Disclosure: This post contains affiliate links and we may receive a referral fee (at no extra cost to you) if you sign up or purchase products or services mentioned. As an Amazon Associate, I earn from qualifying purchases.

The subject of health insurance in the U.S. tends to make people cringe immediately when thinking about it.

And rightfully so! I don’t think anyone can argue that the system in the U.S. is broken. It’s overly complex, the costs are out of control, and something needs to change. Now, we might all have different thoughts on what should be done, but we all know that something needs to be done.

Unfortunately, though, the choices are pretty limited. If you live in the United States, you’re kind of stuck with the system. If you’re employed and your employer subsidizes most of your costs, you’re in pretty good shape.

But what if you want to retire before Medicare kicks in at age 65? Yeah, good luck!

Unless you’re sitting on a giant nest egg, this can be a real stumper. I know of several folks in my circle of “older” friends and acquaintances who would like to retire but will continue to work until age 65.

Why?

You already know the answer to this – they just can’t afford the cost of health insurance in the U.S. otherwise. It’s a shame that it has to be this way, but we’re stuck with it for now, though I do have hopes of this changing down the line.

The choices for health insurance during early retirement generally include:

- COBRA – for up to 18 months after leaving your employer (though that tends to be very expensive)

- The public marketplace (aka the Affordable Care Act or Obamacare).

- Non-insurance coverage such as the health care sharing ministries (though there are a lot of limitations in these)

- Mooch off your spouse’s health insurance if they’re not planning to retire anytime soon

- Finding a part-time job that offers health coverage (Starbucks, anyone?)

- Bailing completely and moving abroad

There are other options for health insurance in the U.S., but these tend to be the ones talked about most frequently.

When I first retired at the end of 2018, we used Liberty HealthShare, a health care sharing ministry, for about 8 or 9 months. It filled the void for us, but we weren’t impressed. They were doing some huge infrastructure upgrade that went south around that time and it made it a nightmare for everyone. We spent a year or two constantly chasing after them to get reimbursed for even just routine physical claims…. not fun.

We’ve been fortunate though to be living in Panama for the past 2 years since 2019. Because of that, we were able to switch to ex-pat insurance, which is available to folks who are out of their home country at least 6 months out of the year. We have a silver Global Medical Insurance plan at IMG Global and pay just $345.59/month total for the three of us. You can see what an ex-pat plan would be for you here:

This covers us across the globe – including the U.S. If we chose not to include the U.S., our cost would be much lower. However, the main purpose of us having the insurance is to cover us when we would come back to the States for a visit.

When we go to the doctor here in Panama, we don’t even use our insurance. Lisa just had a routine mammogram this past summer and the total cost without insurance was $55 out-the-door. That’s for the testing, x-ray images, and lab results with diagnosis. We paid while leaving and that was it. It still amazes me.

But now, the times, they are a-changin’. We’ll be moving back to Ohio in the spring of next year. There are good and bad points to this move but believe it or not, I think the cost of health insurance in the U.S. for us will actually be one of the good points.

Strange, right? Doesn’t seem to make a lot of sense, does it?

You wouldn’t think so because you’d expect our costs to go up dramatically. However, I’m anticipating that our premiums will go up only slightly but our deductible will go down and our plan will be better.

Don’t go rolling your eyes at me – it’s true! Here’s why…

The odd nature of a modest retirement

Our budget for our family of three comes out to roughly $50k per year right now. We could probably spend a little more than that and be fine, but I prefer not to if possible since it starts to break my comfort level a little.

Some may look at that as pretty minimal, but I’d have to disagree. Although we tend not to spend a lot on things we don’t care about like cars or fancy clothes, we get to travel more than most folks we know, go out to eat regularly, and don’t really seem to want for much.

But there’s one little benefit to our spending that’s also useful for us. Although I’m earning a little bit on this blog, it’s not very much (for now). So our main source of income is just the Roth IRA conversions that we’re doing every year. This is being done slowly as a ladder to move money from our old 401(k) plans (now in rollover IRAs) to our Roth IRAs.

As we do these conversions, we’re careful in trying to stay in the 12% tax bracket. Because our conversions are taxable events, that means our goal is to stay under $81,050 in adjusted gross income for 2021, for example.

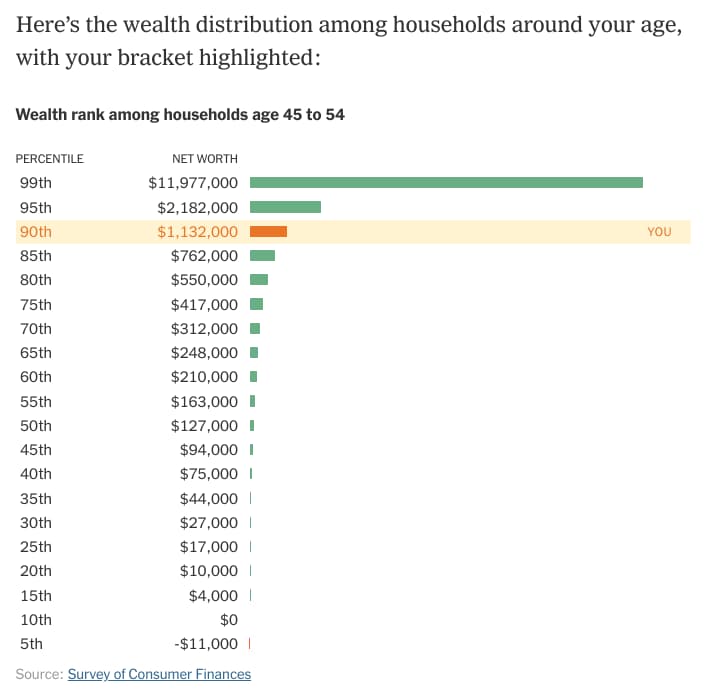

So here’s where it’s a little strange. We currently have over a $1.6 million net worth that puts us over the 90th percentile in “wealth rank” among households age 45 to 54…

Nice job to us… pat on the back.

However, because we’re not actually pulling in much of an income, we look to be relatively “needy” through the government’s eyes. For some reason, income is the metric generally focused on in determining how well-off you are versus looking at your net worth.

This can likely also be helpful if/when Faith goes to college in regards to financial aid. Although some private schools drill deep into your net worth, most state universities use the FAFSA and look at your income instead of your net worth.

So by living a more modest lifestyle in retirement, we actually end up keeping a lower profile with regards to the government and several other entities.

Why that matters for health insurance in the U.S.

Ok, so let’s get to the heart of the matter. Because of the government’s metric, we’re more than likely eligible for subsidies offered for health insurance in the U.S. through the ACA health insurance marketplace.

That’s right – our health insurance will be cheaper than what a high-income self-employed person would pay for the same insurance. It might even be cheaper than what an employee might be paying in premiums through their paycheck – even after their employer absorbs a good portion of the cost.

Is that fair? Maybe or maybe not, but those are the rules that are currently in place for the time being. It’s another example of where the more money you make as an employee can be a penalty in our society.

And similar to how there are legal ways to pay less in taxes as long as you’re still playing by the rules and investing in real estate or businesses, this is an example where our modesty pays off.

It’s interesting to me that the rules bend the way they do. Something like this doesn’t help all early retirees either. I’m sure those who are Fat FIRE, like my friend Leif from Physician on FIRE, likely won’t qualify for this. Assuming his family is getting their healthcare through the ACA (I don’t know if that’s the case), they’ll likely have larger premiums with no help. Granted, Fat FIRE folks are further ahead than we are financially, but there’s no reason we should really be eligible for this either just because our expenses are lower. It’s just such an odd thing to me.

Anyway, when you apply for insurance through HealthCare.gov (the Affordable Care Act marketplace), you estimate what your household income will be for the year. It then determines what your savings will be based on your modified adjusted gross income (MAGI), which is your adjusted gross income along with a few other factors.

Once we move back and the dust settles, our MAGI will likely float around $75,000 per year. Remember that for us, this is not how much money we’re earning or spending. Instead, it includes our Roth IRA conversions since those count as taxable income. It also includes any earnings Route to Retire brings in. The number could change based on several variables but I think $75k is a fair number to use right now.

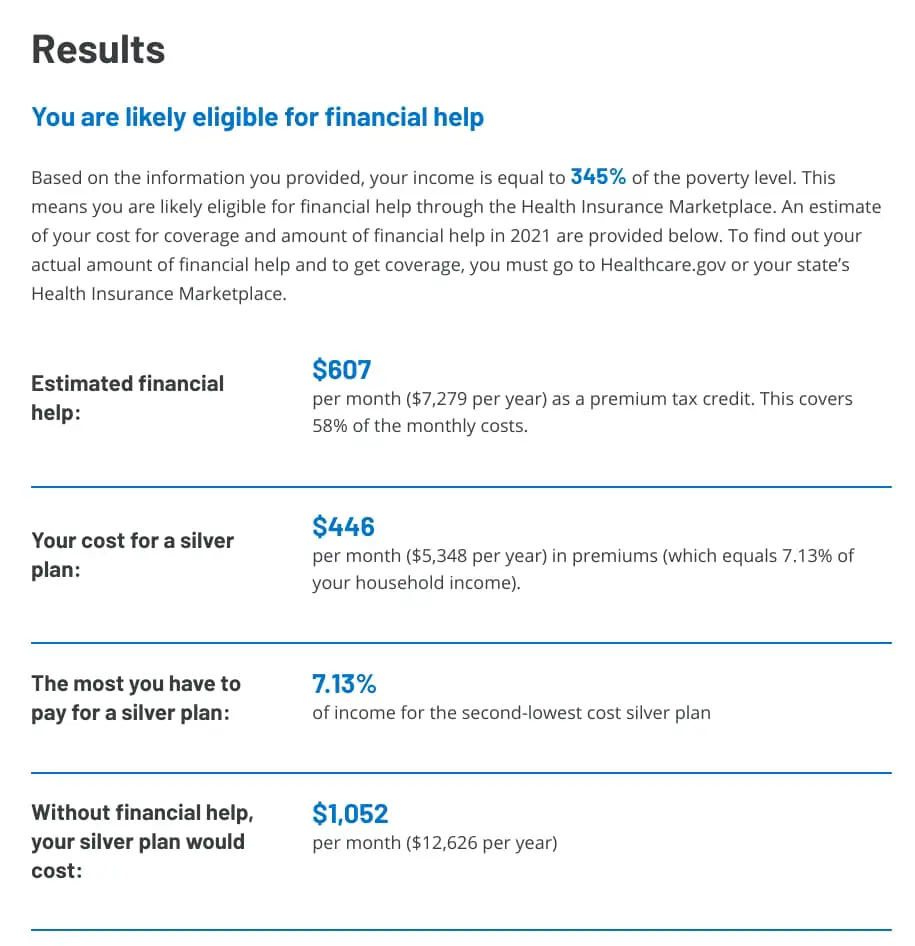

When I plug that in (along with our ages, kids, etc.) into a health insurance marketplace calculator, like the one Kaiser offers, here’s what it returns…

Looking at this, you can see that we can expect to pay around $446/month for our family of 3 for a silver health insurance plan. In this example, 58% of the plan’s cost will be subsidized… 58%!

During my last year of employment in 2018, I was paying what amounted to $411.69 per month in premiums. My employer was picking up the rest of the cost, which I’m sure was substantially more.

That was 3 years ago and for a high-deductible plan! With this, I can expect to pay about $35 more than that per month for a lower deductible plan. It’s also only a little more than $100 more than we’re paying now for our ex-pat insurance. And right now, we have a higher deductible, which might not need to be the case anymore… though we might keep it higher to drop the premiums even more!

Incredible, right?

Again, I’m not saying whether I agree with the rules or not – that’s for the majority of voters to decide over time. But I can tell you that we’ll gladly accept the offer while it’s available to us. That will make health insurance in the U.S. affordable to us.

As a side note, Justin from Root of Good is an early retiree who has been utilizing these subsidies for himself and his family for years now. He’s written some great posts on the subject (like this one), which is what drove me to investigate this years ago.

Odds and ends…

First off, this hasn’t taken into consideration the specific plan we’ll choose. Maybe we’ll go with a higher plan or maybe a lower plan. We’re also not going to need insurance until we return either and we might even stay on the ex-pat plan for most of next year.

Considering the choices and that everything changes over time, know that these aren’t going to be exact numbers. However, it gives us a nice feel on what to expect when we do make the change.

Another important piece of information is the so-called “subsidy cliff.” Essentially, this term meant that if you had an income of even $1 over 400% of the federal poverty level, you lost all help from the government. This all changed recently though…

Ever since the health insurance marketplaces/exchanges debuted for 2014 coverage, the premium subsidy (premium tax credit) eligibility range has been capped at household incomes of 400% of the federal poverty level (FPL). People with incomes above 400% of FPL have been on their own when it comes to paying for health insurance. (Note that California has its own premium subsidies that extend to 600 percent of the poverty level.) But that has changed for 2021 and 2022, thanks to the American Rescue Plan’s provision that eliminates the subsidy cliff.

— Healthinsurance.org: Obamacare’s ‘subsidy cliff’ eliminated for 2021 and 2022

Who knows if it’ll return after 2022, but it’s one less worry for the time being.

And then, of course, other factors could come into play. Lisa wants to get a part-time job when we get back. Will her income affect these numbers? Will she have an opportunity to get insurance through her employer? Will Route to Retire start bringing in enough income to throw everything off?

What’ll happen then?

Nobody knows. And that’s fine.

In some scenarios, we can make some easy changes. We could adjust our Roth conversions to have less taxable income. We could shelter some (or all) income from Route to Retire or Lisa’s part-time work into 401(k) plans. Regardless, there will always be something to take into consideration.

We have a plan for now for health insurance in the U.S. once we return. But, as we all know, this is a moving target (and usually not for the better). If changes occur that make the cost of insurance unaffordable at some point, we’ll adapt accordingly.

For now, I’m just content knowing that I won’t need to go out and get a 9-5 again anytime soon. 🙂

Plan well, take action, and live your best life!

Thanks for reading!!

— Jim

Excellent post Jim. Very informative and useful information. Thank you for taking the time to share this. I value and appreciate reading your posts.

Thanks, Vinay – much appreciated!

I’m happy health insurance is still affordable for you & your family as you’re still young. Wait until you get to be our age. When we left the USA, I was age 63 and my husband was age 56. Our gross income was $60,000 a year. Our health insurance was almost $2000 per month. I was told it was due to our advanced ages. This was the straw that broke the camel’s back & caused us to finally leave the USA. I kept track of our premiums for 15 years. In just 7 years since OBamaCare went into effect, our premiums tripled & our once 80/20 co insurance eroded to 30/70. Our original $2500 deductible rose to $8200 (per person!). You are lucky you are still young so it’s alot more affordable for you & your family.

Hi,

Just wanted to leave a comment on your post. I definitely don’t argue the point that ACA premiums and the whole health insurance situation is a mess, but I wanted to give an example of our premiums to compare and contrast what you were paying. My wife and I are both 53, and our son is 21. We retired last year (somewhat early I suppose you could say) and this is our first year on ACA with subsidies. We live in Ohio and we pay $572 a month for a good Silver plan with individual deductibles of $1450 per person and a family deductible of $2900. I chose the best plan that we could afford for our situation. Its through Ambetter-Buckeye Health. While it is not perfect it does provide what is needed, and we have found some terrific Doctors that are on the plan. Our yearly income to obtain those subsidies is $67,000. We are not in the best health, and have used the coverage. Like Jim mentioned in the article, not sure what the answer long term will be, but for us having to help elderly parents moving out of country is not an option at this time. Hope these numbers help someone else.

David S thanks for sharing. Jim – great article!

Thanks, Matthew!

Thanks for providing those numbers, David – very helpful! That seems to be pretty much on par with what I would expect. Glad to hear that it’s been working out fairly well for you guys, too. It’s sad that the healthcare industry has gotten so powerful that we’re in this situation to begin with, but it’s nice that the subsidies are helping make the costs more manageable.

Thanks for the information David. I’m the same age (also in Ohio) and have one son that will be 21 soon and another that turned 18. I’m also retired but the wife still works for now. Never know when that will change. I hope everything goes well for you in retirement!

Wow, that’s crazy, Debbie… and sad to hear! Something’s got to change – it just can’t continue to go on this way. The upside is that you probably would never have considered moving to Boquete if this didn’t happen. 🙂

I saw Chuck at the Sandwich Shop the other day but I missed seeing you. Hope all is well!

Sorry I missed you at Boquete Sandwich Shop! I was at the car talking to friends! By now you’ve heard the news the 90 day tourist rule is back to 180 days for Americans & Canadians so you won’t have to pay any fines for staying beyond the 90 days. Rules change constantly here. TIP! And yes, I’m grateful I stumbled onto your blog thru JMoney’s old blog when you left a comment about retiring at 43!! It definitely was a life changer for us. Thanx again!

I did hear about the walk-back on the tourist rule for the U.S. and Canada… which is excellent news for us! I’m so glad that you found out about Panama and love it, Debbie. 🙂

I’m very jealous you get healthcare subsidies as a millionaire!

We pay about $2300 a month for a Gold healthcare plan with UnitedHealth. Family of four. And it keeps going up.

It’s an interesting situation, because I’m not sure I want to earn within 400% of the federal poverty limit to get subsidies.

So there’s nothing we can do except lower the plan type.

Sam

$2,300/month… I’d have to go back to work! But I guess that’s the reality. If you make enough money, your costs go up, and then you need to keep making more money to be able to afford the higher costs. It’s the reason why so many people have to work until they can get Medicare.

But you’re right – living within 400% of the federal poverty limit isn’t something many folks want to do. When weighing the thoughts of making the extra income and paying the higher costs for insurance vs a more modest lifestyle but lower health insurance costs, the extra income wins out many times. And the good thing is that you’re able to afford that higher payment without too much skin off your back.

If you do your ex-pat living that you want to do down the line, the low costs of ex-pat health insurance might make you not want to come back to the U.S.! 😉

Great post! Since we’re not pulling much of an income as well, we also have subsidies. Makes things manageable. Hasta luego

Nice – glad to hear that this works for you, Nancy. I’m happy that our costs aren’t going to jump too much when we move back or that could be a real hindrance.

Miss you guys and hope all is well!

A lot of our financial planning revolves around controlling health care costs. Keeping our AGI at a certain level drives other investments and how we do things.

It’s unfortunate that health care costs need to be such a big part of financial planning, but it is what it is, I guess. We’re pretty lucky to have a lower AGI right now to be able to take advantage of things like the subsidies offered.

I’ve been battling through three different health plans in Early Retirement and capitulated over to an ACA Bronze Plan in 2021.

The costs seem fine ($674/mo for two people) with a $6,750 deductible, but then we started using it and it’s the same awful process to get expenses to qualify for the deductible. Pre-approvals everywhere, routine stuff being declared “investigational” or “experimental”, and no coverage outside of my small state.

Given the ACA change I’m considering moving up to a Silver plan, but not sure if it’ll be more valuable given the challenges to get anything to be considered covered.

Sorry to hear that your plan’s been a pain in so many ways. I haven’t been down this path yet and I’m not thrilled to see how it goes. I’d be curious if the upgraded plan will make a difference for you. Gotta love our system… ugh. It’s so funny how much easier things are here in Panama. My wife just went for her annual check-up/physical the other day. She made the appointment about a week ago, we went in, she got it done efficiently, and paid $20 before leaving… and we’re done. It’s like night and day between the U.S. and most of the world… something I’m going to miss a lot!

Best of luck!

I’m a little late to this discussion, but came across your post and thought I’d offer a hybrid Fat Fire approach to the ACA, for what it’s worth. This approach involves a real estate investment strategy, which I realize, is not for most. But it is very effective for early retirement income and managing typical health insurance costs at the same time. Some up front info, we are in our mid50’s. Spouse has a significant health issue, but is managing it well with medication. My spouse and I have been early retired for five years.

We have utilized the ACA during those five years via an BCBS/Anthem Bronze HSA eligible, high deductible plan. Our out of pocket premiums have been as follows during those years:

2017 – $1.57 (per month)

2018 – $20.59

2019 – $52.49

2020 – $120.85

2021- $27.87

2022- $72.21 (will likely drop slightly)

Our 2021 deductible was high (currently $5.9k indiv/$11.8k family). Max out of pocket $7k indiv/$14k family). This is pretty typical of Bronze HSA plans. We have yet to fill an annual deductible in five years, even with my spouse’s expensive ongoing medications. This led us to stay with the Bronze plan verses a Silver or Gold plan, which would’ve cost more out of pocket (premiums combined with copays) during each year. This seems a little counter intuitive at first, but makes sense financially when you dig into actual cost comparisons.

We managed to keep premiums low (obtaining subsidies) by keeping our incomes below the 400% FPL. We were able to keep our incomes low via living only on our rental income portfolio and allow our traditional retirement funds to continue to grow untouched, as we are still under 59.5 years old. With a lower six figure rental income, you can utilize depreciation to lower your taxable income (we do so by nearly 45%). For example, one could make $120k per year in “spendable” rental income (after normal rental expenses), and have annual depreciation of say $55k per year on taxes, effectively reducing your “on paper”(MAGI) earnings to just $65k (just under the 400% FPL for a couple, qualifying easily for ACA subsidies). Each year, we further reduce ours MAGI by $3000 of previous tax losses and $9300 for annual HSA contributions each year. Essentially, lowering our MAGI income to around $52k, allowing us to do small Roth conversions back up to the 400% FPL each year. Simultaneously, we have grown our HSA account(s) to just over $55k during this five year early retirement period, which will provide longer term tax free healthcare income. Our net worth is in the 95-97 percentile, and has increased by more than $1.5M during this five year period, thanks to the fantastic equities market growth.

This is another example for those looking for early retirement options for reducing healthcare costs, while utilizing a Fat(ter) Fire approach. I hope it helps a few, who are still searching for options to leave those jobs and company health plans behind.

This is an excellent and helpful comment, ThomH! As you said, it isn’t something everyone can use, but it’s still very interesting regardless… and makes me want my rental properties back! 😉

Just understanding how the system works makes all the difference in the world in being able to leverage it successfully. This is a perfect example of that. Congrats on this approach – it makes a lot of sense and will hopefully help out some of my other readers as well!

Thanks for sharing!

Great summary of the ACA situation Jim! I’m actually pretty disappointed to hear about the problems with health ministries; that had seemed like a good option for awhile.

*Sigh* I guess I’ll be going the ACA route someday too, with some kind of high deductible plan. There really isn’t a very good option otherwise.

Even after you reach 65, it makes a lot of sense to buy additional coverage beyond medicare. My parents have done this, and it seems to be working out for them.

One route I suggest you not forget the HSA. It’s possible to pay into a HSA during your saving years, invest the money, and then let it grow until you really need those funds in the future (when you get older). This kind of tax free growth is a good way to keep up with rising healthcare costs!

At any rate, thanks for the post!

It’s possible that Liberty and the Health Sharing Ministries are fine – our experience just wasn’t very good. 🙁

Out of curiosity, what are you guys currently doing for insurance?

That makes sense to buy coverage beyond Medicare. I don’t know enough about how Medicare works yet. I figure I’ll start digging into that as I start to get a little closer to that age.

Awesome point on the HSA, too! We still have an HSA from my career that’s fully invested and built up to about $42k now. We’ve just been paying for medical out of pocket and collecting receipts so that we can pull that money out later to reimburse ourselves. Once we’re back in the U.S., I’ll likely try to get a high-deductible plan and see if I can do an HSA for Route to Retire. I don’t know the details on if/how to do that, but it seems like a smart move.

Jim,

Regarding your comment ” Once we’re back in the U.S., I’ll likely try to get a high-deductible plan and see if I can do an HSA for Route to Retire”, I wanted to clarify that people do not have to own a business or have earned income to contribute to an HSA; the only requirement is to participate in a qualified HDHP with HSA option. The plans available will vary geographically of course.

Thanks for this clarification, JN – I haven’t dug into it yet, but that puts me in the right direction. Good to know that the only requirement is a qualified HDHP. Finding a plan I can use with an HSA option is almost a no-brainer then. Thanks! 🙂

That’s what we plan to do when Mrs. RB40 retires as well. I just hope the healthcare.gov is still around when she does. Once our son goes off to college, I plan to live outside the US and go with the expat health insurance.

We’ll have about a 10-year gap for Medicare to kick in.

It’s sad that we have to consider thoughts like “will healthcare.gov still be around” in a few years. It’s hard to make a plan when things can bounce back and forth every 4 years.

That’s awesome that you’re planning to live outside the country down the line. I’m so glad I had the opportunity to do that and I’m a little envious! Best of luck, Joe!!

I don’t like how the health sharing ministries exclude certain pre-existing conditions. Especially the ones that say they are faith based. Excluding people for certain things would seem to go against the whole idea of being faith based. But that’s just my lowly opinion.

We were fully retired in late 2019. For years I thought the ACA would be the route to go. But then I found out the ACA plans don’t cover any of my specialists or our general doctors. We are near one of the top cancer hospitals in the country and it is not covered on the ACA plans. Although I am in remission from leukemia, I need blood work a few times a year and to see my oncologist at least once a year. I’ve been with the oncology team for 10 years now and am not ready to give them up.

For 2020 I went on COBRA and in 2021 we are on a small business health insurance plan. In our state a husband and wife can have small business insurance without any additional non-family member employees. So we established an LLC for a small business we are trying to build. Our small business insurance has nationwide coverage and includes ALL of our doctors (whereas the ACA plans don’t cover out of state or any of our doctors). It is not cheap (essentially marketplace coverage without subsidies), but gives us peace of mind for the access we have.

I think you all are in a good position since you wouldn’t have any attachments to local doctors since you have been gone for awhile. So you can find the right plan and price and build up from there.

100% agree on the health sharing ministries. We used one as a “go-between” for a short while before we left the country, but the fact that’s it’s not actually insurance is a tough pill to swallow. Not only can they exclude pre-existing conditions but they can deny anything they want and you technically can’t do a thing about it (not that happens a lot, but the possibility is there).

Congrats on being in remission from leukemia and also for being able to afford the insurance through your business. Even though the costs are high, being able to sleep better at night can outweigh that, especially when you’re in a position where you know you need routine medical care.

I wish you the best!

Hi Jim!

Thanks for the post. We found one big problem when looking at ACA insurance for us. We are in between jobs (3 month gap) with 2 kids. As you pointed out COBRA is extremely expensive ($2k/month). Based on our income we would normally quality for free insurance, however because we are married filing separately we are 100% excluded, so basically we have to purchase a plan out of pocket or go without. This is just one of many ways the government penalizes MFS tax status. If we were MFJ then we would pay thousands extra on student loans so we are really stuck wishing we had just shacked up rather than getting married. BOHEKA!

Oh, wow, that sucks – so sorry, AJ. I never even thought about the marital filing status making a difference. That’s interesting that they treat that so differently. I know someone who is doing exactly what you’re talking about (living together w/o getting married) because he makes a lot of money and her kids from a previous marriage would be penalized for that when they apply for loans for college. What a world!

Hey Jim,

I just stumbled upon your blog, so I’m a little late with this comment, but I wanted to throw out a scenario that my family faces every year with the ACA. My family circumstances are very similar to yours. Although my wife and I aren’t “retired” we both work very part time hours and therefore don’t make a large salary. Also, neither of us qualify for an employer sponsored health plan coverage. We’ve been “forced” to use the ACA for 6 years now. We live in NH and I’m not sure what the income thresholds in Ohio are, but what we “earn” (including Roth conversions like you) put our son on the edge of qualifying for childrens Medicaid in our state. In actuality, he qualifies for it every year but we inflate our income higher through the Roth Conversion to disqualify him from the “free” health plan from the state. My income is right in line with yours. My son is a type 1 diabetic and we prefer to have him on our family health insurance plan. He’s been knocked off of our plan on the ACA in years past because of our “low income”, so be careful of that happening to your daughter because that’s a massive headache. Of course, if your daughter qualifies for a Medicaid type program in Ohio and you’re fine with that, then so be it. The irony is that when they kick my son off our ACA plan, our premiums are higher for two of us. When we “make more money” to disqualify him from the state health insurance plan, our premiums go down for the ACA plan. So long story short, based on your income, it’s possible your child will not qualify on your family plan that you pick with the ACA and will be bumped over to a state sponsored plan. So be sure to know those income thresholds for Ohio if you don’t want that to happen.

That is truly interesting! So glad you wrote this comment – this is something I’ll definitely have to dig into to make sure that we don’t stumble on this. The first year of doing this will probably be a little bit of a learning curve but it’s comments like yours that will help us from fumbling too much. Thanks so much!!