Disclosure: This post contains affiliate links and we may receive a referral fee (at no extra cost to you) if you sign up or purchase products or services mentioned. As an Amazon Associate, I earn from qualifying purchases.

I’ve bounced back and forth over the years in preparing my own taxes or having a CPA handle the job. If you’re using TurboTax, H&R Block’s software, TaxSlayer, TaxAct, or some other software when doing your own taxes, you’re already familiar with how they’re relatively easy to use (except when they’re not).

But if you’re trying to do financial planning along the way that might affect your taxes, running solo can be a struggle if you don’t know the ins and the outs.

My accountant/financial advisor gave me the boot after doing my taxes for 2020. Fortunately, it wasn’t because of me but rather because he’s concentrating on working with recurring revenue clients with assets under management. I just need some one-offs here and there so I don’t fit that business model well.

Unfortunately, that means I’m now on my own!

That’s both good and bad. There’s no doubt that it’s better to understand the details of taxes and financial planning to ensure you’re making the best decisions. However, there’s also that feeling of helplessness during the learning process when you don’t understand various aspects or know whether or not you’re making the right choices.

Doing your own taxes… there’s more to it than just using software

Doing your own taxes is nothing new for me – I did that for 17 years until I brought in David from Remote Financial Planner around 2018. I hired him specifically to shoot holes in my early retirement plan. I also wanted his help in some of the more unique facets of the plan… our Roth IRA conversion ladder and the financial side of living outside of the U.S.

The bonus though is that he’s also a CPA and so he was also doing my taxes. That meant he was seeing both sides of the equation (financial planning and taxes) and that helped the overall planning to be more strategic and well thought out.

So life was good – he’s an extremely smart guy and well-versed in living as an ex-pat outside the U.S. (he lived in Spain for a few years) and with the idea of early retirement. I couldn’t have found a better fit and he really made my life so much easier.

Losing him for the taxes side of the finances isn’t the end of the world. Again, doing your own taxes is something I’ve done plenty before and we’ve simplified our financial life dramatically since. We don’t have a mortgage anymore, we sold our last rental property at the beginning of 2021, and neither my wife nor I currently have W2 jobs anymore (though I do have self-employment income to deal with).

Toss in that TurboTax and the other tax software programs available have arguably gotten better and simpler to use over the years and doing your own taxes isn’t the nightmare that it used to be.

So, what the heck is this post about then?!

Easy, Charlie – simmer down! It all comes down to this…

It’s important to understand the tax side better in order to do the financial planning side better.

It’s easy (mostly) when TurboTax asks you questions and you just reply “yes” or “no” and you’re presented with follow-up questions along the way based on your answers. But actually grasping why the question is important and what’s taking place to arrive at the numbers in your return is what really matters.

It’s great that accounting software helps you not leave anything out and that your numbers are calculated correctly. However, it’s up to you to decide if you want a better comprehension of the details.

When David let me go as a client, I considered bringing in another CPA that could help me with my tax planning (particularly my end-of-year Roth IRA conversions). I reached out to friends on Facebook and Twitter asking for referrals…

I have a love/hate relationship with social media in general. However, it’s hard to beat it for reaching out to friends, family, and others in your circles in one fell swoop to ask for advice or help.

There were a lot of helpful responses and leads. The most valuable reply though was from my wonderful friend Amy from Life Zemplified, Women Who Money, and co-author of the book, Estate Planning 101 (one busy lady, right?!). She’s also a wonderful friend.

She recommended reaching out to Kathryn from Making Your Money Matter. Holy crap – of course!! I met Kathryn at a FinCon personal finance expo a few years ago and she was part of “our group” that hung out together throughout a couple of these conferences.

Kathryn is smart (and a CPA), has an understanding of the FIRE movement, she’s lived overseas for the past few years, and she’s probably about a decade younger than me (meaning she ain’t no fuddy-duddy stuck in old ways of thinking). In other words, she would have a solid hold on what I’m trying to do financially.

Perfect! Except when I reached out to her, she told me that she’s no longer preparing tax returns and…

“My passion is in helping to give people the tools to do their own tax planning and providing them with any additional guidance they need to support that than doing it for them.”

Um, yeah… not what I was hoping to hear. Sigh.

But as we got to chatting more and I explained exactly what I’m trying to accomplish, she recommended her “Personal Finance Bundle” of spreadsheets. Oh, boy – here comes the sell! **Eyeroll**

Long story short though, this actually made a lot of sense. She said the spreadsheets could help me determine the right amount of money to convert from our traditional IRAs (our old 401(k) plans) to our Roth IRA accounts and she has a lot of people purchasing the spreadsheet specifically for that reason to help avoid any tax surprises.

And because it has a single “Tax Inputs” page, it can be easily updated and reused over the coming years.

I bought it.

At $130, this made a lot of sense. If this could do what I wanted it to, that’s easily worth the cost.

And I’ll say it again – doing your own taxes is something that doesn’t bother me. My main concern is planning for these Roth IRA conversions every year. That’s the pain point I have since I don’t know enough about what’s truly happening on the backend to be sure I’m coming up with a good conversion estimate.

This gives me the best of both worlds. Not only would I be able to determine my conversion amount myself, but I might gain a better understanding of some of the intricacies of doing your own taxes.

If you’re planning on doing a Roth IRA conversion ladder, I have a simple calculator to help you determine approximately how many years it’ll take to make it happen. It also shows you when you can withdraw what amount without penalty. You can get that (along with several other cool spreadsheets!) just by jumping on my mailing list…

How’d the first Roth IRA conversion go?

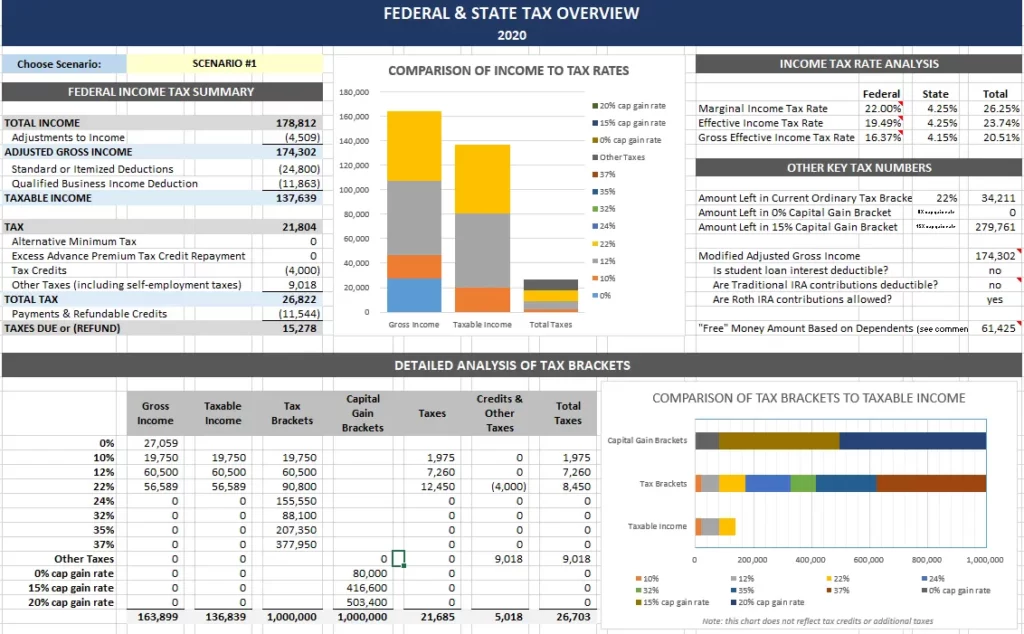

December’s when I do the Roth IRA conversion for the year. Why wait until the end of the year? Because now I can get a pretty clear picture of how the year went and determine a darn close estimate of how money to convert from our traditional IRAs to incur minimal taxes.

My goal is to stay within the 12% marginal tax bracket and keep the tax rate on the conversion very low (in 2019, it was 5%). Being meticulous in these conversions can result in monster tax savings.

However, there’s really only one way to figure out the right amount to convert… by doing your own taxes beforehand (or bringing someone else in to do it). In other words, I need to essentially do my taxes twice. It needs to be done during the current tax year to determine the estimate so I can do the Roth IRA conversion. Then after the tax year ends, it needs to be done again as normal to submit the return to the IRS.

So how did it go this time?

As I’ve said, doing your own taxes using tax software that’s asking questions and guiding you through the process is one thing. Knowing what you’re doing and filling in spreadsheets appropriately is another.

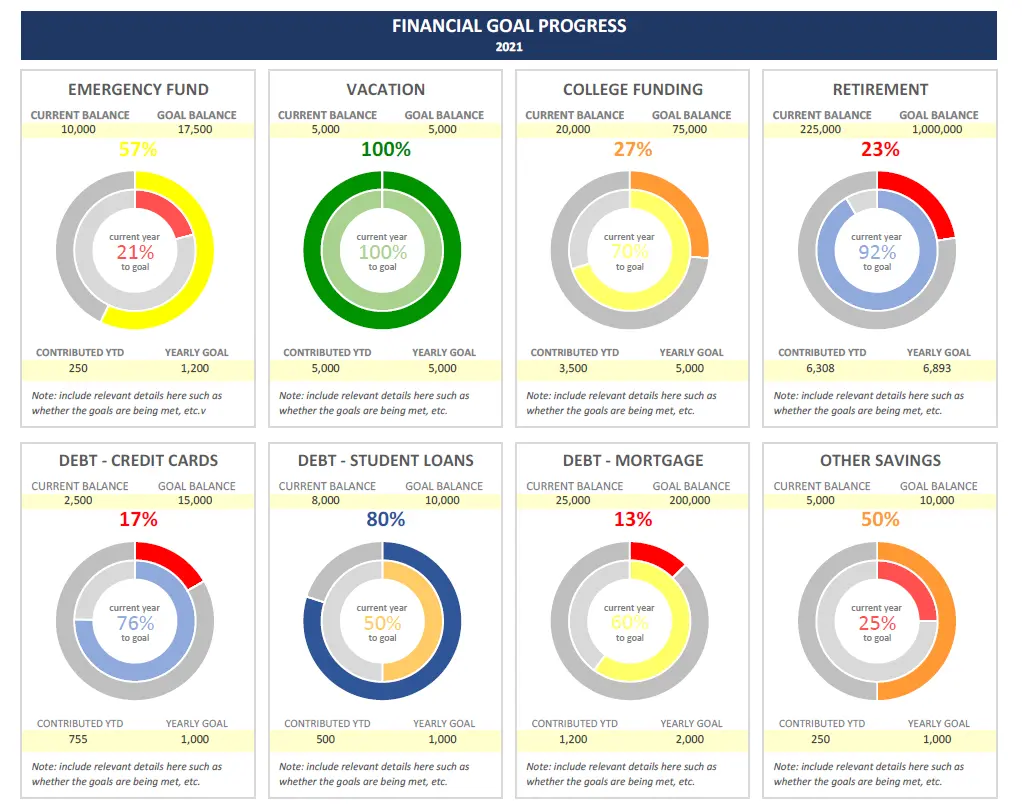

I struggled. Katherine’s spreadsheets are amazing (they really are!), especially for someone who wants to track cash flow. They take you through every facet of your financial life including financial goals and tracking, debt management, college, retirement, and estate planning, and a ton more.

I mean, this thing is bad-@#$! Where else can you take control of your entire financial life for less than you what you probably pay for one trip to the grocery store?!

I love what she’s created and the detailed instructions she provides in taking you through getting this setup and working for your individual needs.

The struggle I had was that I wanted to just pull one small piece out of this to use… and quickly so I could just get the conversion done. And I became completely overwhelmed in making that happen.

So I reached out to Katherine and she was more than happy to schedule a video chat with me to go through how to accomplish what I wanted.

In probably a total of 45 minutes, in addition to catching up on each other’s lives, she had taken me through everything I needed to know to get this done. By the time our call was over, I just needed to pull a couple of specific numbers from some financial details over this past year and plug them in… and that was that.

Because we had sold our last rental property at the beginning of this year for a hefty profit (we made triple what our down payment was in 5 years!), we have to worry about getting dinged for capital gains as well as the depreciation recapture. So we didn’t convert as much as we’ve done over the past couple of years.

In the end, I converted just over $25k from my traditional IRA to my Roth IRA… but it’s done.

The best part though is that now I’ve got an understanding of how to do this over the coming years. Next December, I can just update a few key tax numbers in the spreadsheet to match IRS changes (phaseouts, tax brackets, etc.), modify a few of my income numbers, and then easily see how much to convert in 2022. How cool is that?!

Who said doing your own taxes is hard?! 😉

Is this personal finance bundle good enough for more than just doing your own taxes?

Without a doubt.

If you’re someone who likes to have full control of your finances, this package is for you.

This thing is incredible. Everything is well laid out over tons of sheets that link to each other seamlessly. Beautiful charts and overviews make it easy to see where you stand.

Here’s what you can work through and accomplish with the bundle (I’m only showing you one of the spreadsheets for each category)…

Financial goals – set smart financial goals and track them easily…

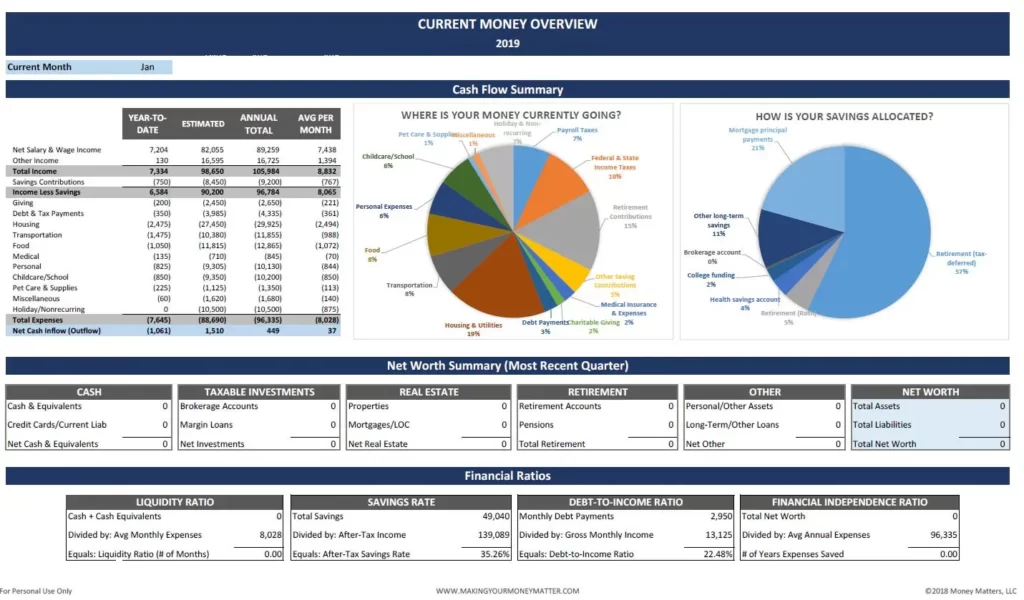

Cash flow tracking – see where your money is going to ensure your spending/saving aligns with your values…

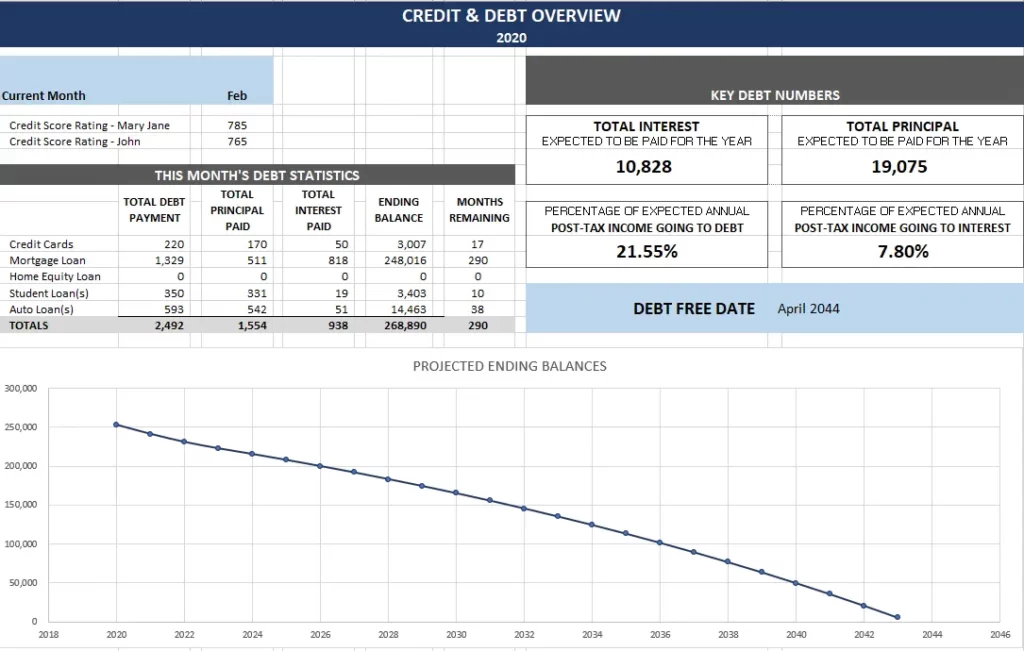

Debt management – create a real plan to help eliminate debt. This was a feature Quicken also offered that helped me get out of $30k in credit card debt years ago…

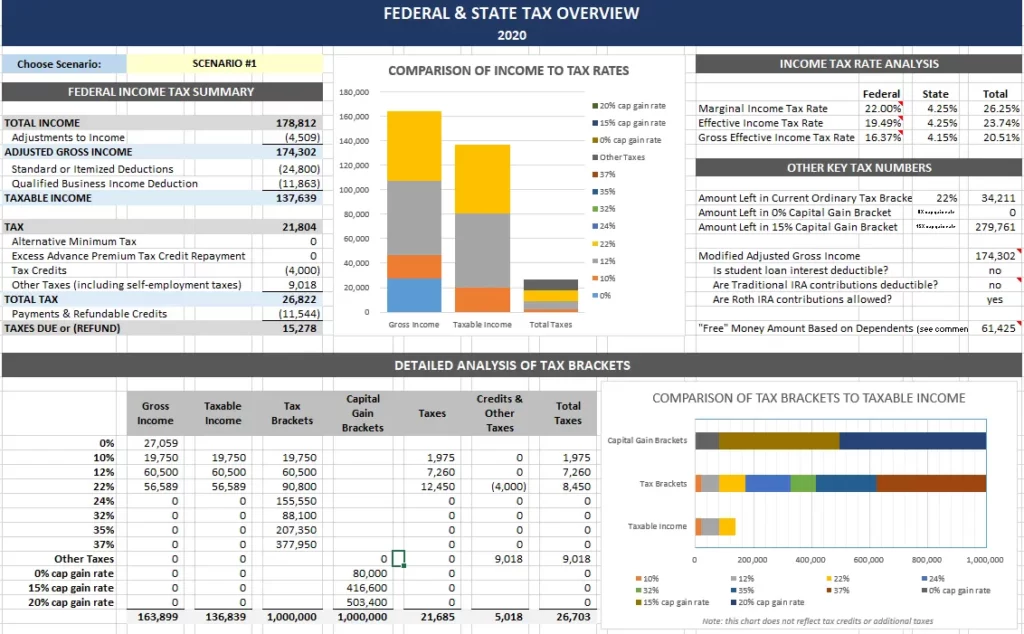

Federal/State income taxes – estimate taxes for the year (great for making quarterly payments!), help determine the right amount for Roth IRA conversions, and more…

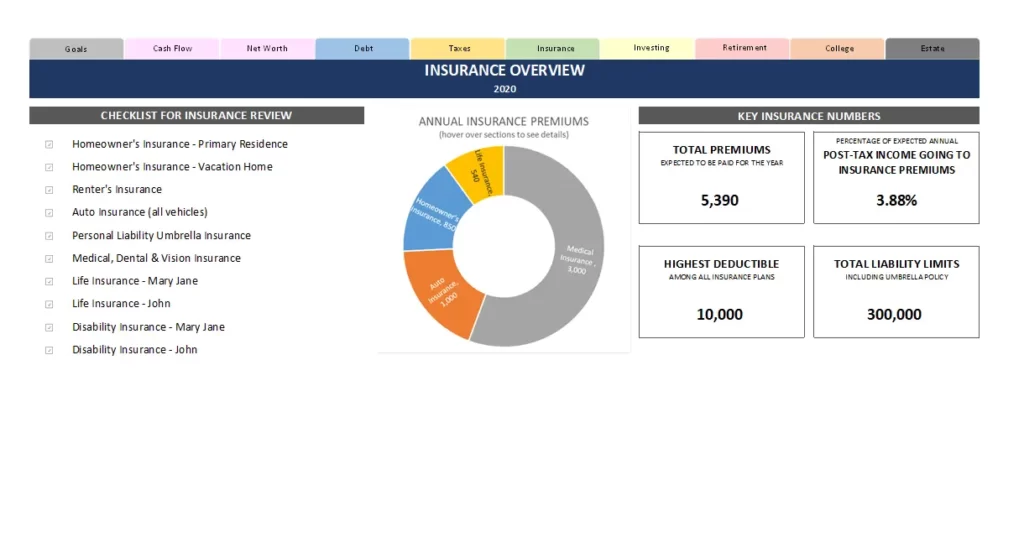

Insurance planning – determine if you have the right insurance and the right amounts needed…

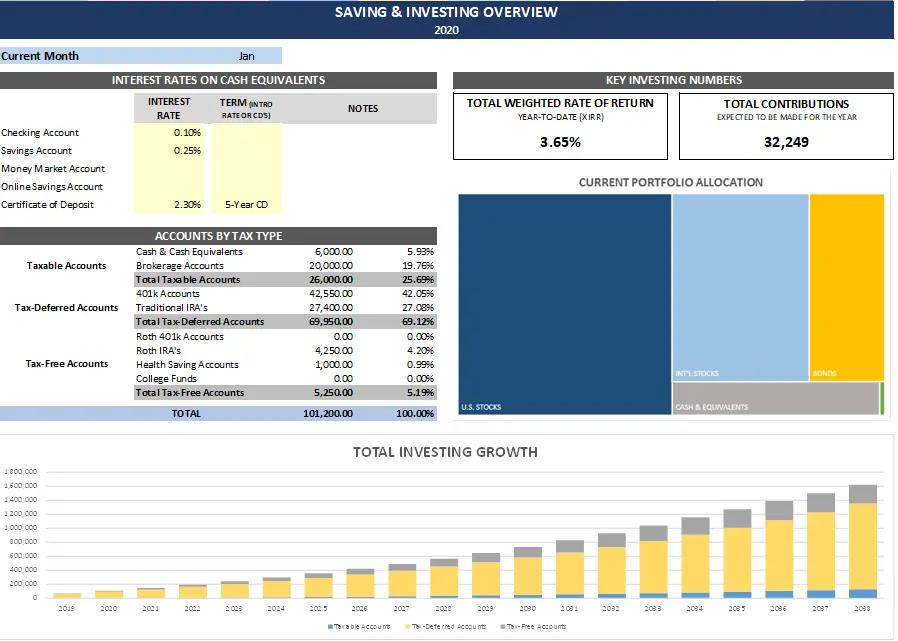

Saving and investing – easily track your savings and investments in total and by account…

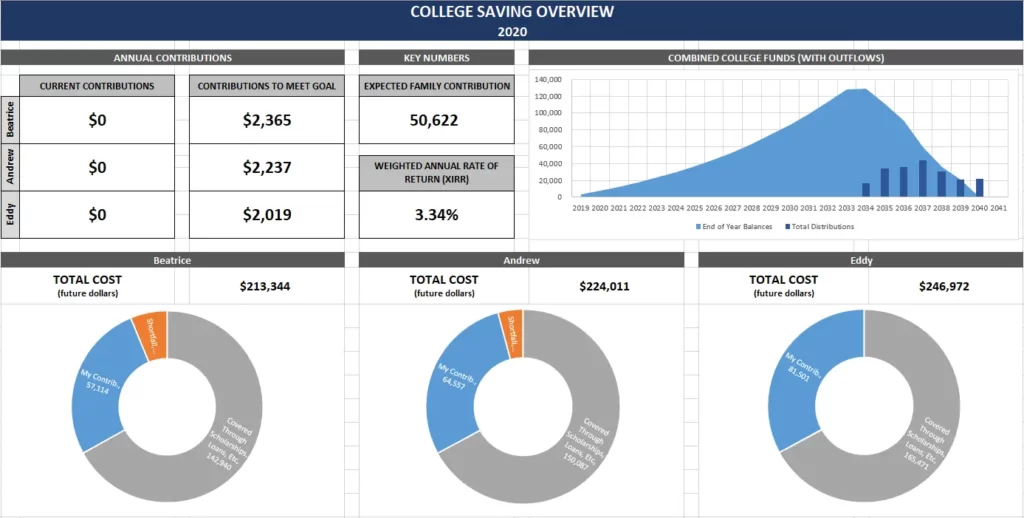

College planning – helps you set a goal and track it. There’s also a FAFSA calculator to help determine your expected family contribution…

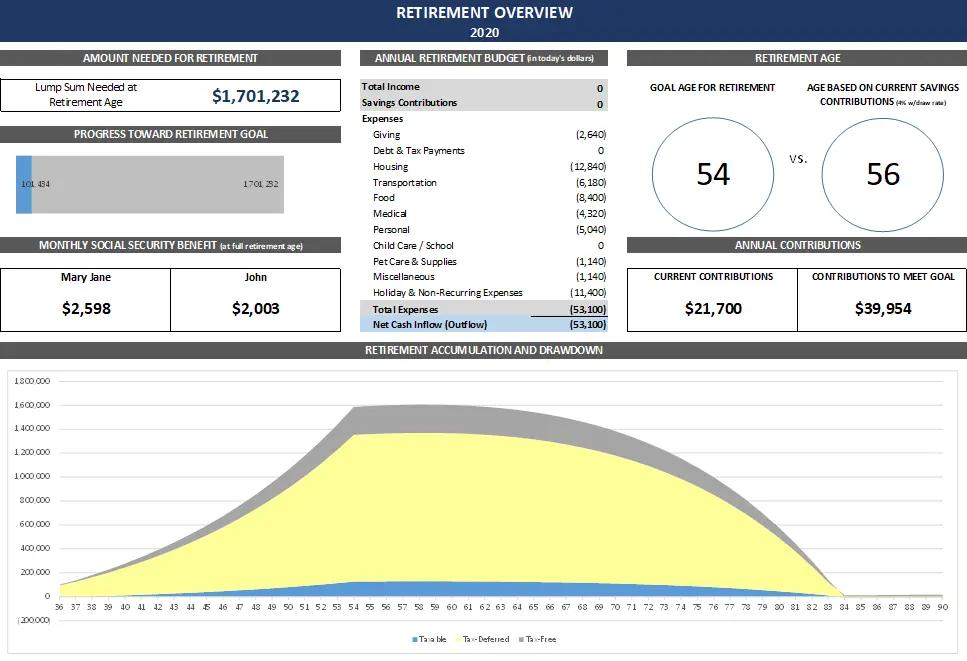

Retirement planning – determine how much you need to retire, see what age that should happen, calculate social security, and more…

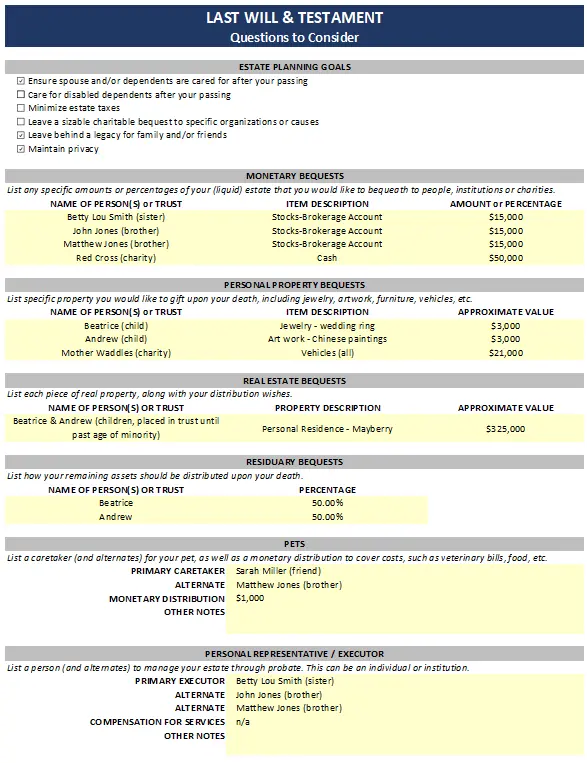

Estate planning – helps get you on the right track with ensuring your wishes are followed when you pass. This is a great complement to Vicki and Amy’s well-written book, Estate Planning 101…

Note that there are actually are a LOT of spreadsheets throughout all the topics that link together. I only included one screenshot of each category to give you an idea of how well-put-together this is. You can see all the screenshots on the Making Your Money Matter site.

The fact that you’re paying only $130 for it (once, not a recurring charge!) AND you can use it for multiple years makes it a fantastic deal! I used Quicken for 20 years and it didn’t do a fraction of what this does… and now Quicken’s become a subscription that hits your piggy bank too often!

This gives you the flexibility with them being spreadsheets to customize to your needs – something you can’t do with most other financial software or online calculators. Plus, you can pull in transaction data from YNAB, Tiller, Mint, and others if you use any of those.

She has these in both Excel and Google Sheets versions (I’m a Google Sheets user on my Chromebook!) so you’re covered regardless of your preference.

And, if you need any help, Kathryn can help and work her magic for you (at an additional rate).

I don’t think there are a ton of you out there still doing your own taxes without the help of software like TurboTax. But if you are or if you need to do tax estimates throughout the year, these spreadsheets have you covered as well. Perfect for self-employed folks needing to determine quarterly estimates!

This isn’t some little spreadsheet that was put together to handle a couple of simple tasks. Kathyrn has put several thousand hours into creating this bit of awesomeness and $130 is a real bargain!

If you want a better understanding of where your money’s going and how to optimize your cash flow better, this package is a win and only at a fraction of what you’d pay a financial advisor or CPA.

You can check out all the details and screenshots, as well as a really nice video she put together explaining how this all works and comes together here:

Making Your Money Matter – Complete Personal Finance Bundle

If you find that it doesn’t meet your needs, Kathryn will take care of you…

“If you are not 100% satisfied with your order, we ask that you first send an email with the issues that are causing you to be unhappy with our product (we can help!). If we are unable to resolve your issue, we will happily issue a complete refund within 30 days of purchase.”

Hard to go wrong!

I talked with Kathryn to see if we could offer a discount for Route to Retire readers and she hooked a brotha up. So, if you thought $130 was cheap for something that offers as much as this bundle does, enter in code R2R10 for 10% off your order! That coupon code is good on anything in her shop and is valid until 1/15/22 so get it while it’s hot!

Making Your Money Matter – Complete Personal Finance Bundle

As a reminder, this package includes both the Excel and Google Sheets versions of the bundle.

UPDATE 01/17/22: Kathryn just informed me of a promotion going on throughout the month of January for 20% off for the new version of the bundle. She also told me that she’s leaving my special discount code in place until 1/31/22. That means if you hurry, you can get 30% off your order! This really becomes a no-brainer now!

I’m now actually looking forward to determining the amount of my Roth IRA conversion next year on my own. Who’d a thunk it?!

Are you doing your own taxes or do you outsource that? Would something like this be helpful for you for taxes or other aspects of financial planning?

Plan well, take action, and live your best life!

Thanks for reading!!

— Jim

What are the main challenges you’ve had with determining how much to convert?

The first couple of years were easy because my CPA just showed me what my tax liability would be given a few different amounts. The only challenge I had this time around is that I just didn’t know enough on what I needed to enter to do the calculations in the spreadsheets. Now that I do, this should be a snap next year. I’ll just update some numbers and then I can quickly run a few scenarios to determine how much to convert to stay in the lower bracket without needing to owe the IRS much, if anything.

Thanks for the shout-out, Jim! Kathryn and her spreadsheets are wonderful. You’re pretty great yourself too. 😉

Aw, shucks – thanks, Amy! 😊

TurboTax works for most people unless they have sone complicated investments or business income. But your article was interesting.

Agreed. That was one of the reasons why I shifted to a CPA years ago – we had the rental properties, 3 small businesses, etc. I was pretty sure I was doing everything right but I wanted to see what would come back from someone else doing my return. The good news is that I was doing things correctly – the bad news is that I liked someone else doing the return a lot better! 🙂

Now that we’ve simplified so much, TurboTax is kind of a gimme for me to use.

Jim, thanks for sharing! I hadn’t heard of Kathryn’s blog or Excel bundle before; I will have to go check them out! After all, I love a good Excel Spreadsheet to accomplish my goals.

It’s really impressive, Olaf, and I just updated the post to mention a 20% off promotion she’s running. Combined with the discount code I mentioned, that makes it 30% off. So if you’re interested, you can save big money if you get it before my code expires on 1/15/22.

Interesting! I’ll have to give this a look. I do our taxes (with TurboTax), which always takes me at least 8 hours with rental properties and such. I paid someone once, but it seemed that the time-consuming and complicated part was just gathering and organizing our info, which I had to do anyways! And like you said, understanding how it all works give me a deeper understanding of our situation and helps us make choices that are much more strategic.

Haha, doing all the time-consuming stuff before letting an accountant just punch in the numbers was always my big gripe, too! 🙂

Kathyrn just released a new version of the bundle that I’m excited to test out. As she put it to me, “[it] has more advanced tax calculations for those with K-1 investments and passive losses as well as retirement distribution strategies that factor in taxes and Roth conversions (it does require a little bit more manual process for those under 59 1/2, but allows for custom distributions in that case).”

I’m far from an expert on this stuff, but this may be a great way for folks like me and you to understand it a little better and like you said, “make choices that are much more strategic.”