Disclosure: This post contains affiliate links and we may receive a referral fee (at no extra cost to you) if you sign up or purchase products or services mentioned. As an Amazon Associate, I earn from qualifying purchases.

In case you haven’t noticed, I’ve been trying to give my daughter the hook-up on her credit lately. Yes, Faith’s only 12, but that’s even more of a reason to work on it now – this will put her on the right track so she’ll be starting out strong.

A few weeks ago, I discussed Freezing Your Child’s Credit: Why It’s Critical and How To Do It. This was the first step I wanted to do to make sure she won’t become an easy victim of identity theft (kids are becoming a much more common target).

That one took a little bit of time to implement. It’s not difficult but there are several steps you need to do to ensure it happens correctly.

But today I want to talk about how to boost your child’s credit score. And I have good news for you – this one’s quick and easy to do!

Wait, is a credit for a minor even a thing?

Generally not. In most cases, your child isn’t going to have any credit cards or loans so they won’t even have any credit to report to the bureaus.

One bad way they could have a credit report though is if they’ve been the victim of identity theft and the fraudster uses their identity to open up lines of credit.. yikes! It’s possible for their credit to be ruined for years without you even knowing about it!

If you followed my guide on freezing your child’s credit though (and you should), well, then financial identity theft is extremely unlikely. The process of freezing their credit will, however, create a credit file for your child… and that’s a-ok.

In most cases though, minors won’t have a credit score until they start establishing credit, which is usually later in life.

Why you want to give your child’s credit score a boost

Just because your child doesn’t have any credit to report though, doesn’t mean that they shouldn’t. In fact, this can be a fantastic opportunity for any kid.

I remember the good old college days and working to build my credit. I think back to getting my first credit card in exchange for the exceptional reward of… a t-shirt. Ugh. Ah, to know then what I know now! Now I don’t even look at credit cards if the rewards aren’t going to give me back at least several hundred dollars!

As a reminder, I’ve written a ton of posts about how we continue to leverage travel rewards every year. Here are several:

- A Month-Long Panama Trip for 3 for an Unbeatable Price of Less than $1,500!

- We Got the Chase United Explorer Card… Again. Boom! Easy Free Travel!

- Is It Worth It to Open a Credit Card With a Huge Annual Fee?

- The #1 Best Way To Track Credit Card Rewards

- The #1 Easy Way We’re Getting the Southwest Companion Pass

- Our Travel Perks Are Drying Up and That’s Big $$$!

- Free Nights – We’ve Had 5 at Hilton Hotels Recently

- Travel Rewards – 12 Free Flights Earned in 9 Months!

Building good credit takes time to make happen. And that’s not a problem for a minor… until they’re ready to do something like open a credit card, get a loan for a car, or buy a house. If they don’t have a good credit score, making these things happen could be a little dicey or could make a huge difference in the rate that’s offered.

If only there was a way to boost your child’s credit score without a big hassle. Oh, wait, that’s why you’re reading this, isn’t it?!

So how do I make this magical child’s credit score thing happen?

This could be the simplest thing you’ve done in a long time. To increase your child’s credit score, you really only need to do one thing… make him or her an authorized user on one or more of your credit cards.

Your child gets all the good qualities on their credit report…

- The card’s credit limit (higher is better)

- Credit utilization (how much credit is being used – lower is better)

- History of payments being made (both on time and hopefully in full)

These factors can help create and push a child’s credit score up before they’re even old enough to vote!

Before you freak out about how maybe your kid isn’t ready for a credit card yet or that you don’t want them mooching on your money or screwing up your credit, take a breath. I never said to give them the credit card.

You’re welcome to give them the card if that makes sense to do in your household. But there’s no reason that you need to do that – you can hide or shred that card if you want. You really don’t even need to tell them you added them as an authorized user. Your child’s credit score will grow solely based on your use and handling of your own card.

Cool, right?

Now, there is an important caveat to this. This will only work effectively if you’re handling your own credit well. The better you are at managing your credit, the better that will carry over to your child.

In other words, if you’re paying off any credit cards they’re an authorized user on every month and you have low credit utilization, your kid’s going to be golden. But know this…

On the flip side, if your parent misses payments or uses a big portion of their credit limit, your credit may not improve. The impact of negative information depends on how the credit bureau views that history. Experian, for example, won’t include the information on an authorized user’s credit report if the primary account owner misses payments, but high credit utilization—like a maxed-out credit card—could wind up damaging the authorized user’s credit.

Experian — Credit Card Authorized User: What You Need to Know

So you only want to go down this road if your own house is in order. If it is, this simple step can give your kid the hookup!

Each credit card financial institution will vary slightly in how to add an authorized user. I did this for Faith for the Chase Freedom Unlimited card that I have and it was unbelievably easy. I logged into the Chase website, selected “More” for that card, expanded out “Account services”, and chose “Add an authorized user.” Then, it was just a matter of filling in a few quick details…

Yeah, that’s it – easy, right?

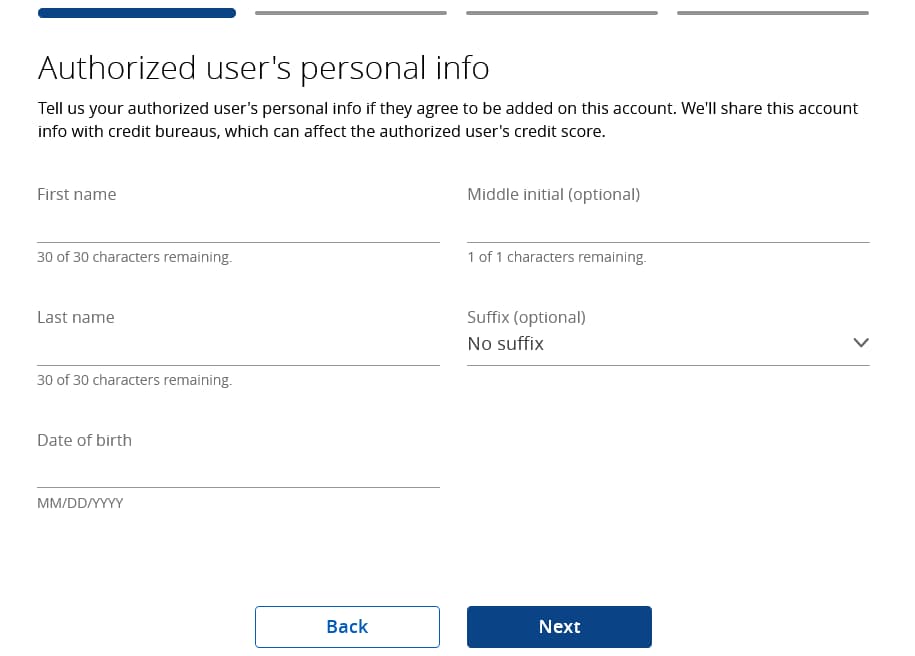

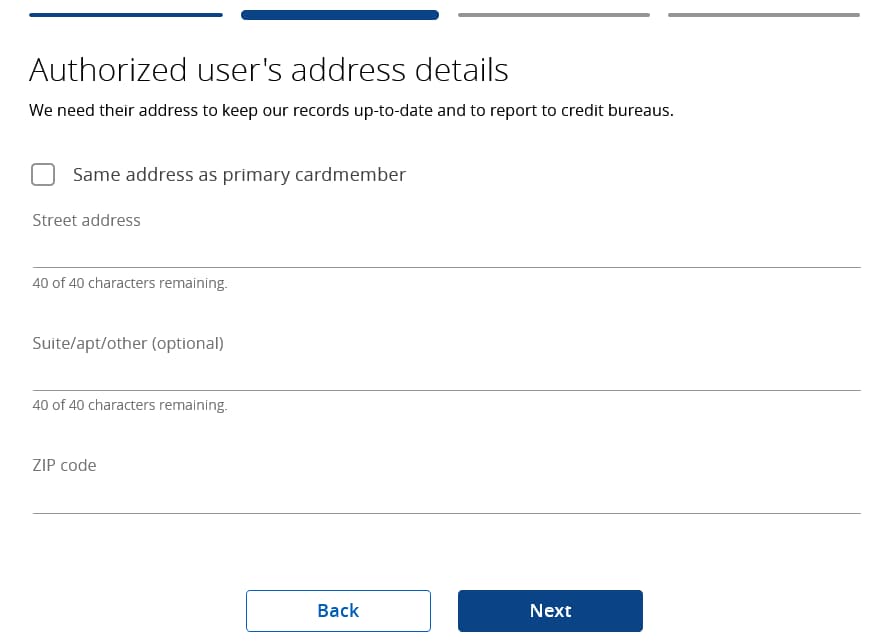

What surprised me is that they don’t ask for a social security number or even do a credit check. Not doing a credit check was helpful since I had frozen our daughter’s credit and thawing it for this would have been a bit of a pain since it can’t be done online. Essentially, all that was needed was:

- Legal name

- Date of birth

- Address

The process is just as simple for Capital One, Citi, and American Express. It’s worth noting that some issuers will require a social security number. For example, American Express states…

You will need to provide your Additional Card Member’s Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) now, or when you receive the Card. Your Additional Card will be canceled if this information is not provided within 60 days after the Card is issued.

— American Express

Also, be aware that some credit cards charge for adding an authorized user – the Chase Sapphire Reserve being one of them. So be sure to dig into that before just adding away.

Finally, note that although there’s no legal minimum age to be added as an authorized user, issuers can set their own rules in that regard. While Chase, Citi, and Capital One don’t set minimums, American Express, for example, sets a minimum age of 13 years old. Bankrate has a nice table showing minimum ages for authorized users as well as information needed (like an SSN).

And that, my friends, is an easy way to give your child’s credit score a boost to help them off to a good start.

I’ve started with my Chase Freedom Unlimited card since that’s my fallback card when we’re not chasing travel rewards. I will likely add her to a couple of the cards that we’ve had for a long time as well, but I wanted to play this one through first and get the actual card.

What I don’t plan to do is to add her to cards that we likely won’t hang onto. For instance, I absolutely love the Capital One Venture X credit card that we have, but with a $395 annual fee, it’ll likely cancel it when that fee comes back around (though the bonuses absolutely made it more than worth it!). Adding her to cards like that and then having the card closed will throw off her credit utilization and could possibly ding her credit.

The one thing that sort of stinks though is that you can’t easily keep an eye on your child’s credit score to see how it’s going (at least as far as I could figure out).

The ideal solution would be to monitor his or her account using Credit Karma. This is something that everyone should create an account at to be notified of any problems with their credit. It’s free and easy and could prevent some real problems down the line. It also lets you see your credit report and VantageScore anytime you want for two of the three credit bureaus (TransUnion and Equifax).

Unfortunately, you need to be 18 or older to have an account with them so that’s not going to be the solution to seeing your child’s credit score. The only way I know of to see where they stand is to write to each of the bureaus and include all sorts of identification. While that was fine to do as a one-time event to freeze Faith’s credit, it’s too much hassle to do as a regular task.

If you enjoyed this post, maybe you should be signing up for my email list. I’ll keep you up to speed with new posts that come out as well as what we’ve got going on. I’ll also send you some cool freebies, which currently include:

- Recurring Expenses Spreadsheet

- Credit Card Rewards Tracker

- Portfolio Rebalancing Spreadsheet

- HSA Unreimbursed Expenses Tracking Spreadsheet

- Roth IRA Conversion Ladder Calculator

- Alcohol Tracker

And if you’re planning to apply for a new credit card, please consider signing up through the links on my Recommended Credit Cards page. It won’t cost you anything and I’ll receive a small commission that helps support this blog.

Finally, if you’re wondering… no, Faith’s not getting the credit card when it shows up. She’s a responsible kid for sure, but there’s no need for that stress in my world yet! 🙂

UPDATE 04/04/2023: After Clark Howard discussed a question I had written to him about recently (you can hear that at this link at around the 23:50 mark), I learned that if the credit card company doesn’t have your child’s social security number, their credit history likely isn’t being passed along to the credit bureaus.

This prompted me to call Chase to have them add her SSN to the authorized user account. That’s when I learned that Chase doesn’t pass along credit history for minors. Bummer. So improving your child’s credit score with Chase isn’t going to work if they’re a minor.

However, I also have Citi cards and confirmed with them that they do pass along credit history for minors. So I have since added Faith as an authorized user on two of my Citi cards. They don’t ask for the SSN when adding them, but you can call in after they’ve been added (they suggested waiting until at least 24 hours after) and they can tie your child’s SSN at that time.

So be aware that not all financial institutions will support this process. I had read on a third-party site that Chase did support this and even the king, Clark Howard, assumed that was the case. It’s probably best to verify with any credit card company you plan to do this with before adding them as a user as I did with Citi.

Good luck!

Plan well, take action, and live your best life!

Thanks for reading!!

— Jim

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.