Disclosure: This post contains affiliate links and we may receive a referral fee (at no extra cost to you) if you sign up or purchase products or services mentioned. As an Amazon Associate, I earn from qualifying purchases.

We’ve been leveraging credit card travel rewards for several years now. It’s given us the ability to travel the world either for free or very inexpensively. The biggest hurdle though is figuring out a good way to track credit card rewards.

I wrote in my post, Travel Rewards, 12 Free Flights Earned in 9 Months!, that I had created a spreadsheet to track credit card rewards for ourselves. I use it all the time and it’s a freebie I share with my email subscribers. You can sign up on our mailing list on the sidebar or later in this post to get that and some other cool spreadsheets.

So that’s worked pretty well for us over the years, but it’s still a manual process so it’s not perfect.

Here’s some good news… I’ve found what I now consider to be the best way to track credit card rewards. I’ve been tinkering with it for a while now to evaluate how useful it is.

It’s a website/app called Travel Freely and it’s slick. It’s simple and effective – you really can’t ask for anything more! I’ve been toying with this for probably a year or so now and I feel good about recommending it to you. It’s extremely useful and might just be the thing you’re looking for that you didn’t even know you needed!

What is Travel Freely?

Travel Freely is a free service specifically designed to help you take those dream trips you might never have thought possible.

It’s the brain creation of Zac Hood who loves to travel. He figured out the benefits of credit card rewards years ago and has been saving tens of thousands of dollars on travel ever since. He created Travel Freely to help others do the same.

It allows you to manage your cards and you can even track a spouse/partner’s info as well. This is huge. Lisa and I alternate on who’s opening the next credit card based on which reward we’re after, how many cards we’ve opened recently, and other factors. Travel Freely being able to take this into account is a big benefit.

It’s so simple to make use of this free tool, too. Here’s the gist of the steps recommended once you create an account:

- Add in your existing credit cards – don’t worry, you’re not connecting any services or giving away any personal info like your card number. You just put in what card it is (like “Chase Southwest Airlines Rapid Rewards Priority Card” for instance), the date it was opened (important to track bonus expirations and annual fees), and information about any bonuses. And the nice thing is that Travel Freely auto-fills in most of this as you put it in – it knows what the cards are and what the bonuses are.

- Set your travel goals – Essentially, just figure out what you’re after – where would you like to go if you could travel more?

- Track your credit score – You shouldn’t be working on credit card rewards if you have credit card debt or a bad credit score. I highly recommend using Credit Karma (for free) to monitor your score regardless of whether you have stellar credit or horrible credit.

- Estimate monthly spending – Your monthly spending determines the credit card bonuses you’d be able to attain. The key is not to spend more than you normally would in order to get the bonus – just shift all or most of your spending toward the card you want to get it with.

- Get your first card – Travel Freely’s CardGenie will give you some recommendations on which card to start with. You can also check out my Recommended Credit Cards page on the cards that have helped us to travel the world for free or cheap!

- Earn your bonus – Add the credit card you got to the My Cards page of Travel Freely and nail that minimum spending requirement!

- Travel freely! – You earned your reward and can figure out how you want to use it! Zac has some good resources on how to make the most of your rewards.

Not much to it other than adding your cards in. It’s hard to find a reason not to use this if you’re hoping to track credit card rewards for yourself and maybe your spouse.

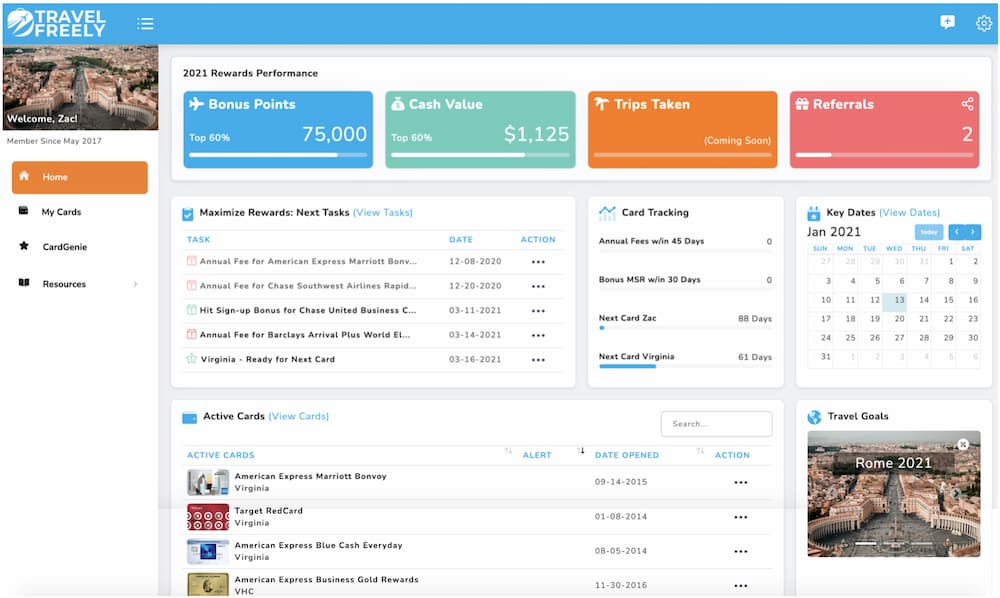

Here’s what a sample dashboard ends up looking like…

Why is this a fantastic way to track credit card rewards?

Ok, so Travel Freely is a great resource to help you manage what credit cards you have open, but it’s a fantastic way to track credit card rewards as well.

As I mentioned earlier, I already have a Credit Card Rewards Tracker that I’ll send you for free (along with some other cool spreadsheets) just for signing up for my mailing list…

I still use my spreadsheet to track credit card rewards because it allows me to add some other info that I can’t on Travel Freely. But I add every card to Travel Freely as well.

The reason why I like Travel Freely so much is that it keeps you notified of the status of all your cards. Similar to my spreadsheet, you can just look at the dashboard and know at a glance where you stand with each card.

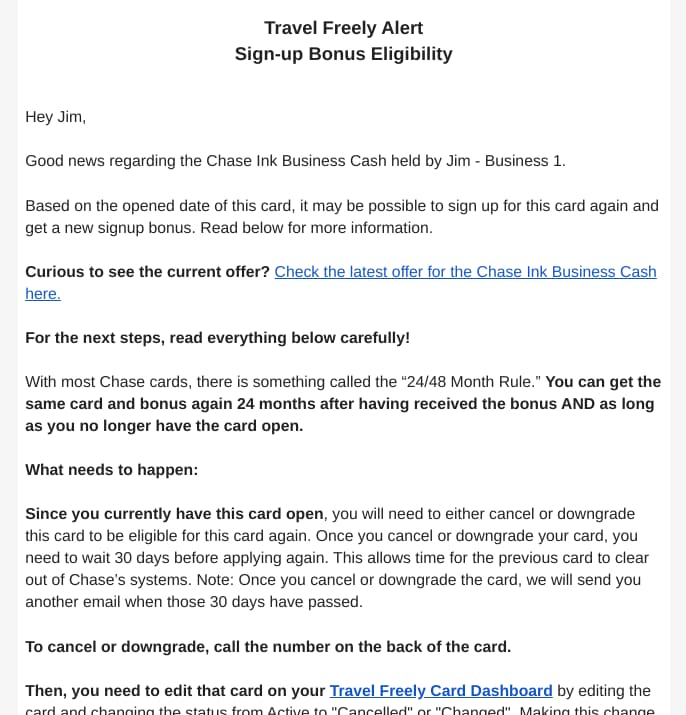

But let’s say that you have a credit card with an annual fee. Travel Freely will send you an email reminder around the time the fee is due and propose some options for you on the card. If you’re planning to keep the card because the fee is worth it, no problem.

However, if you don’t want to keep it, there are a couple of other options other than just canceling it (which will ding your credit score slightly). It’ll suggest calling the bank’s retention department and asking them to waive the fee. If that doesn’t work, many cards will let you either downgrade the card to a no-fee card or transfer your available credit to another card at the same bank if you already have one. Travel Freely will let you know the downgrade card options, too.

To track credit card rewards is one thing, but knowing when to get another card is another. Travel Freely will tell me when it’s time for me or Lisa to open another credit card based on when we’ve hit our bonuses, the banking rules on how often you can apply, and more.

I’ve also gotten emails to consider closing and opening a replacement card like this one…

That’s some cool stuff!

To truly be successful with travel rewards, you need to be on top of the credit cards you have. Travel Freely takes the chore of tracking credit card rewards weight off your shoulders to make it easy.

Although my spreadsheet is extremely useful, you still need to remember to go into it to stay on top of things. With Travel Freely, you get emails as needed along the way. This can ensure that you don’t miss bonus deadlines, annual fee alerts, or opportunities to really crush the travel rewards.

The website and app offered are completely free, so this should be a no-brainer for anyone looking to track credit card rewards.

What else can Travel Freely do?

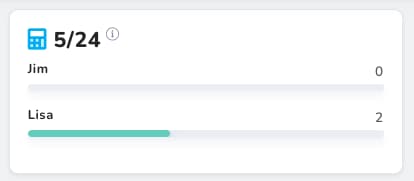

Similar to my spreadsheet, Travel Freely tracks Chase’s 5/24 rule. If you’re not familiar with that one and you’re hoping to seriously take advantage of credit card rewards, it’s a very important concept to understand so you’ll know how to prioritize applying for Chase cards based on their limits. You can read more about Chase’s 5/24 rule here.

I like that the site shows you exactly where you’re at on the 5/24 rule right across the top of your My Cards section…

As you can see, we’ve got plenty of breathing room to get rolling again. While we were living in Panama, most of our spending was in cash so we had to take things a lot slower. Now that we’re back in the U.S., it’s definitely time for us to accrue some more travel rewards!

Then there’s CardGenie. CardGenie is a feature of Travel Freely that helps you selectively pick your next credit card. As the site puts it:

“The CardGenie does some algorithm magic between your cards, bank rules, and the best available offers. If you can see it, you’re eligible for it. Approval is not guaranteed but you’re in very smart hands.”

— Travel Freely

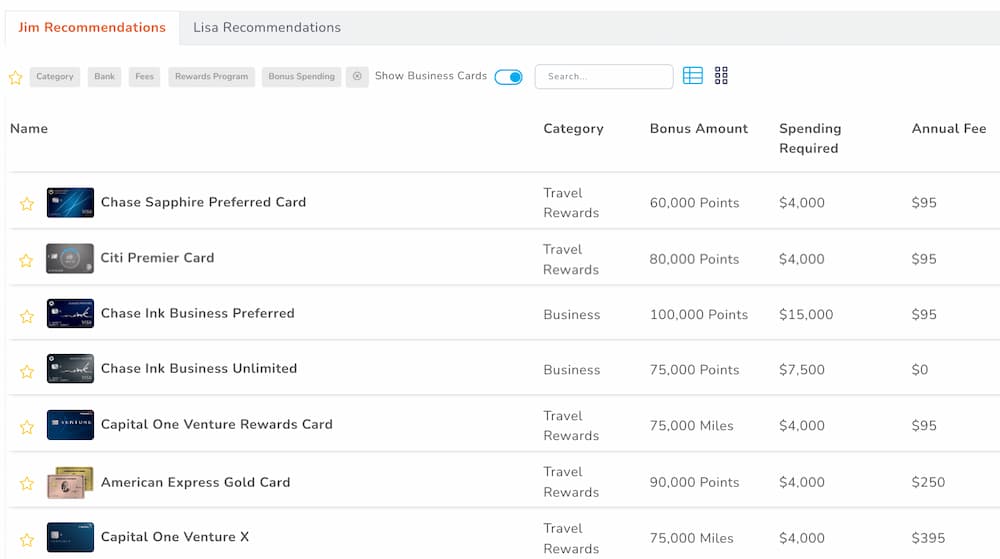

Just to show you, here are the top recommendations for me right now from CardGenie based on what it knows about my open credit cards and profile…

Funny enough, I was already considering opening the Chase Sapphire Preferred for my next card so this is right on target.

So, if you’re excited to track credit card rewards for free on Travel Freely, you can sign up on the Travel Freely site or the Travel Freely app.

Don’t forget that I do offer credit card recommendations as well on my site as well. I keep this page current and up-to-date on the best offers that have helped us to be able to save thousands of dollars on travel. I do receive a commission at no cost to you anytime you sign up for a card through my site. I don’t earn much overall for the effort I’ve put into this site since 2015 so I do appreciate the support.

I know it almost sounds like a slight business conflict to send you to a different site that lets you signup for credit cards considering I do that here. That said, I enjoy Travel Freely so much that I really wanted to make sure to share it with all of you!

Personally, I sign up for credit cards using my own links because, frankly, I make a few dollars each time doing it that way. I then like to use a combination of my spreadsheet and Travel Freely to get the best of both worlds, but you do whatever works best for you.

Regardless of how you decide to track credit card rewards, if you have a good credit score and pay off your credit cards each month, travel rewards are an amazingly simple way to save thousands of dollars. If you’re not sure of your credit score or want a great way to monitor it and other extremely useful information, create a free account at Credit Karma.

I’ll leave you with some past posts I’ve written about our experiences with credit card rewards. They’ve helped us to enjoy so much traveling we probably couldn’t have done otherwise:

- The #1 Easy Way We’re Getting the Southwest Companion Pass

- Our Travel Perks Are Drying Up and That’s Big $$$!

- Free Nights – We’ve Had 5 at Hilton Hotels Recently

- We Got Turned Down for a Credit Card… Ok, Four!

- Travel Rewards – 12 Free Flights Earned in 9 Months!

Plan well, take action, and live your best life!

Thanks for reading!!

— Jim

Interesting app Jim, I will have to check it out. Only thing that concerns me is that whenever you apply for another credit card, doesn’t it ding your credit? I do love the looks of the Travel Freely interface though, so I will certainly check it out!

You do get a slight ding temporarily, but then it’ll actually usually increase your score because it brings your overall utilization down. Let’s say you have 2 credit cards and owe $1,000 on your available $10,000 of available credit. Then you open a new card with a $5,000 limit. Now your utilization is $1k out of $15k instead of out of $10k. This accounts for a big part of your score so it’s actually a good thing on that level.

Canceling that card down the line is where you need to be careful because you could then lose that extra available credit you gained. But generally, you can downgrade the card to a version without a fee or sometimes transfer your available balance to another card with the same bank. And of course, if you apply for another card and get a similar available credit line and then cancel, that can even things out.

My wife and I are very active in reaping the credit card rewards and we both maintain scores of around 825-835… not too shabby, right?! 🙂

Not too shabby at all. Thanks for the explanation, its very helpful! When you going on your next out of town excursion?

Caribbean cruise coming up in about a month!! 😀

Jealous! Hope to hear about it….Will you partake in fishing in the Caribbean? A whole bunch more species of fish to snag down there! Have a great time!

No fishing on this trip, but that would be fun!

Looks like a nice app. I maintain a spreadsheet for our credit card, but it’s annoying. Too many spreadsheets to deal with already.

Haha, I’m with you on the spreadsheets, Joe! I actually love ’em but I have too many of them and that part’s annoying. Check out Travel Freely if you’re into the travel rewards – it’s simple and just works.