Disclosure: This post contains affiliate links and we may receive a referral fee (at no extra cost to you) if you sign up or purchase products or services mentioned. As an Amazon Associate, I earn from qualifying purchases.

There tends to be a stigma in society that you need to own a company, become some big real estate mogul, be a celebrity, or just come from money in order to find your way to financial independence.

So then we like to come up with excuses reasons as to why we can’t do that ourselves… “If I was in that position, it would be easy! No way I can do that because of xxxxxxx [insert whatever rationalization you want here].”

That’s all fine and dandy (it’s not), but it might be a surprise to know that it’s possible to have a boring career path and still reach financial independence.

My career path wasn’t what you might expect and we still attained financial freedom. Oh, and that’s with a kid as well, which is also something that floats out there as a reason folks can’t get on the right track financially.

I’m not saying that it’s possible for everyone to do, but if you want it bad enough, maybe knowing that you don’t need a huge household income might be good motivation to make some changes in your own life.

My career path from start to finish

Good news, folks – I found an old spreadsheet that kept track of my little career path along with the wages that I made. So today, you get some more real-life numbers to take in!

Convenience store

I remember my first job at a convenience store beginning in 1990. I was 16 and started there part-time and would work full-time during the summers. I started out at $3.85/hour… that’s crazy. That would be about $8.96/hour in today’s dollars, which still isn’t anything to brag about!

I worked there for a few years throughout high school and really enjoyed it. The owners and other employees were great, I took pride in what I did (pretty much everything) and thought it was a great first job. By the time I left, I was making an earth-shattering $4.75/hour ($9.75 in today’s dollars).

Landscaping

One summer during college, I worked as a landscaper. It paid $5/hour ($10.26 today), I got to enjoy being outside all day, and I got a nice summer tan. I worked from dusk until dawn every day and would usually be too tired to go out and spend the money I was making, which was an added bonus. I made a decent buck that year and I liked doing the work.

Lackey for home and building renovations

I had several months where I just did odds and ends for different friends of the family and friends’ parents. People who owned and were renovating rental houses or even big apartment complexes were the main ones. I just did whatever was needed. Sometimes that meant being up on a ladder and cleaning brick buildings clean with a scraper and lovely toxic chemicals and sometimes it could be hauling things, fixing windows, or whatever.

Honestly, this ain’t my kind of work. Grunt work. Not fun but it paid the bills. One gig brought in $6.50/hour ($12.97/hr today), one was $7.50/hour ($14.97/hr today), and another brought in $8/hour ($16.42/hr today).

Electrical assistant

Another summer in college, my cousin called me up and asked me if I wanted to do some work helping him. He was working for his brother-in-law as an electrician at the time. That sounded fun so I went with it.

We worked overnights for a month or so changing out ballasts and fluorescent light bulbs to more efficient ones throughout a massive community center. As silly as that repetitive work was, I didn’t mind it at all. Most of the time, I was working on my own, listening to music, and just working away.

One thing about me is that if I’m getting paid to work, I work. I’m not there to #$%^ around. One day, my cousin even pulled me aside and struggled to find the words to ask me to try to slow things down to “a more reasonable pace.” They were union workers after all and heaven forbid that a precedent gets set.

That gig paid $7/hour ($13.97/hr in today’s dollars).

Walmart

This is where things started to get a little serious. It ended up being a turning point from having a job to putting me on a career path (which I’ll explain shortly). I started as a part-time sales associate in the jewelry department since that was the only position open at the time. Yeah, I even pierced a lot of ears while there!

I started out a $5.50/hour back in 1995 ($10.98/hr today) opening up a brand new store and I loved the time I was there. Retail’s not a hard gig and it was a great place to meet new people. I just had fun with it and even made my way into a regional Walmart commercial at one point as I’ve mentioned in an earlier post or two…

Yeah, it’s tough being a celebrity. 😉

As a side note, I just started a YouTube channel under Route to Retire. I only have a couple of videos on there so far with one taking you on a tour through our new RV travel trailer. But hook a brotha up by clicking the Subscribe button on the main page or just go directly to this link. The plan is to put up videos of our different adventures including our month in Panama (where we’re at right now) and our RV travels.

Anyway, later, I became a department manager in menswear and then in sporting goods. For those of you who don’t know me, I have zero fashion sense and never cared a lick about sports (though I do watch the Cleveland Browns bumble their way through every season nowadays). But I was bringing in about $7-$7.50/hr doing that (around $13.57/hr to $14.54/hr today).

After that, I was promoted to Assistant Store Manager in another store. I worked there as we converted it from a regular store to a supercenter. Being an assistant manager had its good and bad days but I generally enjoyed it.

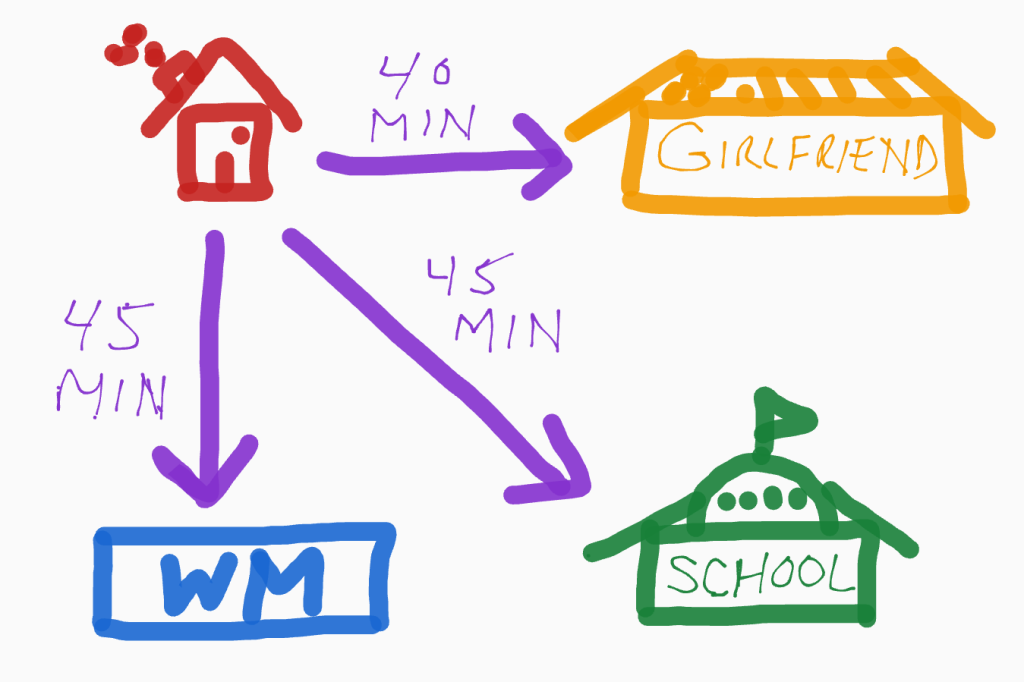

The biggest problem was that I was working about 50 hours/week in a store that was about 45 minutes from home (well, my parents’ home where I was living at the time). And I was still in college doing 3-4 classes a semester, which was also about a 45-minute drive from home (in a different direction). Just to put the icing on the cake, I was dating a girl who was going to school in yet another direction that was about a 40-minute drive away.

I was beat. Even being young and energetic, there’s only so much you can take before you’re toast.

It was a tough balance, but I kept chugging along. I had changed majors from Studio Art to Computer Information Systems (just in time to ride the technology wave) and Walmart had at the time what was believed to be the most sophisticated computer network in the world besides the Pentagon. As an assistant manager, I could have a relatively easy transfer to their home office in Bentonville, Arkansas once I graduated from school.

But I decided that I didn’t want to move to Arkansas and I didn’t want to stay in retail for the rest of my life either. It was time to move on in my career path and make something of my college major… so I eventually quit.

At that time, I was making $35k/year. That comes out to be almost $64k/year in today’s dollars. Not too bad for a kid just wrapping up college!

IT support company

After leaving Walmart in 1999, I went door to door near home (still my parents’ home) wearing a suit and carrying a folder full of copies of my resume. Sometimes a little hustle pays off. With no experience and while still in college, I managed to get a part-time job as a Systems Engineer at an IT support company of about 30-50 employees.

I started at $12.02/hr ($21.94 in today’s dollars), which was a pay cut from Walmart but well worth it in the long run. And at part-time, I wasn’t raking in a ton of dough but my employer worked around my schedule so I could continue with the last 2 semesters of college I needed to graduate.

I worked hard to learn everything I could in this job and garnered a stupid amount of IT certifications – Microsoft, Cisco, Citrix, CompTIA, HPE, and a bunch of others. I was pretty good at what I did – maybe not the best – but I think I was up there.

It was also a great opportunity for me to turn my life around financially and start getting rid of the $30k in credit card debt I had accumulated (almost $55k in today’s dollars… ugh!). I was still living with my parents when I first started there so that helped quite a bit.

Quicken was a great asset to me in making that happen at the time. Now, I use the Empower dashboard to manage all my finances – it’s free, secure, and works extremely well. It works in your browser and also syncs directly to a nice app you can use, too, which is also extremely good. You can check out Empower and sign up for free here.

Within a few years, I was promoted to be the manager of the System Engineers, a position that up until then was being handled by the CEO of the company (not uncommon in smaller companies).

This is really where my career path hit a good stride. It was a long climb in pay and I probably could have made more by jumping around to other companies but I stayed loyal. My boss had taken a chance on me and it was a good company. I stayed there for just shy of 20 years and left at the end of 2018.

When I left the company, my final salary ended up around $120k (about $145k in today’s dollars). It’s not doctor or lawyer money, but it was still pretty good pay for the year. But again, this was my peak salary and most years didn’t look anywhere close to this.

Landlord

I did try my hand at rental properties a couple of times. The first property was a house I bought in 2003. Looking back, I had no idea what I was doing even though I thought I had a clue. I bought in the wrong location (a bad neighborhood) and there was even a shooting right in the street in front of the property while I owned it.

I also didn’t understand the math beforehand. I knew I could make enough rent to cover the mortgage and then some. I was young and stupid though and didn’t know enough to consider other factors like insurance, repairs, turnover, capital expenditures, property management, etc.

We lived in it for a few years while fixing it up first (another thing I was unqualified for). In the end, I got lucky in that I had long-term tenants (2009-2018) that always paid the rent on time and were low-maintenance. But in the end, they also left the place a disaster.

When I sold the house in 2018 (for a loss), I’d say I still probably came out ahead overall, but not by much. I would have done much better just investing the money but it did give me experience.

Property 2 was a duplex that I bought in 2015. This time I understood the math and knew a little more about what I was doing. Plus, I had a friend of mine who also reads this blog who helped me look over a few properties (thanks, Rich!). I got a good deal on the property from a distressed seller in a nice neighborhood, there were existing tenants, and it was essentially rent-ready.

I did much better on this one and had a nice cash flow coming in. Still, it’s hardly a passive gig (managing the property management company is a skill in itself!).

The market went crazy in 2020 and I decided to sell at the end of the year and we closed in February of 2021. I didn’t buy it for appreciation but it was too good of a deal to get out. I bought it for $98,000 and sold it for $158,000. That was over a 61% increase in value in just 5 years so not too bad. Everything I got once the loan was paid off went into REITs… much more passive!

Regardless, even though being a landlord was part of my career path, it wasn’t something stacking my wallet either.

You can read a little bit more about my landlord experience and why I bailed in my post “Owning Rental Properties Is Smart, but I’m Out, Jack!”.

Author

I’ll throw this in there as well, but it definitely wasn’t a money-maker. I wrote and self-published a 288-page technology book in 2007. It was an achievement that I was hugely proud of and although I sold several hundred copies (more than my goal was), we’re also talking about several hundred dollars, not thousands.

In 2015, I wrote and self-published another book (157 pages), this time about organizing, fixing, and sharing all your digital photos. This was another book I was proud of but also not a NY Times bestseller.

I’ve taken both books out of print several years ago. When you write books revolving around technology, you truly have a limited shelf life of usefulness.

Route to Retire

I don’t look at this blog as a cash cow but since it does bring in a little income, I’ll throw it in there as part of my career path. I started this blog in 2015 and I still enjoy regularly writing for it. It’s been amazing to be a part of the community and get to know so many folks whether in real life or via emails or social media.

Last year was my peak year for blogging income and I still only brought in just under $7,800 for the year. I’m pretty sure this year will be a lot less than that.

While it’s a nice bonus for doing something I enjoy, blogging isn’t what catapulted us to financial freedom.

What about Lisa?

Maybe it was your spouse’s career path that helped you achieve financial independence!

Nice guess, but no. I won’t break down Lisa’s career path as thoroughly but my income was much higher than hers. She found her way into a non-profit doing what she loved versus making a lot.

Retail

Lisa’s first jobs were at a clothing store and then at Sears. As you can probably guess, she wasn’t swimming in cash at that point.

Retirement community

Later she worked at a retirement community doing housekeeping and eventually transitioned into being the activities assistant. She worked at this job for more than a decade. Neither position was very lucrative but she did enjoy working with the residents, particularly for the activities.

Make-A-Wish

Then she got her dream job working for Make-A-Wish. How often do people get to work at their dream job?! So that’s pretty awesome.

It paid ok but wasn’t anything crazy. Around 2012, while full-time, she maxed out at $42k for the year (over $67k in today’s dollars). In 2015, until leaving, she worked part-time and made around $22k per year (about $34k in today’s dollars).

So Lisa’s career path wasn’t shooting us to financial independence with ungodly amounts of money. She wins though because she had the job she loved!

Then how did you guys reach financial independence?

It all came down to living within our means, automating saving and investing so we didn’t even see that money, and letting time do its thing.

I made sure to up our contribution amounts or percentages in all our accounts anytime we’d get a raise or when we could. I also saw to it that I maxed out my 401(k), ensuring that we got every penny of the match offered. That dramatically helped make me a 401(k) millionaire.

Over the years, I’ve openly written about everything we’ve done to reach financial independence. There’s no special trick. It really is just living within your means, saving, investing, and waiting. The more you can save and invest and the sooner you can do it makes a difference, too.

And I will say that learning about personal finance can put you worlds ahead – and it’s not hard at all!

If you want some help, without a doubt, two of the best books that simplify what you need to do are The Automatic Millionaire by David Bach and The Simple Path to Wealth by JL Collins. Both of these books take on two different aspects of personal finance in a simple manner and together can put you where you need to be.

I list those and several other fantastic resources that I recommend on my Recommendations page.

Don’t let a career path choice be what’s stopping you from working toward a better financial future.

Get on the mailing list to hear about new posts, what’s going on in the Route to Retire household, and to get some free useful resources and tools for your life…

Plan well, take action, and live your best life!

Thanks for reading!!

— Jim

This was fun, man – really enjoyed it! I think the only thing you left out was *Time*. Time for it all to grow and compound over the decade(s)! The rest, as you say, is just living below your means and investing the rest. It’s not sexy, but it works 🙂

(It also reminds me that I posted something similar a handful of years ago too – all 40 (!) of my jobs: https://budgetsaresexy.com/all-30-jobs-ive-ever-done/ )

Dang, that post is from 2012 – you’re always the pioneer!! I bookmarked it to check out later.

And yeah, you know it – time is everything. I think so many people think you need to be a baller to get where you want to be financially, but really you just need to take action and make a few changes. Between automation and time to grow, you can then just go about your business and one day find yourself worlds ahead and hopefully even FI.

The solution is simple: spend less than you earn. That’s what I’ve done. Over the years, I’ve had stocks that I just left alone, I’ve had insurance policies I didn’t need. I eventually cashed out and reinvested these. Then I set up annuities. Those with a retirement offer and old age Social Security, leave me in the plus each month. Currently, I’m wondering if I should reinvest again, or am I too old to go this route (pun intended). I don’t know what the industry thinks of this idea. Perhaps it’s been addressed or could be by you. Thanks, as always.

I would think that the personal finance community would bring things back to the school of thought that if you don’t need the money in the next 5-7 years or longer, investing it still likely makes sense. That helps eliminate some of the short-term volatility that the market could have. If you think you’ll need the money sooner, it’s probably better to put it in something safer like an online savings account or even some of the money market funds at the brokers like Vanguard, Schwab, or Fidelity.

Are you able to post your House Hunters International episode on your Youtube channel? Or can you share a link?

I wish I could, but I can’t put up the video since it’s copyrighted and I don’t see it out there anymore (I’m sure it had to be taken down from others who posted it). Unfortunately, I think the only way to watch it would be on HGTV or maybe Discovery+. Here’s the episode info if that’s helpful: https://www.hgtv.com/shows/house-hunters-international/episodes/lower-costs-higher-living-in-boquete-panama

My first part time job was at McDonald’s and they paid me $3.25/hr. It think they bumped me up to $3.75/hr after 3 month probation (LOL). Looking back, even though the pay sucked, it gave me some spending money and I made some really good friends there and I think that is all that mattered.

Nice! Yeah, it wasn’t really about bringing in the bucks as it was just getting a little money to pay for gas and to hang out with friends back then. 🙂

Love it Jim, those wages seem like the ones I got paid back in the day. One of my first jobs at a movie theater paid $2.85 per hour back in 1988. They called it a ‘student wage’ because it was below minimum wage. But, the funny thing is there were no shortage of applicants wanting to get paid that ‘student wage’. It was a great job, met some nice girls and saw all the great new movies, great memories there! Look forward to watching your youtube channel and seeing all about Panama! Have a great trip!

Haha, “student wage” is great – anything to get around paying decent money! That would have been a cool gig to work at for sure!

Jim – I had early jobs as a paperboy and working reception at a church rectory. Got a well paying job in a education supply warehouse at 16 (they even paid a $50 bonus in May – and apologized for it) but one task was cleaning the bathroom – not a fan. Quit in the summer to work at the movie theater – about $2.85 in 1979. But the place had other teenagers (girls) and free movies, so…. Returned there during college summer breaks – even passing on an invitation to apply for a math job at NASA. Dumb kid….

Haha, sounds like movie theaters were the cool job to have as a teen! 🙂

This is the typical path for many, and life tends to work like a pinball machine, taking you in directions you couldn’t have imagined even a few years prior. The important thing is you did it, and you made it manageable. This is an approachable way for all, it’s not getting lucky with crypto or Tesla. I didn’t think in college I’d be working for finance, and I also thought I’d make tons of money by now (I make over 6 but apparently that’s not good enough these days). Great work sir.

Gracias, amigo! That’s the key, right? Knowing that this can be done by far more people if they just take the time to realize that it really is possible to do. And it’s not complicated either – save, invest, and wait… that’s it. But a person needs to take action or it’ll just never happen.

My first job was stacking milk cartons in the cooler in the grade school cafeteria when I was in first grade. The principal cornered a group of us before school one day and I was the slowest of the group – so – he caught me. He told me to follow him, so I did. We went into the cafeteria where we met up with the milkman delivering his load of milk. He told me that he would pay me a quarter ($.25) every morning to stack milk in the cooler. I jumped all over that! I figured that $1.25 a week, along with my $.10 a week allowance would make me a regular John D. Rockefeller! (this is 1958 so that’s big bucks!~ $14 in today’s money)When I told my dad at dinner that I had a job, he was real happy for me & told me that now that I was a “working man”, I no longer needed an allowance! LOL! My first lesson in economics also!

Haha, love it! That’s definitely a lesson learned! ????

Yeah – most people don’t get the message about what they expect to earn & what’s left of their pay after all the deductions until they are a lot older than 1st grade.

LOL!

I was just an early bloomer!

It is a good example you’ve provided. A lot of the people in the early (or only slightly early in my case) retirement space were higher earners and really did not have to follow a plan to become financially independent. I don’t think we deserve very much credit at all because we’d have had to be self destructive idiots to not have plenty of money in retirement. While you made good money for a US family you still had to be on your game more than I did and you retired much much earlier. I see you as one of the stars that I admire, both for your fiscal success and for being a great spouse and parent.

Wow, that was not expected – thanks so much for those kind words! 100% though – everyone’s going to be on a different trajectory in life so the more examples folks can see that they might possibly be able to relate to the better the shot of them making the changes needed in life. Financial independence has been one of the greatest gifts I’ve ever had in life and I’d love for others to get there as well.

This post is great. I enjoyed reading it. I didn’t have as many jobs when I was young. Just a few internships, TA, and tutoring in college. Now, I’m doing all sorts of odd jobs, though. Hahaha.

It’s crazy to see how much money kids make in IT these days. They should be able to achieve financial independence much easier.

Haha, you might be the busiest retiree out there, Joe! 😉 It’s true about IT salaries – the amount of money you can make out there can be huge. Maybe we need to get back into that career path… haha, no way!!

impressive what you guys achieved, and cool journey!.

I’m also impressed with how much developed economies pay for work – with obviously far higher cost of living too! the salaries that are paid $100k pa are similar to what middle level investment bankers earn in USD equivalent, whereas teacher or retail would probably get you $20k pa, and minimum wage is around $1 ph.

having said that cost of living doesn’t seem 10x higher in the US, and plenty of electronics, cars etc seem cheaper- looks like a good place to do FI and then like you guys geoarb to Panama etc for a bit =).

hope being back in the US is great too.

You’re absolutely right, Charlie. If folks here could avoid all the temptations of lifestyle creep and feeling like you “need” everything (I used to be in that boat too!), you could move so far ahead just from the bigger salaries. The ones who can work remotely for a job here in the States (or someone else with good-paying jobs) and live in lower-cost-of-living countries can really come out ahead.