Health Savings Accounts (HSA’s) have been around in the U.S. since the end of 2003. However, using your HSA for retirement has only been gaining popularity over the last handful of years.

There’s no doubt that this is one very special account. Although designed as a medical savings account to be paired with a high-deductible health plan (HDHP), there’s a crafty way to make it even more valuable. In doing so, your money goes in with pre-tax dollars, grows tax-free, and can be taken out tax-free as well.

I can’t think of another account that awesome! Even a 401(k) plan loses out against this account (not counting employer matches). Traditional 401(k) money gets taxed when you withdraw your money. And Roth 401(k) plans inherently mean that you’re putting in after-tax dollars.

So a three for three on the tax benefits is unheard of except for using an HSA for retirement.

Some of you may already know about how valuable the Health Savings Account can be. I’ve talked about it years ago in Are HSA Plans the Best Bang for Your Buck? and The HSA Benefits Just Keep Rolling In.

I’ll briefly discuss the value of this account. But what I really want to do is to show you how I keep track of our unreimbursed medical expenses to ensure compliance while making the process as efficient as possible.

Disclaimer: As a reminder, I’m not an accountant, financial planner, or any other fancy-titled person. Contact a professional before making any changes or investments that you don’t fully understand.

Using an HSA for retirement

I first learned about the idea of using your HSA for retirement when I stumbled upon the Mad Fientist’s post, HSA – The Ultimate Retirement Account. It was an a-ha moment for sure – too bad I didn’t come across it until around 2017.

First off, be aware that a Health Savings Account (HSA) is completely different than a Flexible Savings Account (FSA). An FSA is a terrible account compared to an HSA. Nerdwallet has a nice table comparing the two types of accounts, but everything we’re talking about today is about Health Savings Accounts.

When you have an HSA, you have two choices on how to use the money saved in the account to pay for medical expenses:

- Pay for the expenses directly with the debit card from your HSA provider.

- Pay for the expenses out-of-pocket and then reimburse yourself later.

Now, if you’re just using the account as a middle-man and a way to build your HSA a little, either option is fine.

However, if you’re ready to take things to the next level and use your HSA for retirement, you can take advantage of option two with what might be considered somewhat of a loophole.

When you think of paying out of pocket and reimbursing yourself later, you might envision that “later” means sometime in the near future. But, the interesting detail is that there isn’t a deadline for reimbursement.

In other words, you can leave that money earmarked for reimbursement sitting in your HSA until later… much later if you want. As a matter of fact, you can leave it in there until you want to pull it out in retirement if desired.

Think about that – you can pay your medical expenses with after-tax money and leave the money that’s owed to you to sit and grow tax-free in your HSA for years. And then when you withdraw the money, it’s 100% tax-free because it’s a reimbursement for the earlier medical expenses.

That’s it. This simple strategy gives you a fantastic way to take advantage of some nice tax savings over the years.

So, that’s easy enough. It’s an approach that’s floated around and become a popular topic in the personal finance community over the past few years.

What’s not talked about though is how to keep track of what’s involved in using your HSA for retirement. I’m a systems kind-of-guy (to a fault) so I’m going to take you through how I easily and efficiently keep track of everything needed for this strategy.

Organizing/Preserving the receipts

The interesting part about reimbursing yourself for your medical expenses is that you don’t need to submit receipts to the IRS or anything like that. You request the reimbursement through your HSA provider and get your money. The provider issues you IRS Form 1099-SA at the end of the year and you use that to report the distribution on Form 8889 of your taxes.

But at no point in the process do you submit any receipts. It’s almost the honor system in a way. So why keep them at all?

Because if you’re ever audited by the IRS, you darn well better have those receipts as documentation of the reimbursement.

My recommendation is to come up with a system that’s easy to use yet doesn’t keep all your eggs in one basket. Here’s my two-part system:

- Scan the receipts and keep the digital copies organized in cloud storage.

- Keep the physical copies in a folder somewhere safe yet easy to get to.

Let’s go into these in a little more detail.

#1 – HSA for Retirement – Operation scan and store

If you have a printer with scanner functionality, you can always use that to scan your medical receipts. I haven’t owned a printer in probably 15 years now, but technology has made that unnecessary for this case.

There are now several smartphone apps that will let you “scan” your documents into PDFs. I’ve come to like the free app, Adobe Scan: PDF Scanner & OCR. I use it on my Android phone religiously to scan any straggling paper docs in general, including my receipts. But I do see that they offer the app on iPhone as well.

Android: Adobe Scan: PDF Scanner, OCR

iPhone: Adobe Scan: PDF Scanner & OCR

In essence, you snap photos of the receipts using the app, crop them easily as needed (the automatic cropping is usually pretty good if you put the document on a surface of a different color), and save it out. Adobe Scan also OCR’s the doc as part of this process, which turns it from just a photo to a document where you can select text in it, search text within it, etc. – very important.

Even better is that if you have the app installed for your favorite cloud storage provider, you can just share the receipt to that app and it’ll upload right to it. In my case, that’s Google Drive.

I love this method because I can digitize and store a receipt in just a matter of a couple of minutes.

The important part of this though is to keep your digital files organized. Don’t just upload them into the root of your cloud storage and call it a day – you’ll regret that one day.

Create a folder structure and naming convention that makes sense for you. I have a solid organizational structure that works well for me. Bear in mind that I store all my docs in Google Drive so mine might be built up a little more. Here’s a small example of some of the folder structure:

- My Drive

- Finances

- Bank Statements

- Cell Phone Bills

- Credit Card Bills

- Electric Bills

- Health Savings Account (HSA)

- Unreimbursed Medical Expenses in HSA

- Unreimbursed Receipts

- 2017

- 2018

- 2019

- 2020

- 2021

- Unreimbursed Receipts

- Unreimbursed Medical Expenses in HSA

- Insurance (Home and Auto)

- Taxes

- Finances

All receipts are stored in that year’s folder. They’re named with the date format of when it was paid and what it was for or where it took place. For example:

- 06-12-21 – Chiriqui Hospital – Mammogram (Lisa) – Receipt.pdf [I wrote a post on this one!]

- 07-09-21 – Biomedica – Antigen Tests – Receipt (Jim, Lisa, and Faith).pdf

- 09-05-21 – Clinica Monica Sanjur – Receipt (All).pdf

- 09-01-21 – Medico General – Dra. Shannon Tuer – Receipt (Lisa).pdf

These are the actual names of the receipts I have saved (though I changed the dates for privacy and security). This might look complex, but remember, these can be named and shared right from the Adobe Scan app.

Scanning a receipt, renaming it, and sharing/saving it to the appropriate folder only takes a couple of minutes. But look how easy it is now to find what I need. This makes it extremely simple to prepare your unreimbursed funds in your HSA for retirement.

As an aside, I only keep proof of payment (receipts) in these folders. I store EOBs, statements, and other documents in a separate medical insurance hierarchy in order to keep my unreimbursed expenses clean and easy to find what I need in the future.

#2 – HSA for Retirement – Physical copies

You’ll need to figure out an easy way to store the physical copies themselves. Although the digital copies should satisfy the IRS if ever audited, I prefer not to keep all my eggs in one basket.

So I keep the digital copies stored offsite in cloud storage. Then I keep the physical copies at home in a folder. If my house burns down, I don’t lose the digital copies since they’re not stored locally. If there’s a problem with the cloud storage, I still have the physical copies. Better safe than sorry, folks!

Personally, I just keep all our physical receipts in a single manilla folder right after I’m done scanning them. We don’t have a lot of them and I like the simplicity – the newest receipt always goes on top… no muss, no fuss.

Should we start accumulating receipts faster at some point, maybe it’ll make sense to do a folder for every year, but for now, that’s just overkill.

Now, we just need an easy way to keep track of all this…

Tracking the numbers

Hmm, what would be a good way to keep track of all of these unreimbursed medical receipts?

Stop it… we all know it’s going to be a good old spreadsheet to the rescue!

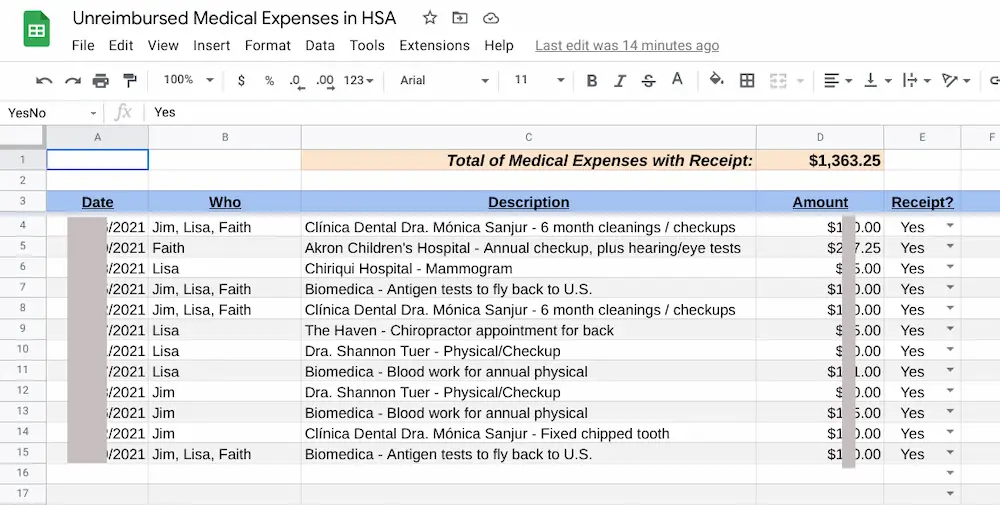

Here’s the great part though – there’s really nothing too elaborate about this spreadsheet. To track the unreimbursed receipts you’re owed from your HSA for retirement (or before if needed), the info to record and present back to you is straightforward.

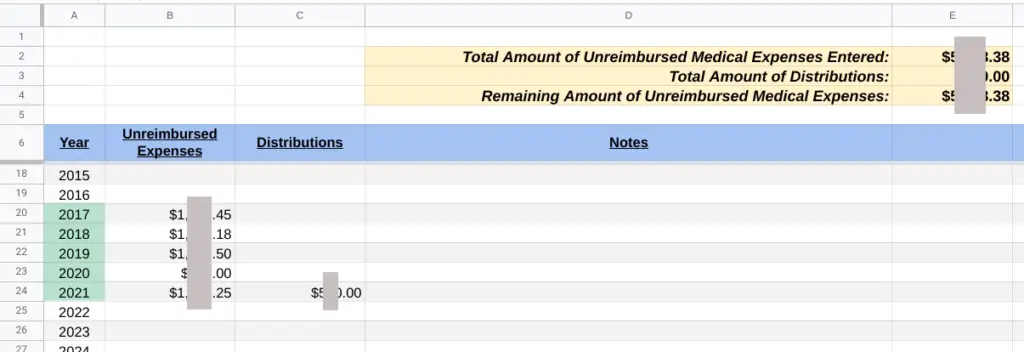

We essentially just need to know the total amount that we’ll be able to withdraw as a reimbursement down the line. Nonetheless, it would be helpful to know how much we still have left to pull out as a reimbursement after we start doing any reimbursement withdrawals. That could be sometime soon or even as far out as retirement.

Fortunately, I have a spreadsheet that does exactly that!

First off, it has a tab for each year to enter in the pertinent information – easy and simple to fill out…

As each new year approaches, ready-made sheets already exist and just need to be unhidden with a simple click. The same goes for previous years that might have some unreimbursed medical receipts as well…

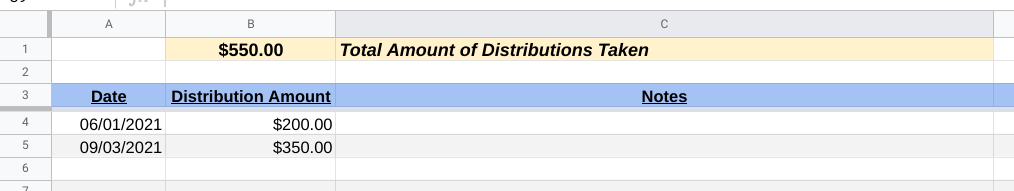

Then there’s a tab to record any distributions taken for unreimbursed money…

And that’s about it for entering the information we’re owed from your HSA for retirement (or anytime before).

Everything is automatically pulled and tabulated on the Summary tab so you can easily see exactly where stand. It’s also a great way to easily track this information to have ready should an audit ever transpire…

So, that’s my spreadsheet – and it’s worked extremely well while still taking just seconds to add an entry as needed.

Nice, right? Wouldn’t that be generous if someone would be willing to share a fantastic spreadsheet like this with you?

Well, boy oh boy, this must be your lucky day! As a gift to you, you can have a copy of this awesome spreadsheet so you can track your own unreimbursed medical expenses in your HSA for retirement!

If you’re already on my email list, you received the link to this spreadsheet in the email that went out this morning. If not, sign up here and I’ll send you an email with this spreadsheet as well as several other cool and handy spreadsheets…

Free with no strings attached! I hope you find this useful. Anytime I create something effective for making my life easier, I love to share it with my loyal readers… you’re welcome!

As a side note, I keep my copy of the spreadsheet in the same folder hierarchy I presented earlier. It sits directly in the “Unreimbursed Medical Expenses in HSA” folder in Google Drive. Organization is king, folks!

So that’s how we use our HSA for retirement. We currently have a little over $45,000 in my Health Savings Account. Not too shabby for having about 7 years with it before retiring at the end of 2018. Now it sits and grows at Fidelity fully invested in the Fidelity ZERO Total Market Index Fund (FZROX). I just watch it continue to creep up in value in Empower (formerly Personal Capital).

Once we’re back in the U.S. next year and as income from the blog continues to grow, I do hope to start contributing once again. I love this account and would like to grow it a lot more.

Of that $45k in the HSA, we currently have around $6,000 in unreimbursed medical receipts.

It’s a double-edged sword, too. $6k isn’t a ton of money, but that’s because we’re a relatively healthy family and don’t spend a lot of time at the doctor (or dentist) outside of routine visits… I’ll take that any day!

Over time though, I’m sure we’ll be able to account for everything in that account. That means we’ll have a good chunk of change coming back to us with money that was put in with pre-tax dollars, is growing tax-free, and that we’ll be able to take out tax-free as well. In the meantime, we’ll let the account continue to grow over the next few decades.

Are you utilizing an HSA for retirement? If so, how do you keep track of your receipts and numbers?

Plan well, take action, and live your best life!

Thanks for reading!!

— Jim

Just started using a HDHP with HSA this year. Thanks so much for the great info! Looking forward to using your spreadsheet.

Awesome! Perfect timing for you, Barak!

I have a hsa and paying out of pocket and not reimbursing myself. I do keep receipts but not religiously. With the cost of health care and the assumption as I age more money being will be spent on Healthcare I figure it will easily get spent as I get older. I guess the disadvantage is I wouldn’t be able to take all out if needed, anything else I’m missing?

You’ll be able to take the money out to pay for your healthcare expenses as they come up, Corey. That’s really the purpose of the HSA and there’s no problem with that. The next level though is what I was aiming for here and that’s to pay for some/all of your medical costs out-of-pocket, you can then leave the money that you’ll be reimbursing yourself with to sit in your HSA longer. That just gives it time for the money to grow tax-free which can be a nice bonus over time. You’ll just want to hang onto your receipts for when you actually do the reimbursement later on. 🙂

I have my handy-dandy spreadsheet and folder set-up in google docs as well (and they look strikingly similar to yours, hahaha). Another tip I really like with the google sheets & stored pdf’s is you can hyperlink that receipt to the spreadsheet entry 😉

That’s a great tip, JP! Simple but very smart!

“At 65, you will gain new benefits with you HSA. Certain insurance premiums can be paid tax free with HSA distributions after you reach 65 and enroll in Medicare. You can pay all Medicare premiums except Medigap. Employee payment of premiums for employer health insurance plans also qualify. You can also pay premiums for your spouse as long as you are age 65.

Distributions that you take from your HSA after 65 are never subject to penalty. What you use the funds for does not matter. All HSA distributions after age 65 are penalty free. even if the funds are not used for qualified health expenses. However, if you take a distribution that is not used for qualified medical expenses, it will be taxable.”

From Sarah Benner, IRA analyst Full article post on the web

Great addition! That’s a real benefit to be able to pay for some premiums with your HSA later on. Until then, most insurance premiums aren’t qualified medical expenses.

I was aware of distributions being able to be used for anything after 65, but the fact that it’s taxable when you do that stinks. Saving your receipts and reimbursing yourself later like we’re talking about is a great way around that detail so the withdrawals aren’t taxable. That way it’s not a withdrawal for something else – it’s a reimbursement for qualified medical expenses taken earlier on.

Thanks for sharing the info, David!

Do you know if the HSA can be used for healthcare premiums?

Hey Rex – unfortunately, usually you can’t use your HSA to pay for insurance premiums. But as David added in an earlier comment, once you turn 65, some of those rules begin to change and some premiums then become eligible expenses.

I believe after a certain point, you can use your HSA for ANY reason, not just healthcare costs and reap the tax benefits

Hi Jonathan – I think what you’re thinking of is that after age 65, you can withdraw your money for anything (it doesn’t need to be for qualified medical expenses) without the additional 20% tax (the penalty). However, the distributions for non-qualified medical are still taxable, similar to how traditional IRAs are taxed.

Here’s the official IRS link: Publication 969 (2020), Health Savings Accounts and Other Tax-Favored Health Plans

Here are a couple of other articles that are a little easier to follow (at least for me):

The Truth About HSAs and Retirement

HSA Rules Get Tricky Once You Hit Age 65

Just a quick reminder for all your readers that you MUST have an HDHP to contribute to an HSA. However, you can discontinue the HDHP and you can still use the money from the HSA later.

Thanks, Tom – that is a great reminder! I’m actually in the position you’re talking about as we currently don’t have a high-deductible health plan right now (ex-pat insurance). Once we get back and get on and HDHP again, it’ll be great to contribute again! 🙂

This is great and so timely, we set up an HSA a few months ago! By the way we pulled the plug and moved to Mexico 2 weeks ago, settling in well and loving life!!

Hey, that’s fantastic on both counts, Rachel! Congrats and glad to hear you’re loving Mexico! 🙂

If I’ve lost some receipts from the actual health care provider, can I use credit card statements as the receipt?

I can’t answer that one, Corey – I’m not sure. You’re best off checking with a tax professional on that.

That said, remember that you don’t need to submit anything during the process. The only time a receipt would be needed is if you’re audited. If that should happen, would credit card statements suffice – I don’t know the answer. My guess is that they probably wouldn’t, but that’s all that is – a guess.

Interesting. I had an HSA once but eventually when we had kids decided a PPO is better. I though an HSA had to be used for health care costs? Or am I wrong on that?

An HSA needs to be used to pay for health care costs or you’ll be hit with a 20% penalty (ouch!) in addition to any taxes owed. That’s where this strategy comes into play – you pay your medical expenses out-of-pocket (whatever you can). Since you can reimburse yourself for those medical expenses anytime you want, you leave the money in your HSA growing tax-free for decades and then pay yourself back down the line whenever you want (potentially in retirement). That’s a huge benefit if you can take advantage of it! 🙂

Yup, we’ve been building up our HSA for years — it’s a great account!! Meanwhile, our medical expenses are pretty low right now. They won’t be some day in the future, and this is primarily why I think the HSA is an amazing account. It’s like a money time machine, transporting your money and compounding it into the future when you’re finally going to need it! All without having to pay taxes!

My recommendation to young folks without a HSA? Get one!

You said it, Mr. Tako – an awesome account and perfect for younger healthier people! 🙂

I have a next-level strategy for this as well, but it doesn’t have the tracking of the actual amounts of what has been reimbursed, just which ones have been. I create a Google Form and collect the responses in a Google spreadsheet. The form asks for the date, who had the bill, amount, and has an upload field for receipts. What you get on the other side is a Google spreadsheet much like yours which you can then add your formulas to do calculations. The drawback are you don’t get the nice formatting and summaries by the year, but that can be added later with minimal spreadsheet-fu. What you do get a spreadsheet and scan workflow that is integrated, since one of the columns in the spreadsheet is a link to the uploaded scan/photo of your receipt that is saved directly in a folder in Google Drive. It’s slick and very similar to your system and I love it.

That really is a slick way to keep track of your expenses, Randy – very creative!

“The FSA is a terrible account compared to the HSA”…glad someone said it like it is.

Normally I’ve found using your HSA card to pay for out of pocket expenses upfront saves a lot of headache, but the idea of waiting to pay for unreimbursed medical expenses until later to soak up the tax advantages is a good idea.

Haha, I try to call it like it is, Gary. It was like a beta version of software that was released without having all the kinks ironed out. I’m not sure why FSAs are even still around.

The dropdown for receipt is in infinite loading. I can manually type “Yes” bypass the issue.

Thanks for the heads up, Max! I fixed the issue if you wanted to grab the latest version – sorry about that! 🙂

Hi – I have looked into HDHPs (with HSAs) on the ACA marketplace website but the thing I find a bit baffling is why the monthly premiums on the available HDHPs are not significantly lower than non-HDHPs. Maybe it is just the state I am in (NJ). For me it then comes down to this: is getting access to an HSA to use as a retirement vehicle worth it if I am paying higher deductibles (and having worse overall health coverage) while getting virtually no reduction in monthly premiums? Maybe a HDHP with an HSA would still be the better choice from a long term perspective, but it just seems really odd to me that the premiums are not lower if I am taking on a higher deductible.

BTW, I have been reading your blog for a while now and really enjoy it.

Thanks,

Matthew

I haven’t shopped HDHPs in a while so I’m not sure where they stand exactly, but I do remember noticing the price gap between them and non-HDHP plans getting smaller a while back. It’s a shame and ruins a lot of the incentive to get them. You’re absolutely right that the decision then comes down to figuring out if it makes sense in your own situation. In our case, we’re healthy and rarely go to the doctor outside of routine checkups so that makes HDHPs an easier choice with the HSA benefit. But that’s just us and who knows how it’ll play out over time. Everyone’s different so you’re stuck guessing which would be a better route for you.

And thanks for the kind words – much appreciated, Matthew! Have a great weekend!

Thank you for this article! I have a HDHP through my employer and they even have a $1000 match for the HSA which is a great benefit. We are love having the HSA. One thing that I would like to add is that I have read that if you have an adult child who is not a dependent but is still on your HDHP (up to 26) they can have their own HSA and contribute the family limit in addition to the parents contributing the family limit to their account. I am not 100% sure if that is accurate but that is what I read when I was researching the HSA before signing up for mine. My oldest is 13 so I have a ways to go before I have to worry about it though. Thank you for the great information!

I remember hearing something along those lines with the adult child at some point. That can be a nice little bonus for older kids if they can understand how valuable this account can be.

Great article and tips. One recommendation to “filing” the electronic copies which makes it even easier to sort and find later is to save as YYYY.MM.DD. This way they will always sort in order of date. Whereas if you save as MM.DD.YY then you will have all sorted by month with many years together. Works great for me.

That’s a great tip, Owen! I wish I had done that from the beginning but now I’ve got decades of files arranged in the structure I mentioned. All good since it works well for me but I do like the idea of going with the year first. Thanks for sharing!