Disclosure: This post contains affiliate links and we may receive a referral fee (at no extra cost to you) if you sign up or purchase products or services mentioned. As an Amazon Associate, I earn from qualifying purchases.

I love reading articles that have something tangible to present. It doesn’t matter if it’s books, documentaries, software, or some kind of hack to improve your life that’s good for your mind, body, or wallet. Make me a better person!

Sometimes folks ask me questions about how I accomplished something or why I do things in a particular way. The questions usually revolve around anything from finances to technology to health or anything else that might be on someone’s mind.

Recently, I started thinking that it would be great to compile some of these resources that I think are particularly helpful. Then I could suggest folks check out the post when the subject comes up.

The problem is that there are probably hundreds of great tools and resources that I’ve found helpful for my mind, body, or wallet. So I decided to just focus on a handful of my favorites today.

Financial resources to help improve your wallet

Mr. Money Mustache (Pete Adeney) at WDS

Most folks who have dug into the idea of early retirement are aware of a guy named Pete Adeney who goes by the moniker, Mr. Money Mustache, with his insanely popular blog. He’s sometimes considered to be the godfather of the FIRE movement (financial independence / retire early).

He retired over 15 years ago at the age of 30 to start a family and lives a more than comfortable lifestyle on what many consider to be a meager budget. He’s also a unique and inspirational guy to listen to in interviews.

For some reason though, I had never even heard of him until probably a couple of years into my FIRE journey. I wish I had found his site sooner though!

One thing I love is a recording of Pete speaking at the World Domination Summit (WDS) in 2016. It’s such a cool and motivating piece that I think can be life-changing. If you want something that can improve your life, it’s hard to beat this talk.

You can view the whole video here… and it’s worth it!

The Millionaire Next Door

If you haven’t read The Millionaire Next Door, it’s time to put it on your list. This book helps to open your eyes to some of the ironies of the rich versus the middle class by presenting research done with American millionaires.

Essentially, we might assume that the people we see driving expensive cars, living in fancy houses, buying expensive clothes and jewelry, and living an extravagant lifestyle are wealthy. However, it turns out that these traits are usually found in middle-class folks trying to look/feel rich. These same people could very well be up to their necks in debt with little to no savings.

What the authors discovered in their research though is that it’s actually tremendously more common that the wealthy are more frugal than you think. They tend to live a much more low-key lifestyle than we would think – living in modest houses, driving used or not-so-fancy cars, etc.

It’s really an eye-opening book that just might change your perspective on money.

JL Collins’ Stock Series or The Simple Path to Wealth

Sometimes friends and family ask me how to invest their money. The funny thing is that it’s generally a rhetorical question because even though they ask, most don’t usually care enough to listen to the answer.

But if I could get even a small percentage of them to read the works of JL Collins, I’d be happy to know that these folks are going to be miles ahead of most when it comes to investing.

JL Collins wrote a series of articles that he dubbed The Stock Series. He wrote them as a way to explain to his daughter how to invest her money for her future. He kept everything simple as can be and put these articles up on his website as he wrote them.

What he probably didn’t anticipate was for this series to be as popular as it’s become.

He broke down investing in such a straightforward way that it can’t help but turn the light bulb on over your head. He lays out why you need to stop listening to the noise and why your investment portfolio can and should be uncomplicated.

Not only does JL explain what you should probably include in your portfolio, but he also tells you why to leave out other investments. Hint: If it’s complicated, it’s probably not going to be good for you… but it’ll be a great money-maker for the broker!

As I type this, there are 36 articles in The Stock Series. They’re not crazy long and they’re in layman’s terms. You could spend just 15-20 minutes a day reading one or two posts and be done with the whole series in just over a couple of weeks. The small amount of time you put into reading this could be the greatest investment you ever make for your wallet and your financial future.

This series became so popular that JL was able to turn this into a best-selling book. The Simple Path to Wealth contains a lot of the same content you’ll find in his online posts. However, he organized it, cleaned it up, and made it more readable.

So if you prefer books, check out The Simple Path to Wealth here. It’s an excellent book!

And, if you’re looking for a better way to manage your investments, I highly recommend Empower (formerly Personal Capital). It’s free and awesome. I use it to manage our finances and I love how it brings in all your banking, credit, and investment accounts into one place so you know exactly where you stand financially.

The investment and retirement tools can help you plan your financial future. The built-in Retirement Fee Analyzer in Empower helped me save an astounding $65k just in fees over a 10-year period with just a few tweaks to our portfolio!

The Shockingly Simple Math Behind Early Retirement

I have to give you another Mr. Money Mustache masterpiece. In 2012, MMM wrote a blog post called The Shockingly Simple Math Behind Early Retirement that I believe is still his most popular article… and rightfully so.

Financial independence is wonderful because it effectively takes money out of the equation of life. That allows you to decide what you really want to be spending your time doing.

The Shockingly Simple Math Behind Early Retirement shows you how long it’ll take you to become financially free based on your savings rate. Realizing what it’ll take to reach that milestone might help push you to make it a reality.

As that article grew in popularity, a calculator was created based on the post. Similar to the article, the calculator is not meant to be crazy on minutiae (there are plenty of other calculators for that, including cFIREsim and the one built into Empower). This one’s there to let you plug in a few basic numbers and see how long it’ll take you to retire. Knowledge is power, my friend!

You can work with the free Networthify calculator here.

Obviously, there’s more to reaching financial independence than just looking at a few numbers. However, this helps you get a gauge on where you’re at and what you might need to change to get it to be something more suitable for your needs.

Mind/Body resources to help improve your life

What Alcohol Does to Your Body, Brain & Health | Huberman Lab Podcast

I’m about to announce something new here… I recently stopped drinking. I didn’t just cut back either – I outright quit drinking. My last drink was on 9/19/22 and I don’t anticipate that date changing at any point ever.

I’ve never been a heavy drinker but I would probably drink about 6-8 beers over an average week. Regardless, I’ve always felt that I needed to scale back simply because I know it’s unhealthy. I even wrote about an alcohol tracking spreadsheet I created earlier this year just to get a better idea of how much I was actually drinking.

But then one thing changed everything. I stumbled across a Mr. Money Mustache post on Twitter (damn, a lot of MMM stuff in today’s blog post!) referencing a podcast from Andrew Huberman, Ph.D. I had never heard of him before but he’s a neuroscientist and tenured Professor in the Department of Neurobiology at the Stanford University School of Medicine. So I’m going to guess he’s maybe a billion times smarter than me! 🙂

But what sucked me in was one of the replies to MMM’s Twitter post talking about Huberman’s episode on alcohol…

I just discovered this one and well and finished the episode on alcohol and the impact on brain and health. I may never drink again. Good stuff !

— heidi engelhardt (@HeidiEngelhardt) September 15, 2022

That got me curious. So I decided to watch it on YouTube. It was long (over 2 hours!) and probably not the most entertaining show to listen to, but it was still fascinating.

It also happened to strike me at the right time and caused me to stop drinking completely just like that. I was scared straight as they say. If you’re trying to improve your mind and body and you’re still drinking alcohol, it’s worth hearing him out. And be aware he’s not condemning alcohol or folks who drink it – he’s simply laying out the facts.

Here’s the episode in full…

I still enjoy the idea of cracking open a beer and just relaxing on the couch though so I’m starting to experiment with non-alcoholic beers to see what I might enjoy as an alternative.

Yes, I know there’s still up to 0.5% alcohol in many of these. However, my understanding is that due to the fermenting process, you’ll find measurable amounts of alcohol in bananas, apple juice, and bread as well. So I’m willing to accept that – especially since I would usually only drink one or two.

And like Huberman, I’m not judging anyone for drinking. This was a personal choice I made for myself and my own mind and body. Whatever your own choice is, that’s completely up to you.

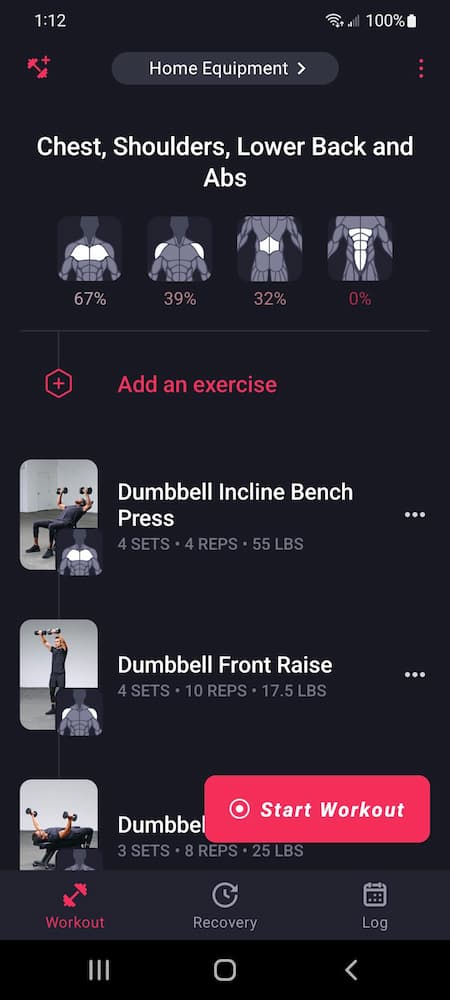

Fitbod / DAREBEE / Evidation

Unless you’re a gym nut, one of the big struggles with fitness as a newbie is finding a little guidance. How do you begin if you don’t know where to start or what to do?

One option is YouTube and you can find a helping hand out there if you know what you’re looking for.

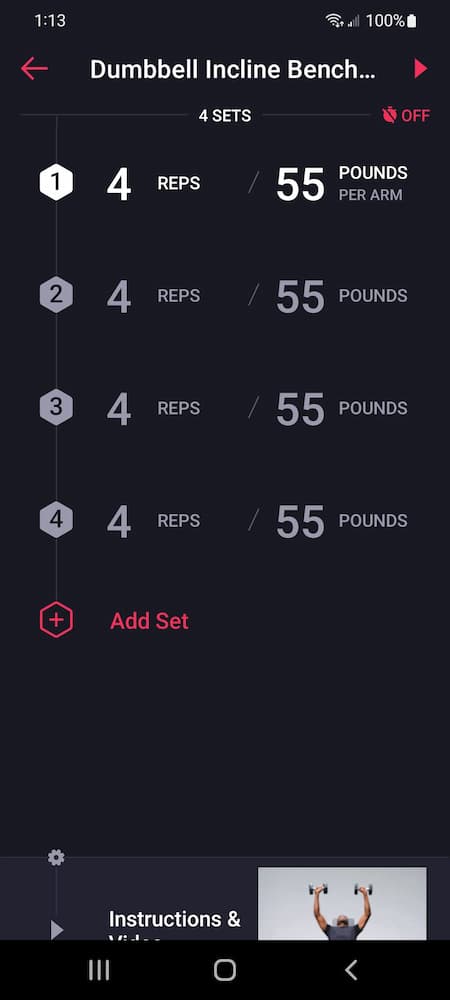

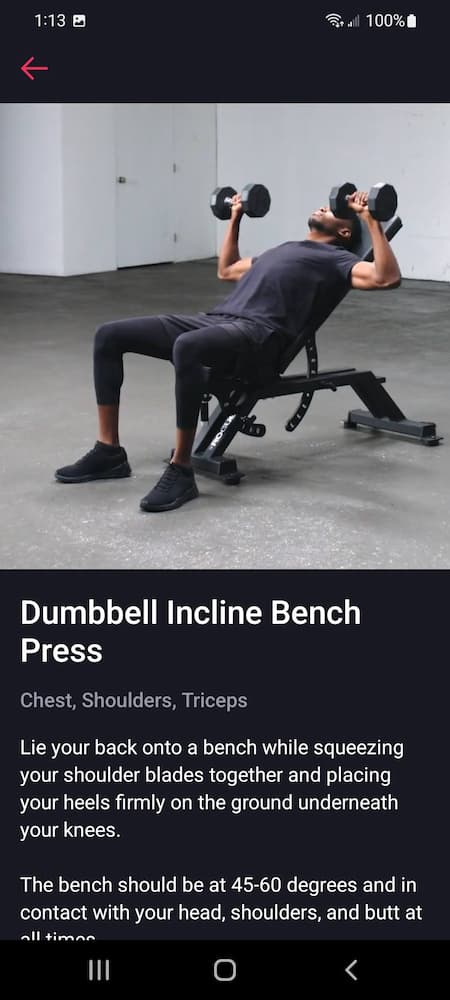

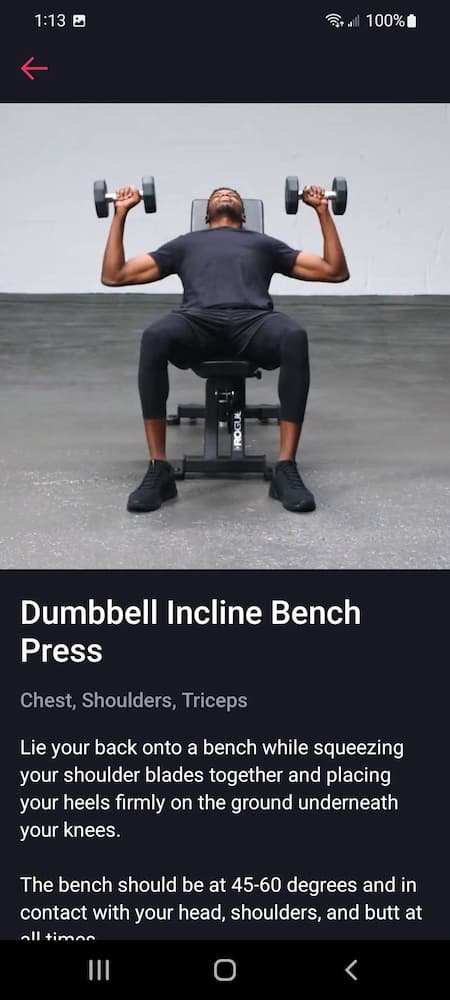

For me though, I found Fitbod to be a game changer. Having an app that tells you what to do and how to do each exercise is important. It also keeps track of your workouts, varies it up according to your goals, and slowly increases your reps and weights. This has been exactly what I needed. It’s like having a personal trainer but always on your schedule and for a fraction of the cost.

I wrote a whole post about Fitbod a couple of years ago and although some of the screenshots have changed, it’s only gotten better over time… much better. I love this app and use it 5 days a week!

You can check out Fitbod here.

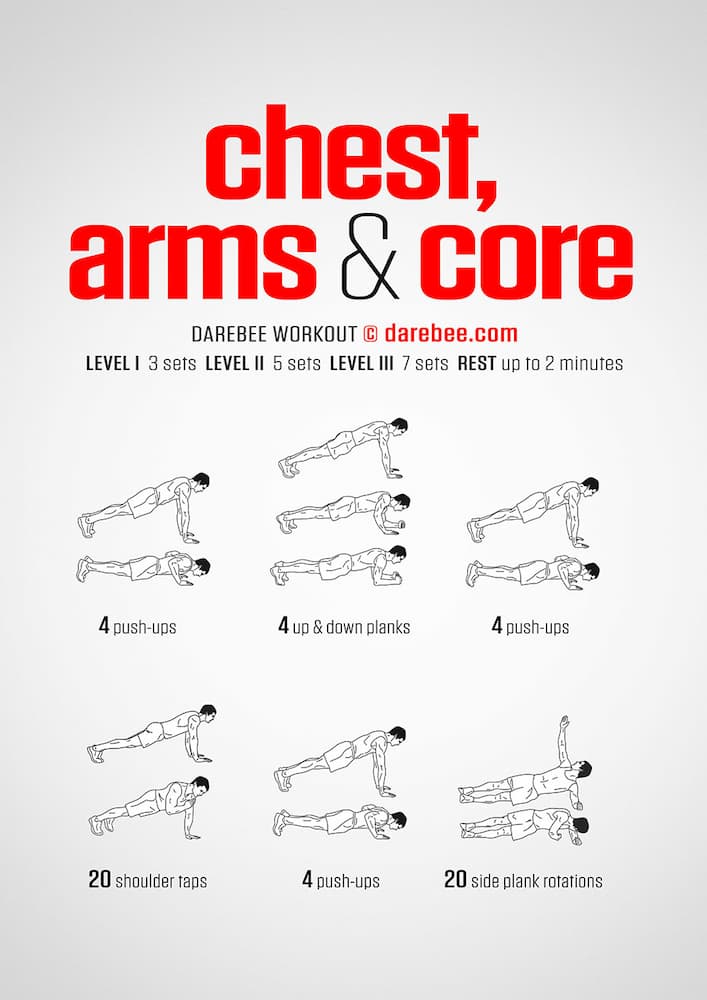

And here’s a free alternative that I think is really cool, too. It’s called DAREBEE and it markets itself as a “non-profit free, ad-free and product placement free global fitness resource.”

So here’s what’s awesome about it – there are no signups or anything. You just go to the website and find what you’re looking for and you’re done. As I write this, the offerings at your fingertips include:

- 1900+ workouts

- 58 programs

- 150+ challenges

- 130+ guides

- 58 collections

Almost all of these are bodyweight only and require no equipment. However, you can filter them down to include some basic equipment you might have at home such as dumbbells or pull-up bars (my two favorite pieces of equipment!).

DAREBEE doesn’t guide you or automatically help you increment your reps or anything like Fitbod does. But it has workouts for everyone no matter who you are and it’s 100% free (though donations are accepted) so there’s no excuse not to be looking out for your mind and body with some regular exercise.

The other one I wanted to mention real quick is Evidation. Evidation is a free app that rewards you for how many steps you take, how well you sleep, optional surveys you can take, and more. In a nutshell, you earn points for doing things you’re mostly already doing. You can then redeem your points for cash or donate to charities.

There are several apps like this out there. I like Evidation because it ties right into Samsung Health, which I use on my phone already. It can also tie into Fitbit, Google Fit, and 20+ other apps and it’s available for both Android and iPhone.

So here’s the deal – I installed it on my phone and created an account… that’s about it. It talks to Samsung Health on my phone to see how much I’ve walked and gives me points for it. I could do more with it but I don’t – it’s basically just tracking my steps and that’s it. I rarely even open the app.

Right now I have a little over 8,000 points after about 8 or 9 months. At 10,000, I’ll get $10 sent my way via PayPal (there are other options for payout, too).

Is it like a major casino jackpot? Not so much. But it’s $10 for not doing anything except keeping my mind and body up and running. Getting rewarded for your health ain’t too shabby!

Kindle Paperwhite + Library Extension

If you’ve ever read digital books on a Kindle Paperwhite, you probably already get it. I love my Paperwhite… and mine’s over 8 years old!

These are not like reading on a tablet or a phone screen which tends to put a strain on your eyes over time. A Kindle Paperwhite uses e-ink technology – it’s almost like reading a newspaper or magazine. You can read it while out in the sun without the difficulty you might be familiar with when trying to see your phone in bright light. You can also read it at night with the built-in backlight.

Throw in that it’s as light as a paperback, can hold thousands of books, and a single charge can last weeks, it’s tough not to love it. Not sure what a word means? Press and hold to see the definition pop up. Like a passage? Press and drag to highlight. As a bonus, you can get to the highlights you’ve made from your computer or phone as well.

Why am I throwing this in as something good for your mind and body? Because knowledge is power and imagination encircles the world. Books help to satisfy both of these needs.

But the Paperwhite is only a vehicle for knowledge and imagination. You still need materials to read.

It’s rare that I purchase books from Amazon or anywhere else. Instead, I read most of my books through the library. But I don’t go to the library to get them. I don’t even start at the library’s website for my searches.

Instead, I use a fantastic (and free) Chrome extension called Library Extension. The extension is available for Firefox and Edge, too.

So what does it do?

You initially add the library (or libraries) you’re a member of into the extension… no card number, credentials, or anything private – just the library name. And that’s it.

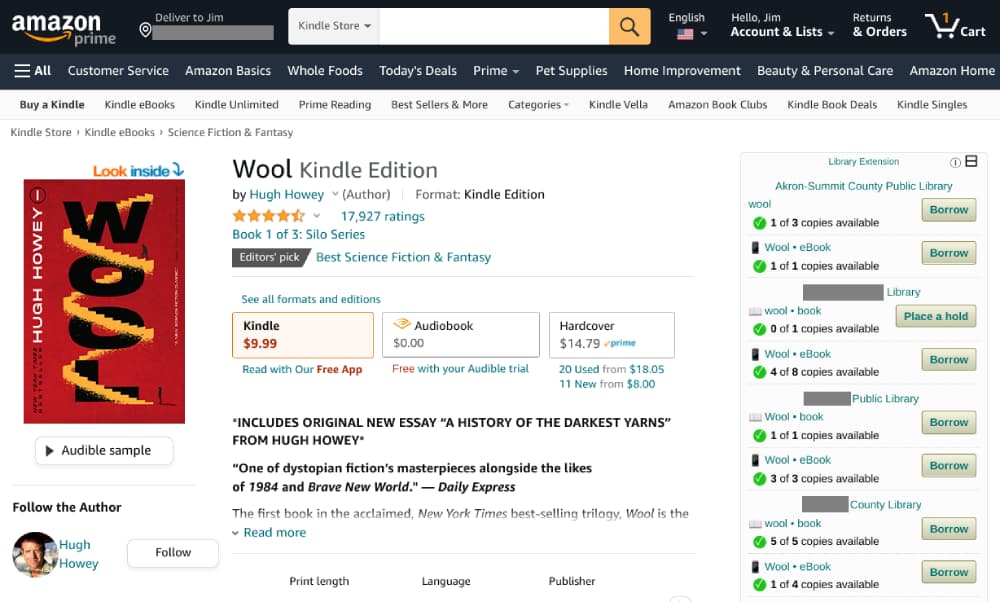

Now, anytime you go to a supported site (Amazon, Barnes and Noble, Goodreads, Audible, and several others), the extension does its magic and pops up to let you know if it’s available at any of the libraries you configured.

Here’s an example of the book, Wool – a fantastic book series, by the way! When I go to the Amazon page for that book, I automatically get a listing of all my libraries with availability right on the page along the right-hand side…

This shows you if the hard copy, eBook, or audiobook is available at your library. Clicking through on any of those links on the right takes you directly to the library’s listing so you can easily borrow it.

Easy peasy way to improve your life by finding the right books, utilizing your local library, and leveraging the go-to sites for books… it’s genius!

I have so many other resources to share but this has already been a long post. If you think this is worthwhile let me know in the comments and maybe I’ll do more of these.

And if you enjoyed this post, it’s probably time to get on the mailing list if you’re not on it yet! I’ll keep you in the loop on new blog posts and keep you informed on life in early retirement. I’ll also send you some cool freebies just for signing up!

Did you sign up yet? Did you do it? Time to get to it!

I would bet this post probably got you thinking about some resources that you think can help others with their mind, body, or wallet as well. Spread the love by sharing it in the comments – let’s all learn from each other!

Plan well, take action, and live your best life!

Thanks for reading!!

— Jim

I have just a few drinks per month and I’m not ready to quit yet. 😉

Although, I’ll probably buy more non-alcoholic drinks. I had a few when I was in the Maldives and they aren’t bad.

I’m surprised to hear there were some choices in the Maldives – that’s cool! It’s incredible to see how many different varieties of non-alcoholic beer have come out. I’m actually looking forward to trying some of the various ones as time goes by.

Great post Jim, thanks for sharing your insights on the affects of alcohol, I’m going to sit down and watch this Huberman Lab youtube video. I’m not a big drinker at all, but I think it’s still worth a watch. Love MMM and the Millionaire Next Door, great resources, thanks for sharing!

Thanks, Jim – his shows are long but super informative!

Hey Jim, thanks for posting this! These are some great resources. I’m a big fan of The Millionaire Next Door and The Simple Path to Wealth.

One mini-rant I have (not directed specifically at you, just some general thoughts!) concerns that article/concept The Shockingly Simple Math Behind Early Retirement. It sort of drives me nuts that the assumption is one’s spending will remain static in retirement. I have a pretty high savings rate because I want to retire early. Let’s say I’m living on $20,000 per year. But I don’t want to live on $20,000 in retirement! I’d want to live on more, especially since (for me), living on $20,000 meant virtually no vacations anywhere fun. When I’m retired, I want to travel to fun places! I just don’t think time until retirement is entirely dependent on one’s savings rate. Savings rate is definitely factor, but I think the table/calculator MMM provides isn’t really the full picture. 🙂

That’s an excellent point, Natalie! Calculators like this one are a great start for most folks just to get a gauge on where they’re at. From there, everyone should be digging deeper regardless in their planning. But you’re right, If you want to do more in retirement that requires more bankroll, you need to plan for that as well. Great points, Natalie!

Been sober for over 32 years in AA. Definitely don’t begrudge people drinking, but it was/is for me a physical allergy and mental obsession that will never leave me. I am fortunate to have stayed stopped, but many have not. The success rates in recovery are not good…I’ve seen numbers like 3%. AA saved my life. FIFE (or FIRE), financial independence, freedom early is a great addition as well. PS- I’ll have to check out that video.

32 years of sobriety – that’s fantastic! I didn’t realize that the success rates of recovery are so low – you overcame some great odds then. Congrats on the amazing journey you’ve been through to conquer alcohol and find FIFE (that’s a new acronym to me)!

Have < 3 drinks for last few year. Can't feel better. There are just too much things to focus on even after achieving FIRE, and life is too busy for us to drink.

Yeah, it’s interesting because it’s become so ingrained in society. I know that anytime I would plan to get together with someone I haven’t seen in a while, we’d always try to “get together for a beer.” It’s such a part of the social dynamic that it’s sometimes hard to see that you don’t need to drink. I think that’s why the non-alcoholic beers will still give me the feeling of not being an outsider so much, but without the downsides of the alcohol.

Congrats on just a few drinks a year – that’s fantastic!!

Thanks for sharing all of these resources! Limiting my drinking is something I’m currently facing in my life right now. I picked up a bad habit of drinking quite a bit of wine during the pandemic.

That was a habit that many folks understandably picked up during that time. I knew I wanted to cut out drinking eventually but that video was a trigger for me. The idea of cancer scares the #$%^ out of me and hearing about what transpires in your body was enough for me to just call it quits. No time like the present to cut back, Samuel! I found that tracking my alcohol intake over this past year was helpful as well… good luck! 🙂

Jim, Great content in this post. Just watched Pete’s talk at the WDS, and really loved it. Thanks for sharing it!

Also congrats on your net worth – that’s awesome. Haven’t found anything about how you invested your money or how you manage it. Maybe that would be a cool section to add. As for myself, I am a big fan of have and keeping several accounts for specific purposes (e.g. trading / longterm dividend investing / thematic portfolios / etc.). I openly share all my portfolio on my website if you like to check them out!

Anyways, keep up the good work!

Cheers from Singapore,

Noah

Thanks, Noah – I don’t have a specific section on our investments, but I do have a couple of posts written about it from several years ago:

Believe it or not, not too much has changed since then, but I did talk a little bit more about our bucket strategy in my post: Is This Down Stock Market Problematic as an Early Retiree?

I’ll be sure to check out your site as well!