Disclosure: This post contains affiliate links and we may receive a referral fee (at no extra cost to you) if you sign up or purchase products or services mentioned. As an Amazon Associate, I earn from qualifying purchases.

You ever see those offers from the credit card companies with the big juicy sign-up bonuses? They might be offering 50,000 points or miles in travel rewards for spending maybe $3,000 in the first few months.

If you’re like I used to be, you get those offers in the mail and just tear ’em up and pitch ’em. Those jerks aren’t suckering me into their little trap of overspending my hard-earned money for a lousy plane ticket or hotel stay!

Yeah, well that was then. Back in my college days, I got my first credit cards and ran up about $30k in credit card debt. It took me years to realize just how screwed I was and work my way out of that hole.

And back then, to top it off, all I got was a free t-shirt or cup for signing up! No wonder the credit companies love the idea of targeting naive young people like I was.

But we’re all familiar with the line… if I knew then what I know now.

Looking back, I wish I understood how valuable these offers really could be. Not necessarily for when I was in college (that would have been a disaster) but rather once I had a stable career going.

If you’re a responsible credit card user and pay your cards off every month, travel rewards offer a fantastic opportunity to travel the world for free!

What the heck is travel hacking?

Travel hacking is a term that’s come about as a way to describe a strategic and methodical way of signing up for credit cards in an effort to take advantage of credit card bonuses.

Credit card companies obviously want you to sign up for their card. And by offering certain incentives like travel rewards, it’s like dangling a carrot in front of you.

Taking advantage of these offers can be very lucrative for you. A free domestic flight in the U.S. generally costs around 25,000 frequent flier miles. So by hitting a 50,000-mile bonus on a single card, you’ve just earned two free round-trip flights… awesome, right?

Some people have made it a part of their lives to figure out some of the best strategies and rules out there to continue to accrue a bunch of travel rewards. You can find tons of great resources across that fancy Internet out there. Listening to Brad and Jonathan on a ChooseFI podcast was a good start to get me going on this.

You might think that it’s not in the bank’s best interest for folks like you and me to sign up for these cards and take advantage of the bonuses. But don’t forget, they’re making money on every single purchase you make with their card along the way. Believe me, they’re not hurting.

Why did we go down this path?

I only decided to take the whole idea of travel rewards seriously less than a year ago. In fact, I opened our first credit card specifically to tackle getting a sign-up bonus in January.

In that small amount of time though, we’ve racked up about 250,000 points in bonuses alone with another 40,000 miles to post by the end of this month. Tack on the miles and points we get for each dollar spent and we’re at over 300,000 points in nine months!

If you figure each domestic flight being 25,000 miles each, we’ll have earned 12 free flights in only 9 months!!

This is astounding to me. According to the United States Department of Transportation, the average domestic fare in the first quarter of 2018 was $346. A little math – carry the one – and that equates to us receiving about $4,152 worth of in free flights for nothing.

On top of all those free flights, some cards also include Global Entry or TSA Pre✓ application fee credits as well. Mrs. R2R and I will be able to get Global Entry compliments of the credit card companies by next summer. Any regular flier will tell you that this is a great little luxury to have when traveling.

And the best part is that we didn’t change our spending habits at all. We aren’t juggling 50 credit cards. The only change we made was that we sign up for a credit card and share it with each other for two or three months. That’s it.

There’s really not a lot of good reasons not to do this. Free travel just for being a loyal credit card user for a few months.

Because we’re planning to move to Panama next summer as part of our FIRE plans, we’re anticipating some travel time while there. We’re not applying for residency until we’ve been there for a year so we can decide if want to stay there (due to the costs of an attorney).

That means we’ll just be tourists for that first year. Tourists can only be in the country for 180 days at a time and your U.S. driver’s license is only good 90 days at a time. After that, we need to leave the country for 30 days before going back. A little bit of a hassle, but we’ll probably be anxious to come back and visit friends and family a little more that first year anyway.

However, that means we’ll have some flight costs creeping up on us.

Travel rewards are giving us the ability to fly back and forth between Panama and the U.S. and possibly a couple times across the U.S. while here. It’s very exciting to have this opportunity and it’s coming at the right time for us.

A couple things to look out for

You do need to be careful when earning new rewards. There are some things you want to keep in mind when you sign up for a new credit card…

Spending

Let’s start with the biggest regulation you should have in place.

In my book, there’s a golden rule with travel rewards – don’t change your spending habits to hit a goal.

If you’re spending more money than you normally do, you’re not doing yourself any favors. You’re now incurring more expenses and debt than normal. Moreover, you probably could just have bought yourself that flight or hotel room outright.

Also, don’t sign up for multiple cards at once. Instead, choose one and then just aim to funnel all your normal spending to that credit card. Use that card for all your purchases until you reach the required spending amount.

If that’s not feasible, then this isn’t the right move for you. You don’t want to get yourself in over your head just to earn some travel rewards.

In addition, don’t pay for bills that charge a fee for using a credit card just to get the credit toward a bonus. I know some folks who pay all their bills with their cards even though they get charged “handling fees” for doing so. That’s silly and really a complete waste of money.

Chase rule

Chase tends to offer some of the best incentives for signing up for their cards. Because of that, you need to be aware of a couple important details.

1) The 5/24 rule – Chase has an unpublished internal rule on approving credit card applications dubbed by travel rewards junkies as the 5/24 rule. The gist of it is that if you’ve opened five credit cards across any bank (not just Chase) over the past two years you’ll be automatically declined on your application.

There are some exceptions, but because the general public isn’t in the know on the specifics of this rule, you’ll find some discrepancies all over on what counts or doesn’t count. Regardless, you’ll want to keep this in the back of your mind as you go down this journey.

2) Authorized users – In rule #1, you learned that you can’t have opened five credit cards in the past two years or you’ll automatically be declined. Well, guess what – that includes adding your spouse as an authorized user. So whenever you sign up for a card and add someone else to that card, that dings you as another card opened… ouch.

As we’ve been going down this for the past nine months, I’m careful that we don’t add each other as an authorized on each card we go after. Then we just pass the card back and forth each day.

“Hey, I’m going to be going to the grocery store today so I’ll take the card.”

“I need to get gas today so I’ll need the card”

What’s funny is that no one ever questions whose name is on the card. Gotta love the security measures that establishments take with credit cards.

Won’t this hurt your credit score?

This was a big concern of mine for a number of years. Opening more cards is going to hurt my credit score and I definitely don’t want that just to get some fun little travel rewards.

Well, I was wrong on this. Believe it or not, opening credit cards actually helps your credit score.

And the reason for this is that your credit utilization becomes less, which is a contributing factor in your credit score. Because you now have more available unused credit, you’re looking better to the banks out there as a loan candidate.

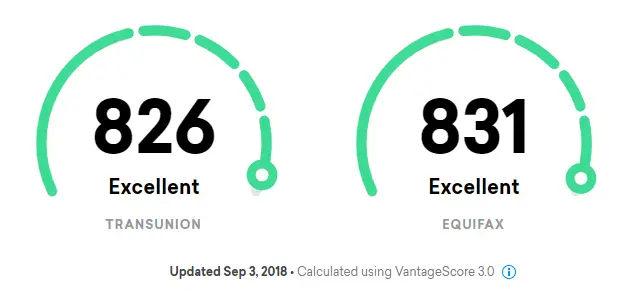

I just logged into Credit Karma and checked my score for TransUnion and Equifax:

Not too shabby as the max VantageScore is 850. Keep in mind that this is different from your FICO score and the above scores don’t include Experian, but we should be in the ballpark regardless.

The point is that opening new cards is not detrimental to your credit score.

That said, closing cards is not good and can ding you slightly. So if you sign up for cards with annual fees (some waived the first year) and decide to close them at some point, that might knock a few points off your score. In all likelihood though, your score may have gone up a couple points when you signed up for the card anyway so it won’t matter much.

Our travel rewards path

Ok, here’s the most important section – the order of the credit cards we’ve opened this past year. Some of the travel rewards sign-up bonuses may have gone up or down since we had gotten them, but as you’ve read, it’s been a worthwhile path:

| Card | Who Signed Up | Rewards / Notes |

|---|---|---|

| Chase Sapphire Preferred | Me | 50,000 |

| Chase Sapphire Preferred | Mrs. R2R | 50,000 plus 10,000 when she used my referral link |

| Chase Ink Business Preferred | My publishing company | 80,000 |

| Citi AAdvantage Platinum Select World Elite Mastercard | Mrs. R2R | 60,000 |

| Chase United Explorer Card | Mrs. R2R | 40,000 + Global Entry or TSA Pre✔ credit |

Not much to it, right? Just a handful of cards (one at a time) and spending like we normally do and poof – awesome travel rewards!

And the exciting stuff is just getting started. Ever heard of the Southwest Companion Pass? I hadn’t, but when I did, it was like there was a choir of angels explaining it to me!

The Companion Pass allows you to choose one person to fly with you for free (excluding taxes and fees) every time you book a Southwest flight.

You need to either fly 100 one-way flights or earn 110,000 frequent flier miles in one calendar year. But once you hit the goal, you’ll earn the Companion Pass for the remainder of the calendar year you earned it plus the entire following calendar year.

Normally, this bit of craziness is something only the big-time fliers can pull off getting. But guess what – depending on the bonus level at the time, signing up for the Southwest Plus or Premier card gets you around 40,000 miles and their Premier Business card gets you maybe 60,000 miles.

With the miles you also earn along the way during your regular spending, this can be bagged without too much effort. Our plan is to wait until December to sign up for one of the cards since miles don’t post to your account until your statement date (so January in this case). We’ll earn our miles and then jump right into the business card.

Hopefully, we’ll earn the Companion Pass by spring. That means I’ll have it for at least a year and a half!

| Card | Who’s Signing Up | Rewards / Notes |

|---|---|---|

| Southwest Rapid Rewards Plus or Premier | Me | 40,000 |

| Southwest Rapid Rewards Premier Business | Route to Retire | 60,000 |

And when that expires, Mrs. R2R will probably go through the same process.

You can read more about all these cards on my Recommended Credit Cards page.

I do receive a referral fee at no extra cost to you for signing up for any of these cards so any click-through sign-ups are truly appreciated.

Free credit card tracking spreadsheet

Following through with credit card travel rewards offers isn’t hard at all. However, you do want a way to keep organized. For example, you might decide to renew cards with annual fees or you might not depending on the benefits you get with each card.

But either way, wouldn’t it be great to have a way to track all this?

Good news – your good ol’ Uncle Jim here at Route to Retire is coming to your rescue!

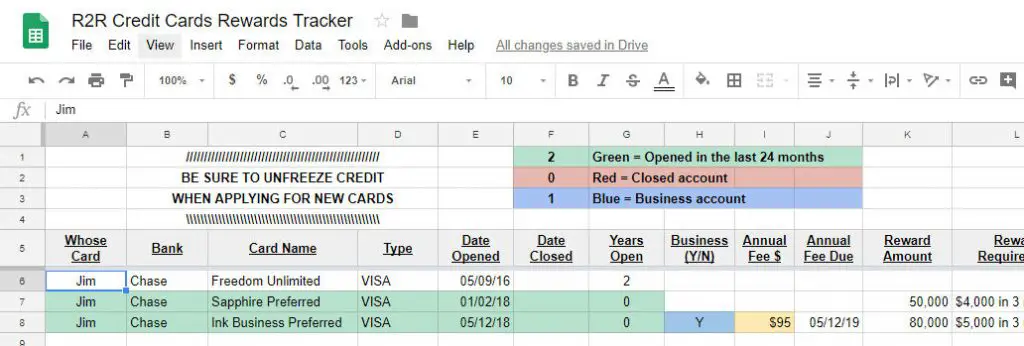

I created a spreadsheet in Google Sheets that I’ve been using to track my own credit cards. Here’s a snippet:

And just by signing up to my weekly email of goodness, I’ll send you over a link to this tracker. It even highlights cards opened in the last 24 months to help you stay on top of Chase’s 5/24 rule. Make it happen right here…

So, you can definitely see that the credit card travel rewards offers can be super rewarding! If you’re like I was – pushing these offers to the side and thinking it’s not worth the trouble – think again!

Consider checking out some of our recommended cards and enjoying some of the benefits of the sign-up offers. And if you’re not big on flying, keep in mind that most of the rewards can be used for hotel stays and other vacations as well.

Good luck!

Have you considered chasing after some of the travel rewards offered by credit card companies?

Thanks for reading!!

— Jim

We just started travel hacking by signing up for a Chase Sapphire Card. 50,000 point bonus for first $4,000 in spending. Another 30,000 points when we spend $20,000 in first 12 months. Add authorized user and they use the card – 5,000 points. Referral bonus (which we have not done yet) is another 10,000 points.

Before we just had a Southwest card we had used for years. We did change over to United Explorer card and wracked up hundreds of thousands of miles.

As you mention the key here is to spend as normal and pay off the card. Avoid going into debt and doing minimum payments.

On the credit score – If you are F.I. and/or avoid debt it doesn’t matter if your score goes down a bit when you close an old card!

We also timed our new card to correspond to some big expenditures to rack up the dollars quickly. These were routine and normal expenditures for home/auto insurance and the insurance company accepts credit cards so why not. This way, when we get around to the next payment cycle we will set up Mrs. r2e with a new card using the referral bonus!

Excellent points, R2E! It’s amazing how powerful travel rewards can be with little effort. Smart move on the timing for big expenditures – we just did the same for the final payment on our cruise we have coming up.

— Jim

My wife and I love to ravel and do have credit card that offer hotel rewards and she has one that offers airline points. We recently got rid of one that we received shopping rewards for a new one that offers travel rewards. Traveling is much better than shopping!

I’m with you on that, Dan – enjoy the experiences and not the material stuff! 🙂

— Jim

Perfect timing! I need to pay estimated tax by the end of this month so why not get some bonus points. We need a bit more AA points for our vacation next year. AA points seem good for Central America and Bahamas trips. Maybe we’ll see you in Panama next year. 😉

Haha, I’d actually love it if you guys made a trip to Panama! I’m sure it’s different wherever each of us lives, but I know American was the best option for us when we flew down to Panama last year.

— Jim

Wow! This has got to be one of the most comprehensive travel hacking posts I’ve seen, and it is inspiring! I’m waiting right now for my Chase Business Ink card to be approved, and that will certainly bump up my stash a bit. We are in the beginning phases of this, meaning so far my wife and I have each done the Chase Sapphire Preferred card (one at a time, of course!).

Much appreciated, Captain! Sounds like you’re already headed down the right path with travel rewards. Those Ink cards do a nice job on building up the points pretty quickly, that’s for sure!

— Jim

LIke you Ive been travel hacking for the past couple of years. In fact, thanks to travel hacking my wife and I enjoyed an 8-day trip to Florence and Rome, Italy (business class seating!). The one caveat that everyone of your readers need to know is that most of these travel rewards cards do charge an annual fee. The higher the fee, the more generous the perks. I’m okay with that but some extra-frugal readers should be forewarned.

As for bills that charge fees for paying with a credit card; here’s what Ive been doing for the past couple of years…

I charge my two daughters’ college tuition on my airlines credit card even though there’s a nominal fee; then the college 529 plan reimburses me for the expense and I later pay off the balance.

Think about it; I’m paying about $330. In fees but I am earning thousands of frequent flyer miles. For me, it’s worth it. I do the same thing with my annual property tax bill which totaled $10,400. Last year (I don’t escrow). These bills and charges (college tuition, property taxes, etc.) really add up and I’m able to parlay these into hundreds of thousands of airline miles; which affords me business class international flying.

Now that definitely sounds like a great trip to use travel rewards for – it’s much easier to enjoy a vacation when some or all of it was paid for by your rewards!

I’ve heard of other people doing the property tax bill on their credit cards as well. I like that and might have even considered splitting that off instead of escrowing, but that moment’s past for me since we’re in the process of selling the house.

Good point on the annual fees vs the perks. People going down the travel rewards path to find a balance that works for them.

— Jim

Great post Jim! My wife and I recently got into travel rewards and completing that first Chase Sapphire Preferred bonus felt awesome! We’re now working on the next one with my wife’s card. Thanks for sharing your experience.

Awesome to hear, Scott! It’s pretty crazy how the rewards can add up in a short amount of time and for barely doing anything.

— Jim

I’m impressed! My first year of travel hacking has not been quite as successful as your first 9 months, but any free money is still free money, right? Keep up the good work! Those miles definitely make international travel expenses easier to swallow.

Absolutely – free is free and there are some great returns out there for not doing anything different with your spending habits!

— Jim

That is so encouraging. I haven’t started travel hacking yet, I’m looking for Australian credit cards, I’m guessing less competition, therefore less rewards but I’m keen to research. A free trip will be worth it.

If you’re going to be spending the money anyway, might as well do it strategically and get something back for it. I just wish I had realized how valuable this was years ago! 🙂

— Jim

Hi,

What about the annual fee for the credit card if you cancel the card after 3 months and to go with another one?

Thanks,

Kerstin

Hi Kerstin – I’ve never heard of any type of 3-month rule for getting the annual fee back (that doesn’t mean it doesn’t exist though). Here’s an article talking a little bit more about when you can get it back: Canceling Credit Cards: Will I Get My Annual Fee Back?

If they waive the fee the first year, you’re good because you can generally cancel whenever you want within that first year without having been dinged a fee at all. But if they don’t waive the first year fee, my understanding is that you’re pretty much stuck with it. Maybe you can try to talk to them to try to cancel and get the fee back after a couple of months, but I would guess that’s not going to happen if you plan on keeping the bonus.