Breaking Up With PocketGuard: Why Quicken Simplifi Won Me Over

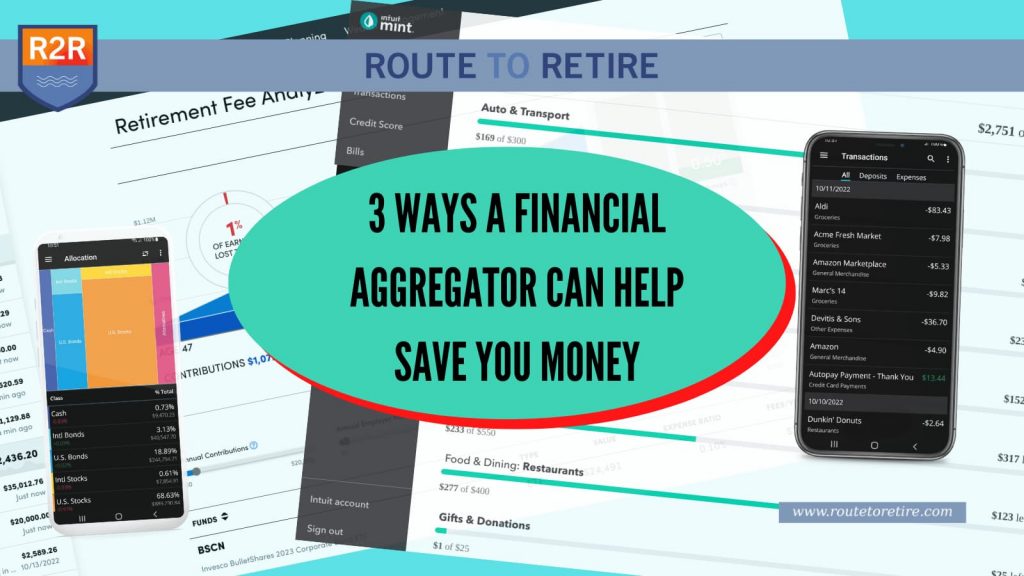

Well, I’ve gone and done it again… I switched personal finance apps in my quest to find the right one for what I needed. I thought PocketGuard was the one, but it turns out I was wrong. I only used PocketGuard for about 6 months but it had some shortcomings that just didn’t work well for me… so I decided to bail on it. Fortunately, I think Quicken Simplifi will be the answer I have been looking for all this […]

Breaking Up With PocketGuard: Why Quicken Simplifi Won Me Over Read More »