Disclosure: This post contains affiliate links and we may receive a referral fee (at no extra cost to you) if you sign up or purchase products or services mentioned. As an Amazon Associate, I earn from qualifying purchases.

Once upon a time, I decided that I wanted to be a little more “hands-off” with our finances once we became early retirees. This didn’t mean to push down the major planning or big moves but rather just the day-to-day spending. For years, I was spending my life inside Quicken instead of taking a step back, handling the big picture, and not worrying so much about all the smaller details.

So, I let Quicken go after almost 20 years of use and moved to Empower (formerly Personal Capital) for aggregating and looking at my investments and Mint for handling expense tracking.

That’s the system I had in place for probably about the past 5 years or so and it’s worked fairly well. Empower is fantastic at getting a handle on your investments and Mint was… well, good enough.

Life was good until Intuit decided they were pulling the plug on Mint and leaving users scrambling to find a replacement. I ended up going to PocketGuard and that’s been working well for what I need – basic expense tracking. And I’m still using Empower to manage our investments.

But there’s one really handy feature that Mint had that I haven’t been able to find in other apps and I’ve been struggling without it… tracking upcoming credit card bills.

So today, I’ll tell you more about what that feature was, why it’s important, and why I decided to just make a version of my own. Not only that, but I figured that if it’s that valuable for me, others might be missing it as well, so I might as well share it with you, too!

The Credit Card Bills Problem

If you’ve been following our story for even a little while, you already know that credit rewards are an important facet of our lives. We use them responsibly, pay them off every month, and sign up for new cards to gain access to the benefits they offer, but more importantly, the sign-up bonuses.

Taking advantage of credit card rewards has allowed us to take a ton of free flights, stay at hotels for free, and enjoy travel perks like airport lounges for free. It’s truly been awesome for us and saved us ridiculous amounts of money.

If that’s something you want to check out, here are several articles I’ve written on the subject:

- A Month-Long Panama Trip for 3 for an Unbeatable Price of Less than $1,500!

- We Got the Chase United Explorer Card… Again. Boom! Easy Free Travel!

- Is It Worth It to Open a Credit Card With a Huge Annual Fee?

- The #1 Best Way To Track Credit Card Rewards

- The #1 Easy Way We’re Getting the Southwest Companion Pass

- Our Travel Perks Are Drying Up and That’s Big $$$!

- Free Nights – We’ve Had 5 at Hilton Hotels Recently

- We Got Turned Down for a Credit Card… Ok, Four!

- Travel Rewards – 12 Free Flights Earned in 9 Months!

You can also see a list of credit cards I like on my Recommended Credit Cards page.

We currently have over a dozen active cards (that number goes up and down over time). It’s not hard to manage though since we’re generally only focusing on the card we’re working on getting a bonus from.

Lately, though, we’ve been trying to be a little better at using the “right” card for our purchases until we’re ready to apply for our next card (soon!). So, we try to maximize using the card that gives us the best points per dollar per category (gas stations, groceries, restaurants, etc.). We’re not aiming to be perfect at it, just to do better than we have been doing.

But with that, those dozen credit cards always seem to have a balance on them. Again, these are paid every month automatically (the issuer pulls the money from our checking account) so that’s not the problem.

The bigger problem is that I need to make sure we have enough money in our checking account to actually pay those bills… yeah, they’re kind of sticklers that they want you to have money in your account.

With the way we draw down from our portfolio, every January, we have a year’s worth of expenses that I put into our online savings account. Then, every month, we get a scheduled “paycheck” from it to our checking account.

Shhh, don’t tell Lisa, but I don’t take the money and evenly move it over to our checking account every month because it doesn’t get much interest there. Instead, I have mostly enough in there and I’ll periodically move over additional money in the month if we need it to cover our bills. Plus, frankly, some months you just spend more than others.

So life is good… as long as I know how much our bills will be throughout the month. And the only bills we have that can vary dramatically? Credit cards.

Tracking Upcoming Credit Card Bills

I was never really blown away with Intuit’s Mint app but it still did the job of helping me to track our expenses. It also allowed me to review the transactions in one place to make sure there weren’t any mistake transactions.

There are a ton of apps that can do this job and, as I mentioned earlier, I’m now using PocketGuard and like that one a lot.

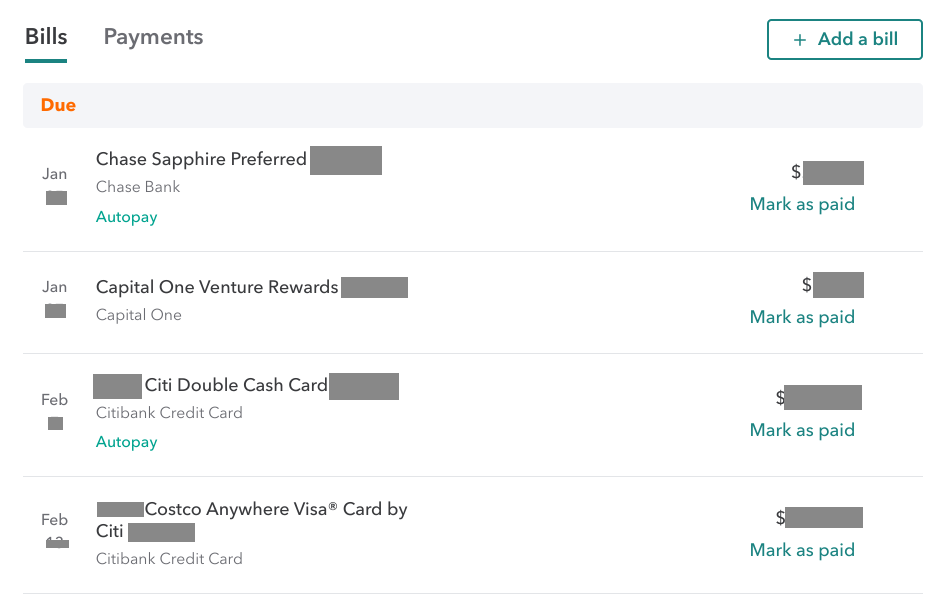

But there was one feature that Mint had that I haven’t found in other personal finance apps… viewing your upcoming bills. In particular, it already had access to your credit card issuers so it could easily help you track your upcoming credit card bills…

I found this to be super helpful! At a glance, I could see the upcoming credit card bills that would be paid out in the current month, do a little rounded math, and then look at our checking account balance to ensure we had enough $$$ to cover everything.

If we didn’t have enough, I would just move a little money over from our savings… easy peasy.

With Mint going away though, this has become a little thorn in my side. It’s kind of a hassle to log into each credit card provider’s site and see what balance is going to be paid and when. Then I’d have to add it all up and figure it all out. I need to do this regularly maybe every few weeks or so… not something to look forward to.

I didn’t like it. Tracking upcoming credit card bills shouldn’t be this hard.

Since I couldn’t find an easy solution, I decided to make my own tracker for our upcoming credit card bills.

Jim’s Famous Upcoming Credit Card Bills Tracker!

Ok, it’s not famous (well, not yet anyway) but it is something that’s already become a game-changer for how I handle our upcoming credit card bills. Since it’s my own spreadsheet, I can mold things to make it a little better for what I need as well.

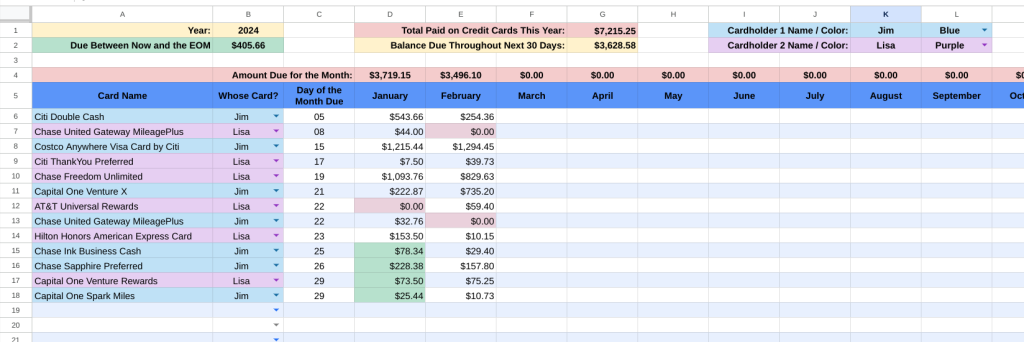

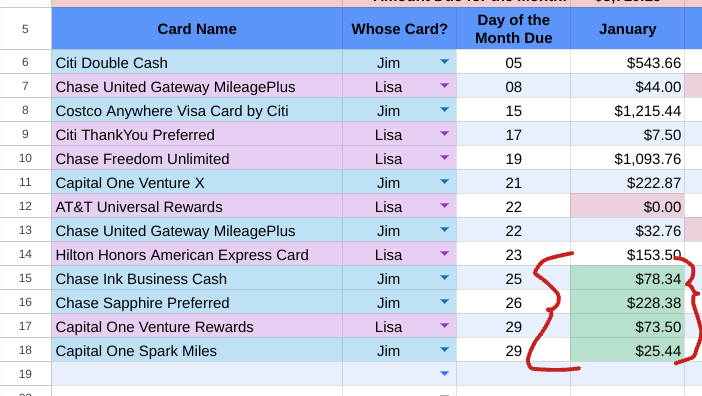

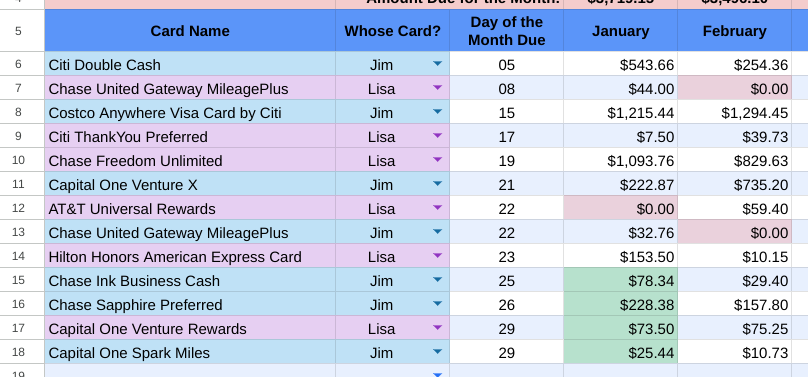

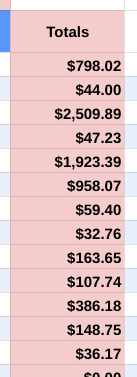

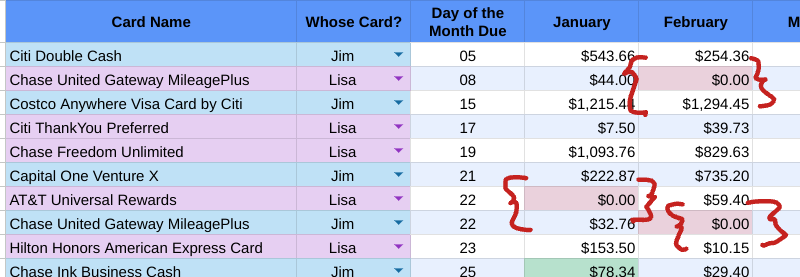

I wanted something simple that I could just use on the fly. After some revisions, here’s the spreadsheet I came up with…

Let’s talk about why it’s so great…

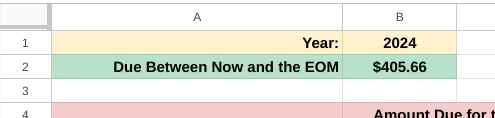

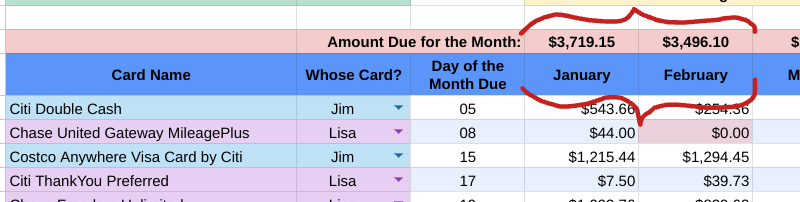

Balance Due Between Now and the End of the Month

It shows the total balance due between today (the day you look at it) and the end of the month.

This is the number that I’m after – if it’s June 12th and I’m just doing a check to make sure we’re good for the rest of this month, I just want to know what’s left to pay from June 12th through the end of the month (June 30th).

As a bonus though, it highlights those dollar amounts included in the total so you know which of the upcoming credit card bills are due in the current month, when they’re due, and the amount.

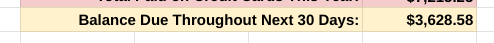

Balance Due Throughout Next 30 Days

Just to cover a little more ground in the summary numbers, it also shows the total balance due over a rolling 30 days from now.

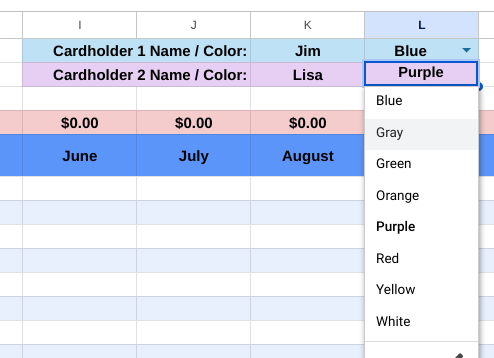

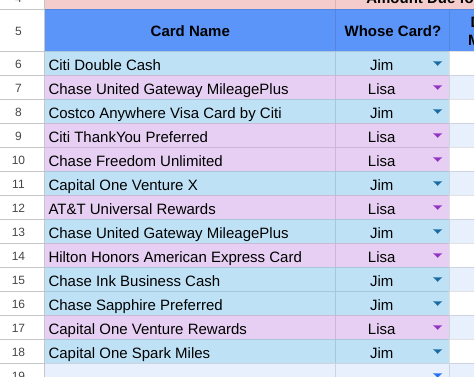

Two-Player Game

A small detail, but one that I thought was relevant was that sometimes Lisa and I have the same card (maybe I sign up for us to get a bonus and then later Lisa signs for us to get a bonus on that card as well). Since the card names are the same, I wanted to be able to easily distinguish the difference at a glance.

With the way I set it up, you enter in names for you and your spouse and set a color…

Then when you’re listing a card on the sheet, you choose one of the names you added that show up in the dropdown box, and the color is automatically applied to the card.

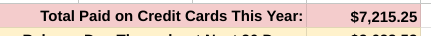

See How Much You’re Spending on Your Credit Cards

Since the data’s already in there, I figured it could be nice to just total things up to see the amount being paid on my credit cards. So you can easily see totals for:

- Each credit card for the month or the year…

- All the credit cards together summed up by month or year…

Get Those Inactive Cards Active Again!

Credit card issuers get a little weird about cards you leave inactive. If they sit inactive for too long, they might lower your available credit or close out your account completely.

Don’t let this happen – that can be a nice ding on your shiny credit score for no reason. I had this happen with my oldest card years ago before I knew better. That was a needless hit on my credit score when it happened (don’t worry I’m well over 825 now!).

When you have $0 amounts entered, they show up in red. That’s just to allow you to see the big picture. If you have a card with several $0 amounts in a row… it’s time to use that card. Use it to fill up on gas one time or whatever – just some kind of purchase to generate some activity.

Most issuers consider accounts with no activity for 6 to 12 months as “inactive” and may decide to cancel them. I try to put all our less-used cards out there for a quick spend a couple of times every year.

Google Sheets Means Always Available

Because this upcoming credit card bills spreadsheet is in Google Sheets, that means it’s available anytime and anywhere (hopefully!). It’s probably a little easier to do the initial setup from the desktop, but I like that now I can pull it up on my phone at any time if I want to check it or enter a quick number or two.

Pretty cool, right? A simple but very effective spreadsheet!

So How Hard is This Spreadsheet to Use?

Ok, here’s the deal – I don’t have access to Plaid or Yodlee or any of those middle-men tools that all the personal finance apps use to handle the exchange of data from the various financial institutes. I also didn’t want to go down the road of data scraping from financial institution websites (that would be messy, complicated, a security headache, and ever-changing). So the one downside is that it’s still a manual process but that keeps things simple and I’ve made it a lot less painstaking than it would be otherwise.

The initial setup just means that you need to put in your name (or names) and whatever names you want to put in for your credit cards. The other thing you need to do is look at a past statement to see what day of the month your card is due so you can add that to the sheet. All issuers that I’m aware of do a set day of the month rather than something like “every 30 days” so you can just add that day of the month on the sheet during the initial setup and call it a day.

That’s it for getting it set up!

Using it depends on how you do things. For me, the balance for each of my upcoming credit card bills is paid automatically. I get an email notice usually a few weeks before to tell me that I have a statement available and/or that it’s set to be paid automatically. With most of them, they tell me the balance to be paid as well.

So for me, all I need to do when I get that email is put in the amount on the spreadsheet for the right card for the month it’s due. That’s it. The day of the month is already set so I don’t even need to do that. One dollar amount to enter and done!

There are a couple of cards that I’ll need to log in or look at a statement to see the amount that’s going to be paid but most of the time, it’s right there in the email.

If you have paper statements coming, you can just use that info to add the balance due.

That’s all easy. If you don’t pay the balance due every month though, you’ll just want to put the amount you’re paying into the spreadsheet. The only real difference is that the summaries you see won’t reflect how much was spent for the month/year but rather how much was paid for over the month/year.

Pretty simple right? It’s not automatic like Mint was but it’s so little effort that I think makes it a no-brainer. And since you’re now seeing more information on your upcoming credit card bills as a whole, it makes it worth it. This should help you get a better handle on what’s going on with your credit cards.

Gimme, gimme, Jim! I Want This Awesome Spreadsheet!

Easy, easy… no pushing and shoving! There’s no need to cut in line – it’s free and it’s digital so we’re not gonna run out of it!

I created this for myself and decided that because I found it so valuable, I wanted to offer it up to you as well.

If you’re on my email list, you already got a link to the spreadsheet in this morning’s email… you guys are always first in line!

If you’re not on the email list, now’s your chance! No spam – just an email from me usually every couple of weeks letting you know about new posts and other things that I don’t put in the blog. And, of course, you can unsubscribe anytime you like.

Not only will that get you a copy of this spreadsheet to track your upcoming credit card bills, but I’ve got a bunch of other goodies that will be in that welcome email as well such as:

- Recurring Expenses Spreadsheet

- Credit Card Rewards Tracker

- Portfolio Rebalancing Spreadsheet

- HSA Unreimbursed Expenses Tracking Spreadsheet

- Roth IRA Conversion Ladder Calculator

- Alcohol Tracker

- Next-Chapter Matrix / Bucket List

Not bad for taking 5 seconds to enter your email right here, right?

Did you do it? That welcome email will be on its way before you know it!

Anyway, folks – I really do hope you find this spreadsheet useful. Sometimes you can’t find what you’re after and just need to do it yourself.

I’m happy with how this turned out and with the information it gives me. It’s already saving me time and effort and providing some good insight!

Plan well, take action, and live your best life!

Thanks for reading!!

— Jim

Nice spreadsheet. I wish all my cards would give me a balance due for the upcoming bill – most don’t so it is a real nuisance to need to log in to see it.

Change in travel plans already? You must have reached Key West. Many get there and never really leave…..

Yeah, I get why they don’t put it right in the email sometimes, but that’s a little bit of pain nonetheless. At least it’s not hard to do though.

I’ll leave you hanging on what the change in plans were until my next post, but I can tell you that we’re not the ones in Key West never leaving… though that is sounding pretty good! 😉

“With the way we draw down from our portfolio, every January, we have a year’s worth of expenses that I put into our online savings account. Then, every month, we get a scheduled “paycheck” from it to our checking account.”

Can save you an extra step. You can close your checking account and just pay your bills straight from your online savings account. The transaction limit of 6 per month was removed, so now no need to transfer any money over to the checking or think if you have any money left in the account, aside maybe from closer to the end of the year if you overspent. 😉 Great spreadsheet though to still keep track, but one less account to worry about.

I didn’t even think about that, Paul – that’s genius! I knew they removed the transaction limit a while back but my bank (Ally) was stating that it was a temporary thing. I just haven’t dug into it since to see if that’s become permanent. The only downside to that is that I actually like having a “paycheck” every month because it acts as a guardrail for us. Not to say that we would go crazy in spending otherwise but it still helps keep me on track.

But maybe I could use your logic to do something similar at Ally. Ally lets you create “buckets” within your savings. I’ll need to dig into whether that could be a feasible way to do things.

Thanks for the idea – very smart!!

I had the same thought as Paul. Just pay them out of your savings count directly, assuming you don’t have a transaction limit.

Or why not just use Empower? You can see the balance of your credit cards and checking count there. Set your payment date for your credit cards to the same date or close (most banks let you do this.) Then as your payment date comes close take a look at your credit card total balances and your checking account balance and transfer accordingly.

The savings account idea is a good one – something I didn’t think of. I replied back to Paul’s comment with some thoughts on that.

Changing payment dates on all the cards is an interesting one, Sarah, and another one I hadn’t thought of… very creative! I do keep an eye on my balances in Empower but with due dates all over the place, it doesn’t mean much except to know how much we’re spending. But your idea could help make it a little worthwhile. I’ll need to think about that and paying from savings and determine if one of those might be a better option for me to use. Thanks!

You have 13 credit cards???? No wonder you have a problem tracking this stuff. We have 3 cards(with a combined capacity of $100,000), use only 2 of them and I’ve never thought I needed a spreadsheet to keep track of everything. I’d suggest you cut that number down by 3/4’s and simplify your life.

Haha, yeah, that does sound like a lot, right? Bear in mind though that almost all of these have we’ve downgraded to no-fee cards that usually just sit in a drawer. The exception is really any active cards we’re working on nailing sign-up bonuses for. We normally only pull out the other cards once or twice a year just to put a small charge on so they don’t get canceled due to inactivity.

I usually don’t cancel any just because it can give you a ding on your credit score. But honestly, other than the ones that we’ve had forever that we want to keep open for that “length of credit history” factor, we probably could close some out. To keep the credit utilization from increasing as we do this, we could ask for credit increases on a few that we want to keep to help balance things out. Thanks a lot for giving me another project to work on!! 😉