Disclosure: This post contains affiliate links and we may receive a referral fee (at no extra cost to you) if you sign up or purchase products or services mentioned. As an Amazon Associate, I earn from qualifying purchases.

A financial aggregator is sort of a broad term that generally refers to software or services that can pull all your financial data into one place. We’re talking about balances and transactions for your bank accounts, credit cards, investment accounts, loans, and more.

You might already be familiar with some of the older players in the game like Quicken, which is still a huge competitor. I used Quicken from 1999 until 2019 (20 years!) until I switched to both Empower (formerly Personal Capital) and Mint.

Empower and Mint are more modern, have nice mobile apps, and can be more hands-off than Quicken. I like each of them for different reasons, but since they’re both free, I can use them in tandem for what I need without worrying about any costs.

There are numerous others as well that could fit well depending on what you might need in a financial aggregator. A few other popular choices include You Need a Budget (YNAB), Tiller, and Moneydance.

If you haven’t used a financial aggregator before, you might not realize just how valuable it can be. It’s very hard to get an all-encompassing handle on your finances without one of these tools. Being able to see current information on all your money in itself can make it tremendously easier to spot problems and get ahead.

Recently, I had something happen that would have cost me almost $200 for absolutely nothing. I would likely not have even noticed it without one of these. I thought I’d share that with you and let you know other ways a financial aggregator can help you with your finances – regardless of how hands-on you want to be.

#1 It’s much easier to spot incorrect transactions

Last week we went on a week-long Caribbean cruise… it was wonderful. If you’ve ever cruised before, you probably know that you should fly in the day before the cruise – just in case. If you have a delayed or canceled flight, this can make the difference in enjoying a stress-free cruise or trying to figure out how to get to the next port of call to catch up to the ship.

Our cruise was departing out of Miami so we got in the day before and stayed at a hotel in the area. I book most of our stays through Priceline because that’s generally where we find the best deals on hotels. I had booked and pre-paid for the hotel in Miami through Priceline a couple of months prior to our stay.

That “pre-paid” part is pretty important. The cost was just under $100 for the night – not horrible for a fancy hotel in Miami.

As is generally the case, they ran our credit card for any incidentals (something we strive never to have!) when we checked in. It was a beautiful hotel, the staff was great, and we couldn’t have asked for anything more for our one-night stay. We checked out without any issues and headed off to our cruise…

Here’s where things get fun. After our cruise, I opened up the Mint app on my phone while waiting at Miami airport since we had hours to spare before our flight.

I noticed a charge in my latest transactions for $190.97 from the hotel… the same hotel that I had pre-paid for through Priceline. Hmm, what could that be for?

So the next day, I called the hotel to find out what was up. They said that the virtual credit card number that Priceline sends over didn’t go through right so they simply charged me the hotel rack rate for the night of $190!! What????

Suddenly, my hotel stay of less than $100 was costing around $300… hoofa!

I’m not going to lie – this became a headache to fix and took more than an hour of phone calls back and forth to Priceline and the hotel. This shouldn’t have even been my problem but it is what it is. I got the whole thing sorted and got our charge of almost $200 refunded.

The moral of the story though is that because I caught this quickly, I was able to get it rectified. Using a financial aggregator like Mint makes this easy – as long as you use it routinely. I would likely have not even noticed this charge otherwise. Always keep an eye on what you’re being charged.

Another option could be to turn on transaction notification alerts with every credit and debit card you have. This can work but can be a pain to set up if you have cards through a lot of banks.

You could also review your credit card statements each month (which you should be doing anyway). The downside to this approach though is that it could be weeks before you even notice (making it more difficult to fix). And because a fair amount of time has passed, it’s possible not to even realize why a transaction shouldn’t be there.

My routine is to regularly check and review the downloaded transactions in Mint. I probably log in once a week either on my phone or the computer and rename/categorize the new transactions as needed. It takes me less than 10 minutes and ensures that I’m not seeing any unusual transactions that shouldn’t be there or are the wrong amount.

It’s an easy procedure and has the potential to save hundreds of dollars (as I just mentioned) or even more.

#2 They help in monitoring your budget and investments

Did you ever think, “Where’s all my money going? I work a full-time job and somehow I don’t have much to show for it as I probably should.”

That’s a sign you might need a budget or a better way to track your money.

The nice thing about using a financial aggregator is that it can make budgeting fairly painless. You can track what you’ve been spending and reign it in as needed… unfortunately, the “reign it in” part of things still falls on your shoulders to make happen.

Being able to see all your finances in one place and see the specific categories you’re spending your money in is important. This can be the first step to being able to fix the problem and save yourself a lot of money.

You Need a Budget (YNAB) and Mint are a couple of great choices if budgeting is a hot-ticket item for you.

Funny enough, the biggest reason I started using Mint alongside Empower is that Empower doesn’t allow you to add any manual transactions. This was a big deal for the 3 ½ years we lived in Panama since a lot of what we spent was in cash (including our rent). Although we don’t budget per se, I do track to see how we’re doing and that was more difficult with Empower alone.

That said, we moved back from Panama and I’m still using Mint for managing our finances when it comes to our banking and credit cards.

But… although Mint is great on the transactional and budgeting side, it doesn’t do a great job of managing your investments and your money as a whole. That, my friends, is where Empower shines as a financial aggregator.

Having your total financial picture right in front of you provides opportunities to leverage tools that can give you better insights. Those insights can save you thousands of dollars.

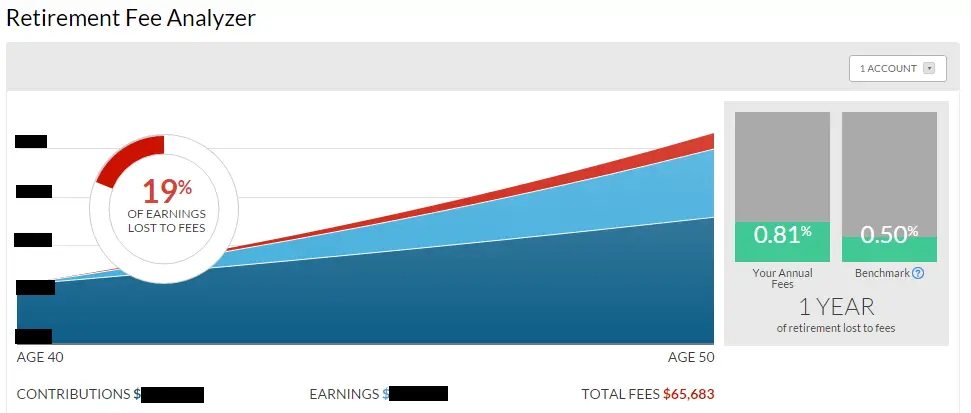

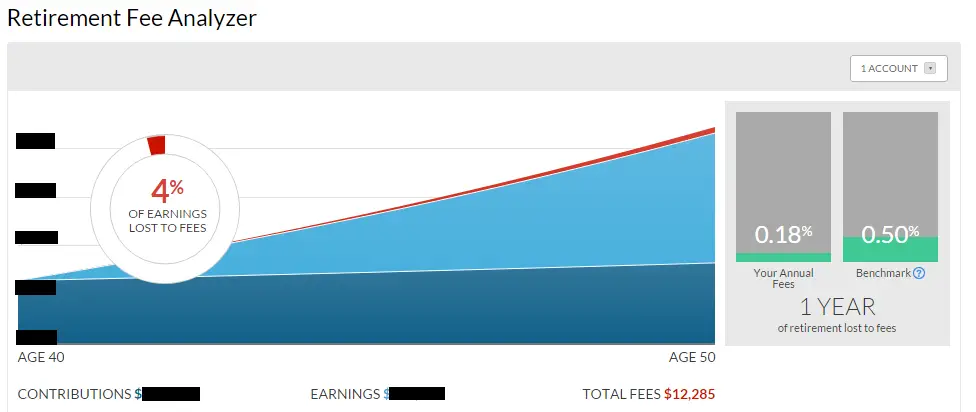

I’ve talked about how Empower showed me that I was paying way too much in fees with my 401(k) choices when I was working. I then changed the funds to similar, lower-cost funds. That small change ended up saving me over $50,000 in fees (fees alone!!!) over a 10-year period. That’s incredible!

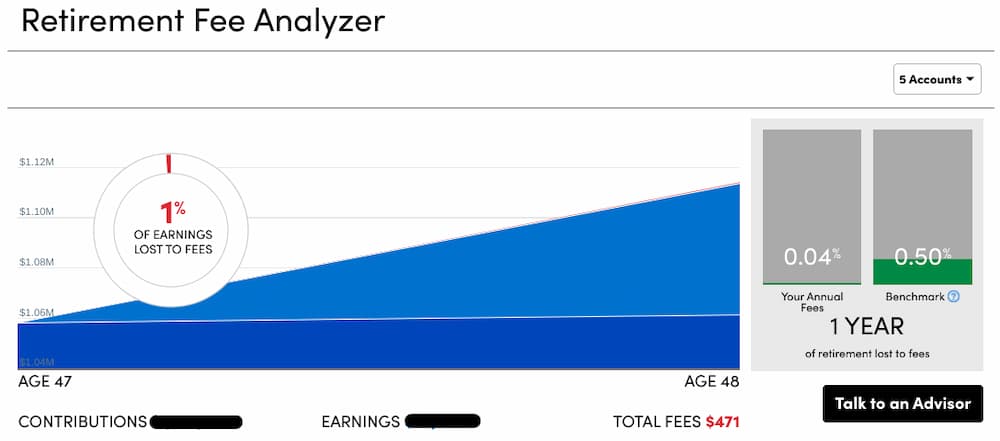

As a side note, once I left my career and rolled over my 401(k) to an IRA at Vanguard, I was able to move to even lower-cost investments from there (mostly VTI).

Wouldn’t you like to possibly save tens of thousands of dollars for just a couple of hours of work?

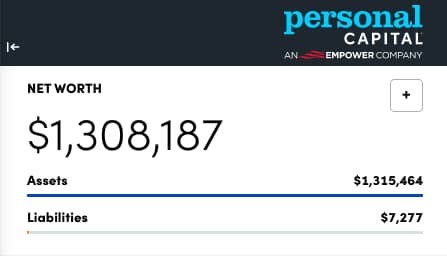

#3 Using a financial aggregator is an easy way to track your net worth

If you hang around the personal finance community long enough, you’re bound to hear how it’s important to track your net worth.

Why?

Because your net worth is what matters. You could make $400,000/year, but if you’re not saving, then what you end up with after all is said and done is a big fat zero. Your net worth is simply your assets (savings, investments, etc.) minus your liabilities (credit card debt, remaining mortgage, etc.). In other words, your net worth shows you exactly what you’re left with if you paid off all your liabilities.

Hopefully, that number is positive but it might not be. If you have more debt than you have savings, your net worth will be negative. That’s ok if you see that and are working to change it.

But how do you track your net worth anyway? With a financial aggregator, of course. Once you connect all your accounts, they do the heavy lifting to tell you exactly where you stand.

Your net worth can be the key to financial independence. Another can be owning significant assets that pay you for the rest of your life (like owning rental property) but that’s a topic for a different day.

Tracking and building up your net worth can lead to a life of financial happiness and hopefully financial freedom.

I still update my net worth every month on my Net Worth page. While I do share mine with the whole darn internet as encouragement for others in the community and for self-accountability, you don’t need to make yours public. You just need to track it for yourself.

A financial aggregator makes that easy since it already knows all your numbers. I’ve found that tracking mine is a little exciting and gives me an incentive to continue to grow it by saving and investing more.

I use Empower to track my net worth, but any financial aggregator worth a lick will do the same.

Is security a show-stopper when considering a financial aggregator?

So I talked about just 3 of the great ways that these tools can help improve your finances, but what about the risks?

Sometimes folks ask me if they should be concerned about security if they use a financial aggregator… of course, you should be concerned!

With anything you do that revolves around the internet, security should always be a concern. Is the risk too much of an issue with these sorts of tools to forego using them though?

That’s going to be something you’ll need to decide for yourself. There are a few reasons why I’ve been ok with trusting them with my information for so many years:

1) All the major aggregators state that your information is encrypted. In theory, that would mean that if a breach occurred, the hacker would only gain access to a bunch of gobbledygook that would be useless to them. We obviously don’t get to review their programming code to see if that’s really in place, but I would smell major lawsuits if it’s not and a breach should ever occur. Plus, it’s so much easier to implement encryption nowadays than it used to be that it would be stupid for them not to.

2) The data that is stored by the aggregators is essentially read-only and doesn’t give access to make transfers or do anything with your actual money. So, if someone somehow did manage to see your financial data (which we just said is extremely unlikely), they can’t do a ton with it.

3) After fighting the idea of a financial aggregator for years, the banks and other financial institutions have finally started to work with them instead of against them. And by that, I mean that with the banks that have embraced this, you no longer hand over your banking credentials to the financial aggregator. Instead, the aggregator now sends you over to your financial institution to log in and you then grant access through a special token to the aggregator. In this way, the financial aggregator never has access to your banking username and password. This is exponentially more secure to have in place. Not all institutions support this yet, but the number continues to grow.

Again, the level of trust you have in using them is in your court, but I’m comfortable with them and feel any risk is well worth the reward you’re getting out of them.

I take money seriously and maybe that’s part of the reason we were able to retire so early in our lives. But to effectively manage it, these tools have the power to make your life tremendously easier.

I still have that tinkering mindset (I love cool software!) and so I’ve tried out so many of these money management apps over the years. But for me currently, Mint and Empower fit the bill for what I need. You might find that your needs are quite different so it’s worthwhile to try out different ones.

My friend, Jim Wang over at Best Wallet Hacks has a couple of great articles on the various financial aggregators you can use for money management that you may want to check out:

- 11 Best Mint.com Alternatives for 2022

- You Need A Budget (YNAB) vs. Mint – Which Budgeting App Is Better For You?

Whatever you decide to use, I hope you’ll find that it helps your wallet as much as they’ve helped mine.

Are you currently using a financial aggregator to manage your finances?

Plan well, take action, and live your best life!

Thanks for reading!!

— Jim

Thanks for sharing this Jim, I really do need to look into a financial aggregator. I’m pretty fanatical about tracking my investments/dividends, this would probably take it to another level…Hope you had a great cruise, other than your having to fix that overcharge! We were supposed to be in Florida last week but the hurricane altered our plans!

Better to have to change your plans than to have been down there during the storm, right? I hope your modified plans are as fun or better than what you had hoped for initially! 🙂

i’ve been using my Excel spread sheet to track things since 1995. I’m not stopping now!

Wow, 27 years – that’s some dedication! Have you checked out Tiller at all? Spreadsheet enthusiasts seem to swear by that since it pulls data down into your own spreadsheets. So it’s all still your own data but it helps save some time in managing it and it could supercharge things a bit. I haven’t used it but it seems pretty cool.

I haven’t seen Tiller. Just looked at it. My budgeting and input is pretty simplistic but serves the purpose. As long as we aren’t overspending we’re good!

Simple is good!

Thanks for posting about these, Jim. I tried Mint for a bit back in the day, but the security made me SO worried. Granted, this was when you had to provide Mint with your online banking username and password, so perhaps I was right to worry! It does sound a lot safer now, based on how you described it (and if I remember correctly, you did IT stuff for work, so I trust your opinion!).

And yay for VTI! I am a fellow VTI investor—I have my money in some other funds (including a Vanguard target date fund for work because that’s the only Vanguard option for my 401k) but I am mainly in VTI.

Yeah, it’s great that the financial institutions have realized the aggregators aren’t going anywhere and have figured out a safer way to work with them.

Haha, I was doing the same as you while in my career… Vanguard target retirement fund for the 401(k) and most everything else in VTI. It was nice to be able to move my 401(k) to a rollover account after leaving and being able to invest in what I wanted (most VTI!). But it does feel a little scary thinking that most of your eggs are in one basket (even though it’s really not). 🙂

I am using Fidelity’s “full view” instead of a 3rd party to track net worth. I trust their security more and since I already have an account, don’t need to create yet another one.

That’s pretty cool, Phillip. I have an HSA account at Fidelity so maybe I’ll check that one out to see how it compares. Thanks!

Do you have any experience or knowledge if any of these work with other currencies other than USD. I live abroad thus we save, invest and spend in the local currency. We also have investments in USD. It would be nice to have a program that showed us both currencies….

Hi Marla – sorry, but I haven’t dug into using non-USD currencies. It might be worthwhile to check around with some of your fellow ex-pats there or the locals to see if anyone’s got any recommendations. Maybe the Facebook ex-pat groups for the area might reveal something good.