Disclosure: This post contains affiliate links and we may receive a referral fee (at no extra cost to you) if you sign up or purchase products or services mentioned. As an Amazon Associate, I earn from qualifying purchases.

I just finished one of the best money books I’ve ever read. It’s vastly different than other books I’ve read over the years… and that’s a good thing.

Alternating between reading fiction, non-fiction money-related books, and non-fiction books unrelated to finance works well for me.

I love learning new takes on money but I don’t want to become completely absorbed in it. I also want some time for fiction to take me away periodically and allow my imagination to take hold.

That’s my routine. Right now, I’ve already moved on to reading Lord of the Flies. It’s an iconic novel that I haven’t read before… so far, so good.

But I’m not here to tell you about Lord of the Flies – I’m here to tell you about a great money book. This read came about after I happened to notice an Instagram post from fellow early retiree blogger, A Purple Life…

I haven’t met Purple yet, but she’s given some interesting takes so I thought I’d give her recommendation a chance… and it was worth it.

Ladies and gentlemen, The Psychology of Money by Morgan Housel has got to be one of the best money books I’ve ever read. Thanks, Purple! It’s only about 250 pages, but such a great read.

It’s not the same old re-hashed info you get in so many other books. It’s a fresh and original take on money that I found extremely interesting. It’s almost as of you’re getting secret insight into how the world of money actually works. You simply feel smarter reading this book.

Now, before I go on, I want to make sure that I don’t detract from some of the other best money books I’ve read. For instance…

The Simple Path to Wealth by JL Collins is my absolute favorite book on investing. Direct, easy-to-understand, and logical. This is the book I recommend to anyone trying to get a better handle on investing in the stock market.

Click here to check out The Simple Path to Wealth (Amazon link, I’ll get a small commission at no charge to you if you order via this link).

And The Millionaire Nextdoor is a fascinating understanding of how those who “look” like millionaires with their fancy pants possessions are usually the ones who might have a lower net worth. On the other hand, many millionaires tend to drive used cars and live in modest homes. The research presented in this book is truly captivating.

Click here to check out The Millionaire Next Door (Amazon link).

I list a bunch of my other favorites on my Recommendations page if you want to check that out.

But The Psychology of Money is different. It’s not necessarily a numbers book more than it is a practical takeaways book… and I enjoyed this difference more than I anticipated.

I’ve mentioned before how I love to read my books on a Kindle Paperwhite (you need this treasure if you don’t have one!). One of the many reasons I love this device is because I can highlight text or make notes and easily get to it later (it syncs ups to your Kindle notebook if you didn’t know that). I can then easily copy and paste anything I want to reference later as well.

Why am I mentioning this? Because I’ve never highlighted more content in any book than I have in this one – not even close. I usually find a handful of valuable quotes in a book, but in this one, I probably highlighted a quarter of the thing.

That, my friends, is a good sign of why I consider this to be one of the best money books. To find that much beneficial information in a single book is a rarity.

It’s also made this post more difficult for me to write. I had so many amazing quotes from the book that I wanted to share but I removed a ton of them so as not to infringe on copyright protection. Such is life… guess you’ll have to read it yourself to gain some of these great thoughts.

What makes up one of the best money books…

Each chapter of The Psychology of Money essentially presents its own story and a sort of lesson to take away from it. Here’s a listing of the contents of the book…

Introduction: The Greatest Show On Earth

1 – No One’s Crazy

2 – Luck & Risk

3 – Never Enough

4 – Confounding Compounding

5 – Getting Wealthy vs. Staying Wealthy

6 – Tails, You Win

7 – Freedom

8 – Man in the Car Paradox

9 – Wealth is What You Don’t See

10 – Save Money

11 – Reasonable > Rational

12 – Surprise!

13 – Room for Error

14 – You’ll Change

15 – Nothing’s Free

16 – You & Me

17 – The Seduction of Pessimism

18 – When You’ll Believe Anything

19 – All Together Now

20 – Confessions

Postscript: A Brief History of Why the U.S. Consumer Thinks the Way They Do

Housel does a fantastic job of helping you realize that there’s a lot more to personal finance than what we perceive. We only know what we know and fill in the blanks from there.

“Your personal experiences with money make up maybe 0.00000001% of what’s happened in the world, but maybe 80% of how you think the world works.”

— The Psychology of Money by Morgan Housel

That’s a huge reason why we look at things differently than someone else and think each other is utterly crazy. Each of us understands different aspects of money that lead to our own conclusions, which in turn draws us to make our own unique decisions.

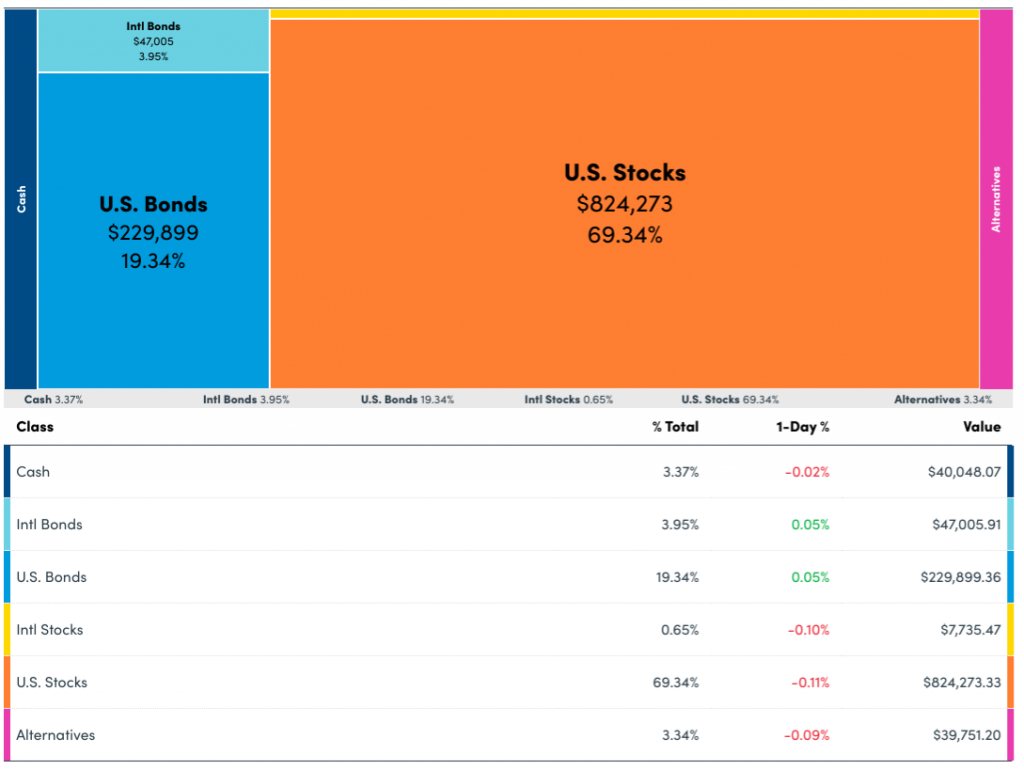

And unlike most books, Housel helps you realize that just because the numbers say one thing, doesn’t mean that our emotions won’t say another. For instance, it’s easy to set an asset allocation based on what you think makes the most sense. And a free account at Empower (formerly Personal Capital) will allow you to easily see exactly where your allocation stands.

So that’s easy enough… at least mathematically it is. But when that bear market hits, it could be a whole different ballgame emotionally!

“Spreadsheets can model the historic frequency of big stock market declines. But they can’t model the feeling of coming home, looking at your kids, and wondering if you’ve made a mistake that will impact their lives.”

— The Psychology of Money by Morgan Housel

That’s the side of money that we don’t generally take into consideration as much as we should when handling our finances.

Here’s an interesting tidbit I didn’t know before that shows how powerful money and emotions are…

“Only 2.5% of Americans owned stocks on the eve of the great crash of 1929 that sparked the Great Depression. But the majority of Americans—if not the world—watched in amazement as the market collapsed, wondering what it signaled about their own fate.”

— The Psychology of Money by Morgan Housel

With such a small percentage of folks invested in the stock market at the time, it’s fascinating to realize that the 1929 crash was such a catalyst for the Great Depression. Emotions (and the media) though are immensely powerful.

What honestly makes The Psychology of Money one of the best money books is that the information is quite logical and you can’t help nod your head as you read it. Housel presents the information in a straightforward way that’s easy to understand, but it’s profound enough that you find yourself thinking, “Wow, that makes so much sense!”

Small insights go a long way…

I really appreciated even the small insights sprinkled throughout the book… things that are dead-on that you might not have thought about before.

“When most people say they want to be a millionaire, what they might actually mean is ‘I’d like to spend a million dollars.’ And that is literally the opposite of being a millionaire.”

— The Psychology of Money by Morgan Housel

That is true, isn’t it? When people fantasize about being a millionaire, they’re picturing themselves out on a monster-sized yacht and returning to a mansion with a full staff waiting on them. It’s the spending that excites people more than just having a million dollars to live a more modest yet secure lifestyle.

Housel does an excellent job of helping you understand what you should be aware of in a broader way throughout the book.

“[G]ood investing isn’t necessarily about earning the highest returns, because the highest returns tend to be one-off hits that can’t be repeated. It’s about earning pretty good returns that you can stick with and which can be repeated for the longest period of time. That’s when compounding runs wild.”

— The Psychology of Money by Morgan Housel

The critics tend to get on him for what they perceive as pushing frugality and index funds. I didn’t see this as so much of a sell though but more of just an understanding that you need to spend less than you make in order to get ahead. And although indexing is mentioned (which I’m strongly for), there’s no sell to you on it.

This isn’t meant to be an instructional book – it’s written to explain how people tend to think about money and how this helps mold your individual thinking.

Feeling good about “pretty good” investing

By the time I finished reading this book, I felt differently about our money. Up until this point, I’ve always tried to take emotion out of the equation. But I realized that that’s not possible. There will always be some feelings that affect the financial decisions we make.

And that’s ok. We’re sitting on more cash right now than probably a lot of folks. And there’s been a part of me that hates that. The money’s just sitting there barely growing at all.

But completing The Psychology of Money helped me feel better about that. Even though that money’s on the sidelines, I sleep better at night because of it. Knowing that we can go through a bear market without having to sell investments at a major loss is instrumental in my sanity.

Another reason I consider this to be one of the best money books is that it’s helped me realize that this can be completely different for someone else. Just because we’re sitting on so much cash doesn’t mean that it makes sense for everyone. Based on what I know, this is a good decision for us.

“No one wants to hold cash during a bull market. […] But if that cash prevents you from having to sell your stocks during a bear market, the actual return you earned on that cash is not 1% a year—it could be many multiples of that, because preventing one desperate, ill-timed stock sale can do more for your lifetime returns than picking dozens of big-time winners.”

— The Psychology of Money by Morgan Housel

You don’t need to be perfect in your financial choices… you just need to be reasonably good. Ask any millionaire if they’ve made financial mistakes in their life and I guarantee that the answer will be a resounding “yes.” I’m no exception to that and we’ve done just fine so far.

“Become OK with a lot of things going wrong. You can be wrong half the time and still make a fortune, because a small minority of things account for the majority of outcomes.”

— The Psychology of Money by Morgan Housel

Understanding that you don’t need to be perfect in your investing and can still do just fine should be a weight lifted off the shoulders of many. So many folks are so overwhelmed by the breadth and complexity of possible investment options that they simply don’t invest at all. Don’t take that road – focus on understanding a piece well and then take action.

Continue to learn and as you make mistakes (you will), make corrections accordingly and your nest egg should continue to grow.

I’m now incorporating some of this book into my personal finances lessons for Faith’s homeschooling curriculum. Although some of it might be a little too much for her, there are too many valuable tidbits in this book not to make this part of her personal finance education.

If you’re looking for something new to read, I’m sure you’ve figured out that I highly recommend The Psychology of Money. Sure, I appreciate you using my Amazon affiliate link to get it (at no extra cost to you). But get it from the library if you want – it’s absolutely worth reading no matter where you get it.

Plan well, take action, and live your best life!

Thanks for reading!!

— Jim

I’m ready for a good general read so I’ll check it out. And don’t fret the cash allocation. For my part keeping 4 years of spending in cash/bond ladders keeps me sleeping at night. If you want more punch in your cash, US I bonds are paying 5.3% for next six months. There are some restrictions but can still be useful for part of the cash stash

I’ve been starting to read more about I bonds lately so maybe that would be a good option for me to consider. Thanks, Kev!

Great book, indeed. Funny how you jump genres, I do the same thing. I jump from fiction to history to politics to finance to retirement. Gotta keep it interesting!

Gotta keep both sides of the brain working, right, Fritz?! I did read an interesting book called “Keys to a Successful Retirement” that I list on my Recommendations page… you should check that one out as well! 😉

I’m reading it too! It’s really good. I think top 5 in personal finance book. It’s very insightful and I’m learning a lot.

Top 5, without a doubt – very unique so it’s tough to call it the #1 personal finance book, but it’s up there for sure! 🙂

Hey Jim,

Been lurking for a few months, first time commenting. Good post, I like that you tend to make your posts meaty. I know there are a ton of NEWB’s out there who like it short and sweet so they don’t pop a light bulb (that’s fine, we have all been there) but for us guys that have been personal finance nuts for 10 or 20 year or more….we need the meat lol. So kudos.

I DON’T read many personal finance books anymore. Why…..I generally know 80% of the things written and the 20% new content is generally NOT enlightening enough for me to bump a book that would teach me something outside of finance to use in my life. THIS though….just made it to the top of my “going to borrow from the library next” list. Maybe I will drop another comment in a couple months when I have a chance to go through the book.

Thanks for the recommendations and EXPLAINING why this is worthy of many peoples time.

Thanks for posting, Will! Haha, yeah, I do have a tendency to talk too much! 😂 But seriously, yeah, if I’m going to provide info to others, I try to put all my thoughts into it. For good or bad, that generally means a longer post.

I hope you enjoy the book, Will, and definitely follow up with your thoughts!

Seems like a decent book, and I’ll definitely put it on my reading list. Housel is a good writer and really knows how pull in his readers. Whether he knows anything about money or not, I guess I’ll have to find out!

This was actually my first time reading anything by Housel. He’s written a couple of other books but I think he’s more well-known for being a former columnist for The Motley Fool and The Wall Street Journal. Is that where you’re familiar with him from? It’s a worthwhile book to read, Mr. Tako – I hope you enjoy it!

Morgan Housel’s book keeps popping up here and there. A lot of people like it.

I saw that he posted on Twitter that it’s sold over half a million copies as of June so it sounds like it’s doing pretty well. 🙂

This book taught me controlling my time is the highest dividend money pays. The opportunity to wake up and say, “I can do whatever I want today” is the highest type of fortune. Morgan illustrates this notion with a story about interning as an investment banker. He enjoyed the work and worked hard, but he realized that doing something you appreciate on a timetable you don’t control can feel like doing something you despise.

Such a good read! That’s probably one of the most important lessons (in life overall, too!). When I retired from my job a few years ago, that “I can do whatever I want today” was truly an amazing feeling. But it took me a while to get a good balance going because then I wanted to do everything all at one time! Now that I’ve figured it out, life is good… beyond good! Being able to focus on what you enjoy doing when you want to makes it 100% better.