Disclosure: This post contains affiliate links and we may receive a referral fee (at no extra cost to you) if you sign up or purchase products or services mentioned. As an Amazon Associate, I earn from qualifying purchases.

I talked last year about how we planned to keep our health insurance costs low once we moved back to the U.S. from Panama. Well, that time is now and I wanted to share how ACA subsidies have enabled us to keep our costs even lower than anticipated.

One of the toughest areas to plan for in early retirement is health insurance. Finding quality health care coverage at an affordable price to tide you over until Medicare eligibility at 65 can be difficult.

When we were living in Panama, this wasn’t much of an issue. We decided against traditional health insurance while living there because of the low costs of quality medical services the country provided.

However, we did enroll in an ex-pat insurance plan through International Medical Group (IMG) for our years there for two reasons:

- As perpetual tourists, we traveled back to the U.S. a couple of times each year. Should we get sick or into something like a car accident while in the U.S., we wanted some type of insurance in place just in case.

- Although the medical costs in Panama are cheap, if something more catastrophic or intensive had reared its head (i.e. cancer), insurance could still be worth the cost.

We had a Silver Global Medical Insurance plan that ran us less than $350/month total in premiums for our family of three. Not too shabby, right? If you’re curious, you can see what an expat Global Medical Insurance plan through IMG would run you here.

But that was then and this is now. How in the world would we be able to afford the ridiculously-priced health insurance here in the U.S. when we returned?

The answer was exactly what we were hoping for… help from ACA subsidies.

What are ACA subsidies?

To assist low-income families in purchasing health insurance, the government helps pick up part of the tab for the insurance premiums. This is all handled through, HealthCare.gov, the companion website of the Affordable Care Act (ACA).

These ACA subsidies can then be applied toward the health insurance plan you choose. And they’re no joke either – if you qualify, you can save some big money on your insurance!

There’s an interesting twist though that I talked about last year in my post, Health Insurance in the U.S. – How We’ll Keep Costs Low. Because we’re living a somewhat modest lifestyle in early retirement with our yearly Roth IRA conversions being most of what qualifies as our household income, we’re able to benefit from the ACA subsidies.

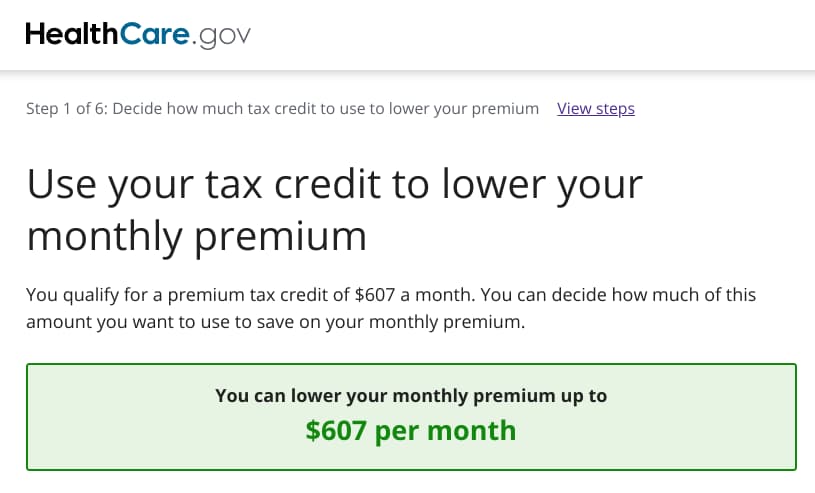

When I filled out my application on HealthCare.gov and the questions revolving around ACA subsidies, we were happy to see that we qualified for $607 in credit per month…

Essentially, we would receive a discount of over $600/month on whichever plan we would choose.

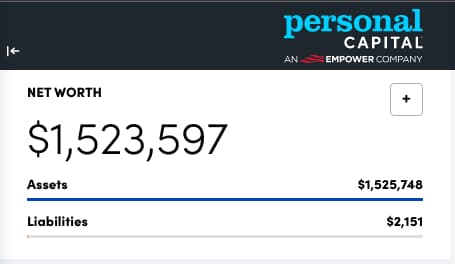

Think about that – as I type this, Empower (formerly Personal Capital) shows that we have a net worth of over $1.5 million…

As a side note, if you’re not using Empower to help manage your finances and track your investments, you’re missing out. I’ve been “all-in” on using Empower for a few years now and love it. You can check out Empower here – it’s easy and free to use and the built-in tools are phenomenal.

Our $1.5 million is far from the most money anyone has ever stashed away, but it’s still a significant amount of dough. In fact, the median net worth of U.S. households is only $121,700 as revealed in the Federal Reserve’s 2019 Survey of Consumer Finances.

As early retirees with almost 10x that, you wouldn’t think that we should qualify for ACA subsidies. Be it as it may, the formula is based on income and not net worth.

Is it right that a household with a net worth of $1.5 million should get ACA subsidies for health coverage? That’s not for me to decide but I’m definitely going to take advantage of the benefit while it’s offered.

You can get a rough idea of how much in ACA subsidies you’d qualify for by using one of the many calculators out there. I like the simplicity of Kaiser’s Health Insurance Marketplace Calculator as a good starting point.

Bear in mind that the ACA subsidies are not written in stone until you settle up after the end of the year as you file your tax return. If you over-estimated your income projection for the year, you’ll be getting a tax credit toward your tax return. But if you made more over the year than you had projected, you’ll be paying Uncle Sam back the difference as part of your return.

A bonus for me is that the vast majority of what counts as income in our case revolves around the Roth IRA conversions we’re doing at the end of each year. That means we can essentially mold what our “income” amount will be by just converting less or more for the year.

The ACA subsidies aren’t necessarily a forever thing either. They were set to expire recently but it looks like that will be changing around the time this post comes out.

It’s expected that President Biden will sign the Inflation Reduction Act into law this week (it may have even already happened by the time this post was published). Regardless of your political views, this bill does provide something important to early retirees such as myself:

The passage of the Inflation Reduction Act will extend temporary subsidies, preventing out-of-pocket premium payments from rising across the board next year for virtually all 13 million subsidized enrollees. In the 33 states using HealthCare.gov, premium payments in 2022 would have been 53% higher (more than $700 per year more) on average if not for these enhanced subsidies. The same is true in the states operating their own exchanges.

— Kaiser Family Foundation – Five Things to Know about the Renewal of Extra Affordable Care Act Subsidies in the Inflation Reduction Act

In other words, the ACA subsidies will continue for at least the next three years.

This is great news because these ACA subsidies are really the only reason we’ll be able to continue to afford health care insurance. Without that help, we would need to utilize other options such as Health Care Sharing Ministries (HCSM), which then carry their own set of issues.

Our health insurance plan

Open enrollment for insurance on Healthcare.gov tends to run from November 1 through December 15. That wouldn’t work for folks like me who moved back from Panama in the middle of the year.

They do offer special enrollment periods for qualifying life events though. Fortunately for us, our move back from Panama/Texas to Ohio was a valid qualification to take advantage of this.

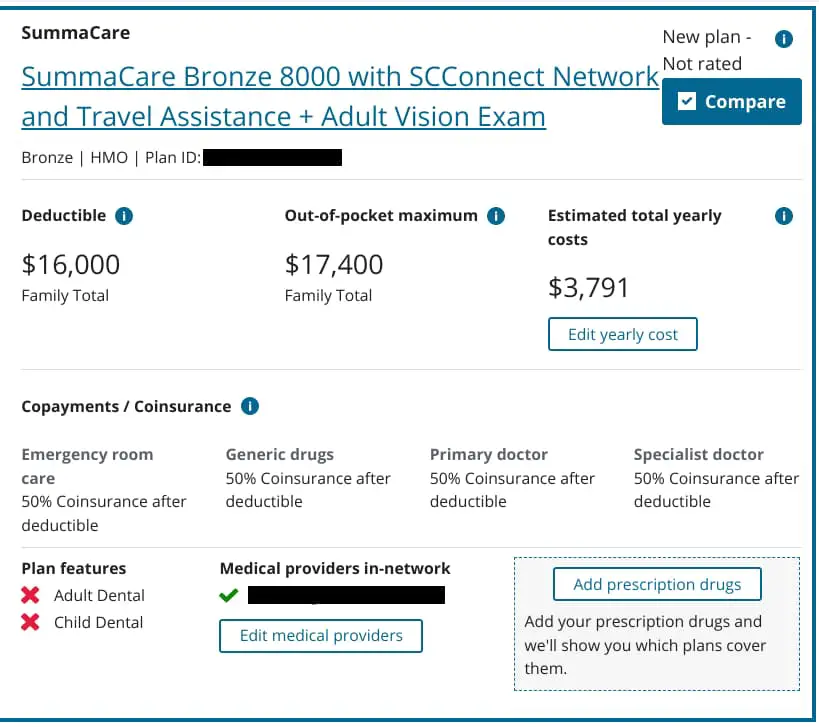

However, I did notice that “the pickings” on HealthCare.gov offered seemed a little sparse. There were still a fair amount of health insurance plans available but not as many as I was expecting to see. My guess is that this is because it’s not open enrollment, but again, that’s just a guess.

Regardless, Lisa and I had long discussions in trying to determine the right plan for our family. Yes, premium costs are important to consider, but there are so many other factors to think about as well.

In our case, the three of us are all thankfully healthy and don’t usually require many visits to the doctor’s office. And fortunately, we have enough money to cover higher deductibles if desired.

After a lot of digging around and much discussion, we decided that we would go with a less costly plan that covered our needs. The odds are that we’ll barely use it and we’ll save a lot of money rather than going with a more expensive plan. Of course, there’s always the gamble that something catastrophic could happen, but we could still cover the out-of-pocket maximum if needed (though it would still sting a little).

Here’s what we decided on…

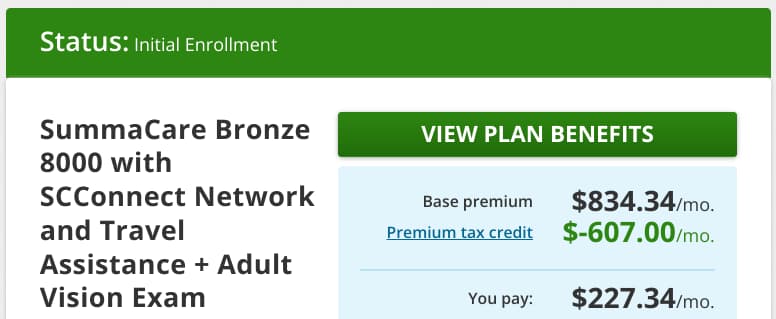

The total premium for this health insurance plan for our family comes to $834.34/month. But after our $607 in ACA subsidies, that brings our monthly premium down to $227.34 for our family of three.

As insane as it is, I was paying almost double this amount out of every paycheck when I was working, even after my employer’s subsidy. This is one interesting country we live in.

One thing that I do like is that we’re looking at this as a sort of temporary coverage plan just to carry us through the rest of this year. At open enrollment in November, we’ll be re-evaluating the available plans. We’re hoping to see more choices at that time so we can find a plan that’s a little more finely tuned to our needs.

Even though I’ve been retired for over 3 ½ years, most of that time we were in Panama. So this is the first year where we needed traditional health insurance.

The costs for health coverage in the U.S. can be expensive (stupidly expensive) but the ACA subsidies available have the power to make it a little more palatable.

If you enjoyed this post, consider joining my mailing list. I’ll keep you in the loop and send you some cool freebie spreadsheets just for signing up…

Plan well, take action, and live your best life!

Thanks for reading!!

— Jim

Another great article. I will definitely need this in a couple years if all stands the same. But question is around IMG. We are looking to work remotely for then next two years and stay out of the US for more than 330 to take advantage of the IRS code FEIE and are looking at IMG for health insurance. Did you get the plan that covered you in the US also? If so did you have any issues in the US of finding in network drs.? Did you ever need to use it in Panama? If so did you find it cheaper just to pay out of pocket or use it and pay the deductible? Not sure if you mind sharing but what was your deductible? Im looking at a higher deductible so our monthly premium is lower and just pay out of pocket for smaller stuff and really use the insurace for big unexpected/major incidents. Thoughts/Advice?

Hi Nadeem – that’s exactly why we got the IMG plan (ours was the Global Medical Insurance Silver Area 3). Panama wasn’t so much a concern, but we wanted to ensure we would have coverage when we would visit the U.S. as well. Because that was our main purpose for having it (more catastrophic than anything), we set a slightly higher deductible on our plan ($1,000 each). That kept it cheap but also protected us in the event of something major happening.

Regardless, we didn’t use the insurance much during our few years (that’s a good thing, right?!). We never used it in Panama – medical was so inexpensive there that we just paid out of pocket because we knew we wouldn’t be anywhere close to hitting the deductible. Here are a couple of examples:

• My Test Run of Medical Service in Panama Went Awry

• An Example of the Cost of Healthcare in Panama

We did use it a few times in the U.S. though. Finding covered doctors/facilities that we already used wasn’t hard. That said, we did pull our hair out a few times because it felt like we had to resubmit claims multiple times on more than one occasion. It’s very possible though that this was related to the facility we used those times, but I can’t say for sure. The other issues we had is that because we had a semi-higher deductible and we’re pretty healthy, I don’t think we ever hit the deductible so had to pay out of pocket anyway. The exception is the routine annuals and whatnot that were either covered or mostly covered.

The last issue we had was very unique to our circumstances and the time that things happened. But we left Panama during the pandemic to go back to the U.S. from July-October 2020. When we wanted to return to Panama though, we were required to get an antigen test. Those were not common then like they are now. Even though the U.S. government mandated that these tests would be covered, IMG refused stating that they’re not a U.S.-based company so didn’t need to comply… BS if you ask me. We ended up having to pay out-of-pocket for these, which wouldn’t have been a big deal but the facility was gouging at $278 each!!! We later negotiated down to a still ridiculous $150 each but I wasn’t very happy nonetheless.

I don’t want to scare you off but want to make sure you know what we experienced. I still think I would use IMG if we were in Panama or living elsewhere in the world. No health insurance company is all peaches and cream but it was nice knowing we had coverage in place should something major happen in either place.

Hope that helps and good luck on your travels!

Jim, thanks for sharing your experience signing up for ACA, do you have to send them a check each month for the full amount $807 and then get a credit when you file your taxes. Also be careful with Healthcare sharing ministries,check the reviews as some say they couldn’t get covered/reimbursed for some health issues.

Hi Marge – during the signup process, I had the option to apply the full credit to the monthly payment or adjust it in increments down to nothing. With the latter, you just get the full credit when you file your taxes. I chose the former so I’m just getting charged the discounted price each month. I’ll still need to settle up at tax time but the difference (plus or minus) should be minimal at that time.

With the Healthcare Sharing Ministries, we actually did one of them just for a handful of months to tide us over from when I left my job until we moved to Panama and got expat insurance… we weren’t impressed to say the least. They did cover the health costs we had during that time but it took over a year to get reimbursed for some of them!

Hi,

Enjoyed reading your post. My situation is pretty close to yours & I also benefit greatly from the subsidies & the ability to calculate the sweet spot for my annual roth conversion amount to maximize my healthcare subsidy amount.

It sounds like you were able to qualify for getting the subsidies upfront (your monthly premiums include the subsidy reduction) as opposed to paying full price now & getting back the subsidies when you file your tax return. Assuming I am correct about that, were you asked to provide documentation supporting your estimated income & if so what supporting docs did you provide? I actually pay the full premium upfront (there are obviously negatives to doing it this way) & then get back the subsidies once I file my tax return; however, I have always been curious what supporting docs someone would need to provide if their income is from Roth conversions & wanted to get the subsidies upfront.

Also, this may be a state-specific exchange issue, but I have found that once the subsidies are factored in there is very little difference in the premiums for high deductible plans vs plans with much lower deductibles.

Thanks,

Matthew

Good question about the documentation! The site said a couple of times that I may be asked to provide documentation. However, I was not prompted for that during the signup process. That said, if I remember correctly, that could be asked of me at any time down the line. I guess time will tell! 😉

That’s cool that you could get lower deductible plans for about the same cost as the higher ones. That didn’t seem to be the case in the selections I had to choose from – some of them were ridiculously priced for the premiums. Hopefully, we’ll see a broader selection in November with some better options.

Hi Jim:

Thanks for sharing. We retired earlier this year in NJ and are experiencing similar results (so far). We actually pay zero in monthly premiums and only $72 a month for dental coverage. This despite an elevated net worth like your family.

I will be happy when the bill passes extending these subsidies for 3 years. That will get us to age 60, not home free but closer to age 65.

Meanwhile, staying active and trying to make smarter decisions that will keep us healthy which ultimately is the best financial and life move!

Glad you are doing well!!

Thanks for info – that’s the kind of premiums I’d love to see! 🙂 I’m assuming you’re not going to have major income coming in from Roth IRA conversions or anything like that. That’s a great situation!

The bill was signed into law yesterday so you’re likely good to go for the next few years. 🙂

Your last point is the most valuable – working to stay healthy can ease the burden over the long haul for sure!

“ I’m assuming you’re not going to have major income coming in from Roth IRA conversions or anything like that.” – That is true for 2022 but starting in 2023 after our move to Florida with no state income tax, we will begin the balancing act of ACA subsidies and Roth conversions. I would love to see you post on how you are deciding to strike this balance within your family. Where are you drawing the line on annual Roth conversions with an eye to maintaining a reasonable ACA subsidy?

That’s a great question and one I don’t know the answer to yet. This will be our first year of “the balancing act” as well. When I entered our expected income for this year, I shot a little high on the conversion with the aim not to not have any surprises come tax time. That said, I’ll delve more into this in December to see how the numbers work. If it makes more sense to lower the conversion somewhat then that’s what I’ll do. If there’s any excitement to this whole deal 😀, I’ll write a post about how I decide on how much to convert like you suggested.

Thanks Jim. I have read a bunch on this and asked many FIRE folk. Seems like most are trying to balance these competing needs. If you unearth something interesting, please do share.

Thanks again. Love your blog but I will miss the Panama pictures.😀

Haha, I miss actually seeing Panama every day!! 🙂

It is quite the balancing act. As you convert more IRA, you could pay a higher marginal rate than expected because you are adding income tax (and maybe more of one’s SS becomes taxable income as well) PLUS the effect of decreasing one’s subsidy.

I have done a great deal of sensitivity analysis in the latter part of the last few years. A great tool which I’ve utilized is called the “Case Study Spreadsheet” which can be found in the forums of Mr. Money Mustache. It is updated periodically so make sure you are always using the most recent version. See https://www.mrmoneymustache.com for his website.

Good luck to all in the balancing act.

Awesome! Thanks for the info, Charlie – I’ll check that out!

The ACA subsidies are a great thing — glad they have been extended an extra 3 years.

Since you are in an HMO, do you have to see your primary care doctor or can you see any doctor in network? We’ve had some challenges with my wife’s HMO — it’s been hard to get an appointment with the doctor — just for a routine physical the doctor was booked up for 3 months!

You mentioned the plan choices seemed fewer than you were expecting. From my understanding, the plans are based on your home zipcode. So it can vary from place to place. I don’t think the mid-year enrollment influenced the number of plans you saw. If I look at my home zip code, I see the same number of plans now as I did during open enrollment. You may see more plans in 2023, as new carriers are entering the marketplace.

I didn’t do too much digging into this but it did appear that I could see any doctor in the network. The concession we had to make is that I finally found a primary care doctor that I’ve had for several years now and really liked and she’s not part of the network… of course. So I’ll have to figure that one out at some point. Similar to you though, it used to take months to get in to see her.

Good info on the plan choices and what you were seeing during your enrollment compared to open enrollment. I did have a reasonable number of choices for plans but I was still surprised that I didn’t see more options. I guess I’ll keep my fingers crossed for more during open enrollment!

Those subsidies are great Jim! I can’t believe how cheap that is! Definitely going to use them if our current health plan falls through.

Yeah, it definitely makes early retirement “doable” for more folks that couldn’t do so otherwise. If we didn’t have the Roth conversions to do every year, we could easily get our premium cost down to close to $0. Oh, well, no complaints here! 🙂

Thanks for sharing this Jim, I often wonder about how I could afford the cost of Healthcare if I were to be my own boss. I still have 13.5 years until I’m 65 so not being eligible for Medicare yet, would certainly have to be part of my plan. This is really helpful, thank you!

You’re quite welcome – always good to know your options! 🙂

We’ll use ACA when Mrs. RB40 retires. Hopefully, it will be extended in 3 years.

The US needs this. I looked into ministry health share plans and they have a lot of problems.

If ACA isn’t extended, we’ll probably move abroad for affordable healthcare.

I agree about the health sharing ministries – it’s nice that it’s not traditional insurance in the sense that we’re so messed up on that stuff. However, the fact that they’re not real insurance means they don’t need to adhere to a lot of the same standards and that backfires on folks all the time.

I like your plan of moving abroad if needed. You do Thailand, I’ll go back to Panama, and we can visit each other periodically for some big vacations. 😉