Yeah, getting turned down for a credit card isn’t a good feeling.

Yeah, getting turned down for a credit card isn’t a good feeling.

It doesn’t matter that Lisa and I each have credit scores of over 800. It doesn’t matter that we have plenty of credit cards already and don’t really need another.

We also have more of an unused credit line spanned across all our cards than we’ll never need. And then, of course, there’s that little piece of info that we’ve saved up enough money that we never have to work again – we’d be very low-risk to default.

But it doesn’t matter.

It still sucks when you get turned down for a credit card. When the online application screen changes and tells you’ve been declined, it’s a small punch in the gut… ouch. Then do that four times and see how it feels.

So let’s talk a little bit about what transpired and why it’s not the end of the world.

Chasing travel rewards

In early 2018, after realizing the benefits of travel rewards, I put us on a path we’d never been down before. I proposed to Lisa that we strategically apply for credit cards in an effort to take advantage of the sign-up bonuses.

The idea was that all those points and frequent flier miles would be a huge asset for us after we moved to Panama. We’d be traveling back and forth and could use them to take a major dent out of our expenses.

And it worked well. By late summer of 2018, we’d earned enough for about 12 free domestic flights. We attained thousands of dollars worth of free travel without increasing our spending. We would just do one card at a time and put all our normal expenses on that card until we’d hit the bonus and then sign up for another.

I created a credit cards rewards spreadsheet to keep track of everything. I wanted to make sure to cancel cards that had an annual fee before it hit. It was also important to track which were business cards and which weren’t. And I needed to know when we had applied for cards to keep track of how long we had to hit the bonus and Chase’s 5/24 rule (you can only apply for 5 cards in a rolling 24-month period).

You can get a free copy of the spreadsheet I use here (along with my bad @#$ recurring expenses spreadsheet):

That wasn’t enough in my book though – we kept going into 2019. The last big one we got was what some might consider the holy grail in travel rewards – the Southwest Companion pass. We attained that in the spring of 2019 and it’s good until the end of 2020.

The way it works is that anytime I book a Southwest flight, I can take someone else for free (Lisa insists it’s her each time!). That’s a huge benefit! We use the frequent flier miles I accrued to book me and Faith for free on flights and then add Lisa as a free companion. Free, free, free (except for a few dollars here and there for taxes)!

We finished up right before we headed out for our July adventure. Because of how busy we were and the tiny detail of moving to Panama, we took a little break.

Note: You can read more about the path we went down in my Travel Rewards – 12 Free Flights Earned in 9 Months! post.

Getting turned down for a credit card… round 1!

Even after we got settled, we weren’t planning on chasing any new travel rewards. Boquete, Panama is an area where cash is still used in the majority of purchases. So being able to get the required spend-through on a card to hit the bonuses would be tougher.

But then…

In October, we were planning our visit back to the U.S. to comply with Panama’s tourism laws. We had made most of our plans, but we also decided to try to find a deal on a last-minute cruise for the tail end of our U.S. visit.

After thinking about the possibility of a cruise, we realized that the cost would be enough to get us through most of the required spending to hit a credit card sign-up bonus. So it was time to look at getting another card!

Based on the cards we had already gone through and what we were looking to do, the Chase Sapphire Reserve card looked like a good choice:

- Big point bonus (50,000 when we applied) – We’d have to spend $4,000 in 3 months to get it, but with the cruise, that would get us about halfway there. Between that and our time in the U.S. for our visit, we thought we could pull it off with some creativity if needed.

- Trip cancellation / Trip interruption insurance – This would be perfect for booking our cruise!

- Complimentary airport lounge access – We’re running out of lounge access passes and this is a real benefit with layovers when we bounce back and forth between the U.S. and Texas. This card gives you Priority Pass Select access at no cost… nice!

- $300 travel credit – Um, yeah… this one’s self-explanatory.

- No foreign transaction fees – Except for our Schwab card, we don’t have a card we could use freely in Panama. That would be a solid perk to have in place.

There’s also the Global Entry or TSA Pre✓ fee credit. This is nice, too, but all three of us already have Global Entry so we don’t need it.

There are so many other great benefits with this card, but those were the big ones that sold me. You can find more info on the card on my Recommended Credit Cards page.

So I unfroze my credit at all three bureaus and nonchalantly applied.

Declined.

Huh? I should be Ok on Chase’s 5/24 rule but maybe they counted business cards or something.

Ok, I don’t want to wait until we get the rejection letter in the mail. Let’s just make this happen.

Time for Lisa to apply.

Declined.

What the what?! That’s rejection #2! Frustrating.

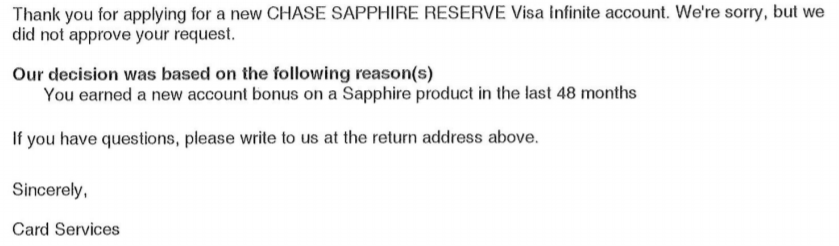

We waited and then the letters came. They both said the same thing:

Son of a biscuit! I forgot that we had each had the Chase Sapphire Preferred cards a few years ago.

Well, such is life. That’s my stupidity for not thinking of that… onto the next attempt.

Getting turned down for a credit card… round 2!

Comparing anything to the Chase Sapphire Reserve card is a big letdown. It’s a fantastic card, albeit pretty expensive.

But I still tried to find something that would make sense. It was tough because of all the different cards we’d already gotten in such a short amount of time. Playing by the rules and finding one that would make sense for us was time-consuming.

Finally, I decided to “settle” on the Capital One Venture Rewards credit card. I say “settle”, but it truly is a great card. It just doesn’t have all the fun perks that the Sapphire Reserve carries. But it would give us:

- A hefty sign-up bonus of 50,000 miles – We’d still have to spend $3,000 in 3 months, but that would be much easier than the $4k needed for the Chase card.

- Not tied to any airline (or hotel) – There are plenty of other cards for specific airlines or hotels (some of which we have), but I like the flexibility of not being locked into one… and the miles don’t expire for the life of the account.

- No foreign transaction fees – As I mentioned before, it would be good to have that so we could keep accruing miles while in Panama.

- $0 intro annual fee for the first year – The no-annual-fee cards for the first year are great for capturing the rewards and then getting out if you decide you don’t want the card.

And, of course, you get the cool benefits like the Global Entry or TSA Pre✓ fee credit, but again, we already have Global Entry. This was named “The Best Travel Card” by CNBC in 2018. You can find out more on my Recommended Credit Cards page.

So time to rinse and repeat. I unfroze my credit at all three bureaus… again. Then I confidently applied.

Declined.

What the what?!! Now I was ticked. What the heck is going on this time – we’ve never had a Capital One card before so that can’t be it.

Time for Lisa to apply…

Declined.

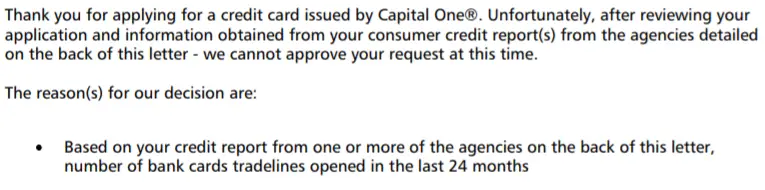

Sigh. Capital One was a little nicer though in that we got an email with the rejection relatively quickly after being denied:

Yup, can’t really argue with that.

In the end…

Getting turned down for a credit card hurts, but this was four times for us. I was frustrated but decided to throw in the towel… for now.

Sure, we could have called the reconsideration numbers to try to get the decline overturned. Or we could have found another issuer that might be a little more lenient.

But I didn’t want to waste any more time and honestly, this isn’t that big of a deal. We’ve socked away so many points and miles that we’re set for the time being.

We’re going to wait a little while for the dust to settle. Then when we know we’ll have another big purchase coming up, we’ll give it another shot.

In the meantime, we used an existing card (Chase United MileagePlus Explorer) to book our cruise. That’ll give us some additional United miles which never hurts!

We’re less than a week away from our cruise aboard the MSC Meraviglia. We’ll be going from Miami to Jamaica (Ocho Rios), the Cayman Islands (George Town), Mexico (Cozumel), the just-opened Ocean Cay (MSC’s private island in the Bahamas), and then back to Miami.

The 8-day/7-night cruise with a balcony for three of us with the basic drink package cost us $2,220. Not too shabby for a cruise line that’s not considered a budget line (like Carnival). We’ll also be on a ship that’s only three years old. We’ve found better deals in the past, but I’m content with it.

And I have a feeling that I won’t even remember getting turned down for credit cards even once while we’re aboard!

If you’re considering going down the immensely valuable path of credit card rewards, consider using one of the links on my Recommended Credit Cards page. I’ll receive a small bonus (at no cost to you) to help support the Route to Retire site.

Have you ever been turned down for a credit card? Did it sting at all?

Thanks for reading!!

— Jim

I sometimes wonder about the long-term viability of travel hacking. We do it casually like you do, with a spreadsheet to keep track of what we’ve done and earned along the way, no manufactured spending or anything too complicated. For 2020 (our first year of FIRE), we’re planning on paying all of our regular travel expenses out of pocket and if we earn any travel rewards along the way, that’s icing on the cake. One card on my list is the Capital One Venture Rewards card specifically b/c it’s flexible with “erasing” travel purchases, which could be things like a weekend at the Great Wolf Lodge or RV campground fees that aren’t typically purchasable via points.

I didn’t realize those benefits of the Venture Rewards card! I was aiming for just getting the sign-up bonus, but that sounds like it’d be a really useful card. Now I’m really sad I got rejected on that one! 😉

How do these rejections affect your credit score?

The rejections themselves don’t come into play. Credit inquiries due to the application itself though have a small impact on your score. And when you do multiple applications around the same time, they’re generally treated as one inquiry. In other words, it barely has an effect on your score.

Methinks the 10% new credit aspect is what triggered the rejections https://www.myfico.com/credit-education/whats-in-your-credit-score

Yeah, the rejection of the Capital One card is absolutely because we had opened a number of cards already during the past year or so. 🙂

How many cards did you open in the last year anyway?

Never been declined. Average about 5 a year for the last 6 years.

Great question! I opened 3 in 2018 and 2 in 2019. Lisa opened 3 in 2018 and only 1 in 2019. Not really that many, but I guess it is what it is.

Capital One is known for being very picky about the number of new accounts you have. I have been very hesitant to try to get the Venture card as I open 2-3 new cards a year. Also they pull from all three credit bureaus. Maybe look at Citibank if you don’t have any accounts with them.

Thanks for the tip – I didn’t know Capital One was picky on new applications so that’s helpful. I do already have a couple of Citibank cards, but I’ll keep looking to find our next option. Thanks! 🙂

I got declined by Chase in the summer. Their program is pretty strict. Apparently, if you got declined, then they’ll keep declining you for 24 months. I’ll go into a branch to apply next time. Make sure you’ll get approved first before applying for a Chase card.

Capital One? Why decline? The message seems unclear. I just got one last month to pay taxes. Whew, I guess I was lucky and didn’t hit their snag.

Interesting – I didn’t know about the declining for 24 months… good to know! Maybe we’ll try the branch trick next time we’re visiting the States again.

Not sure on Capital One, but I’m sure I’ll get the itch to get back on the horse again and get a new card soon! If I get declined again, I’ll probably start calling the reconsideration numbers.

Wife recently rejected for a Venture One card (I have one at an older fee – it is a good card). We were told they would send a letter with reason why – but never got one. So applied again 2 weeks after getting laid off and it was approved – go figure. We’ll use the bonus points to save $500 on our pending pilgrimage trip after paying off the balance on the trip.

You might try the Barclay’s card – it has similar bonus as the Venture and is as easy to redeem….

That’s funny on the Venture card, but hey, that works out good regardless!

Good call on the Barclay’s – I had looked at that one a while back but forgot all about it. That may very well be the next card we get! Thanks for the suggestion!

Well that kind of sucks. You must have started tripping the “too many cards too fast” limits that I’ve only heard about.

We only lightly travel hack, so I haven’t run into this issue yet. I get maybe 1 or 2 new cards a year, and haven’t been rejected for anything yet.

Let us know how it goes! I’m curious where the limits are!

That would make a lot of sense, Mr. Tako. I’ll probably take a little break for now until we have another big purchase to make. 🙂