I had a thought recently that made me wonder how much free money for retirement was given to me during my last job. My former employer was always generous in taking care of employees through the 401(k) plan offered. So just how much of our net worth could be attributed to that facet of saving?

I dug up my old 401(k) statements and expected the need to spend a lot of time breaking things down and then adding up all the numbers. To my surprise though, each statement kept an accumulated tally of the breakdown. So what I needed could simply be found on the last statement I received shortly after I retired from the company.

Although I knew I’d find it to be a sizeable chunk of money, I was blown away to see just how much. The free money for retirement I received from the company added up to $181,433.49! This was money they just GAVE to me.

I’d like to think that it’s just because they thought that I was awesome, but somehow I don’t think that’s the case. In fact, since the offer of free money for retirement was open to anyone, I’m relatively sure that’s not the case.

But let’s talk about how I got this money and just why it’s so incredibly valuable in your working career…

My free money for retirement

If you haven’t guessed, the free money for retirement I’m referring to was an employer match on 401(k) contributions. In this case, part of the money I received also included a type of profit-sharing into our 401(k) which I’ll talk about momentarily.

Here was the breakdown on my statement ending on March 31, 2019:

- Employer Match: $149,989.13

- Profit-Sharing: $31,444.36

- Total: $181,433.49

My employer offered a 25% match for every dollar you invested in the 401(k) plan. To be clear, there are a lot of plans that offer bigger matches – some even do dollar for dollar – but here’s the kicker… this one didn’t have a cap. You could contribute up to the federal limit each year and you’d be getting the match on everything you put in.

For instance, in 2020 the contribution limit is $19,500 ($26,000 for those 50 and older). If I was still working there and maxed out my 401(k) contributions for the year, I would have also received a match of $4,875. That’s a big chunk of change!

Then, the “extra credit” would show up after the year ended. For as long as I remember, we would receive a profit-sharing bonus into your 401(k). Here’s the catch though – it was a bonus of 10% of whatever you had contributed into the 401(k) the previous year. So if you hadn’t contributed anything, that’s what you got as a bonus(that stinks, right?!). But if you maxed out for the year, you came out ahead.

In essence, because the profit-sharing paid out 10% every year that I could remember, we were essentially receiving a total of a 35% match on all 401(k) contributions. The profit-sharing is also one of the reasons that I made sure to finish out the year before I left the company.

Assuming the profit-sharing pays out again after this year, those employees still there who are maxing out their 401(k) won’t just have a $4,875 match – they’ll have a $6,825 match for that year. $6,825 of money for retirement just for being a good saver!

Over the years, I continued to increase my 401(k) contributions and there were several years where I got close but still didn’t hit the federal max. Looking over my past statements, it was a little difficult to determine exactly when I started maxing out each year. However, I believe I started to hit that limit somewhere between 2006 and 2008.

That means for years I was getting a nice match every year, but then for more than a decade, I was receiving the maximum match every year. Not only was I saving a ton of money in the plan, but I was also getting a 35% return with each contribution. That adds up, folks!

The power of a company match

I’m sure you’ve heard people say that you shouldn’t pass up free money or that you’re leaving money on the table if you’re not taking advantage of an employer match. But did you ever stop to think about what that really means?

I was earning a 35% return on my money… even before any market returns!

Most of us are excited about the hope of simply getting a possible 10% return on our money in the stock market (before inflation). But then you also have to take into consideration that the return would be over the long haul and that it’s just an average based on historical data. An employer match though is an instant return on your money.

35% is a phenomenal return on my investment. But even if an employer match you’re offered is less, it’s still an immediate return on your money. And for what – choosing to save more money for retirement? Um, yeah, that’s what you should be doing anyway.

Of my entire $691,298.37 I rolled out of my 401(k) in early 2019, $181,433.49 was money for retirement that was just given to me. To put it in perspective, that free money alone accounted for over 15% of our net worth! We likely wouldn’t have been able to retire when we did without that extra boost.

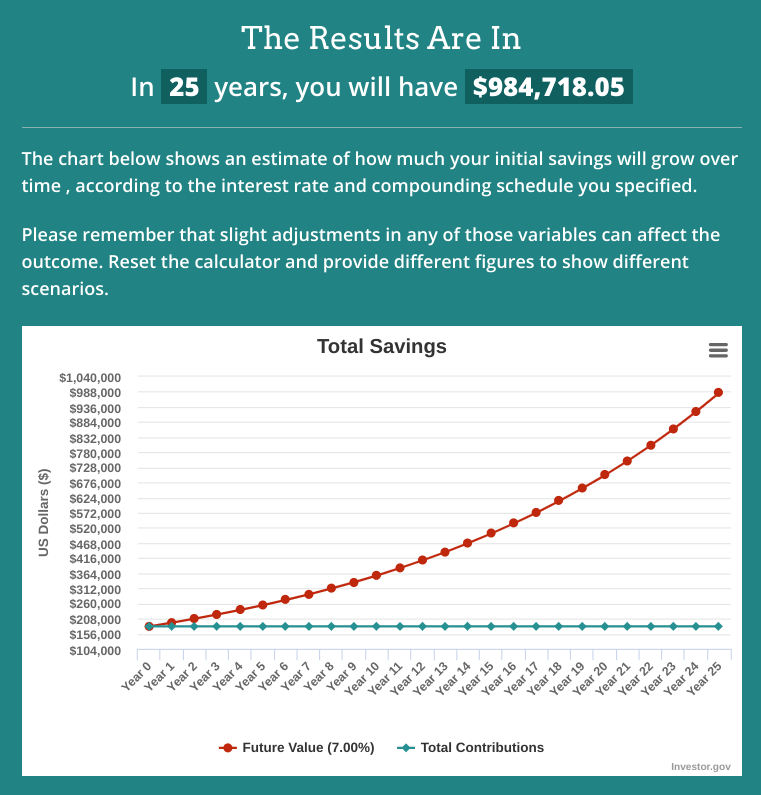

Over the next 25 years, it’s reasonable to see that $181,000+ grow to be almost a million dollars… and I’m talking after inflation. That’s a lot of money for retirement that I essentially got for free!

Don’t pass up free money for retirement!

Look, I know not every company has the same matching program as I had the opportunity to participate in over the years. Some are better and some are worse. Most institute a cap on how much you can contribute. In my case, the match itself was decent but the real bonus was being able to continue receiving a match up to the federal limit each year.

Here’s what most places of employment are doing regarding company matching…

The majority of companies offer some sort of matching contribution for an average of 4.3% of a person’s pay, but there are many formulas out there. The most common match was 50 cents on the dollar. For every $1 you contribute to your company 401(k), your company will contribute 50 cents. About 71% of companies with matching contributions contribute 50 cents for every dollar employees contribute up to 6% of their pay. Another 21% match employee contributions dollar for dollar, but the maximum is normally lower—commonly 3%.

Investopedia

My wife, Lisa, had a 401(k) plan at work that offered a 25% match, but only up to 3% up to her salary. That not great, but we absolutely contributed that 3% before moving onto any other investment vehicles. Why? Because that was a guaranteed 25 cents in free money for every dollar invested. That’s a 25% return on the money that was contributed.

The point is that most employers offering a 401(k) plan offer some type of match.1 That’s an instantaneous return on your money before it even has a chance in the market to grow further. Passing that up really is like leaving good money on the table.

I don’t know of a lot of guaranteed investments that pay you returns like 35%, but if you do, please send me the exclusive!

It took me a handful of years of my two-decade career at my last place of employment to realize just how valuable the match is for your portfolio. If I had realized it earlier, that $181,000+ the company gave me would have been even greater.

If you’re not taking advantage of every penny of free money for retirement offered to you, it’s time to sit down and figure out why. Maybe you legitimately can’t contribute any more money into the plan and that’s ok. But don’t fool yourself into making that an excuse if there’s an area where you might be able to trim the fat a little. Every dollar you can funnel toward your 401(k) plan while getting that match is well worth it.

I find it a little funny that this was the first time I looked at the actual numbers from my old 401(k). I knew that I was getting some solid money for retirement for nothing, but these numbers are a real eye-opener.

If you’re working for an employer who offers a 401(k) plan with a match, I hope you’ve seen some great results over the years as well!

Thanks for reading!!

— Jim

1 Vanguard 2018 Defined Contribution Plan Data (pages 20-21)

That’s a cool number to find!! Good idea!

I worked at a startup once that matched 100% of whatever you put in up to the legal limit and STILL only a small percentage of people contributed 🙁 I literally lived off $200 paychecks for like 3-4 months to max it out at the beginning of every year just in case they canceled it one day, lol… Which they eventually did, but not before getting that free $40k’ish! 🙂

Holy crap – that is awesome! I think a lot of cheapos would have lived like you did… I know I would have! Nice job on your ROI for that gig, J!

You’re right though in that it seems like a lot of people just don’t seem to realize just how big of a deal something like this really is. One of the engineers I managed was contributing something like $5 every two weeks to our 401(k). It took well over a year of me pushing him until he finally increased it to something more substantial. Not only wasn’t he building up retirement savings but he was missing out on so much free $$$!

Wah, that’s a lot of money. You are a lucky guy. For me in Malaysia, I just max up my EPF contribution since these will be the tax free money later for my retirement ?

I do consider myself very lucky being able to be a part of that plan – it’s odd that so many others don’t push everything they can into it as well. I’m not too familiar with EPFs, but any vehicle where you can reap some tax savings for retirement is usually a smart move – nice job, Dr Goh!

Hi Jim,

You were lucky to work for companies that gave great matches. Like the pensions of old, lol. Was never so lucky, currently encourage my kids to take advantage… unfortunately they don’t all listen.

Sure hope you make it home soon, I can only imagine how hard these last months have been for your family. Faith has been a trooper I’m sure. Life is throwing lemons in 2020 for sure.

Stay safe

Haha, yeah, I do wish I was lucky enough to get a pension though – those are like finding buried treasure nowadays! 🙂

That’s too bad that your kids don’t jump on the free money. It’s one of those things that sometimes you don’t realize until it’s too late. Hopefully, they have that epiphany at some point sooner rather than later though.

Thanks for the well wishes on getting back to the US for a visit. We’re actually in the middle of booking a humanitarian flight right now, but this has me pretty anxious… we’re flying right in the hornets’ nest! We’re going to have to be super careful if we do come back.

You stay safe as well, Kathy! 🙂

Excellent points Jim!

In addition to matching 401 contributions, my previous employer also offered a matching program for company stocks. They considered it a means to gain greater engagement and more dedicated employees. Guess what – only about half of the people took advantage of it!

Sorry to hear you’re stuck in Panama and hopefully you’ll find a way home soon.

If that was a 1:1 match on the company stock, that’s one heckuva deal, Shannon… as long as you didn’t let it become too big a part of your portfolio. It’s crazy that more people don’t see how valuable that free money can be. That can accelerate portfolio growth dramatically faster than needing to do everything on your own.

I literally just booked us a humanitarian flight back just a few minutes ago. Unfortunately, that’s the easy part – flying back into COVID-central means we’re going to have to be real careful in how we make this happen. Fingers crossed!

Great share!

Therefore, I tell everyone I know who mentions their company offers a pension matching program to take advantage. By not participating, you’re leaving FREE money on the table!

So hard to just pass up the free money but some folks just need an awakening to really realize just how valuable it is.

Jim

Thanks for the post! That certainly is a lot of money and I am guessing you invested it along the way too so it has been even more valuable for you. It just makes me sad to know that this is what we accept as “generous” from our employers. Sure they do not have to do it, but it is a shame that pensions are now almost obsolete and that all the risk and work fall upon the employees to try to set up a workable retirement. As you point out, many people do not take part fully or at all and one has to wonder what will be the consequences of that. Sad…

It’s a lot tougher to plan for retirement than it was back in the heyday of pensions. Unfortunately, the onus was put on all of us instead of just knowing that your employer would ensure you’re retirement would be covered. Most folks have no idea what they’re doing and that’s going to make reaching retirement very hard.

I love company matching. However, I have no idea how much they contributed.

Also, they only purchase company stocks with that matching! (I think.)

So I had all these company stocks in my 401k. I sold most of it when I left.

That’s interesting regarding the match only on company stock. I’m curious is that was/is the norm with public companies. The company I worked at was much smaller (around 40 employees) and private so that didn’t come into play. The good news is that you got to get rid of it (hopefully at a decent price) when you left! 🙂

That’s one hell of a “bonus”! Great job! I sure wish I had those incredible benefits back when I was working!

It’s hard to believe someone wouldn’t take free money if it was offered!

I look back and realize that I didn’t understand just how important and valuable the company match was when I first started. It took me several years to see just what I had been passing up. In the last few years at the company, I was really pushing the importance of this match to others there with the hope of opening their eyes as well.

My second to last employer had a great match and serious bonus even with a slow vesting schedule. I still left for a smaller firm. Financially bad move, left iver $50k on table. But I might still be working “one more year”. Instead we’ve left CA and are living in a van as we move across country. We might name the van “Covid 1”. It is definitely different than air travel. We made it into both Yosemite and Yellowstone days after they reopened. Cool. But based on the observed casualness of distancing efforts, I would not be surprised to see another round of shutdowns. I hope I am wrong. Best wishes for a good visit to USA. BTW, we did get tested last week. Took 20 minutes for results at an urgent care center. That may help if you face quarantine. Not that those results mean anything now as we’ve crossed paths with hundreds in the parks…

Haha, I think that’s a great name for the van! 🙂

Sometimes the good financial decision isn’t always the best decision like you experienced leaving money on the table. That’s great that you’re enjoying a bit of the slow travel right now. And I’m with you, I have a feeling that another round of shutdowns could be in the cards. The problem is that it’s much harder to taketh away once you’ve giveth. Most people will put up a good fight now to keep everything open.

Thanks for the tip on the COVID test – we’re hoping to do that once we get to Ohio to eliminate most of the quarantine need. We’ll probably go camping for a few days while we’re waiting for the results.

Company matches are awesome but you are limited to whats in their plan. You also don’t have full access to it either. The match is just another company benefit so they can avoid giving you what you really want, a higher salary. I would encourage people to negotiate their salaries. Once you have that money in every paycheck you can invest however you want.

The biggest benefit to a company match over a higher salary for most folks is that they can’t easily access it before retirement. Because so many people spend most, all, or more than they make, the company match has the potential to help them out in their later years.

That said, if you have a decent understanding of personal finance and investing, you’re absolutely right that you can probably do better just making more money and investing it elsewhere.

That company match is nothing to sneeze at. I started maxing my 401K about 2005-2007 time frame, kept contributing even though the market was tanking. Told myself my mom did this back in the 80s and the gain from the run back up allowed her to retire early.

It startled me how many people at work in my age group weren’t contributing to 401K at all or not even enough to get the company match. Lots of excuses why not. I cut my spending way down and never increased my car or housing cost to match my income, so the money went into retirement savings instead. Started attacking the mortgage too. Kept preaching this approach to anyone at work who would listen.

Yet they were still surprised when I took the early retirement package at age 58. They are all still working and now I’m 62.

That’s a fantastic store, Lynne – I hope others read this and follow in your footsteps! It’s unfortunate how there are so many folks who just don’t realize that they are the only ones who can make their retirement happen. And the earlier you start at it, the sooner you can get to the point where you don’t need to work if you don’t want to.

My company, NIKE, gave a dollar for dollar match. It was capped at 4% when I started, and 5% later on. On my salary, that worked out to be about the same as your 25% match. I like the idea of the 25% match without limit, because that gives more matching power to those with a lower salary – more incentive to develop good habits and max out early in a career.

When I hear about dollar for dollar matches, it blows my mind – what a great opportunity to get an easy return on your money. The problem is the cap that almost all employers have. That can obviously limit how much you can get for free. Even though the match I got was so much less, not having the limit really helped me make up for it and more.

Great point about those with a lower salary, too – I became somewhat of a preacher at my old company about the importance of pushing whatever they could into the 401(k). 🙂