Disclosure: This post contains affiliate links and we may receive a referral fee (at no extra cost to you) if you sign up or purchase products or services mentioned. As an Amazon Associate, I earn from qualifying purchases.

I recently wrote a post called Teaching Kids About Money – Valuable Lessons Instilled. As I was in the process of writing it, I got motivated to open a custodial Roth IRA for my daughter, Faith.

If you’re new to this blog, Faith is 10 years old (11 in a few months). When you hear that, you might be thinking, “What the @#$% does a 10-year-old need with a retirement account?” or “Um, Jim, don’t you need to have earned income in order to have a Roth IRA?”

Both of those are fair questions and I’m going to answer them shortly. I’m also going to tell you why opening a custodial Roth IRA for her might be one of the best financial moves ever.

And because I’m such a nice guy, I’m also going to walk you through how to open a custodial Roth IRA at Vanguard (you can’t just do it online).

So let’s get started and have some fun!

Oh, and just a reminder, here’s your disclaimer that I’m not a certified financial advisor and don’t have any cool acronyms after my name. I’m just presenting information on something we’re doing. Be sure to talk to a professional before doing anything you don’t fully understand. Get it? Got it? Good!

What’s a Roth IRA?

Just to make sure we’re all on the same page, let’s start with a quick recap of what a Roth IRA is.

A Roth IRA is a retirement account that you’re allowed to contribute to using after-tax dollars. Hear that? “After-tax dollars.”

In other words, you’re contributing money that’s already been taxed – like the money you get deposited into your bank account from your employer after taxes have already been taken out.

That’s an important piece of information because that’s money that’s never going to be taxed again. It’s the opposite of accounts like a traditional 401(k) or traditional IRA where any contributions are made before taxes are taken out.

Essentially, when you take money out of pre-tax retirement accounts later in life, you’ll still owe taxes on anything you withdraw. So, if you’re looking at your 401(k) statement balance and trying to do your financial planning, keep in mind that you’re going to lose some of that well-earned money to the taxman.

But with a Roth IRA, what you see is what you get! When you pull money out of a Roth IRA, you don’t get taxed on it. Nice, right? See how this can be extremely valuable?

And because it’s a retirement account, you’re shielded from being taxed on dividends and capital gains as well. These are huge benefits!

As far as contributions go, here are two important things to be aware of:

- The IRS sets the contribution limit each year. For 2021, that limit is $6,000 ($7,000 if you’re age 50 or older).

- You can only contribute an amount equal to or less than your earned income for that year up to the limit. So if you’re making say $60,000/year, you can contribute up to the limit ($6k or $7k depending on your age in 2021). But if you’re just working a little and only make $3,500 in income for the year, you can’t contribute more than that into your Roth IRA.

Both of these points are important to consider with Roth IRA accounts… including custodial accounts.

Why you should consider opening a custodial Roth IRA for your kids

Ok, so now you know that a Roth IRA is a valuable account to have. And we all know that the earlier you start saving, the better. Check out this chart from Vanguard that shows you how $1 saved at age 55 can be worth $1.48 by age 65. However, $1 saved at age 20 can be worth $5.84 at age 65. Now imagine that with big numbers!

The power of compounding interest can be crazy valuable for an investment portfolio. Invested money and time on your side can make a tremendous difference in your portfolio value later in life.

And with a Roth IRA being one of the most coveted accounts to be able to invest in, how do get one of these babies for your kid?!

The good news is that as long as your kid has earned income, they can qualify. Even informal self-employment work like babysitting or mowing lawns is fair game.

My recommendation is to open an account at one of the “big three” discount brokers who seem to have your interests at heart more than many others:

| Minimum to open account | Annual maintenance fee | Can start process to open the account online? | |

|---|---|---|---|

| Vanguard | $0 | $0 | No |

| Fidelity Investments | $0 | $0 | Yes |

| Charles Schwab | $0 | $0 | Yes |

Any of these three companies are a win for you so choose what makes sense. If you already have an account at one of them, it probably just makes sense to keep it simple and go with that one.

In our case, I went with Vanguard because Faith already has a custodial taxable brokerage account there. I also value that the company is owned by its customers (similar to a credit union).

Because Vanguard’s the one I’ve gone through the process of opening a custodial Roth IRA with, I’ll take you through the process.

How to open a custodial Roth IRA at Vanguard

I was excited that Vanguard offers custodial Roth IRA accounts since that’s where we have all our investments. However, they don’t make it as easy as the others for some reason. It’s not difficult but for some reason, you need to talk to someone first – you can’t just log in and open an account online.

Instead, you first have to call their “retirement specialists” at 800-551-8631. You tell them that you want to open a custodial Roth IRA and then they send you a “special link” for you to start the process. Essentially, you’re still opening the account online, but you still need to call them first to get the process started… why?!

UPDATE 05/03/21: One of my readers gave us some great information as a comment to this. It looks like you don’t necessarily have to call Vanguard and sit on hold. They provided him with the following info:

I found a way to open the custodial IRA with Vanguard without having to call! (Of course I did have to call the first time and wait on hold FOREVER.) Then they told me how to get to the correct form without needing a link.

Sign in to your Vanguard Account.

Go the the “Forms” menu on on top-right of screen.

Select “Open or transfer a retirement account”.

Select “Open a personal IRA”.

Select “Open or upgrade a retirement account”.

Follow the rest of the process exactly as you described.

That might save you some time… thanks for the info, Ryan!

Anyway, it’s pretty straightforward from there except for one very important step I’ll mention as we’re going through this. I opened Faith’s account recently (March of 2021) so if you’re reading this sometime in the distant future, be aware that the steps may have changed.

Also, be aware that you can click on any of the screenshots to see a larger version. And if you hold down the CTRL key when clicking on it and it’ll open in a new tab. Cool trick, right? This works for most links on other websites as well.

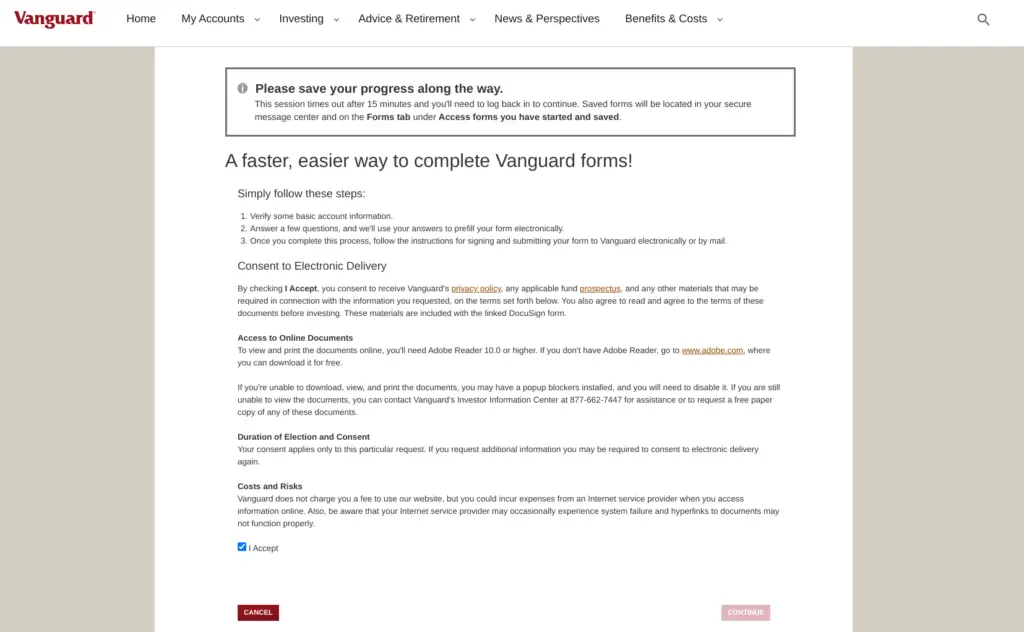

When you first click on the special link Vanguard gives you to open a custodial Roth IRA, you’ll start with a disclaimer that you need to accept to continue…

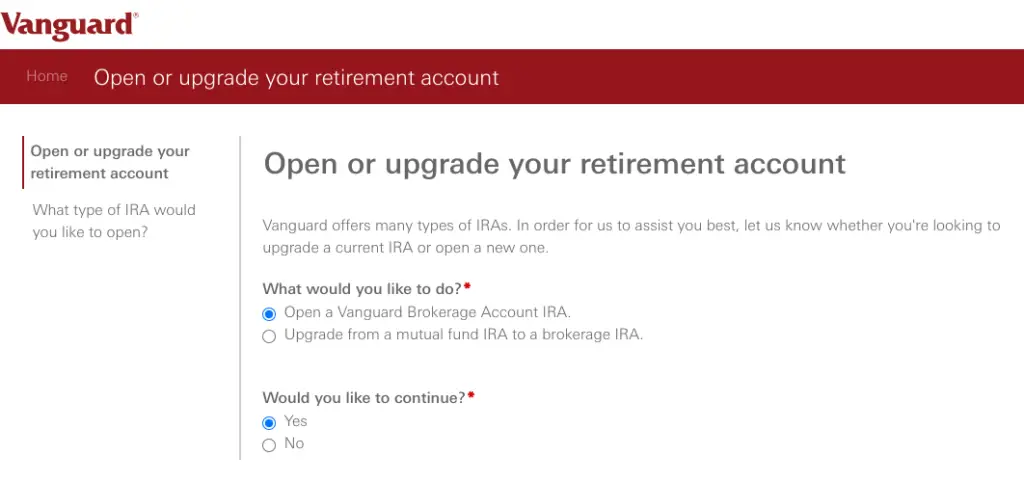

Now, you’re ready for some fun. On the first step of the application, you’re going to choose that you’re opening a Vanguard Brokerage Account IRA…

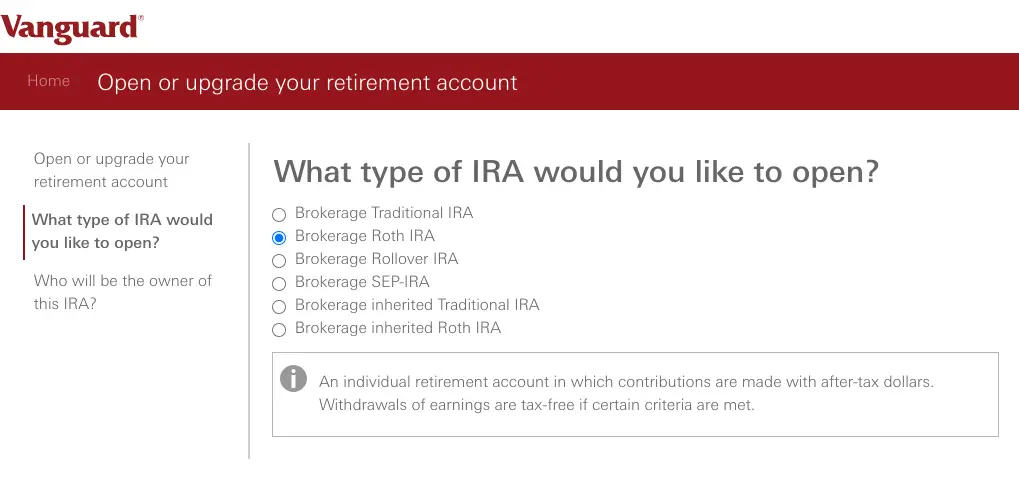

The type of IRA you want is a Brokerage Roth IRA…

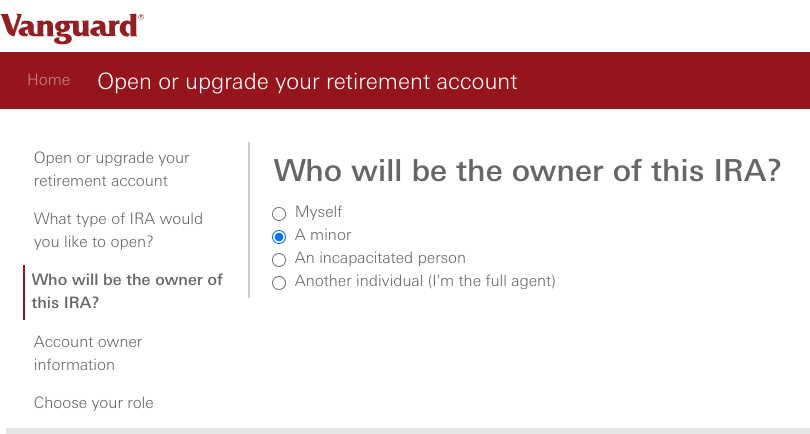

The owner of the IRA is going to be a minor. Your child will own the IRA even though you’ll be the custodian of it until they turn 18…

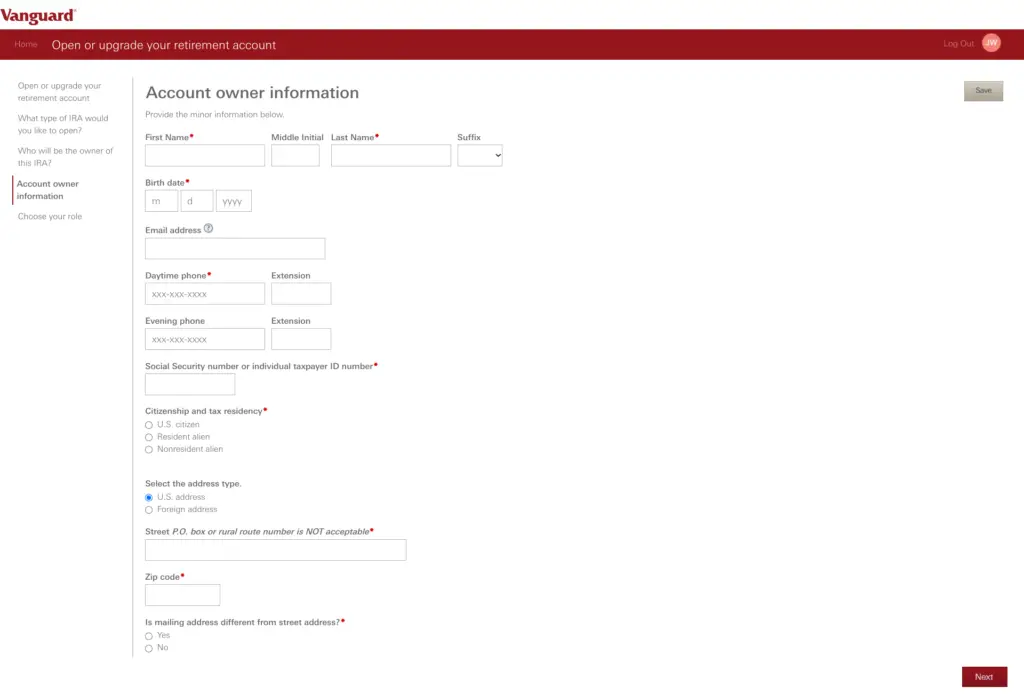

Then you get to fill out the account owner information. As a reminder, this is the info for your child, not you…

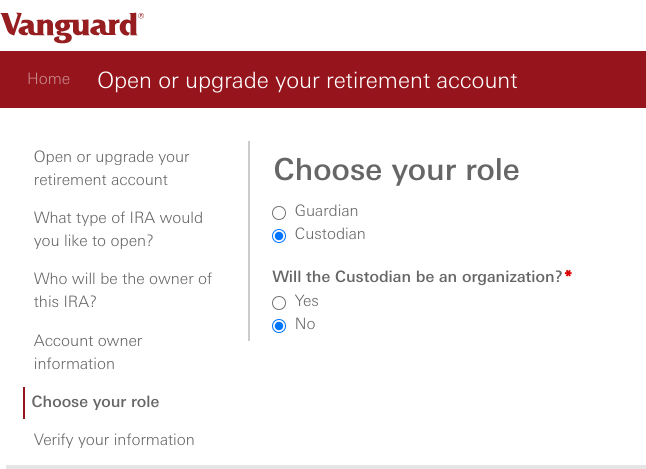

Next, you’ll select whether you’re the child’s guardian or custodian. Since I’m Faith’s parent, I chose “Custodian” here…

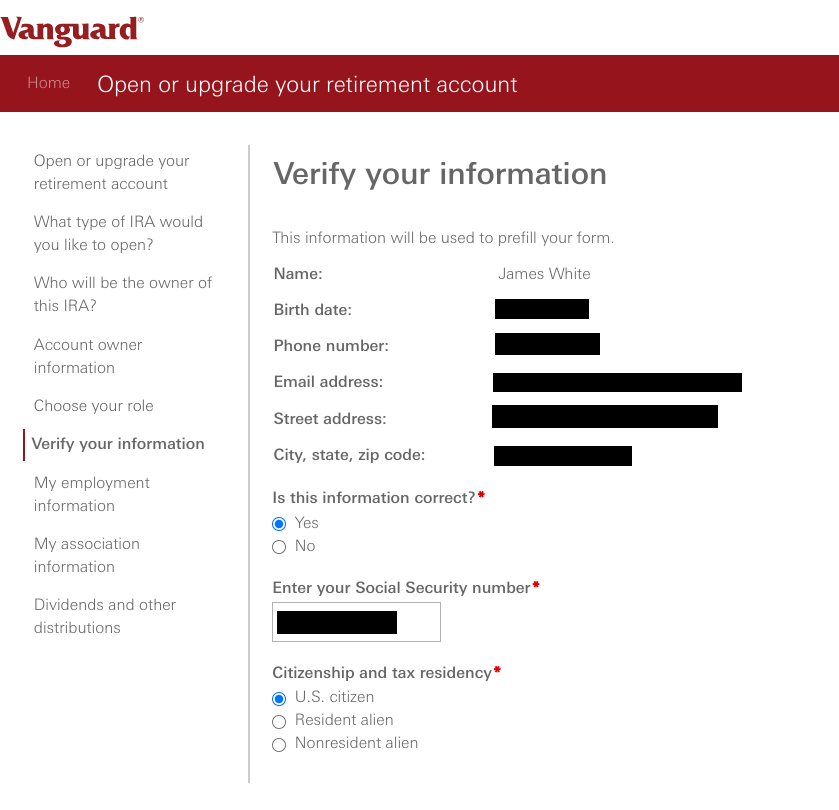

Because I was already logged into Vanguard with my account, it filled in my info automatically. If this isn’t the case for you, you’ll need to manually do this…

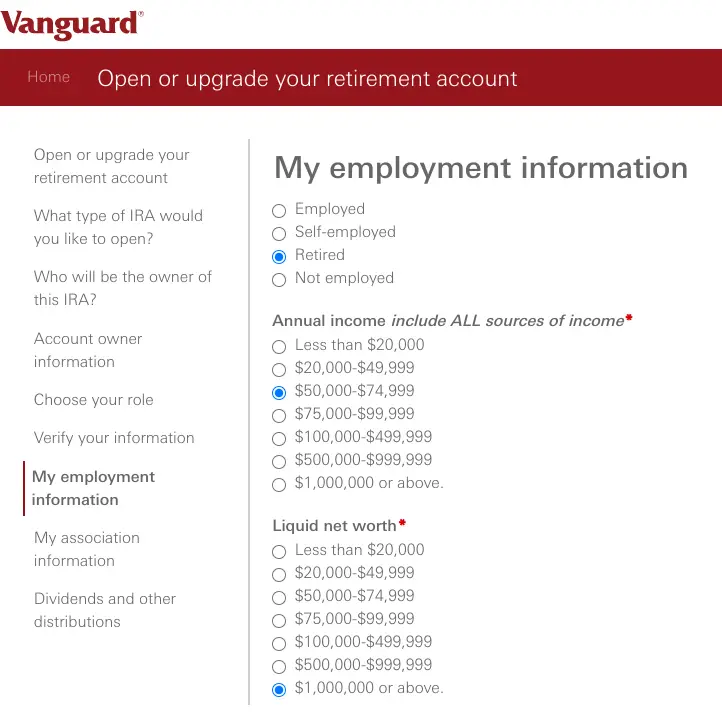

Then they ask you some information that’s really none of anyone’s business but I believe they’re required by law to gather it regardless…

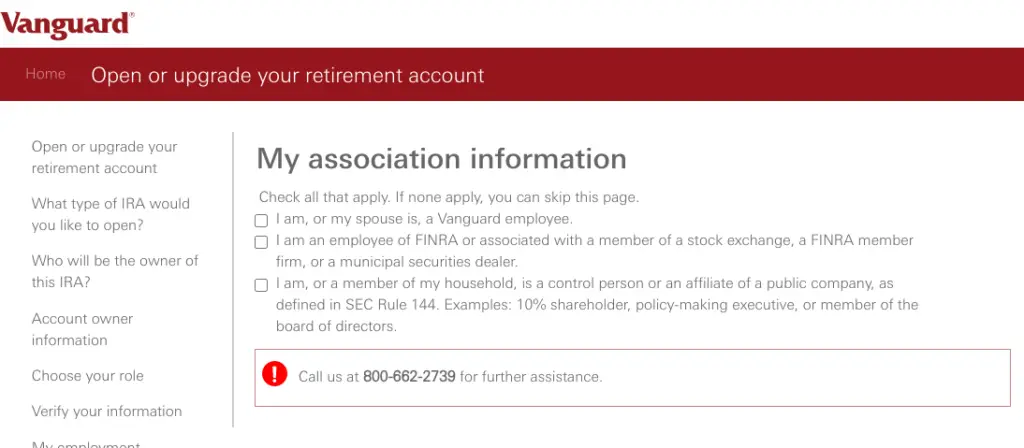

Then it’ll ask you about whether you’re connected to anyone in the biz…

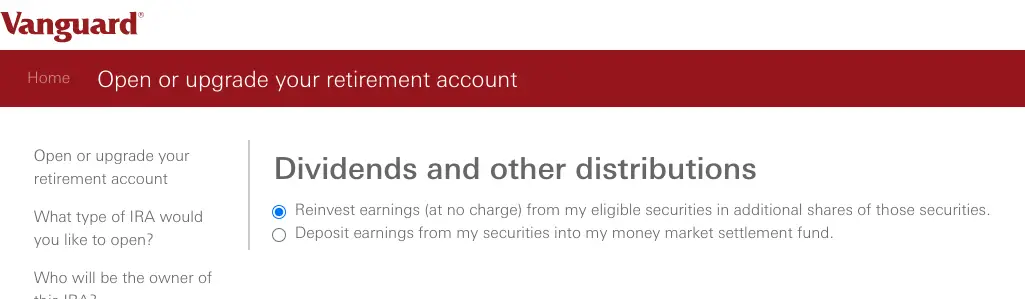

With this next option, you’ll choose what to do with dividends. With a custodial Roth IRA account that we’re hoping will just continue to grow over the years, I would think most folks would just want the earnings reinvested. However, that’s up to you…

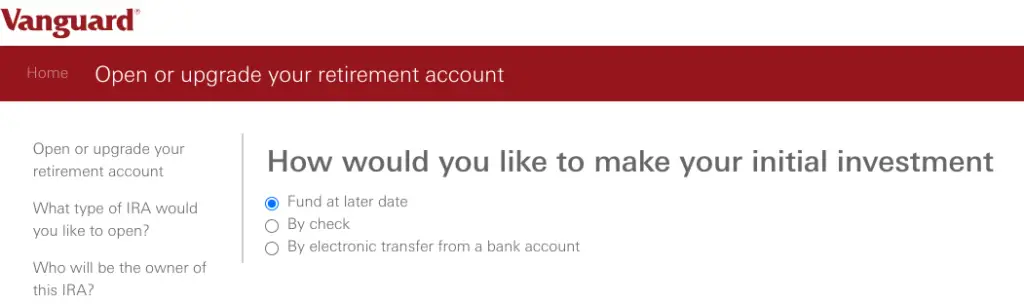

Now, here’s where it gets a little weird. They ask you how you want o make your initial investment. The first time I filled out this form, I checked the option to transfer funds from my bank. Once I got through with the entire application, it created an 87 page PDF document. The site then told me I had to sign and mail a good chunk of those pages back to Vanguard to complete the process.

With us in Panama right now, that makes this a complex process. So I called Vanguard again and the rep was surprised that it wasn’t letting me sign electronically. When I asked if it was because I chose the options to fund from my bank account (where I’d also have to send in a statement or voided check), she was pretty sure that was the cause.

So she sent me another application link and I started everything over. This time, I chose “Fund at later date” and I was able to just sign everything electronically. Better yet, when all was said and done, I was able to just fund the account from my bank account that was already tied to my other Vanguard accounts.

I’d suggest you choose “Fund at a later date” just to get the account open without hassle. After that, you can get the connected bank account done separately if you don’t already have one tied to Vanguard already…

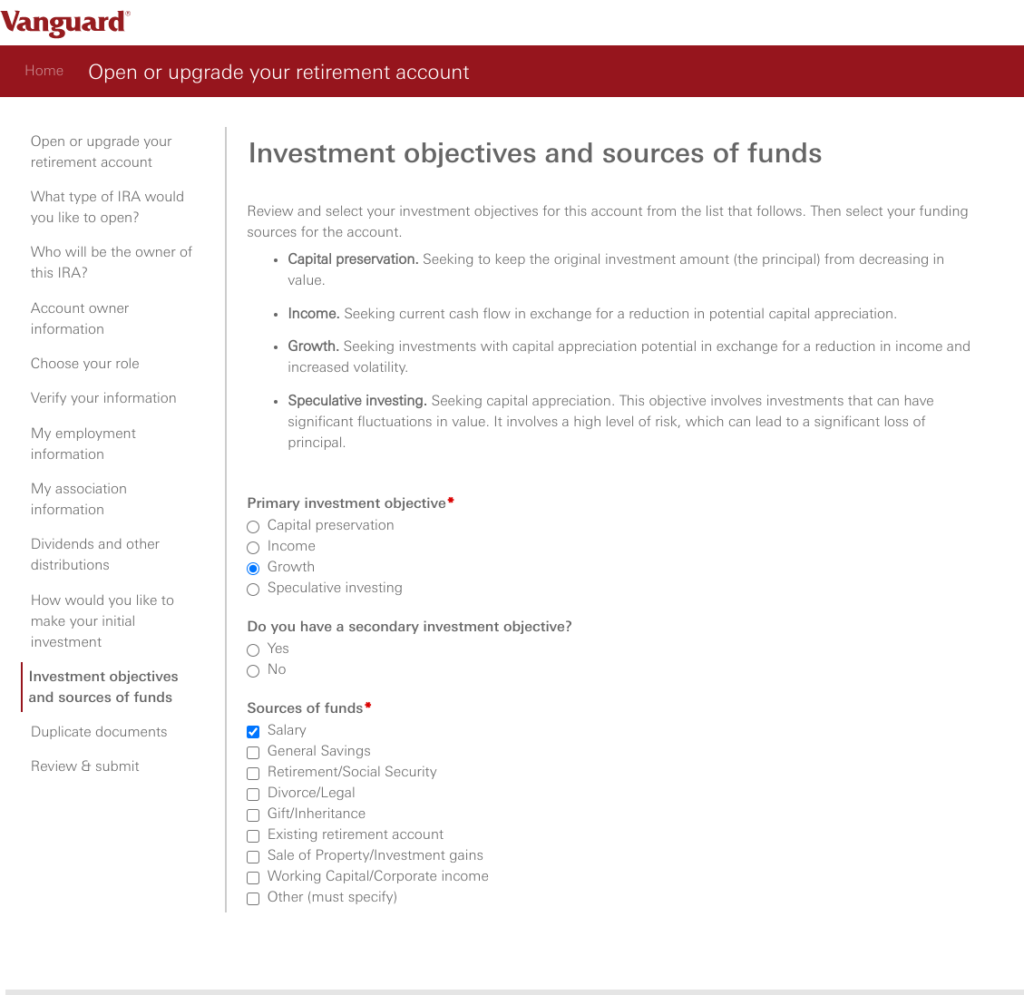

More information that’s none of their business…

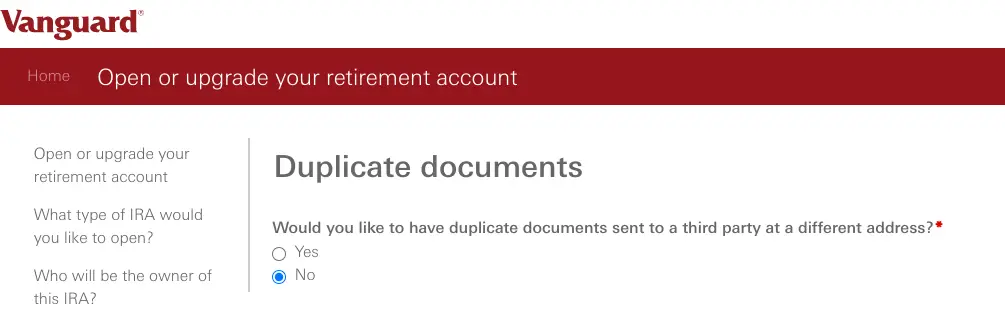

This one’s all up to you. I don’t need any more paperwork in life…

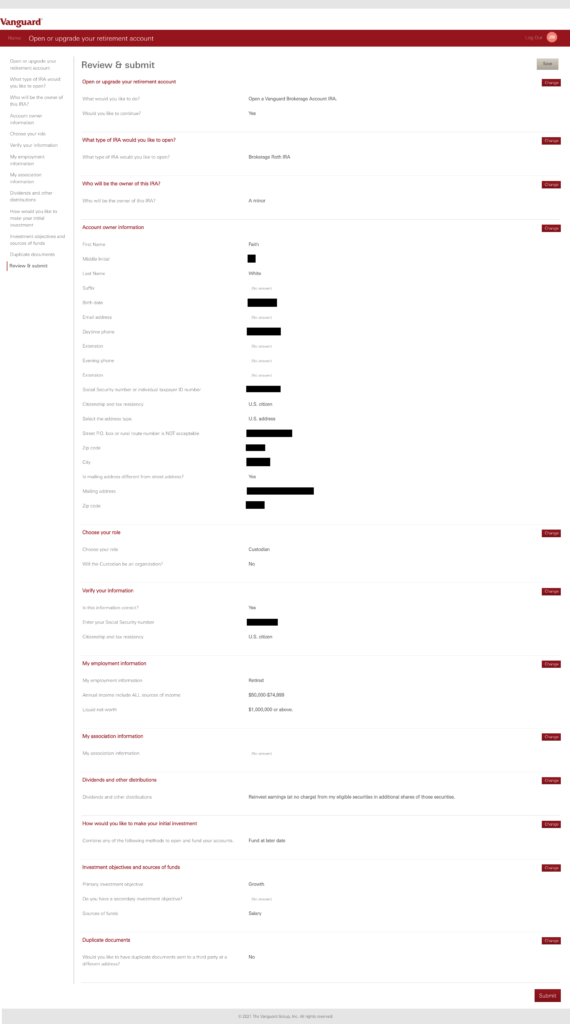

Now it’s time to check things over. I would recommend taking a minute to do this and not just click “Submit.” A mistake could be a real pain in the butt to correct later…

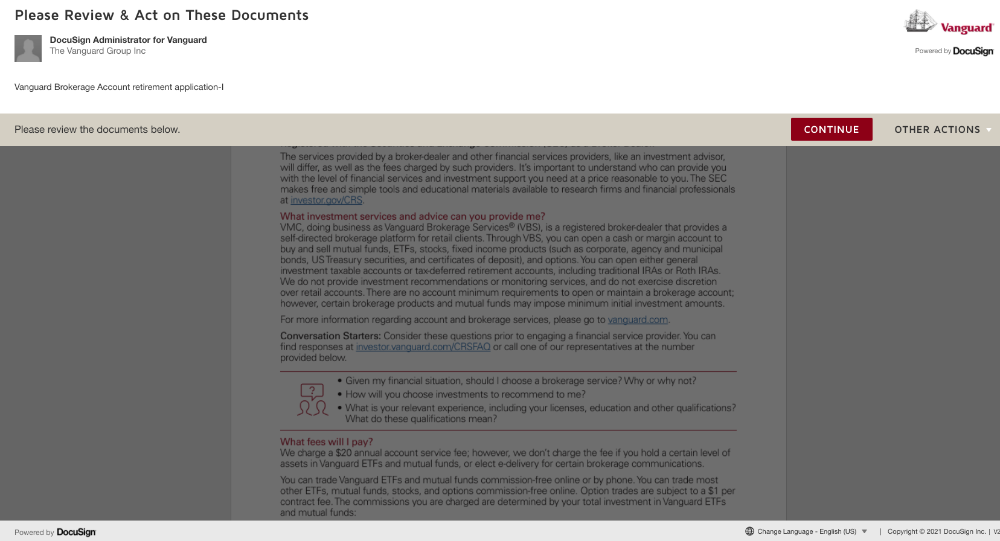

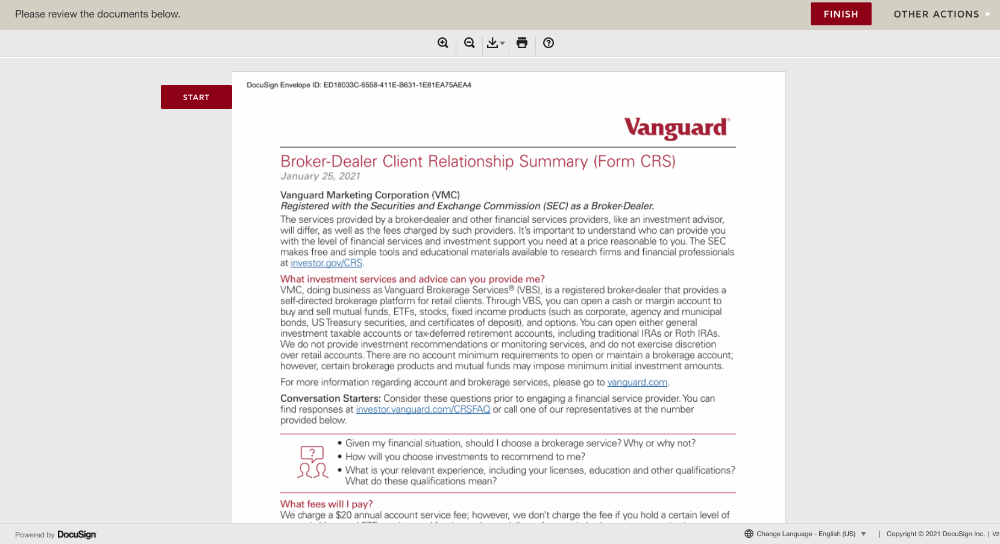

Once you submit the application, it’s time to do a DocuSign electronic signature…

Finish that and you’re done!

It took a day or two for the custodial Roth IRA account to show up on Vanguard’s site for me. I was surprised that I didn’t get any emails communicating the process along the way. I just happened to log in and there it was.

It also showed up automatically in Empower (formerly Personal Capital) since that account falls under the same Vanguard login I use. Empower (formerly Personal Capital) helps me easily track our net worth, see all our accounts in one place, and manage our investments. I highly recommend trying it out (free!) to get your finances in order.

In this case, though, I deleted Faith’s account from Empower (formerly Personal Capital) because her retirement account is not part of our net worth. I also don’t include her savings account, 529 plan, or taxable brokerage account.

You can fund your child’s account in whatever way works best for you. In my case, Faith has a separate online savings account already set up with Ally Bank. So when I pay Faith for photos she takes to use on this site or for her modeling for the blog, I’ll pay her from my Route to Retire business checking account. That money goes into her savings account at Ally. Then I’ll go to her account in Vanguard and pull the money from her savings and invest it accordingly.

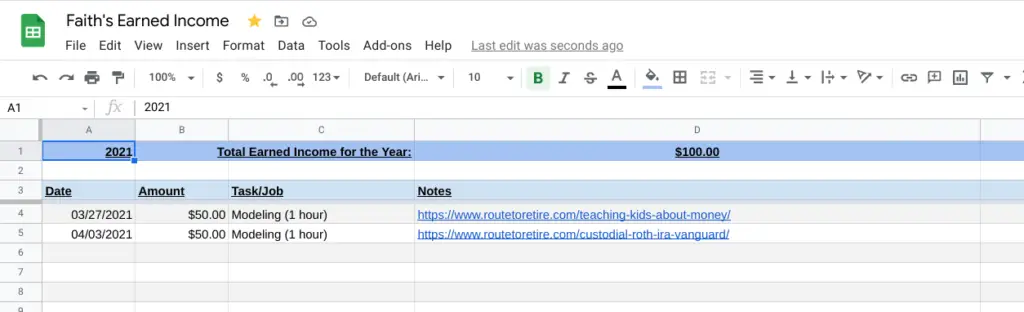

Using the above system will help keep everything in line on a transaction-by-transaction basis in case I would ever get audited. I also created a quick spreadsheet that I’ll use to keep track of her earned income every year – again, this will help ensure that we’re complying with all the rules in the case of an audit.

That’s it, folks! I hope you found this helpful. I wish that I had opened a custodial Roth IRA for Faith earlier. But at 10 years old, this should be a great start to the habit of saving for retirement. And when she gets a regular job at around 16, I hope to push her to continue contributing to the account without missing a beat.

If you have kids, do you have or have you considered opening up a custodial Roth for them?

Plan well, take action, and live your best life!

Thanks for reading!!

— Jim

Short answer is yes.

I originally had the regular custodial accounts for my boys. Have been selling them off to move money to their Roth’s as they earn income from working. I might even gift them money and fund their accounts when they are working adults to give them a little inheritance early to let it grow tax free.

That’s fantastic that you’ll be able to help fund their accounts when they’re working later, Scott… and a very smart move, too! 🙂

You know, I really appreciate how thorough you are. This was also evident when you took us through the airport and on the bus ride from Costa Rica to Panama. I value your writings so much. I am coming to Panama in early June with my grandson. I find this stuff priceless. I will be opening an account for him before we leave. Keep it coming…

Haha, thanks, Wenonah – my thoroughness is both a blessing and a curse!😂 I’m glad you’re finding the content helpful – comments like yours are what make me continue sharing information.

Enjoy your stay in Panama in June!

My son’s custodial IRA is with Fidelity. It was very easy to open. That’s the main reason why I went with Fidelity instead of Vanguard. His UTMA is also with Fidelity.

I think the Fidelity website is a bit better than Vanguard. Vanguard seems a bit outdated. But they are both good for long-term investors.

Agree on all counts, Joe. We have everything through Vanguard (except my HSA through Fidelity) so that’s why we opened the Roth there. Vanguard’s site is a LOT outdated but it gets the job done. It’s hard to lose with either one of them though (and maybe Schwab as well).

Huh. I would have thought that a parent would be the guardian unless someone else has custody of the kid. As in, a guardian’s responsible for the kid physically and financially, while a custodian is just responsible for this financial account?

That part of the form initially made me stop and question the choices as well when I filled it out, Caro. And your comment made me second-guess my choice as well. 🙂

So I just called Vanguard to confirm that information and thankfully, I chose correctly. I think we were both overthinking things, but put simply, a custodian would be for the parent of a child whereas a guardian would be when you’re granted court-ordered guardianship of a child.

Gotta love it when institutions pick names that equally plausibly could mean the exact opposite 🙂

This is a super underrated recommendation. A dollar invested at the age of 0 has a huge potential to turn into multiples of that by the time the baby goes off to college. Compound interest is such a magical thing and the best part is that the child has no idea what is working for them or against them, so the impatience factor is out of sight, out of mind.

Great tips. Tax advantaged accounts are the best things ever!

Thanks, David – I hope this will help provide a solid foundation for her financial future!

Hi Jim. Great article! Would you recommend I go ahead and open one for my child (my son is 6) even though he has no earned income? Obviously I wouldn’t fund it until he does, but I like the idea of getting the setup complete so it’s ready to go when the time comes.

Also, based on my research, it seems like the only option for someone as young as my son is self employment via modeling (similar to your daughter). Have you come across any other options for that age range? Thank you very much!

Hi James – I can’t see why you couldn’t open an account for your son now unless they automatically close the account with a $0 balance for so long. I’d call the brokerage you’re considering (Vanguard doesn’t require a balance to open an account) and run it by them just to make sure there are no gotchas we’re not thinking of.

As far as the income options go, there’s not a ton I can think of until they get a little older. But doing self-employment is also a positive direction to show your son anyway. If you’re creative but fair, I’m sure you can think of some good ways for him to earn self-employment income until he’s old enough to get a job. Here’s an article that might be helpful: How To Make Money As A Kid

Thanks for the great information! I was just getting prepared to open a Roth IRA for my kids who made just a couple hundred dollars last year cutting grass. I’m going to ask the neighbor to sign a form with all the dates and amounts to have an “official” record. I also have our other accounts at Vanguard, and I really appreciate each step you described in opening the custodial account and the tips to keep it simple!

That’s great to hear, Cindy – your kids are going to appreciate that later in life! 🙂

Very helpful! My son is just 3, but many people have told me that he should model. It looks like I should look into it more so I can get a Roth set up for him.

As long as he can get some earned income on the books, the Roth IRA can be a huge benefit to his future, Amanda. Good luck!

Very helpful! Thank you!

I found a way to open the custodial IRA with Vanguard without having to call! (Of course I did have to call the first time and wait on hold FOREVER.) Then they told me how to get to the correct form without needing a link.

Sign in to your Vanguard Account.

Go the the “Forms” menu on on top-right of screen.

Select “Open or transfer a retirement account”.

Select “Open a personal IRA”.

Select “Open or upgrade a retirement account”.

Follow the rest of the process exactly as you described.

Great information, Ryan! I updated the article with your information… hopefully that saves some other folks some time. Very much appreciated! 🙂

Thanks for this informative article. Don’t you need kid to file taxes with IRS when they contribute to ROTH and then pay FICA on their earning? I’d my 17 yo son contribute to ROTH his tuition earning but then we were advised to file taxes and pay FICA for self employment.

Hi Monty – according to Intuit (the makers of TurboTax):

As far as FICA goes, Nolo states:

I’m absolutely not a tax expert by any means and I’ll learn more when we pass everything along to our accountant to file our taxes next year. In your situation, it probably makes sense to check with a CPA to find out for sure, but I’d think that FICA wouldn’t come into play until he turns 18.

I would like to open a custodial IRA for my grandson – is this allowed?

I believe the answer is yes on this, Marie. Here’s a little more info:

https://www.investopedia.com/open-a-roth-ira-for-someone-else-4770855

Just remember that they must have earned income greater than or equal to the amount you contribute to it each year.

Thank you, very much. I give him $10 each week to do little chores around the house and he has saved quite a bit over the years. So, we spoke about it and agreed we can start with $1,000 from his savings and work to open a Roth IRA with Vanguard. Going forward, he will work to deposit $5 or $10 each week as he earns money for doing things for me. It’s not a lot of money, but he’s 13-years old now and very interested in saving and watching his money grow in an investment account instead of sitting in savings acct. I’m a little worried it may impact college tuition grants and/or financial aid – but, I feel like I read somewhere savings/retirement accounts (it will still be a fairly modest total balance for him when he reaches college age) don’t really impact college students all that much.

Be careful about what you’re counting as earned income. My understanding is that household chores don’t usually count though perhaps they might since your in a different household but I’d recommend checking with a tax professional to be sure. Usually, things like mowing lawns around the neighborhood or babysitting are more up the alley of what is legally accepted.

My understanding is that as retirement accounts, Roth IRAs are not reported on the FAFSA unless withdrawals are taken. That’s another reason why this can be such a valuable asset for kids.

It looks to me that Vanguard has a minimum of $1000 investment to open. Did you find this not to be the case?

Hi Michelle – there’s no minimum to open the custodial Roth IRA at Vanguard. In fact, you can open an account with $0 in it. There are minimums on some investments though that you might want to invest in within the account. For instance, VTSAX has a minimum investment of $3,000. However, its equivalent in the ETF form is VTI. VTI’s only minimum is the stock price (a little over $218 today).

For our daughter, that’s exactly the investment we’re using in the account. So, I fund the account slowly since she doesn’t have a lot of earned income. The money just sits there in a money market account. But once she gets enough for a share of stock, then we buy a share… slowly but surely!

Hope that makes sense and good luck!

Great advice!! Thank you for taking the time to write this article!!

No problem, Crystal – I hope it’s helpful for you!

Great article. I never knew about custodial Roth IRA’s until watching a video on TikTok (of all places) lol. This lady said all her children, 13, 8, and 5, has one. I thought this was a great idea to help with positive money education. My youngest son is 13 and he helps us with babysitting his 3 year old sister. So I’m assuming he can “bill” us for his services so there’s a paper trail in case of an audit? My oldest is 15 and working at McDonald’s. So I need to get him one as well so he can add money to it. Again, great article.

Thanks, Kevin! The 15-year-old is a gimme – get that Roth going! 🙂 And don’t forget that you can add money to it as well with the caveat that the total can only be up to the amount of earned income he made (and up to the federal max allowed each year).

If the rates your 13-year-old were charging were fair, that might be acceptable, but I would definitely run that by a professional first. If it was for non-family, my understanding is that’s legit. But since it would be for family, I’d make sure just to be safe. Smart move on the paper trail regardless. Good luck!!

Thank you so much for laying all this out and updating the info! My daughter has earned income from acting and this is such a great way for her money to grow, such a small thing I can do to help that will be so large later in her life 🙂

That’s fantastic, Beth – that’ll be a great start to your daughter’s financial future! 🙂

Thanks so much for this valuable post. I found it when trying to find out the best place to open a ROTH IRA for my 16 year old. I opened it at Vanguard and your step by step instructions were so helpful. I was sad to hear that I could not utilize the VTSAX because it required a $3000 initial investment. Will have to do research on ETF’s. Thanks again.

So glad you found value in the post, Jeanette! Hopefully, once you do some digging, you’ll find that VTI is identical to VTSAX except for a couple of small differences (mostly in how they’re bought and sold). Best of luck!

Good article…thx for the step by step. Vanguard does not make anything easy on their website. I stick with them tho because they’ve been through thick and thin for decades so I trust my money there. For those with younger kids about the only option outside of education accounts are UTMA’s They aren’t perfect but do allow you to start growing money for kids as soon as they’re born if you want. I don’t really see how one could justify opening a Roth for toddlers and little kids. Only very few would have actual earned income (like acting as some others have mentioned), but how many kids are out there acting!? Lol. Once the child is old enough and earning income, then open the Custodial Roth and begin selling the UTMA and convert over. This is what I’m doing…all perfectly legal btw. Just make sure you aren’t taking any of that gift account money back for yourself and you can’t convert more than they make (or $6k per year whichever is less). Keep good books in the unlikely event the IRS ever comes knocking. I don’t think they’re bothered with small fish like most of us but better for your peace of mind. Roth accounts are awesome, and I recommend getting every kid you can into one as soon as possible. Train them young that 10% of every payday goes straight to the Roth before one nickel gets spent on pizza or gum!

Thanks, Tom! Along the lines of what you’re saying, I doubt my daughter will stack a ton of money in her account right now. However, it’ll be a nice foundation that I can hopefully continue to keep her on track with once she starts earning income from a regular job. Love all your thoughts on this!

First off , awesome article . You make it very easy to follow along and open a a custodial account . I have 4 and 6 year old kids who live with myself and my wife . Am I able to open accounts in deposit money in for them even though they are too young to have any earned income? I’m curious what people claim as earned income for such young kids.

Thanks, Jared – unfortunately, you can’t put money in their accounts unless they have earned income. What I did for my daughter when she was younger was to open a custodial taxable account at Vanguard for her. With that, I was able to contribute without having to worry about the earned income (though you don’t get the tax benefits of a Roth IRA). But I put in about $2,500 until she was a little older to get some of the earned income I talked about in this post.

It’s tough to find qualifying opportunities for very young children, but things like legitimate acting or modeling gigs are a couple of thoughts.

Best of luck!

Thank you so much for the step by step. I was able to set up and fund the account for my 17 year with Vanguard. One question…right now I have to log in for my son to see how the account is doing. Is it possible for him as a minor to have his own login or no? Trying to avoid calling and sitting on hold, but I can’t seem to find an answer to this anywhere.

Hi Dawn – yes, you can create an account for your son as well (we have one for our daughter). On the login page, you can choose to “Set up your user name and password.” Fill in your son’s info and it should recognize that he already has an account there since it knows his SSN from the custodial Roth you already set up. As a minor, there are some options he won’t have once logged in, but he’ll be good to go otherwise.

Good luck!

Thank you – this was an incredibly helpful step by step process for setting up an account for my 14 year old son with his first job!

Awesome, Sarah! That’s a giant step toward a successful financial future for him!

This is exactly the info I needed! Would my child be able to contribute now before his first time filing taxes or will he have to wait until he’s filed and then begin next year? He has money saved up from mowing the neighbor’s lawn this year, but he won’t be filing taxes until 2022 for the first time. I guess I’m asking if he already must have earned income on record before he can contribute or if we can contribute then file taxes to prove earned income. Thank you!

Hi Devon, here’s my disclaimer that I’m not a CPA and you should talk to a professional first, but it should be that he can contribute now. The contribution is based on the earned income. When he does his taxes next year, that will be for the 2021 year anyway so he should be good to go.

Good luck and that’s awesome that he’s getting started on building his future already!

One thing of note when paying your kids from a business. According to my CPA, the IRA rules are outdated and do not allow for electronic transfers to the child’s account. You need to write a physical check to keep out of trouble in an audit.

Great write up! It helped my set up the custodial account, especially the comment on where to find the link and avoid the phone call.

Interesting, Phil – I won’t comment on the rules per se since I’m not a CPA. I’ll just say that the way that I do it is electronic but I keep a trail to make sure it flows correctly. In my case, I’m paying her for work she does for my business so I make sure to pay her from that account – a transfer from my business checking to her online savings. I then move money from her online savings to her Roth IRA. By not skipping any steps (ie going from my account to her Roth), I feel that I’m covered in case of an audit. I also have a spreadsheet to document her earnings (the date, the amount, and what it was for).

Glad you got the account set up online, too – nobody likes to spend time on hold waiting for customer service! 🙂

Thanks HUGELY! This is EXACTLY what we were wanting to do today. Thanks for falling into all the pits for us and sharing how to avoid the problems (like using the “Fund Later” option in Vanguard to avoid triggering an 87 page document).

Glad it was helpful, Colin! Hope your holidays are wonderful!

I have been searching information online, about this topic; and came across your article. It combines a lot of what I found in a more clear way. Thanks! I did have a few more questions:

What did you look for when opening a bank account for the minor? Do some brokerage firms also offer “banking” type accounts? It seems like it would be easier to have it all with one company. Until the minor reaches their teens, I don’t imagine they would need any banking services except a place to deposit money to be transferred to the Roth.

My nieces have all had babies in the last year, and I wanted to open Roths for each new child. I believe I read somewhere where this is possible, even though I am not their parent or guardian. Do you know if this is true?

Lastly, many of your comments have the caveat of checking with a CPA. I would like an opinion from the source, the IRS. I want to create a documented “paper” trail that everything I did was deemed legitimate by the IRS. I also wanted guidance from them as to what would be reasonable fees from modeling, what documentation is needed for this earned income, filling appropriate tax forms, etc.

I would hate for the child to find out 60 years from now that a mistake was made at the outset that creates withdrawal problems when they retire. That would be horrible.

I figure, why not go to the source, the IRS, to get the answers. Any advice on getting information from them?

Thank you so much for your time.

Hi Thomas – a few thoughts…

1) With the Roth IRA, the person needs to have earned income in order to be eligible to contribute anything. So with your nieces’ babies, that’s not going to be a likely scenario unless they’re bringing in legitimate income for paid modeling gigs or something along those lines. Chances are, you’ll need to wait a number of years until they’re able to earn legitimate money.

2) As far as bank accounts go, that one’s a little easier. Custodial accounts can be opened for a minor and operated by an adult. Once the minor becomes an adult, the account is theirs. In our case, we have a couple of savings accounts at Ally Bank so that’s where we opened our daughter’s account (long before we opened a Roth for her). The online account earns more interest than you could get at a “bricks and mortar” bank and having it at the same place as ours makes it much easier to transfer funds to her account as needed.

There are some brokerage firms that offer bank accounts (our checking account is at Schwab). But if the intent is to earn some interest for the child, a savings account is the way to go and an online savings account will generally provide interest many times over what an old-school gives.

3) You can try contacting the IRS (https://www.irs.gov/help/telephone-assistance). I’ve never done that so I can’t tell you how smoothly that will go. However, if you already have a good accountant, they can probably answer any questions you have without a problem. As far as withdrawal problems, I don’t think that would be much of an issue. If there were concerns from the IRS, that would likely come at the onset and not so much later on. In most cases, the IRS only has a 3-year lookback on returns though a decade is probably a better safe than sorry duration to have all bases covered.

Again, I don’t think the Roth is going to work for the babies until they get to the point they can qualify as having earned income, but I hope this is helpful regardless.

Good luck!

Thanks for the helpful information.

Our daughter has some youtube earnings from her channel last year. Can this be considered as earned income for Roth IRA? Youtube channel was created from my (parent’s) account since she is a minor, would that be an issue for record-keeping?

Hi Saravanan – I have my thoughts and I think that should be fine if it’s well-documented. However, I’m not a CPA (nor do I want to be one! 😂) so my opinion doesn’t count. You’ll definitely want to talk to a professional to get their insight on this to be sure.

Also there is income limit for Roth IRA for Adults (over a certain income limit, one cannot contribute to Roth). Does parent’s income limit apply when opening kids Roth IRA account?

Thanks.

I don’t think this would have an effect on a Roth for your child, but like I said above, my opinion doesn’t matter. Check with a CPA to be on the safe side. Good luck – this is a good thing you’re doing for your daughter! 🙂

Wow and thank you. I had been planning to do this and so was reading various posts. Finding your step by step guide article was the one that finally got me to take action.

I do have a question…if the account is being funded based on earned income from babysitting or lawn mowing (just as 2 examples), does that need to be a tax return filed by the child in order to make a contribution?

Is there any need for a schedule C to report this type of “self employment” income?

Again thank you

Glad it was helpful, Billy! Again, I’m not a tax expert so don’t take this as gospel – this will be the first time we do this with our daughter’s earned income. But my understanding is that if your child earned more than $400 in income, it does need to be reported as income on a Schedule C form. Based on what I’ve heard from others, I’m banking on this being a relatively easy process, but I guess I’ll be finding out when I do our taxes here soon! 🙂

Thank you for the great information! After not getting anywhere on the Vanguard site, I was able to open the custodial account with your instructions.

Awesome! So glad to hear that, Kate, and congrats on helping to pave the way for your child’s financial future!

Thanks for putting this step by step guide together, it is really helpful.

All of you setting up IRA’s for your kids/grandkids, great work. After your love, this is the greatest gift you can give them.

Thanks, Bob – a lot of kids might not realize how valuable this is when they get it. But if they just leave it alone and let it grow, it could be one heckuva fantastic start to an awesome future!

Very helpful and just completed today! My only problem was that I chose fund at a later date and it still kicked out a 20 page document that I had to mail in.

Glad it was helpful, Robb, and congrats on opening the account for your kid! Shaking my head that you still have to print the long document to mail in… ugh. 🙂

Hi Jim, thank you for all the instructions well outlined. With vanguard After entering the child’s checking bank account info to fund the child’s Roth IRA , who should the sign the document after entering the child’s bank info given the child is still minor and owner of the bank account is minor . Thank you!

Hi San – I don’t remember that specifically, but my guess is that it would be you since you’re acting as the custodian for the child. If you want a for-sure answer though, you can give Vanguard a ring to double check. Good luck!

Do I need to file taxes for them when I contribute to their custodial ROTH IRA accounts

Hi Rizwan – I’m not a tax expert so you should probably check with an accountant, but there are a few things I’ve found to be aware of. First, if you’re the one paying the money to your child (he/she is working for you), then $600 or more for the year will require you to create a 1099 for them. If the earned income is from a job elsewhere, that’s their employer’s job to handle.

Other than that, the rules on whether or not a return needs to be filed can vary on circumstances. Here’s a good start on that one (specifically the section on “When Your Child Must File a Tax Return”: How to File Your Child’s First Income Tax Return. In general, if your child has earned income above $12,950 (in 2022), a return needs to be filed.

All that said, I did a return for my daughter just to be on the safe side. It was easy and took almost no time at all and the only hassle was that the first return needs to be printed and mailed. Next year, I can just file electronically.

Hope that helps!

I’m happy and thankful that I found this blog today.

I’ve two kids, one is a minor but other one is 19.

Can I open a regular Roth IRA for 29 year old?

For my minor, what happens to their Custodian Roth IRA when they turn 17?

These might be silly questions, but excuse my lack of knowledge.

Ignore the previous comment, there was a typo on age.

I’m happy and thankful that I found this blog today.

I’ve two kids, one is a minor but other one is 19.

Can I open a regular Roth IRA for 19 year old?

For my minor, what happens to their Custodian Roth IRA when they turn 17?

These might be silly questions, but excuse my lack of knowledge.

Hi Ravi – yes, your 19 y/o can absolutely open a Roth IRA under his/her name without it being a custodial account.

With your youngest, nothing happens until they turn 18 at which time they’re no longer considered a minor. At that point, the assets now fully belong to the child and you are no longer in control of the account. I don’t know specifically if Vanguard will notify you or your child to do anything or if it just happens automatically.

Good luck!

Thank you — super-helpful.

Awesome – so glad it’s helpful, Mike!

So incredibly helpful. The Vanguard screens and information are still accurate and up to date as of now (March 2023)

Awesome – glad to hear that it was accurate and helpful, Ariel! 🙂