Disclosure: This post contains affiliate links and we may receive a referral fee (at no extra cost to you) if you sign up or purchase products or services mentioned. As an Amazon Associate, I earn from qualifying purchases.

Yeah, you read that right… a 7.12% return with Series I Savings Bonds. Sounds pretty good, right?

Right now, it’s a real struggle to figure out what to do with the cash you’re just sitting on. I talked about that in a post earlier this year, “We Have a Lot of Cash in Hand Now… Too Much!“

The problem is that interest rates are so low. While that’s great if you’re buying a house, it’s not so good on the money you’re saving and not investing.

As part of our early retirement financial plan, we have a bucket strategy in place. That means we’re always going to be sitting on a fair amount of cash.

And that’s ok. Cash is inherently going to be more secure than your other investments (in theory, at least!). Along with that though… no risk = no reward. Uninvested money that you are just sitting on isn’t going to be making you a ton of dough.

Even so, we all want to get the biggest bang for our buck regardless. So what can you do?

Right now, an online savings account (I use Ally bank) is paying 0.50%. On one hand, that’s a heckuva lot better than the waste-of-time big banks like Chase, which is offering a measly 0.02% for their best savings account.

Online banks provide ridiculously better rates than brick-and-mortar banks. And because we need a place to store the current year’s living expenses, Ally works well for that. But it’s still nothing to write home about.

CDs aren’t much better – Ally is currently offering a rate of 0.55%. And just like savings accounts, the big banks are offering much, much less – Chase’s best right now is a laughable 0.05%.

There are other options such as short-term bonds, TIPS, and various other investments. However, none are impressive in today’s low-interest times without needing to take some risk.

So when a loyal and astute reader and fellow retiree, KevG, dropped this comment in my post last week, I took notice…

“I noticed that Series I government bonds are paying 7.12% for next six months. Not bad for a cash stash. You need to hold for at least 1 year to cash them, and cashing before 5 years costs 3 months interest. But still not bad. There is a $10k buy limit per account per year – but you can also buy $5k more with a tax refund. Could make accidentally overpaying estimated taxes look inviting!”

— KevG

I hadn’t ever bought Series I Savings Bonds before so I did some research on it first. But KevG was dead on the money with the information provided (thanks, Kev!). Here’s the scoop:

- The interest rate for Series I Savings Bonds is set every 6 months based on inflation (derived from a fixed rate and a semiannual inflation rate). Right now, it’s 7.12% and a new rate will be announced in April 2022 for the next 6 months.

- The interest rate doesn’t go below 0 and the redemption value of the bonds doesn’t go down to less than you paid for them.

- Redemption:

- You can keep them up to 30 years with the rate changing along the way as mentioned above.

- If you keep them 5 years or longer, there’s no penalty on redemption.

- If you keep them for more than 1 year (the minimum term of ownership) but less than 5 years, you’ll forfeit the interest from the previous 3 months.

- You’ll have to pay federal income tax on earnings but they’re exempt from state and local income taxes.

- The maximum amount of electronic Series I Savings Bonds you can buy is $10,000/year per person. However, you can also buy up to $5,000 with your refund on your tax return.

In other words, a 7.12% return with Series I Savings Bonds is great, but you’re not going to get rich off of them. You’re also very unlikely to get that rate for the entire year either. The 7.12% interest rate is being labeled as “transitory” so chances are the rate will drop significantly with the announcement in April 2022.

And with the cap on how much you can purchase, the total return isn’t going to be spectacular. Let’s go with the crazy assumption that the interest rate stayed at 7.12% for the whole year. Plugging the info into an investment calculator shows that you’d earn $724.67 on your $10k for the year.

But if you then redeemed them after that first year and took the penalty of losing the last 3 months of interest, you’d lose $185.94. That means you’d walk away with $10,538.73. That’s a return of 5.39%… before taxes are taken into consideration. So it’s not mind-boggling, but earning a little extra money on some of your idle cash doesn’t hurt either!

We could have gone with $20,000 ($10k per person), but we talked about it and decided to purchase $10,000 worth. This was based on some additional funds we have sitting in cash that we weren’t concerned with locking up for a year or more.

We’ll determine if we’ll buy more in 2022, but I have a feeling that won’t happen since the odds are in favor of a much lower rate being announced.

But as my gift to you, I’m going to walk you through how to buy these since I just went through the process.

As a reminder, I’m not a financial advisor, so please talk to a professional before buying/investing in something you don’t fully understand.

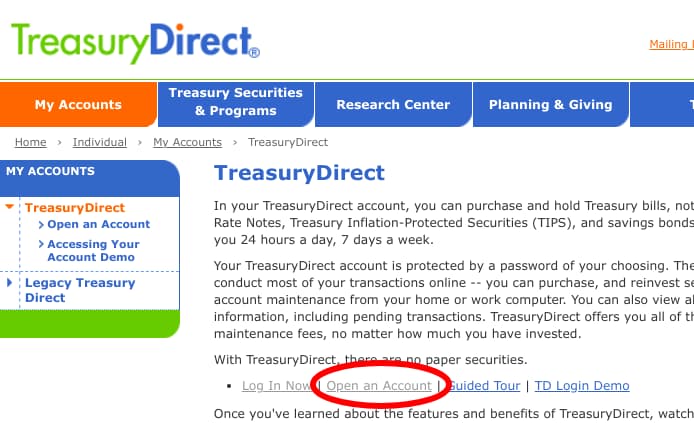

Creating an account at TreasuryDirect

If you already have an account at TreasuryDirect, you can skip this section and jump ahead to buying the Series I Savings Bonds. Otherwise, head on over to the TreasuryDirect website and choose “Open an account”.

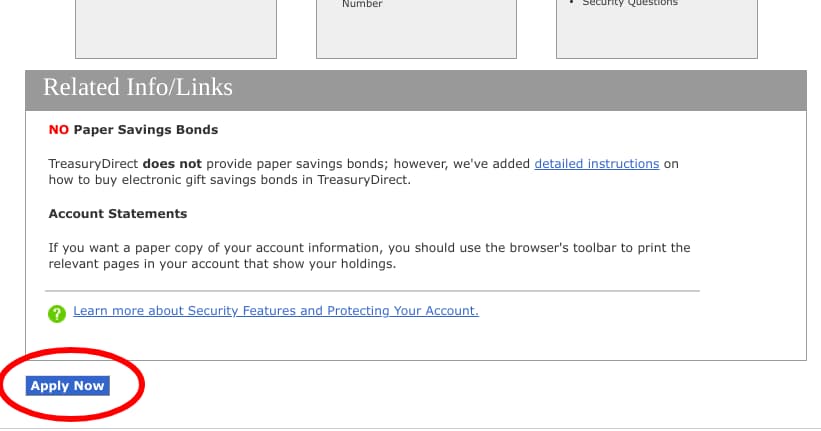

Then at the bottom of the page that you’re taken to, click the “Apply Now” button.

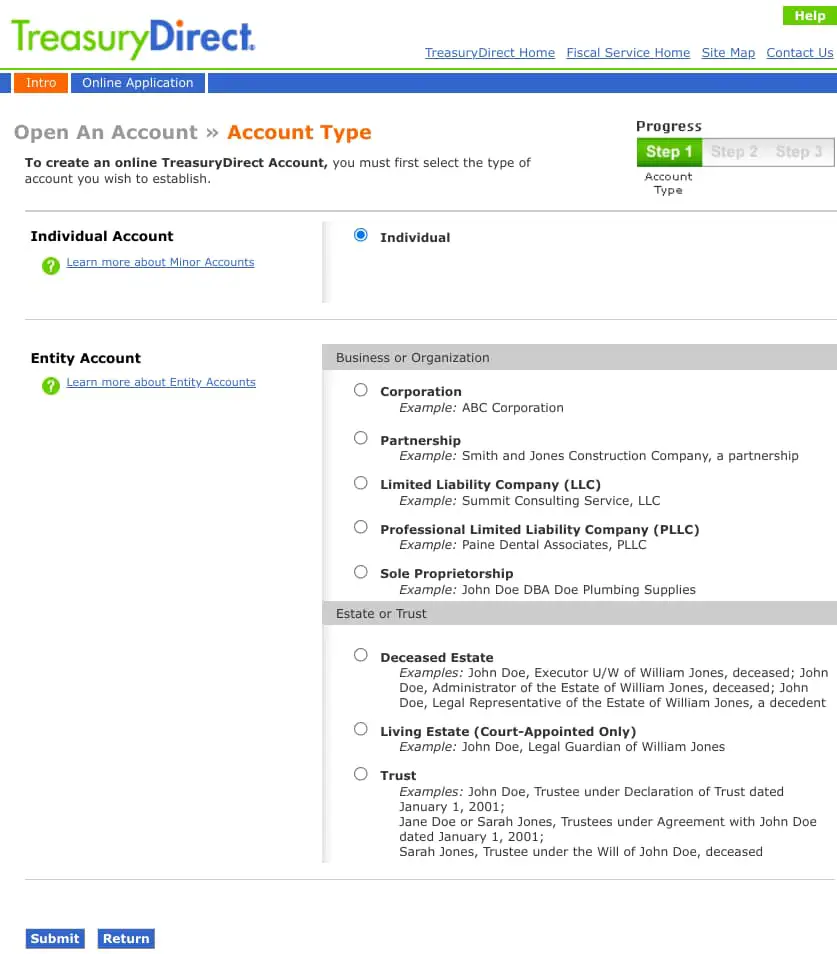

On the next page, you’re going to be asked for the type of account you’re creating. Most folks will choose “Individual” here but select whichever makes sense in your situation.

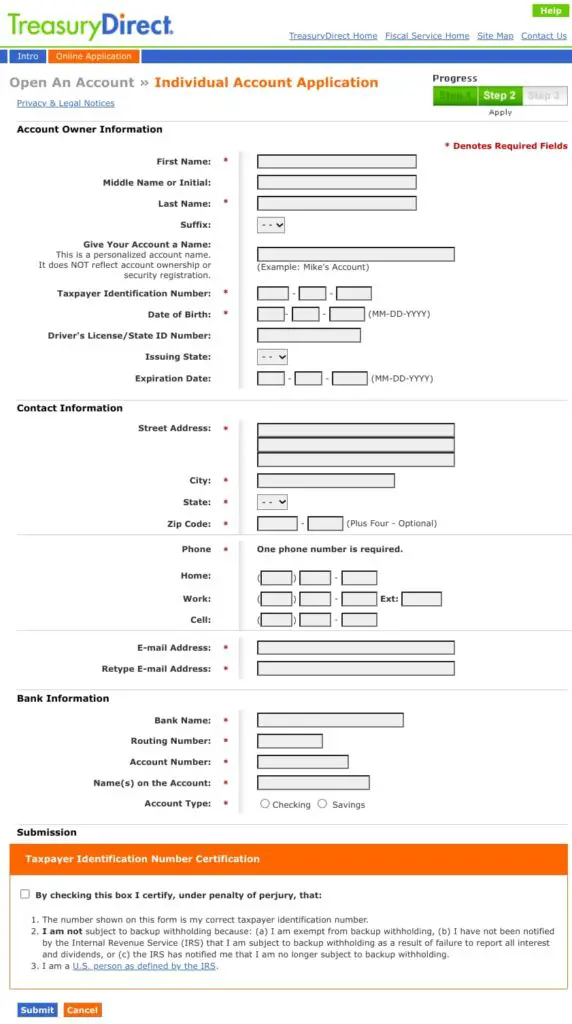

Assuming you chose “Individual”, you’ll now fill out your information. The bank account information is what will be used to purchase your Series I Savings Bonds.

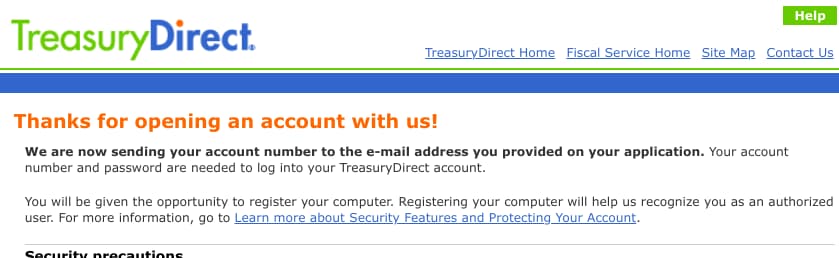

Over the next couple of screens, you’ll create a security image/caption and password for logging in. Then voila, you’re done!

Be sure to keep that email you’re sent. That has your account number and you need that (along with the password you created) to log into your account.

Buying your Series I Savings Bonds

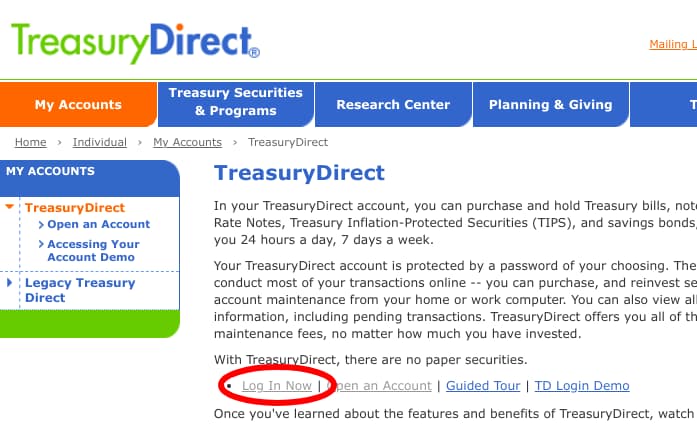

Once you have an account, you’ll head back to the TreasuryDirect website. This time, however, you’ll choose “Log In Now”.

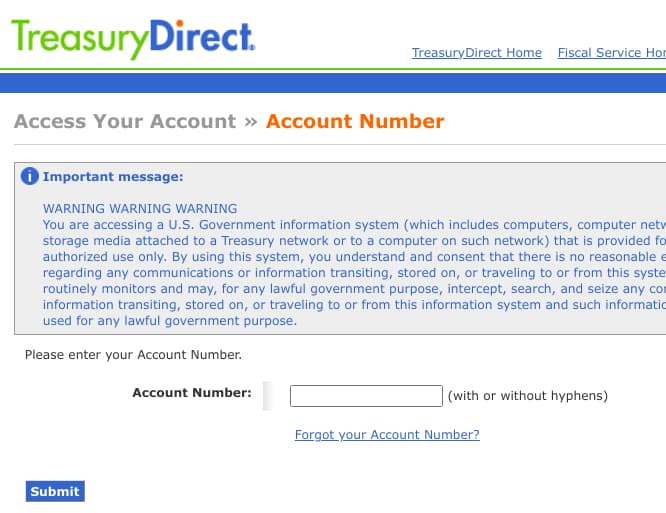

Remember that account number that got emailed to you? Yeah, you need that now.

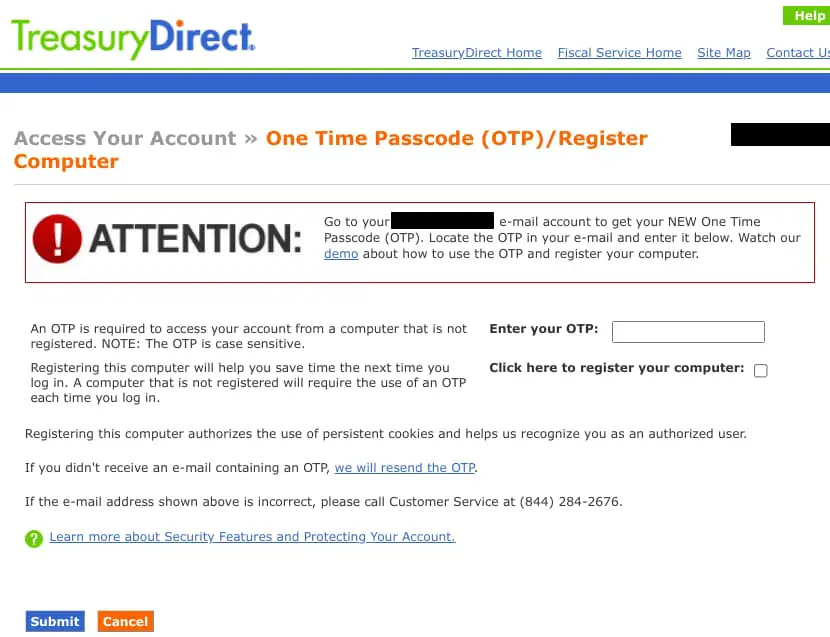

Now you’ll get an email with a one-time passcode (OTP) for security to enter here. You can check the box to register your computer if you’re not on a public computer and don’t want to be prompted for this again the next time you log in.

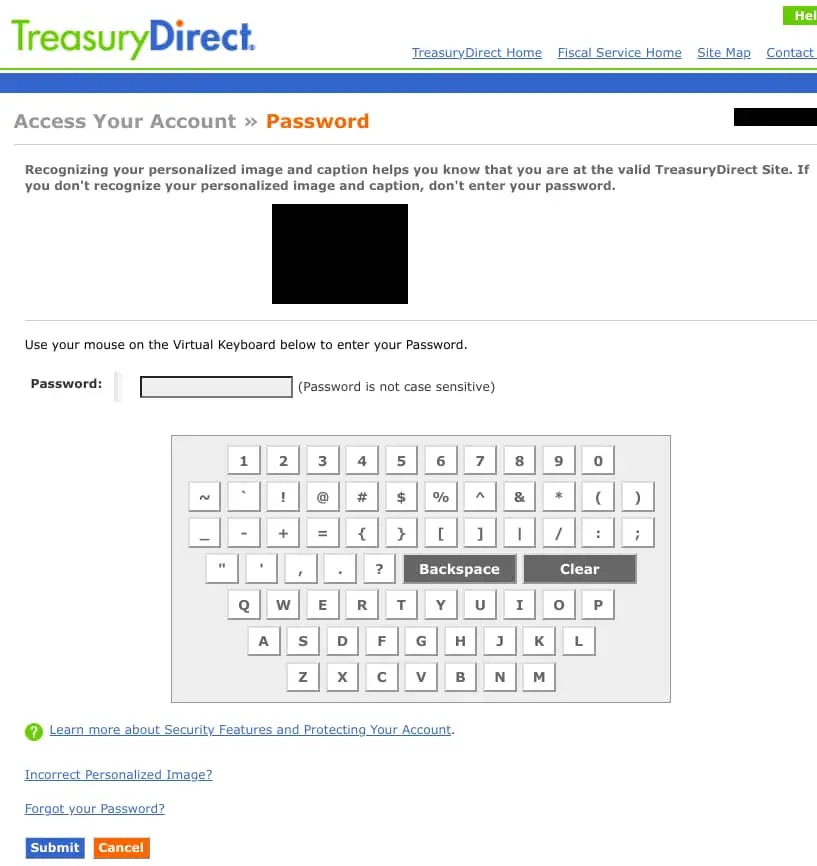

Time to enter your password. This was weird to me. I use a password manager (so should you!) and I clicked it to autofill and nothing happened. Maybe I should have read the instructions first! Lo and behold, you need to use their virtual keyboard to enter your password. What a pain considering my passwords are long and complex. The only good thing is that it’s not case sensitive, which was also odd to me.

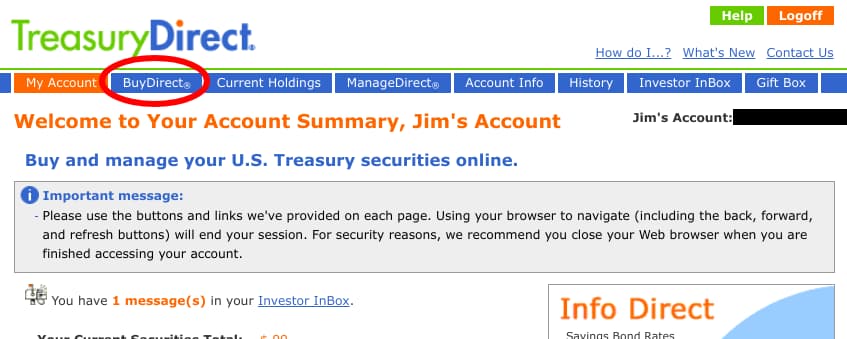

You did it – you’re logged into your account! Click on the “BuyDirect” menu item to buy yourself some of those scrumptious Series I Savings Bonds.

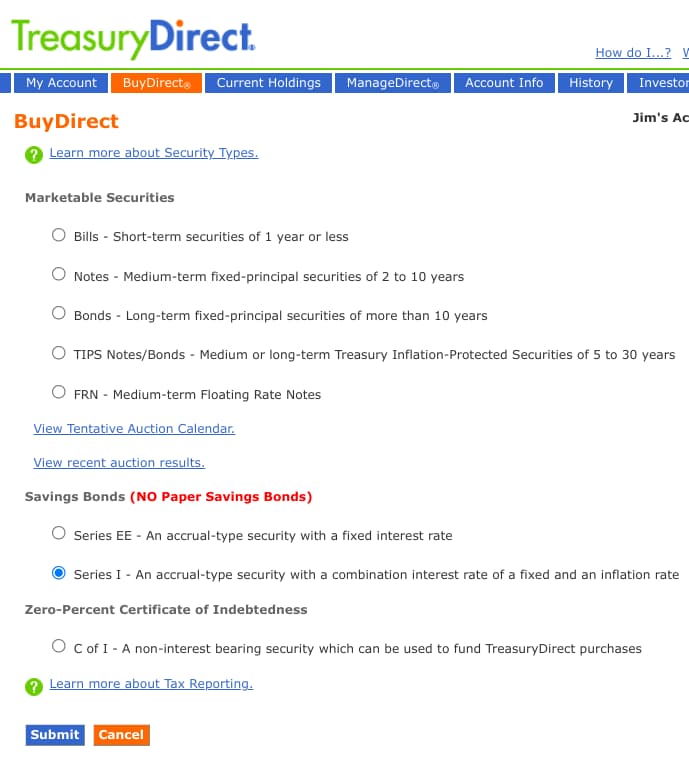

On the next screen, guess what you’ll be selecting to purchase – that’s right, Series I Savings Bonds…

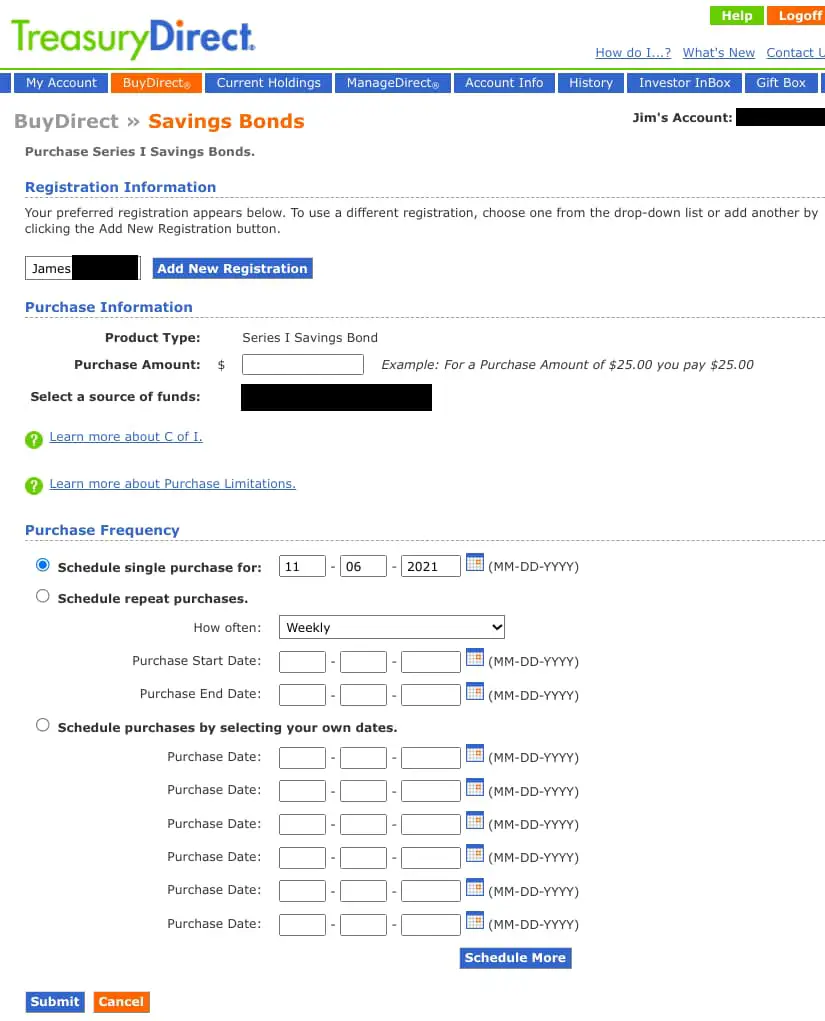

Time to make the magic happen! This is where you’ll select the amount of the Series I Savings Bonds you wish to purchase. You’ll also select the source of funds as well as the purchase frequency.

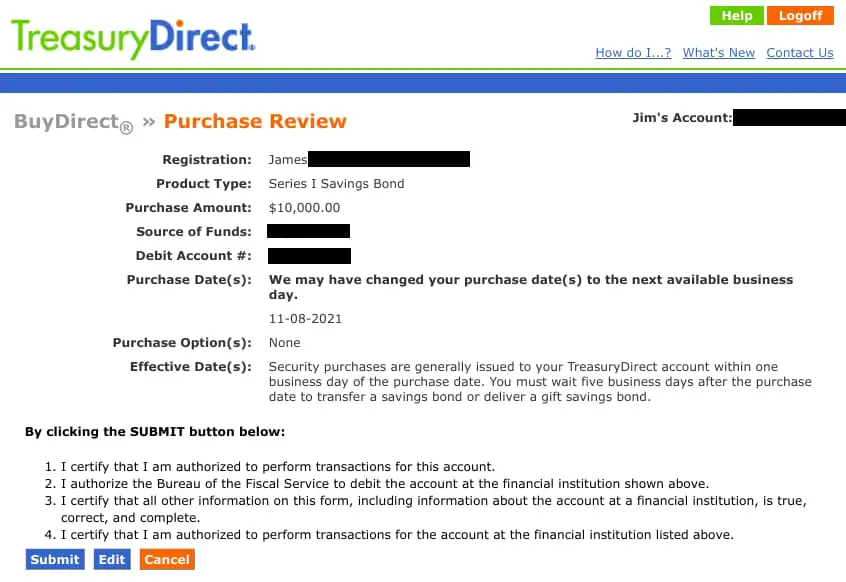

Review your purchase…

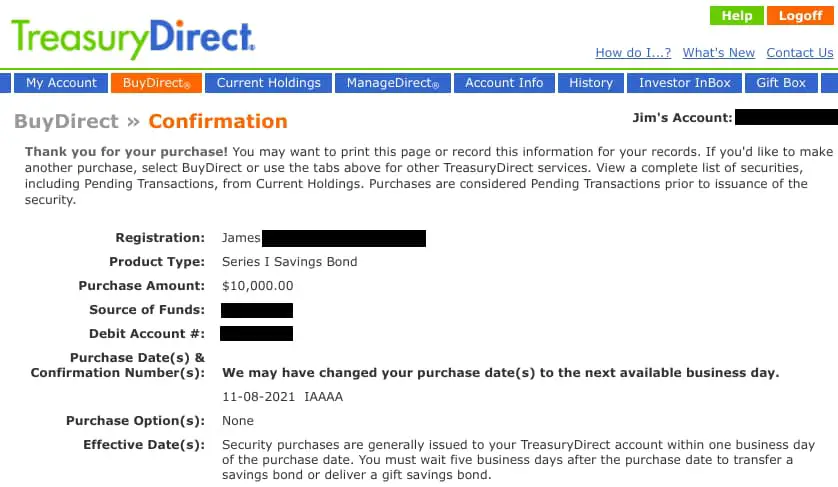

And just like that, you’re the proud owner of some shiny Series I Savings Bonds!

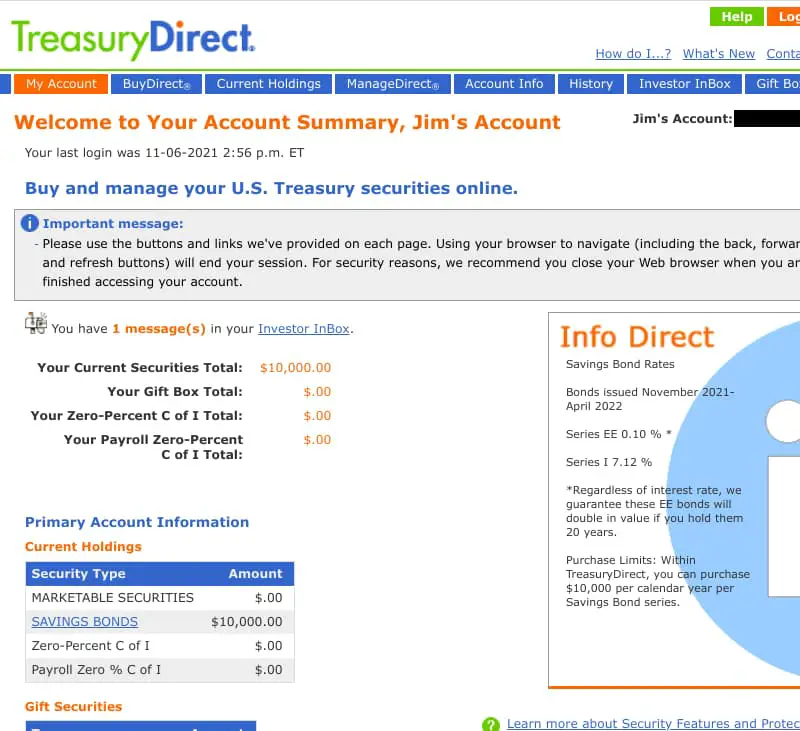

You’ll get an email confirmation on the purchase. You can also click on “My Account” where you’ll be able to see your transaction. Note that it will show as “Purchase Requested” until the transaction officially takes place during business hours.

Hopefully, that gives you a little insight on one way to possibly earn a little more interest on your idle cash.

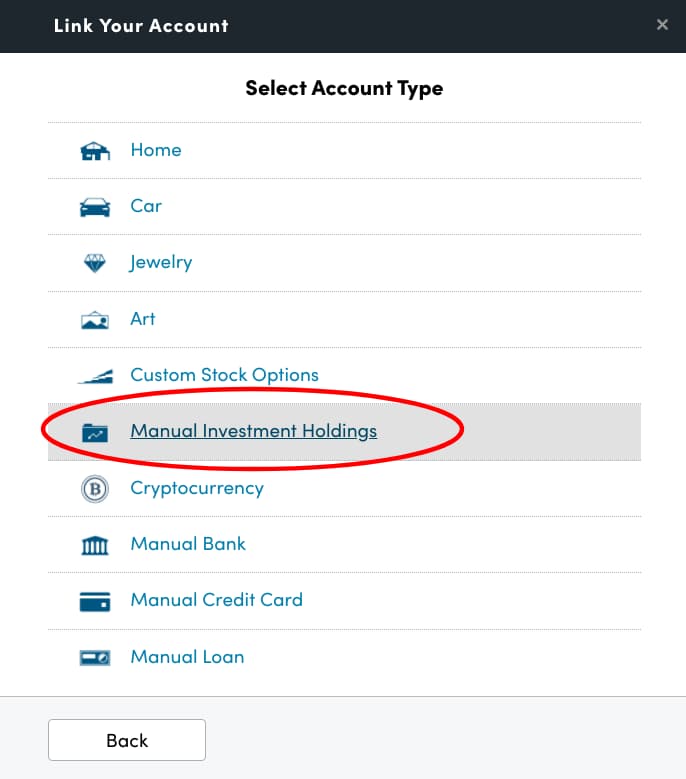

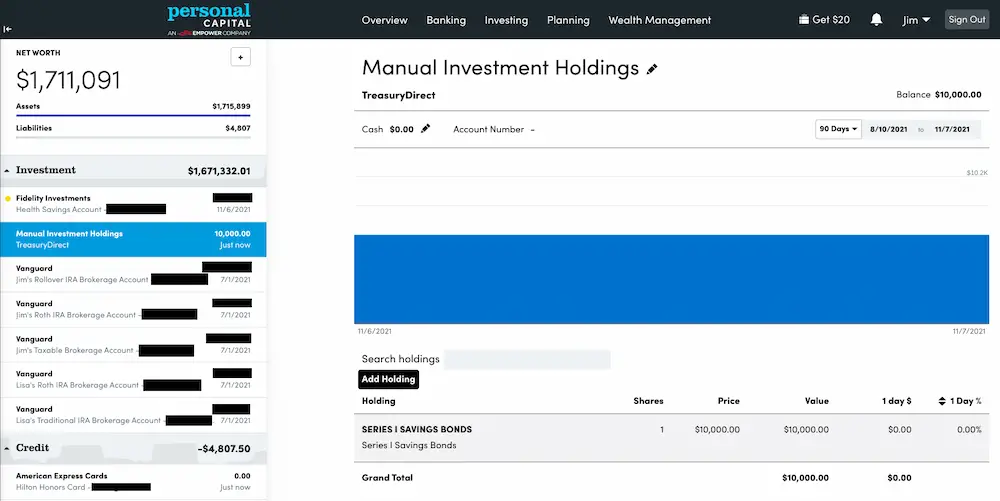

One downside to this is that you’ll have to manually track your savings bonds if you use financial aggregate software such as Empower (formerly Personal Capital) or Mint. The way I set it up in Empower is as a manual investment because I wanted it to show up under investments…

Since the value isn’t going to change much, this isn’t a big deal to have it this way.

Empower is a great free tool to track all your accounts. It has some great planners and tools to help you with retirement planning, see if you’re getting clobbered with retirement fees, easily view your investment allocation, and more. I saved over $50,000 with Empower in just a matter of hours so I’m sworn to it. And at a price of free, it’s well worth checking out!

We’ll keep these savings bonds for the required year but we might also hang onto them for the full five years if it makes sense to do so down the line. That would mean no penalty at all. But would be losing out instead of moving the money elsewhere?

Time will tell and we’ll decide what to do down the line. For now, though, it’s a nice little way to earn a little more interest on some of our cash.

Do you own any Series I Savings Bonds and has this interest rate enticed you to jump on them as well?

Plan well, take action, and live your best life!

Thanks for reading!!

— Jim

Nice. I did end up with a second account – it was kind of an accident though. I have one personal account and one in the name of our living trust. So we could end up with $30k per year (wife, me and trust) if I had that much free cash in a non-IRA type account and I wanted to lock it up for a year. I do hope your prediction of a rate drop in 6 months is accurate….

Since we only did $10k, I didn’t dig much into it, but that’s interesting that you can do another $10k for the trust. With the rate drop, I’m talking about the rate you can get on the Series I bonds, not interest rates. Are we ready for interest rates to start going up finally?

Glad you joined the club. I know there have a been more than a few of us recommending I bonds. I bought earlier this year so I got the 3.5% for 6 months and now the 7.12%. I plan on buying another $10k in January. Think about all the money in your money market if you have any sitting there. It is earning .01% then look at the fees your brokerage charges to own it. It is like stealing….

Yes, I should be giving you credit as well, Scott – you were another one recommending the I Bonds… thanks for the heads up!! It’s pretty crazy the difference in what you can get on these versus other alternatives without the risk.

I would like to add that interest on I-Bonds excluded from federal taxation if they are used to pay for qualified higher education expenses or rolled over into a 529 college savings plan, prepaid tuition plan or Coverdell education savings account. I still have my $5000 invested in 10/2001 I-Bonds and TreasureDirect calculator shows future value as of 05/2022 –> $14,346.00 with Interest Rate 10.23%. My son now is a 9 grade student and probably next year I’ll rollover these I-Bonds (all or partilally) to his Michigan 529 college savings plan. This way I save on federal taxation of the bonds and get more return from 529 plan. The rolover is simple process and the proceeds must be deposited into a 529 college savings plan within 60 days of cashing in the bonds and within the same tax year. There are some more rules to qualify for a tax-free redemption and easy to find on internet.

That’s great information, Alex! I’ll have to dig more into this, but that could be worthwhile to roll part of our investment into our daughter’s 529 plan as well. Much appreciated!

I bought $5K in late October (earning 3.54% for the first six months and then 7.12% for the next six months). I will buy another $5K before the end of the year. The decision to split the purchase was to hedge against the unknown next interest rate. I also plan to buy $10K in early 2022 and maybe overpay Federal taxes to buy up to $5K in paper i-bonds.

I also read that it is best to buy i-bonds near the end of the month, since regardless of when the buy occurs, the issue date is the first of the month. So, one can earn minimal interest in another account for most of the month, and still earn the same amount of i-bond interest as if i-bond was purchased on the first of the month.

That’s a smart idea JN to split the purchase up – you never know what’ll happen. I read the same about the thought to buy near the end of the month as well… I didn’t listen 😂, but I did read that. I should have scheduled our transaction to take place at the end of the month. I’ll make sure to follow that advice if we buy more after the first of the year.

Like you, we just bought Series I bonds for the first time. But like some others, we snagged $20,000 right at the end of October to get 6 months at 3.54% and then the 7.12%. Right now I’m planning on buying another $20K early next year.

You guys are rockstars as always, Amy! You’re supposed to be keeping me in the loop on this stuff beforehand though! 😉

I put $5,000 in I bonds for Mrs. RB40 and I about 8 years ago. I didn’t know the interest rate is 7%. That’s not bad at all.

I took my $5,000 out to invest, but left Mrs. RB40’s portion at the treasury. I should log in and see how much it is now.

Oh, back then the limit was $5,000.

You were buying Series I Bonds before it was the cool thing to do, Joe! 😉 Hopefully, you got some decent growth out of Mrs. RB40’s investment.

Thanks for sharing this tip. I’m 30+ years out from retirement so have most of my portfolio in equity. However, this would be a great option as you mentioned for people near or in retirement since bonds, CDs, and HYSA are fairly worthless these days. My plan for a fixed income in retirement is a rental property. We will see if things change and another asset is more attractive at that time.

I trust you Jim however that website is so archaic looking, normally I would assume it was a fraudulent one 🙂

It’s true that this is good for folks in or near retirement, but it could also be a great place for anyone to stash cash in the meantime. If someone’s saving up for a house or rental property to use in a few years, for example, you’re not going to want to gamble with it in the market for such a short time. However, earning a few bucks more on your money in Series I Bonds could make more sense than some of the other options.

And you’re so right about their site – “archaic” is definitely a fair word to use. It’s not going to win any awards for design for sure! 🙂 The good news is that it’s very straightforward and easy to use.

I seriously don’t know why I bonds are not being talked about more in the Financial blog world. Especially when the intrest rate is at 7%!! Your not going to get a better investment for your cash that at this time. I’ve been buying Treasury bonds with every paycheck for along time. I am really excited about getting a great interest rate with them now. Safe investing makes me smile too.

No doubt, Beau – a 7+% return in one of the safest investments out there is a rarity and makes me smile as well!

Were you able to use Ally bank as your funding source for I-bonds? I’ve tried to add Ally Bank to my Treasury Direct profile several times – never successfully.

Hey, CC – yes, I used Ally Bank (our online savings) for the source with no problems. Not sure what could be going on. The simpler start might be to contact Ally first since they’re easy to get a hold of and verify the info that you would need to enter. If that’s correct, then you’d probably need to contact TreasuryDirect. I haven’t tried calling them before – fingers crossed it’s not a big headache. Good luck!

Great info. How long will you all keep the I Bonds before redeeming them?

You can’t redeem them for a minimum of one year and if you cash them in before 5 years, you lose 3 months interest. So we’ll re-evaluate where interest rates are at after that one-year mark. If they’re not as great of a deal for our money anymore after that, we’ll cash them in and put the money elsewhere. Otherwise, we’ll let it ride until it doesn’t make sense for us anymore.