bill well for me, each of us has our own needs so the choice in personal finance software might be completely different for you. So I’m definitely not trying to sell you on PocketGuard (though I like it!).

If you’re looking for a different Mint replacement, here is a list (by no means inclusive) of apps that seem to be brought up routinely all over the internet:

- PocketGuard

- Empower

- Monarch Money

- Quicken Classic

- Simplifi by Quicken

- YNAB

- Copilot Money

- Tiller

- NerdWallet

- Rocket Money

- Honeydue

- Fidelity FullView

I’ll leave it to you to dig into these to find what works best for your specific needs. Some places with some good comparisons:

- Comparison of Mint Alternatives – has a good spreadsheet comparison

- Mint Successor – This is another good spreadsheet comparison from Reddit but I can’t find the original Reddit post

- The Mint Budgeting App Is Shutting Down: Here Are Some Alternatives

- Mint, the Budgeting App, Is Going Away. Here Are Some Alternatives

Each of us has different requirements for what we need in a personal finance management software app. You should look at the different options to determine which is best for you (though I do think Empower on the investment side is a tough one to beat!).

What about Credit Karma?

Here’s the thing – I’m a big Credit Karma fan. I’ve used this free service to monitor our credit and get a gauge on our credit scores for years.

Everyone should take two steps to protect their credit:

- Open a Credit Karma account to monitor your credit – it’s free, easy, and will keep you in the know if anything out of the ordinary is going on with your credit.

- Freeze your credit at all 3 credit bureaus. Here’s a great guide on how to make this happen and here’s a post I wrote about freezing your child’s credit as well.

Without a doubt, these steps should be taken by everyone – and the sooner the better. If identity theft is a concern of yours (it should be), these two steps alone will help mitigate most of the ramifications that could happen with someone opening a line of credit in your name. Hear me preach and make it happen, folks!

Ok, but what about using Credit Karma to manage your finances? Will Intuit’s plan to push Mint users to Credit Karma be the ultimate Mint replacement?

Honestly, I have no idea. I plan to migrate my Mint data over to Credit Karma just to toy with it, but I’m not expecting much right now. Time will tell, I guess.

In the meantime, I’ll let PocketGuard do its job and we can just hope it’ll report that we have a surplus of spending money every year! 🙂

So that’s where we stand right now. Goodbye, Mint – I’ll miss you. Ok, probably not and it’s time to move on anyway. If you’re a regular Mint user, I hope you’ve found a solution that works for you as well!

If you’ve enjoyed this post, consider jumping on the mailing list. I’ll even send you a welcome email with a bunch of cool spreadsheet freebies as a thank you that I think you’ll appreciate. These include:

- Recurring Expenses Spreadsheet

- Credit Card Rewards Tracker

- Portfolio Rebalancing Spreadsheet

- HSA Unreimbursed Expenses Tracking Spreadsheet

- Roth IRA Conversion Ladder Calculator

- Alcohol Tracker

- Next-Chapter Matrix / Bucket List

Each of these has a related post that talks about the topic more and why this can be helpful in your own life. So quit thinking about it and sign up here…

I hope your holidays are wonderful and I’ll talk to you again in 2024!

Thanks for reading!!

Plan well, take action, and live your best life!

— Jim

PS In case you were wondering, that’s our daughter Faith in the main photo for this article. I hire her as a model for several of these per year to help fund her Roth IRA. Opening a custodial Roth IRA for your child can be one of the best things you can do for their financial future!

Thanks for the break down, Jim. I never liked Mint’s transition feature updates as it was very confusing to separate out investment transactions from regular daily ones. But I do use the net worth feature and aggregation tool, which sounds like Empower and Credit Karma can do. Pokcet guard is a good option too.

Yes, Empower will give you your net worth based off your connected assets and liabilities as well as any manual ones you might add. With Credit Karma, I’m not quite sure how that’s handled yet since I haven’t toyed with it. Most others should give you the info as well (PocketGuard does). Have a good holiday, my friend!

Does PocketGuard offer an overview of budget and categories? That is, Income and Expenses, with all the categories displayed and accessible? Also, does PocketGuard provide monthly rollover/accruals in expenses, so that I can budget properly for an annual expense? (e.g. property taxes, annual donations, etc.)

Hi Tom – yes, PocketGuard does break down your spending (and income) in each category. In fact, that’s pretty prominent on the app and site and something that I was really after. I’m not using it for budgeting so I don’t know all the ins and outs, but I do see on their roadmap that they plan to add “budget rollover” in January. It’s worth trying it out since it won’t cost you a penny. You can only connect two institutions with the free version but that should be enough to get a feel for it. If you like it, then you can always pay to add more accounts and get the additional functionality. Good luck!

I’m an intermittent Mint user as I’ve never found it nearly as good as Quicken used to be. Plus I’ve simplified my budgeting – If I can pay the CC bills every month I’m on track since only so much money goes into the checking account anyway. I’m thinking Intuit has bailed on me twice (Quicken now Mint) so Credit Karma is out. Still, the dweeb in me wants to know if I’m spending more on wine or the beauty salon. Two institutions will work for me for a while. As for Empower – it works great – other than it can’t access the TSP or Treasury Direct very well.

Quicken really was such a great product – it just became a dinosaur over time. Haha, yeah, Intuit’s track record doesn’t lay a lot of confidence for their next act! 🙂

Thanks for sharing this Jim, I’ll look into Pocketguard. I hope you and your family are having a great road trip (though maybe you are back in Ohio now) but an even better Christmas Holiday. Cheers!

Thanks, Jim – Merry Christmas to you as well!!

Upon checking today 2-13-24 according to their website pocketguard is $12.99 monthly or $74.99 annually. Can you please verify what I’m seeing is correct and update your information?

Thanks for pointing that out, Nancy. It does look like they’ve changed their prices. I found this discussion on Reddit where they talk a little about that in the comments. Someone in the comments also said if you wait until the trial expires, you might get an offer to do the lifetime purchase – might be worth giving that a shot.

I’ll update the pricing in the post to mention that.