Disclosure: This post contains affiliate links and we may receive a referral fee (at no extra cost to you) if you sign up or purchase products or services mentioned. As an Amazon Associate, I earn from qualifying purchases.

Ah, how time flies! In February 2019, I wrote a post called The Breakdown of Our Net Worth Savings & Investments that detailed our investment portfolio at the time.

As you’d expect, it broke down all our assets and liabilities and gave a good snapshot of our financial picture. This was just a couple of months after I had retired from the corporate world so it gave us a pretty good baseline to start our retirement.

But holy schnikes – that was almost four years ago!

Even though everyone’s situation and financial goals are usually vastly different, many readers still want to see numbers on personal finance sites. It helps them to get ideas and provides some motivation if they’re looking to do something similar to what others have done.

That’s also the case here. Readers routinely ask me questions about our numbers and I end up pointing them to that post from way too long ago!

So I thought that I’d take the time today to give you an updated look at our investment portfolio. I also like that the stock market’s really cooled off over the past year so this should give a more “realistic” picture of where we stand.

Disclaimer: I’m not a financial planner. I don’t have a background at all in finance. I’m just some random guy who figured out what works well for himself and his family and I post the stuff on the internet. Don’t consider anything here as advice and consult a professional before getting yourself into something you don’t understand.

There are also so many different ways to invest – all with pros and cons. For instance, my friend Mr. Tako has built his massive investment portfolio based on dividend stocks. It’s really incredible and something cool to realize. You can check out his site at Mr. Tako Escapes.

Just because something works well for one person, doesn’t mean it’ll work best for the next. Your job is to learn and figure out the ideal strategy for yourself. And if this isn’t something you want to learn, then you should focus on hiring a fee-only fiduciary planner to help guide you along the way. NAPFA, Garrett Planning Network, and XY Planning Network are great places to start.

Empower (formerly Personal Capital) is Still Rocking It!

I want to start by saying that all the numbers you see here are being pulled from my Empower (formerly Personal Capital) account. If you’re not familiar, Empower is a free online service that lets you link all your financial accounts to it. It then lets you see your complete financial picture so you know exactly how you’re doing.

Not only can you see how your accounts balance each other out (i.e. savings/investments vs debt) but you can drill down to detailed transactions within each account, too. You also get to see the totals for each category as well (cash, investments, credit cards, etc.). I love being able to easily view the asset allocations of my investment portfolio with just a click.

The biggest keys to moving ahead financially are knowing where you stand currently and to also realize where you need to be. Knowing where you are now is a cakewalk after your accounts are all linked.

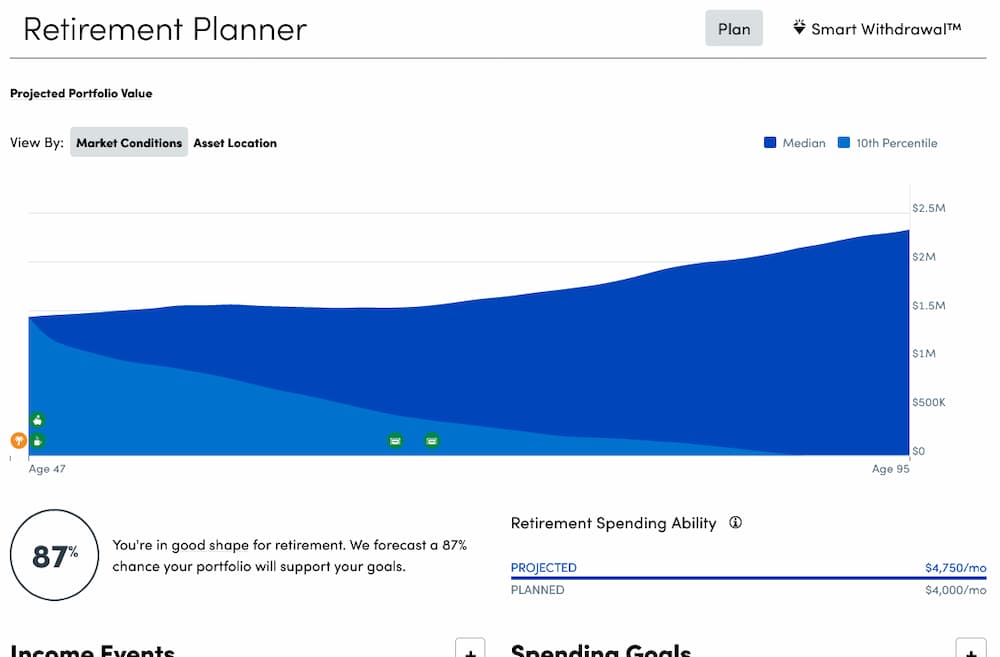

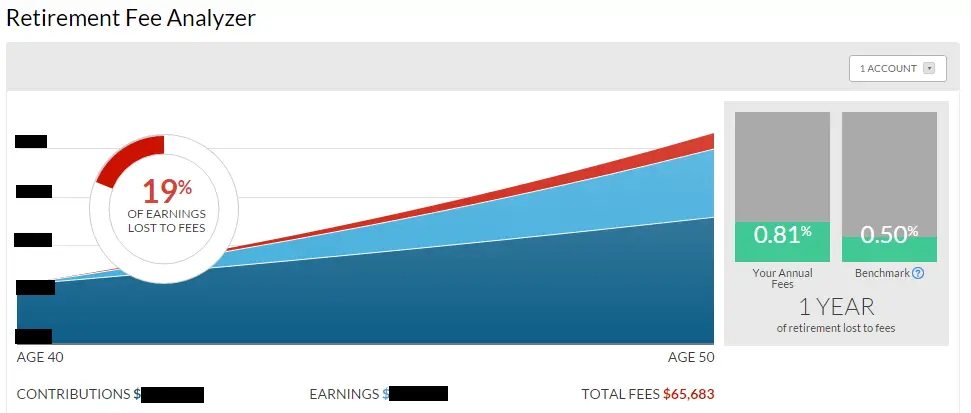

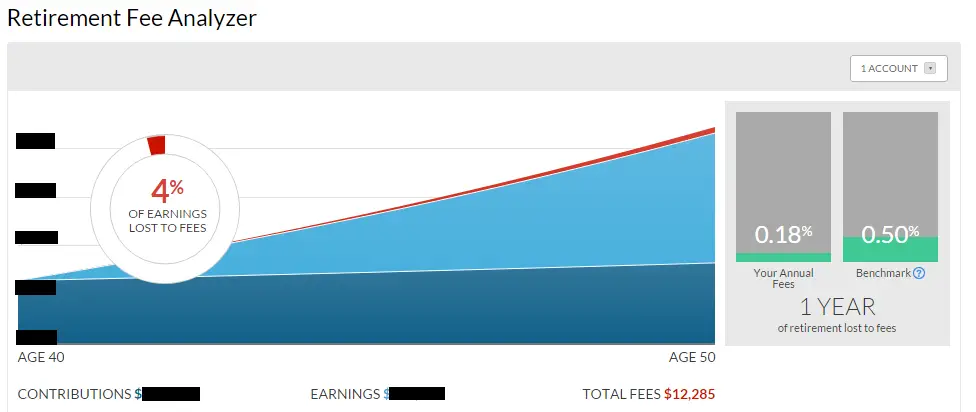

The real magic though is due to the tools within Empower. These include the Retirement Planner, Withdrawal Planner, Retirement Fee Analyzer, and Investment Checkup – and they’re all great at helping you position yourself where you want to be down the line.

Of all the retirement calculators I’ve tried over the years, I think the Retirement Planner in Empower is my favorite. One reason is that it’s easy since you don’t need to enter much on things to get started with because it already knows where you currently stand financially. The other reason I like it is its flexibility in making a lot of “what if” spinoff scenarios. And, like many good calculators, it runs Monte Carlo simulations (5,000 in Empower!) to give you your projection and success likelihood.

And I’ve talked repeatedly about how Empower’s Retirement Fee Analyzer helped me save over $50,000 in fees over a ten-year period with just a couple of hours worth of time. I would have never known about this otherwise… absolutely incredible.

Anyway, if you’re not using Empower for your finances, it’s worth giving it a shot. Considering it’s a free service, it’s hard to go wrong.

You can check our Empower here.

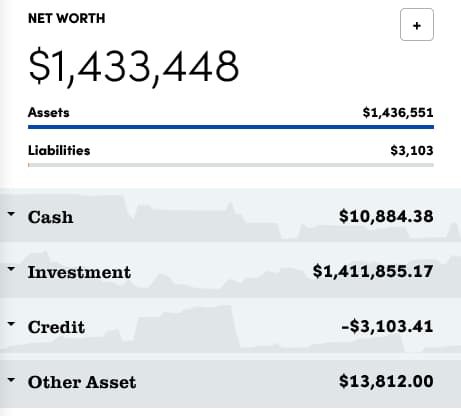

The Balance Sheet Breakdown

I’m going to round some of these numbers in our investment portfolio slightly just for security reasons. What can go wrong with sharing all your personal finance details on the internet, right? ? These numbers are current as of December 2022.

First, is the overall balance sheet…

Here’s a breakdown of our investments and cash…

| Investment | Symbol | Total Value | Expense Ratio | % of Account | % of Portfolio |

|---|---|---|---|---|---|

| Taxable Brokerage Account | |||||

| Allegheny Technologies Inc | ATI | $700.00 | 0.40% | 0.05% | |

| First Energy | FE | $800.00 | 0.44% | 0.05% | |

| Invesco BulletShares 2022 Corp Bond ETF | BSCM | $60,000.00 | 0.10% | 32.98% | 4.02% |

| Invesco BulletShares 2023 Corp Bond ETF | BSCN | $30,000.00 | 0.10% | 18.95% | 2.31% |

| Invesco BulletShares 2026 Corp Bond ETF | BSCQ | $50,000.00 | 0.10% | 31.54% | 3.84% |

| Teledyne Technologies Inc | TDY | $1,000.00 | 0.74% | 0.09% | |

| Vanguard Total Stock Market ETF | VTI | $30,000.00 | 0.03% | 14.95% | 1.82% |

| Vanguard Federal Money Market Fund | VMFXX | $90.00 | 0.05% | 0.01% | |

| Total | $172,590.00 | 100.00% | |||

| Rollover IRA #1 | |||||

| Invesco BulletShares 2024 Corp Bond ETF | BSCO | $50,000.00 | 0.10% | 5.39% | 3.59% |

| Vanguard REIT ETF | VNQ | $20,000.00 | 0.12% | 2.51% | 1.68% |

| Vanguard Total Stock Market ETF | VTI | $900,000.00 | 0.03% | 92.10% | 61.42% |

| Total | $970,000.00 | 100.00% | |||

| Rollover IRA #2 | |||||

| Invesco BulletShares 2023 Corp Bond ETF | BSCN | $20,000.00 | 0.10% | 100.00% | 1.73% |

| Total | $20,000.00 | 100.00% | |||

| Health Savings Account (HSA) | |||||

| Fidelity ZERO Total Market Index Fund | FZROX | $40,000.00 | 0.00% | 100.00% | 2.73% |

| Total | $40,000.00 | 100.00% | |||

| Roth IRA #1 | |||||

| Amazon.com Inc | AMZN | $20,000.00 | 10.19% | 1.32% | |

| Invesco BulletShares 2025 Corp Bond ETF | BSCP | $50,000.00 | 0.10% | 27.24% | 3.53% |

| Alphabet Inc Class C | GOOG | $4,000.00 | 2.18% | 0.28% | |

| Alphabet Inc Class A | GOOGL | $4,000.00 | 2.17% | 0.28% | |

| SPDR S&P Dividend ETF | SDY | $4,000.00 | 0.35% | 2.35% | 0.30% |

| Vanguard REIT ETF | VNQ | $50,000.00 | 0.12% | 26.91% | 3.48% |

| Vanguard Total Stock Market ETF | VTI | $50,000.00 | 0.03% | 28.94% | 3.75% |

| Vanguard Federal Money Market Fund | VMFXX | $60.00 | 0.03% | 0.00% | |

| Total | $182,060.00 | 100.00% | |||

| Roth IRA #2 | |||||

| Walt Disney Co | DIS | $3,000.00 | 13.90% | 0.19% | |

| SPDR S&P 500 ETF | SPY | $4,000.00 | 0.09% | 22.95% | 0.31% |

| Vanguard REIT ETF | VNQ | $6,000.00 | 0.12% | 30.03% | 0.41% |

| Vanguard Total Stock Market ETF | VTI | $6,000.00 | 0.03% | 32.69% | 0.44% |

| Vanguard Federal Money Market Fund | VMFXX | $80.00 | 0.43% | 0.01% | |

| Total | $19,080.00 | 100.00% | |||

| Roth IRA #3 | |||||

| Vanguard Total Stock Market ETF | VTI | $3,000.00 | 0.03% | 99.13% | 0.20% |

| Vanguard Federal Money Market Fund | VMFXX | $30.00 | 0.87% | 0.00% | |

| Total | $3,030.00 | 100.00% | |||

| Treasury Direct | |||||

| Series I Savings Bonds | $20,000.00 | 100.00% | 1.40% | ||

| Total | $20,000.00 | 100.00% | |||

| Cash | |||||

| Ally Bank | $4,000.00 | 36.06% | 0.28% | ||

| Charles Schwab Investor Checking | $3,000.00 | 27.40% | 0.21% | ||

| Business Checking Accounts | $3,000.00 | 27.36% | 0.21% | ||

| Cash on Hand | $1,000.00 | 9.19% | 0.07% | ||

| Total | $11,000.00 | 100.00% | |||

| TOTAL VALUE | $1,437,760.00 | 100.00% |

I didn’t list any accounts where Faith is the beneficiary either. The UGMA bank account we have at Ally and the 529 plan we have in place are hers even though they’re still in our name right now. If she wants to do an investment portfolio review of her own, let her run with that one! 😉

The only other asset not included in the above breakdown is our 2012 Honda Pilot. Yes, I consider the car to be an asset on the balance sheet – it’s a depreciating asset but an asset nonetheless. I could sell it tomorrow for cash if I needed to just like anything else. That’s the $13k you saw in the screenshot of our net worth.

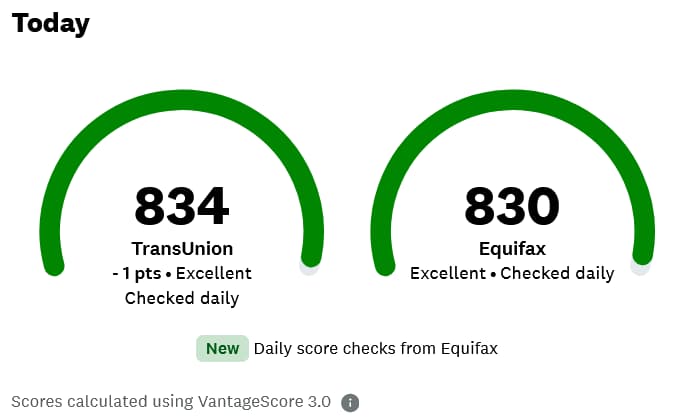

And to round out things, we have our liabilities. Because we don’t own a home, we don’t have a mortgage to worry about. We also don’t have any loans. So the only liabilities in our financial picture are our credit card balances… about $3,100 worth as I type this.

Credit cards??? Come on, Jim – you know better than that! Those things have a 16.65% interest rate on ’em!

Easy, tiger – we don’t keep a balance. All of our credit cards are paid off in full every month.

So why use ’em? First of all, since we don’t have a mortgage or any loans, credit card usage is something important to keep our credit scores up. Here are a couple of my current scores shown through Credit Karma (another fantastic free service):

And the second reason we focus on credit card usage is for the travel rewards. Credit cards have paid for us to regularly travel around the world for free or at a very low cost – something we likely couldn’t afford otherwise. If that interests you (it should), check out some of my travel rewards posts:

- The #1 Best Way To Track Credit Card Rewards

- The #1 Easy Way We’re Getting the Southwest Companion Pass

- Our Travel Perks Are Drying Up and That’s Big $$$!

- Free Nights – We’ve Had 5 at Hilton Hotels Recently

- We Got Turned Down for a Credit Card… Ok, Four!

- Travel Rewards – 12 Free Flights Earned in 9 Months!

I’d also recommend using the free service, Travel Freely, to track your credit cards and rewards. The alerts about annual fees coming up, upgrading/downgrading advice, and when it’s time to apply for a new card (and suggestions on which ones) are extremely helpful. For the low cost of $0, this site/app can make taking advantage of credit card travel rewards simple.

The Bucket Strategy

I don’t want to go into this too much because I’ve already laid things out previously in a couple of posts that I’ll link to momentarily. The gist though is that we maintain 3 “buckets” of money in our portfolio:

1) Cash bucket – This is our money for spending over the very short term. In our case, it amounts to one year of expenses that we keep in our online savings account and transfer a monthly “paycheck” to our checking account for our living expenses every month.

2) Income bucket – This is money that earns a little more than the cash bucket, but not as much as the growth bucket. We have a bond ladder of 5 years (soon to be 4 years) invested in BulletShares fixed-income ETFs. The income bucket enables us to not need to sell our equities during a bear market for several years if needed.

3) Growth bucket – The rest of our money is in our growth bucket. This money is invested in equities (mostly VTI) to grow over the long haul. There will be ups and downs over a shorter duration but over the long run, it should continue to grow solidly.

Every year (or staggered throughout each year), money is moved from the growth bucket to refill the income bucket. And money is moved from the income bucket to refill the cash bucket.

There are many ways to implement a bucket strategy. You can read more about our structure in my original post on the subject, The Drawdown on Investments – Our Game Plan, and more recently in Is This Down Stock Market Problematic as an Early Retiree?

But the credit has to go to my friend Fritz for making me even aware of this strategy. His post, How to Build A Retirement Paycheck From Your Investments, is an excellent synopsis of how this works and why you might want to consider utilizing it. Nice job, Fritz!

The reason I wanted to touch on this is so you can understand why you see the various Invesco BulletShares Corporate Bond ETFs in my portfolio. Each of these represents a year’s worth of our expenses to be moved over when they mature to become our spending money for the year. This ladder helps me sleep better at night knowing I don’t need to sell equities to pay for our expenses during a bear market.

I’ve recently decided that 5 years might be a little much on this and with the stock market still not fully recovered, it’s a good time to skip buying any BulletShares this year. That means I won’t have to sell any equities to make it happen. In the future, I’m going to keep this at a rolling 4-year period.

Details on Our Investments

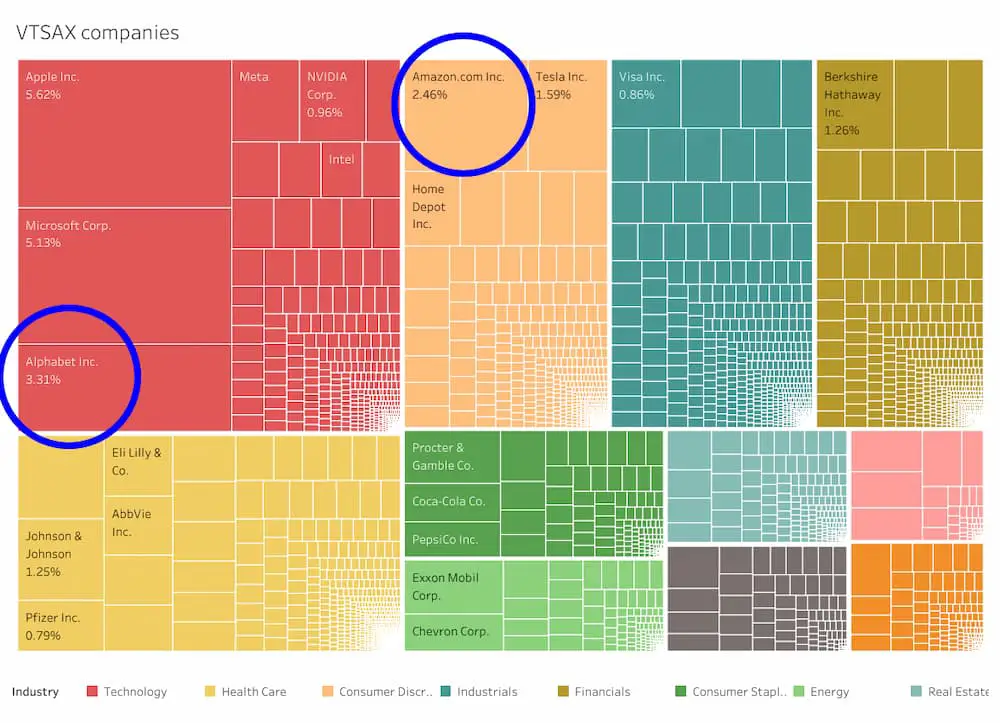

I’m a firm believer in keeping things simple and our portfolio is no different. The majority of our investment portfolio is invested in VTI (the ETF version of VTSAX). VTI/VTSAX are index funds that provide exposure to the entire U.S. stock market.

I’ve found JL Collins’ Stock Series to be a fantastic understanding of how to invest more simply. He took all that information and turned it into a much more polished read in the book, The Simple Path to Wealth, which I recommend to anyone looking to understand a simple and effective way to invest in the stock market.

In a nutshell, we buy the whole U.S. stock market through VTI – we’re looking forward to that providing growth for us for decades to come. You might also notice that we own the Fidelity ZERO Total Market Index Fund (FZROX). That’s because our HSA is held at Fidelity and that gives me another low-cost total stock market fund.

Outside of that, we invest in some bonds (BulletShares Bond ETFs) to help smooth the ride and to be part of our bucket strategy.

Then we have VNQ. When we sold our last rental property in early 2021, I took the proceeds and invested in the Vanguard Real Estate ETF (VNQ). Although owning this doesn’t provide all the benefits of actually owning a physical property, it allows me to continue to have a piece of the real estate market. It does provide more diversification than owning a rental or two and without the headaches that come with being a landlord.

We also bought some Series I Savings Bonds last November and this past January. It was hard to pass up the nice returns being offered. Once the rate becomes less interesting, I’ll keep an eye out for where to move this money next… and keep you in the loop, of course!

And finally, we have a handful of individual stocks in our investment portfolio. These were stocks that we decided to hang onto once we liquidated and moved to index funds. Most of these are our “fun stocks” so to speak… Google (Alphabet), Amazon, and Disney.

I bought 2 shares of Google at about $664/share back in 2007 (it was all I could afford). That’s since split into Class A and Class C shares and then did a 20:1 split this past summer. I’ve had about a 201% return, which is pretty cool.

Amazon was my real win though. I bought 12 shares of Amazon stock in 2008 at $49/share for a total of $588. I sold 2 shares in 2020 before the split at $3,025/share for a total of $6,050! My remaining 200 shares (after the split) are currently worth a crazy $20,000 right now!

But here’s the deal – even though that’s a little fun, I was thinking the other day about VTI being a cap-weighted index fund. That means that the index fund holds percentages based on the stock’s total market capitalization.

In essence, I already own a ridiculous amount of both Google and Amazon within VTI since they’re such powerhouses. According to Katie Donegan’s chart showing the VTSAX breakdown (which is identical to VTI), Amazon makes up 2.46% and Google (Alphabet) makes up 3.31%.

So outside of the individual stocks I own of these, I’m carrying a lot of ownership of these companies through VTI. Why??? It’s not like they’re dividend stocks giving me something different to think about. So, I’m going to be selling these shortly and rolling the money right into VTI. I’ll likely do the same with the straggling few shares of ATI, FE, and TDY, too, just to clean up the portfolio.

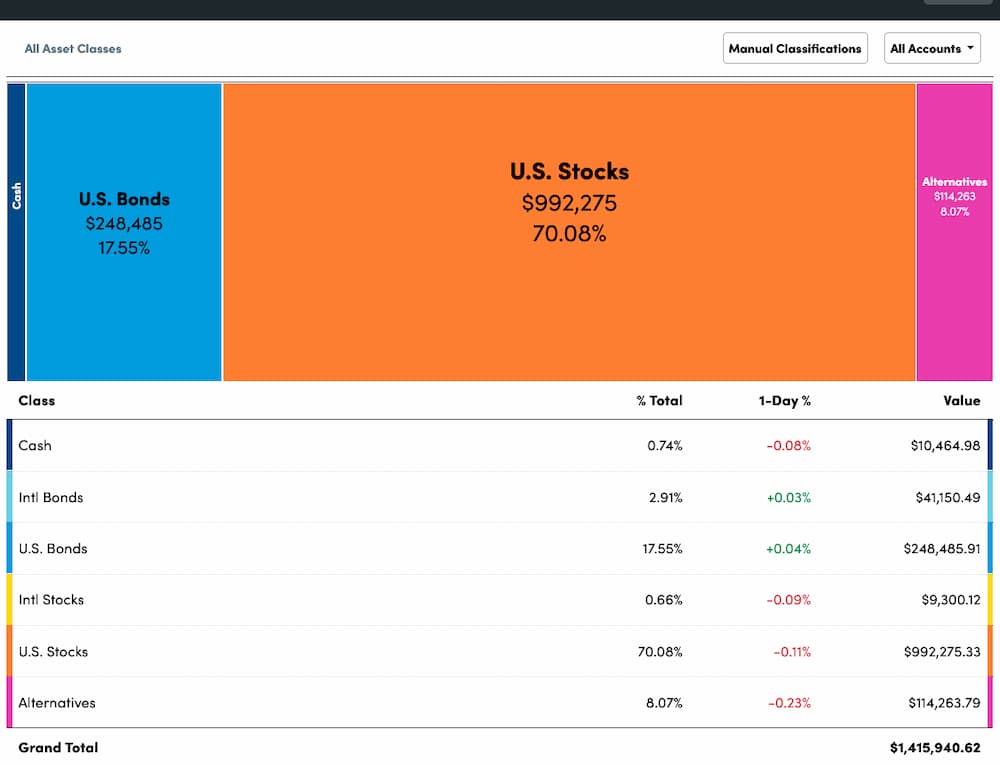

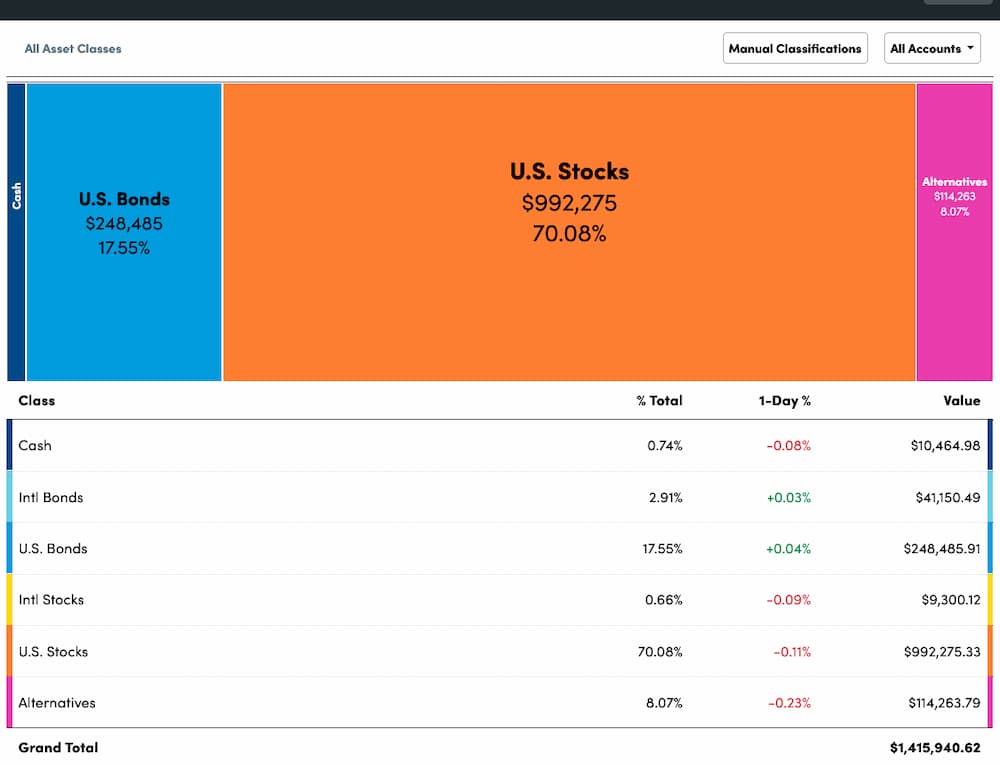

Asset Allocations and Sectors

As I mentioned earlier, it’s nice that Empower does the hard work for you to let you instantly see where you stand on asset allocation. Here’s where we’re at on that…

Something very important to do for your portfolio is to rebalance it periodically (maybe once or twice a year). This can help minimize risk.

I discuss rebalancing, why it’s important, and how I do it in my post, Portfolio Rebalancing: Get Your Asset Allocation in Line. If you’d like a copy of the spreadsheet I created and use for my own rebalancing, sign up for my email list and I’ll send you a copy (you can unsubscribe at any time):

My comfort level of risk is to be around 70% invested in equities. You can see by the chart above that I’m at 70.74% (U.S. plus international stocks)… that’s close enough to perfect for me!

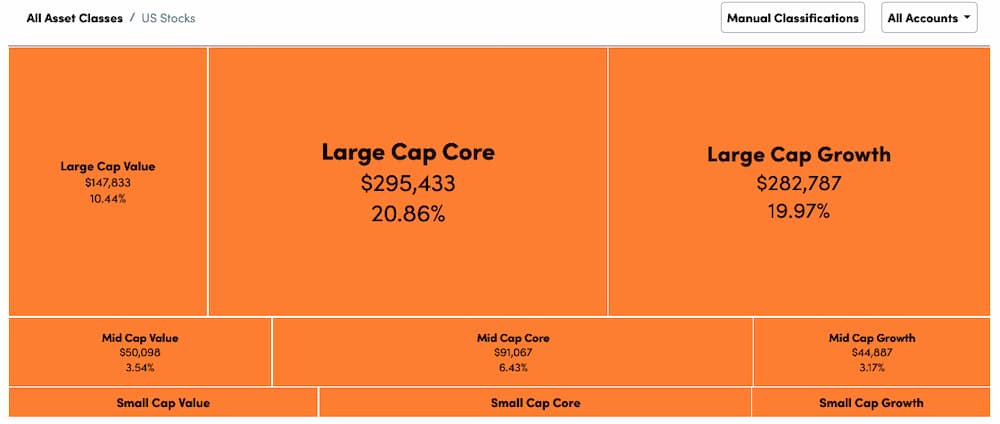

Here is what the breakout on our market caps looks like for our U.S. stocks:

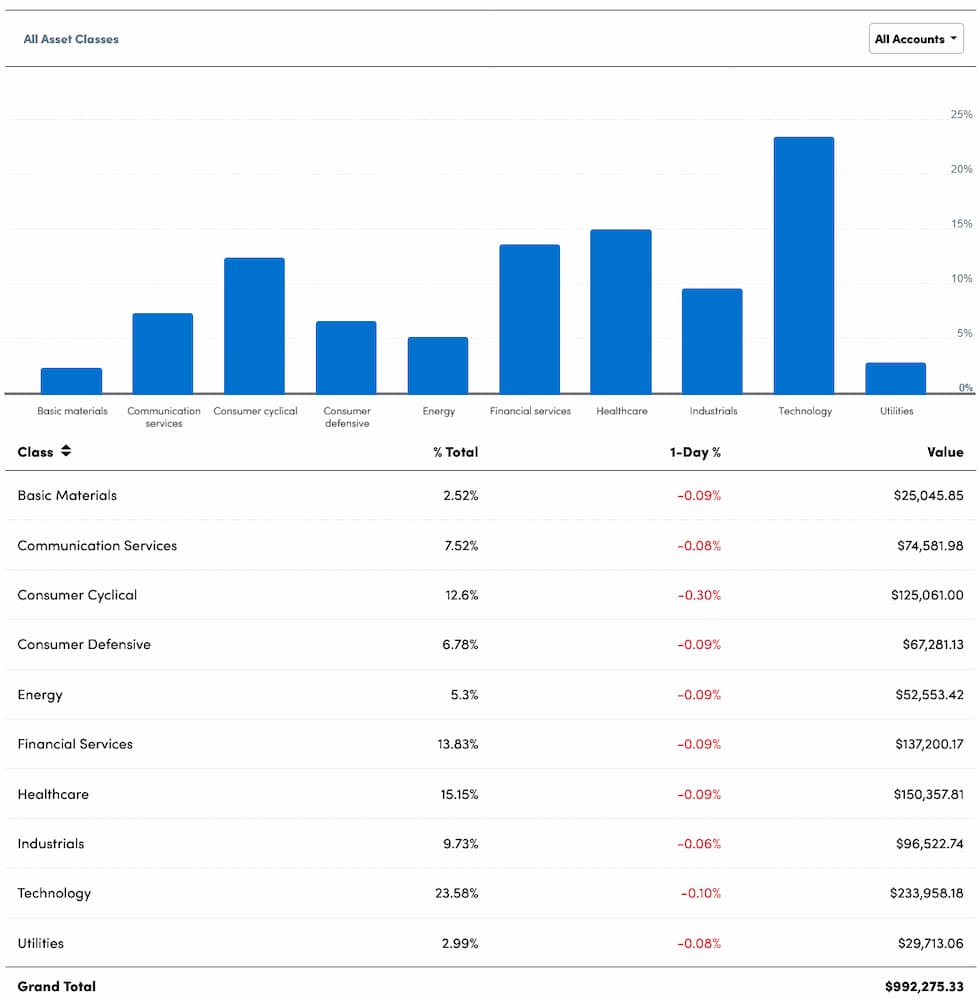

And here are the sectors contained within our investment portfolio:

Here’s the thing though… I don’t really care much about tracking the sectors I’m invested in. The reason goes back to VTI being a cap-weighted index. The strongest sectors are going to carry the most weight and be the largest portion of my portfolio automatically. As time goes on and other sectors become stronger, the index fund will adjust accordingly.

So right now, technology is over 23% of my portfolio, but at one point, the energy sector would have been at the top. Things change and VTI will automatically adjust with no intervention needed.

There you have it, folks – this is how our investment portfolio is looking lately. I’m sure it’s not the perfect portfolio but it does the job well for us. As time changes, I’m sure there will be some adjustments (like the couple that I mentioned throughout), but I do feel good about the current structure overall.

Plan well, take action, and live your best life!

Thanks for reading!!

— Jim

Well done Jim!! 4 years, COVID sell-off, Inflation sell-off, living in multiple countries, successfully raising your daughter, TV star, Internet star; Current balance of $1.4, which I believe is higher than you started. I think you can definitely show this track record as a financial success.

Thanks – we’ve had a good run so far! And you are correct, we retired with a little more than $1.1 mill so no complaints here. 🙂

I know it takes a lot to this info out on the net. Thank you. Solid plan, Jim!

Thanks, Lem – I hope it’s helpful for others!

yes, it’s very helpful, thanks so much for sharing.

Quite welcome, Marge!

I’d say your portfolio looks great Jim, and thanks for sharing. Wondering if you ever plan on getting back into the real estate market by either buying a house or another rental? Hope you and your girls have a great Christmas!

Thanks, Jim! At the present time, I don’t plan to buy another house to live in or a rental. I don’t have anything against owning a home (we owned until we moved to Panama in 2019), but I’m really liking the flexibility of being able to move when we want, not needing to worry about repairs or maintenance, and the lower payment. Obviously, there are downsides and maybe that’ll change down the line, but that’s where I’m at for now.

I’m also done with rentals. We sold our last property in 2021 and I like not needing to deal with those headaches anymore either. I’ll stick with REITs for now and maybe I’ll move to into real estate crowdfunding and syndication at some point, but I like the simplicity we have now.

Hope you have a wonderful Christmas as well!

I love the transparency, Jim, and I’m still envious that you got that Bond Ladder built at the right time (no bond underperformance for you, since you’ll hold them to maturity!). I’m considering adding some of the Invesco dated funds to my Bucket Strategy in the coming weeks, agree it’s the best way to hold bonds in retirement (I also buy the annual max in I-Bonds, and hold some Muni Funds in my after-tax account since they’re tax free).

Finally, thanks for the shout-out on my Bucket Strategy post. You’re going to love the latest Bucket Strategy project I’m working on, which will be a two-part series of articles. Hint: Big ERN is involved. Stay tuned!

I give full credit to my former CPA and financial advisor for the bonds funds – that was all based on his recommendation. That gives me the warm and fuzzies to know that you’re considering following suit – thanks for the validation, Fritz! 😉

Looking forward to the new post – I’m guessing this was born from the discussion we had on Twitter recently?

It was, indeed. I had an idea when I was walking the dogs, sent an IM to Big ERN with a proposal, and he agreed. Stay tuned…

Hell Jim,

I’ve recently signed up to receive your newsletters because you have a smaller portfolio and that’s encouraging for people who don’t $3M portfolios. If you don’t mind asking, how much does your family spend annually in the US? Does all your spend come from your investment porfolio or is a portion of the spend covered by blog and/or rental income?

I was recently advised to check out Bulletshares for the bond allocation, so I will need to learn about them. Do these funds expire by their maturity date or are they rolled over to a new fund upon expiration?

Thanks!

Hi Syd – thanks for signing up and welcome to the party! Since this will be our first year living in the U.S. during retirement (we moved to Panama shortly after I retired), it’s probably going to take a while to know exactly what our annual spend will be. But I think we’ll probably be looking at around $50k/year or maybe slightly more. We don’t have rental income anymore since we sold our last property in 2021. The only other income we really have is from this blog, which looks like it’ll amount to around $8k for 2022. My wife, Lisa, is doing a few secret shopper gigs but that’s accounted for maybe a few hundred dollars so far.

As far as the BulletShares fixed-income ETFs go, yes they expire on their maturity date. I buy them in my Vanguard accounts and once they mature, it just becomes cash in my account. In my case, I then move that cash to my Ally account for spending for the new year.

Hope that helps!

Hey Jim:

Great post, thank you for sharing the details. It is very helpful.

I wanted to ask you a related question. You have a large position in tax deferred money. I know that you have posted about using Roth Conversations to whittle this down. I also suspect that you may be getting your healthcare through the ACA and likely receiving subsidies. How are you approaching striking a balance between Roth conversions and ACA subsidies? Would you mind sharing a few details??

Thanks again!

Sure – I’m actually working on determining our Roth conversion amount for 2022 this week. But you nailed it right – it’s a matter of trying to find the right balance. Keep in mind that this is the first year we’re dealing with the subsidies as well since we didn’t need health insurance while in Panama.

Essentially, I’m letting the Roth conversions be my driving factor since I want to move over as much as I can each year… as much as I can without moving out of the 12% bracket while not needing to come up with too much money to pay in taxes for the year. I’ve been using the Personal Finance Bundle from Kathryn at Making Your Money Matter. This has been such a huge asset in helping me try different amounts to determine the right amount for us to convert.

When we signed up for the ACA in August, we just did a guesstimate on what our conversion would be… and we shot high. For the renewal that we just did, we did the same. We’ve been paying $227/mo for the 3 of us after the subsidies and that has gone down under the $200 mark for 2023 (though we did make a few changes on things like deductibles). We won’t know exactly how we did until we do our taxes probably in Feb, which is when we’ll settle up on our ACA subsidies. Hopefully, we’ll have nailed our guesstimate or overshot and we won’t owe any money (and might get money back). We’ll find out soon enough!

It probably makes sense for us to do a deeper dive into the math in the future to get the “optimal” balance, but for this year, that’s how I’m doing it. I’m also planning to look more into Direct Primary Care though for the future so this might change everything completely if that happens. I’ll write about that for sure once I get a full grasp on that and make a decision if it’s the right move for us.

Hope that helps a little! 🙂

Thanks Jim. Super helpful again. We are in a similar situation as you are with about 75% our our investable assets in traditional IRAs. However that 75% amounts to like $1.8M (good problem to have) and we retired at age 56 which I believe makes us older than you (not such a good problem to have). 🙂

We made modest conversions this year but will be more aggressive in 2023. When you start giving up subsidy dollars for conversions effectively you are in the 20.5% tax rate (12%+8.5%) so the benefits of conversions get murkier.

I suspect we will only convert about 35% to 40% before age 72 but it will be fun to see how it plays out. Always an adventure!!

Thanks again for an excellent post!

Definitely a good problem to have! I feel like I’ve breezed by strategies that might be somewhat helpful for folks in your situation, but unfortunately, that’s not my realm. Not sure if you’ve worked with a good fiduciary CFP (preferably with CPA skills) but that might be worth the investment if you haven’t.

Hi Jim,

Great post as usual. But have you considered alternatives to the Bullet shares for your fixed income side like Treasuries or TIPS whether individually or funds or even CD’s? And when first going with Bullet shares did you consider those also or even just using a bond fund or funds?

Also I am intrigued by the Fritz comment and the tease to an upcoming article it seems on the Bucket strategy especially with ERN somehow involved as I did not think he was a big proponent of that strategy if I remember right. But then you mentioned a twitter discussion which it sounded like involved the three of you. Can you please either post a link or links to it or even just the timeframe as after reading your comment I looked at recent twitter feeds of all three of you but did not notice anything like that.

Thanks.

I had considered TIPS at one point but at the time, I believe the return wasn’t as good as what the BulletShares were giving. Now, inflation’s come in like a lion and everything’s changed. It’s funny that you mention CDs because I was just eyeing up the rates for those recently… I’ve been seeing rates well over 4.5%, which is pretty darn good! When we’re ready to buy our next year’s worth of expenses, I’ll need to dig into that further but keep in mind that we’re skipping buying a year this time around to bring us down to 4 years outside of equities instead of 5.

And yes, there was a small talk on Twitter with the 3 of us: https://twitter.com/RouteToRetire/status/1598747621488721924 (both are friends I met at FinCon years ago). And you’re right, Big ERN has demonstrated that the bucket strategy isn’t necessary and can actually hinder portfolio performance over the years. That said, it doesn’t take into consideration the psychological side of things, which is something both Fritz and I are fans of as well. Even if I lose some growth over the years, being able to sleep at night without stressing at all about a down market is worth it to me. But that’s me (and Fritz) – everyone needs to determine what the right strategy is for them. 🙂

Hi Jim,

Thanks for the post. I’m planning on retiring with only dividend stocks. They are mainly dividend aristocrats so dividend cuts are unlikely. I like the idea of just spending my dividends and not care if the stock prices are up or down. What’s the danger to this plan? What am I not seeing? Appreciate your input.

Hi Mike – different strategies and all have their plusses and minuses. I base our investing loosely around the 4% rule, which allows us to pull out 4% (or less) of our portfolio and in theory it would be very rare to run out of money. In fact, in many scenarios, you’d end up with more than you started with. The simplicity of this strategy is something I’m a big fan of as well.

That said, folks like Mr. Tako, who I mentioned at the beginning of this post, focus on dividend investing. I don’t know enough about the intricacies of that style of investing to be able to talk about any downsides to that. I’d recommend checking out his blog (https://www.mrtakoescapes.com/) as he’s done very well with that.

Thanks. I’ll check it out.

Read big ern at earlyretirementnow, and other sites before you focus on dividends. It is a loosing strategy full of wishful thinking contradicted be evidence. It is nice to say that different strategies work for different people, which is correct psychologically, but demonstably false empirically.

In a nutshell, dividend investing is risk and complication without benefit.

Thanks for your reply. I’ll check out earlyretirementnow to learn more.

A very well organized financial picture, nice work Jim! The bucket strategy makes things easier as well. Will have to watch you for the next good buy as your Amazon and Google picks were spot on.

Curious as to if you’ve also tried Mint as comparison to Personal Capital for monitoring accounts and net worth. I find mint to be increasingly buggy, and am wondering if it’s worth the hassle to link everything to PC.

Haha, I did do well with Google and Amazon but they weren’t all winners… ask me how I did with GM years ago (hint: they went bankrupt!).

I actually use Mint on day-to-day basis as a complement to Personal Capital. I think Mint is great for the transactional side of things (banking, budgets, etc.), but PC is worlds better on the investing side of things (and not great with the budgeting side). I would definitely try out Personal Capital to see what you think. It’s nice that you can run with both at the same time and both are free!

Jim

Nice update. Our overall percentages are similar – although I have way more individual stocks as parts of my portfolio follow a couple of AAII strategies. It is still entertainment but I’ve told my bride to sell them all for an index if I kick it before I sell them. My S&P fund is mostly the TSP large stock C fund. TSP is cheap but has very annoying quirks about withdrawals.

I also use an equal weighted S&P 500 fund (Invesco’s RSP) to avoid overweighting the big boys in the 500. The fund supposedly should do better in a down market but it has only marginally done better so far.

I am mostly jealous that you can keep your spending so low while still enjoying life. I should be able to do a bit better in that category than I presently do. Must be the wine.

Haha, a little wine never hurt anyone! Maybe a lot hits the pocketbook though! 😉

I get the entertainment side of holding individual stocks for sure. After I wrote this, I told my wife that I was going to sell off some of these straggling stocks and she was not thrilled to be getting rid of her Disney stock. It’s not like she ever looks at the market to see how it’s doing, but it’s almost like it puts a face on things a little more and makes it a little more fun.

And guess what… they’re gone. I sold off ATI, DIS, FE, SDY, SPY, and TDY this morning. I want to dig into Amazon and Google a little more first before they’re gone. It might make sense to wait until they bounceback first.

Good to know that BulletShares can be purchased through Vanguard. Vanguard also offers Brokered CDs and Treasuries. DepositAccounts is a good website to research the highest paying CD’s in your area or across the US. Most credit unions have easy access methods for membership, making it convenient to join an out of State Credit Union. Thanks for posting your portfolio. I’ve learned a lot about financial planning from your web site and appreciate your willingness to share your knowledge.

THanks, David – I didn’t know Vanguard offered things like brokered CDs until your comment and some information I just saw from Fritz. That’s good to know that they offer some of these other instruments – that can make things easy to consolidate (assuming the returns make sense). I’ll check out DepositAccounts, too – is that similar to bankrate.com?

Bankrate.com includes CD rates for banks, while DepositAccounts includes CD rates for Banks and Credit Unions.

Bank deposits are insured by the FDIC and credit union deposits are insured by NCUA; both are insured for $250,000 per individual account.

Thanks, David!

what are your thoughts of doing bucket stratety vs a cashflow portfolio ie. live off divis and reit income and care less about NW?

Hi Charlie – those are obviously two different strategies neither of which is going to be perfect. There are also different ways of doing things within each strategy as well. In my case, I feel more comfortable with the bucket strategy as part of my withdrawals. But then you have folks who are a lot smarter than me (like Big ERN) who’ve done the math and say that you might not need to utilize the bucket strategy to provide the optimal growth for a portfolio. I’m willing to sacrifice some of my return though for peace of mind.

That said, there are a million ways to skin a cat and they all have pros and cons. So to get back to your question, living off dividends and REIT income is absolutely a feasible strategy – though completely different than the way I have my portfolio structured. Guys like Mr. Tako (who I met a few years ago) do exactly what you’re talking about and do it successfully. Unfortunately, I don’t know all the ins and outs about the difficulty or any pitfalls but that works well for him and many others.

I do know that I like the simplicity of our portfolio and strategy and that, although not perfect, should prove to be successful based on studies revolving around historical data. And that last part is key that it’s based on history. Things could always change that make this strategy not as successful, but if things go that direction, I’ll look at pivoting as necessary.

Why do you choose Vanguard Total Stock Market ETF (VTI) instead of the Index Fund, VTSAX?

Hi Wallies – the funds themselves are identical but there are slight differences between ETFs and mutual funds. One is that the price for mutual funds isn’t determined until the end of each business day. So even if you buy or sell at say 10am, you don’t know the price you’re getting until that evening (though you can do limit orders to set some boundaries). ETFs are traded like a stock though so you can see and buy/sell at whatever price you’re seeing and the purchase/sale takes place immediately. This is a small difference and just a matter of preference but I like knowing that I can buy/sell immediately as needed (liquidity).

ETFs are slightly more tax efficient as well. Because of how mutual funds are structured they generally incur more capital gains taxes than ETFs. Essentially, ETFs will come ahead with lower capital gains. I haven’t dug into how much of a difference that could make on a given portfolio, but that’s just an added benefit that I’m happy to have with ETFs.

That said, you can buy fractional shares of a mutual fund, which is not the case with ETFs (excluding dividend reinvestments). So when you have X amount of dollars, you can just purchase X amount of mutual fund shares even if it comes out to be something like 10.785 shares. With an ETF, you’re stuck either buying 10 shares or 11. Sometimes that means I’m left sitting with not quite enough money in an account to buy an additional share. That’s money that’s not invested so that stinks. However, that’s something I’m not worried about… the liquidity side of things is more important to me.

The differences aren’t huge and they both have their pros and cons but I personally feel like the ETFs are a slightly better investment. Regardless, I don’t think you can really go wrong with either. 🙂

My question is why don’t use VOO (Vanguard S&P 500 ETF) instead of VTI?

The portfoliovisualizer shows that Final Balance (with reinvested divs) for $10,000 invested in VOO is a bit better than VTI (VTI $38,660 and VOO $40,024).

And for the same time period the SCHD (Schwab US Dividend Equity ETF) beats both of them…

Hey, Alex – I do believe that the S&P 500 has performed better than the total stock market over recent years. That said, obviously what you see in things like Portfolio Visualizer isn’t going to be fully accurate for the future since that’s always going to be unpredictable. Over the years though, the difference between performance on both will likely be similar since there’s so much overlap. I’m comfortable with owning the whole market but either one is likely going to be a great choice down the line for a portfolio. Maybe I’ll stick with VTI and you go with VOO and we can check back in a decade or two and the winner buys drinks! 😉

Regardless of VTI / VOO I hope I can buy you a drink in Panama in less than a decade. My son is a 10th grader now and as soon as he off to college we will be ready to move there…

Hey, that’s awesome, Alex! We actually moved back to the U.S. from Boquete, Panama this past spring. Here’s the post about the why, if you’re interested: The 2 Big Reasons We’re Moving Back From Panama… and What’s Next!. I can tell you that I’m really missing Boquete a lot! You never know where we’ll be in a decade but if we’re back in Panama (a good possibility!), then I look forward to joining you for a drink there! 🙂

I love to see how your investment account is so high and your bank account has only $10k. Awesome keep up the great work

Thanks, Eric – it is the end of the year though so our savings account will gain next year’s “paycheck” in it in the next couple of weeks. 🙂

Jim,

Thanks for sharing the info. I am retired and very interested in your Invesco BulletShares bond Corp. noticed that the ETF price was different when it was issued initially from $16 to $18.5. When it terminates at maturity, what will the price for this bond ETF suppose to be? $21? The BSCM terminated at $21 this year.

If the purchase price is higher than $21, it can still lose money when terminates, right?

Thanks

Hi Jack – like any investment, there will be some volatility along the way. But then it gets a little interesting. Here are a couple of pieces of info from Invesco:

You can see some more information on their BulletShares FAQ page.

Obviously, no investment is risk-free and I’m sure it is possible to lose money, but these have been a nice addition to our portfolio. The way they’re designed has helped us get a nice decent return without much worry.

Sorry one confusion. The initial price for all these ETF was $20. Will they be at least $20 at maturity?

Jim, in one of your comments, you mention using Kathryn Hanna’s Excel spreadsheet from makingyourmoneymatter.com. As a long-time appreciative reader of your blog, I also know you use Personal Capital to aggregate your accounts and track your net worth. How do you use the two together for maximum effectiveness? I’ve found a lot of value in exporting Personal Capital transactions to Kathryn’s Excel file for budgeting and cash flow analysis, and independently, Kathryn’s spreadsheet is great for tax planning. But I’m curious if you’ve discovered other great ways to use the two products to complement each other. Thanks!

First off, thanks for being a long-time reader – I truly appreciate that!

That’s fantastic that you’ve combined the powers of PC and Kathryn’s Personal Finance Bundle. She’s a spreadsheet ninja and this bundle is really amazing for someone like yourself looking to have more control and deep-dive into things.

That said, I try to keep things simple where I can so I mostly just use Mint to track our cash flow and Personal Capital to help manage our investments, track our net worth, and use some of the valuable tools it provides.

Kathryn’s spreadsheet though was something I started using last year specifically for our Roth IRA conversions. I wrote about that in my post, Doing Your Own Taxes and Planning… or Die Trying!. I was struggling to find a good not-too-complicated way to help me determine how much to convert each year. I reached out on Twitter and some of the personal finance Facebook groups thinking a CPA would be the suggestion I’d get. Instead, I ended up being referred to Kathryn and we talked and she recommended how I could use her PF Bundle to do this. I bought it and she even walked me through how it would be easiest to use for my situation. It’s fantastic and I just used it again a week or so ago before doing this year’s conversion.

Last year, I tinkered with some of the other possibilities the bundle could do, but that’s about as far as I took it. So, that long answer was really to tell you that, no, I don’t have other suggestions in other cool ways to use it. It sounds like I should be asking you for ideas! 😂

Hope your holidays are wonderful!

PS For other readers reading this comment, Kathryn just provided me with a discount code to use for readers to get 20% off now through January 15. You can get the Personal Finance Bundle with this link and use the code R2R2023 for the 20% off. Happy holidays!

Hi Alex, just throwing this out there. Have you checked out Portugal? Just wondering if you have investigated it or anyone else reading here. I’ve been researching it for possible 2nd life. I’m learning that it can be affordable, really good health care at a low cost, temperate climate (many report it to be similar to central coast of California), native Portuguese are (generally speaking) welcoming to foreigners, awesome food (especially if you enjoy fish), easy get-aways to other European destinations, relatively easy to get residency. Thanks Jim too for all your transparency and posts! Best everyone!

Hi, John, I agree – Portugal does have some really great qualities and is definitely another option for folks to consider. Cheers to a great 2023!