I recently completed a transfer of our health savings account (HSA) from Health Equity to Fidelity. Today, I want to tell you why I made this move and explain the process.

I recently completed a transfer of our health savings account (HSA) from Health Equity to Fidelity. Today, I want to tell you why I made this move and explain the process.

First off, if you aren’t familiar with health savings accounts, they’re one of the most valuable accounts you can have in your arsenal. I’ve talked about how an HSA is the best bang for your buck in that the account belongs to you and not your employer.

Unlike a Flexible Spending Account (FSA), the money you have in it doesn’t expire after the plan year is over either. It’s yours for the long haul!

Your money also goes in as pre-tax dollars, grows tax-free, AND is tax-free on withdrawal if used for medical expenses. No other account out there gives you all three of those benefits!

Additionally, I’ve written about how your HSA can be even more valuable if used correctly. The Mad Fientist turned me onto the realization that your HSA might be The Ultimate Retirement Account through what might be considered a loophole in the rules.

In essence, you can pay for medical expenses out-of-pocket and then reimburse yourself later. The key though is that there’s no expiration on when you need to reimburse yourself. So, if you can afford it, you can pay your medical bills out of pocket and let the money in your HSA continue to grow tax-free. Then whenever you want – decades later – you can then pull that money out for reimbursement.

That can be HUGE for your pocketbook! In our case, we don’t go to the doctor often, but over the past couple of years, we’re now sitting on receipts for $3,425.33 we’ve been able to leave in our health savings account to grow tax-free over the next few decades.

So now that we’ve talked about how valuable an HSA is, let’s talk about why I decided to move mine.

Our Health Savings Account

I started contributing to our health savings account as soon as it was offered in 2007 at the company where I worked. I didn’t realize the benefits right away and didn’t max it out until the last couple of years at my job.

Over time though, it built up and our HSA is currently valued at $27,245.34. That’s not a fortune, but it’s not chump change either. So, it’s important that we aren’t lax in keeping an eye on the account.

Unfortunately, if you’re lucky enough to have an HSA through your employer, you’re stuck with whoever they provide as the custodian. There are ways around that (like moving your funds periodically to another provider), but that’s some extra work most folks aren’t going to want to do.

In our case, our health savings account was through HealthEquity. When we first started with them, their investment offerings weren’t great and the fees they charged definitely irked me.

But at some point a couple of years ago, they switched to offering Vanguard funds… now we’re talking!

So I changed my investments in the account over to a few of those funds:

- Vanguard Target Retirement (VTTSX)

- Vanguard Institutional Index (VIIIX)

- Vanguard Short-Term Bond (VBIRX)

I had about half of my HSA invested in those funds with the rest sitting in cash. That was all fine and dandy, but HealthEquity was charging me a junk fee of between $4-5 every month for what they called “Investor Choice.” It was a charge of 0.0330% on your invested balance… bastards!

Look, let’s be honest – that’s not going to make or break anyone’s retirement dreams. Regardless, every month when I’d see that charge on my statement, it bothered me.

Enter Fidelity…

As I said, it’s a little bit of a pain to move your investments while you’re with your current employer.

But guess what – I’m retired now (yay!), so when I saw that stupid monthly fee again, I decided it was time to make a change. Remember that your health savings account is yours even when you part ways with your employer.

Most of our investments are through Vanguard so I would have gone that route if I could have for simplicity’s sake alone. But Vanguard isn’t offering HSA accounts to individuals yet.

So, the next logical choice was Fidelity. Not only are they a fantastic low-cost provider, but they’re now offering zero expense ratio funds. To me, it wasn’t enough to move all my investment accounts over to them (the expense ratios for my Vanguard fees are next to nothing), but it made perfect sense to transfer my HSA over to them.

Done deal! Let’s go through the process of moving the account…

HSA Trustee-to-Trustee Transfer

There are different ways to move your health savings account to another custodian. Be careful in how you do it though so you can avoid any taxes and penalties.

An HSA rollover involves your current HSA provider sending you a check or transferring the funds to your bank account. It’s then your responsibility to get that money into the hands of your new custodian within 60 days or you’ll suffer the wrath of the IRS. I don’t like that option.

Instead, I initiated a trustee-to-trustee transfer. I like this method because you don’t touch the money at all – it goes from one provider to the other.

So here’s how this worked…

Create your Health Savings Account

I went to Fidelity’s site and chose the option to open an account and found the choice for “Health Savings Account (HSA).”

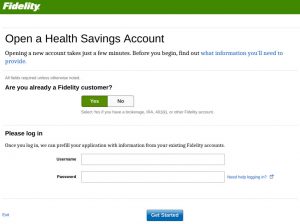

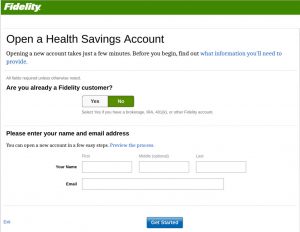

I was then prompted on whether I was an existing customer or not. I had to create a Fidelity login, but obviously, if you already have one, you’ll choose that option and log in:

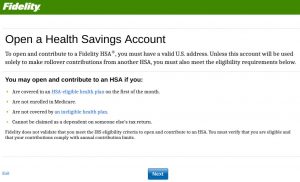

A few stipulations…

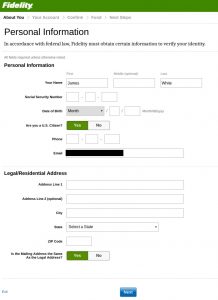

Time to enter in all your personal information…

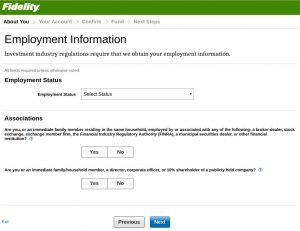

Then your employment information…

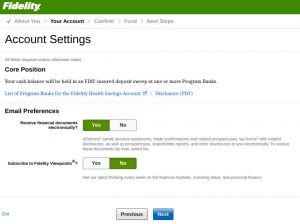

And your preferences…

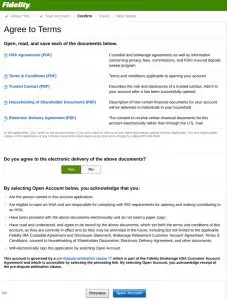

On the next screen, they show you all your information to review and confirm (I’m not showing that one). Then you’ll have to agree to their terms and go through a couple of other screens…

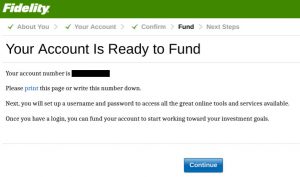

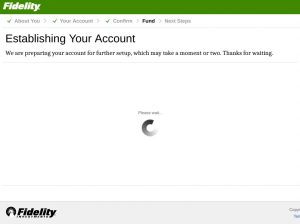

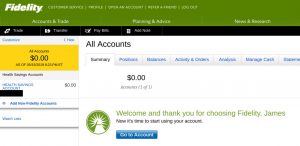

And that’s it – you’re health savings account is done! Well, it’s created… you still have to do the work to bring the funds over from your old HSA…

Starting the Health Savings Account transfer

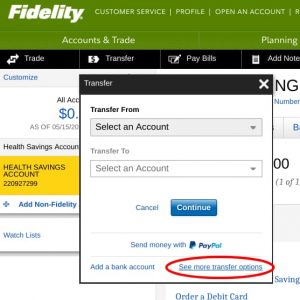

At this point, you’re ready to start a transfer. From the dashboard, you’ll click on Transfer on the top menu. The key though is that in the pop-up box, you’ll want to select “See more transfer options”…

Then you choose “Transfer Assets from Another Financial Institution”…

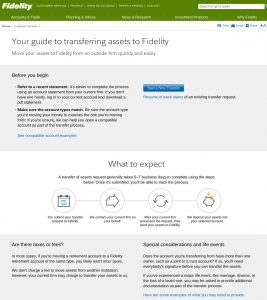

And you get this handy-dandy guide on transferring your asset to Fidelity…

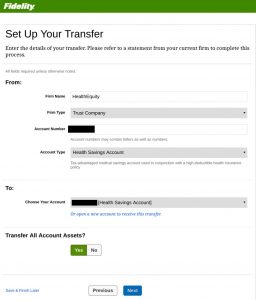

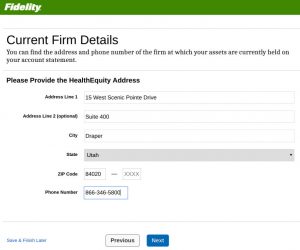

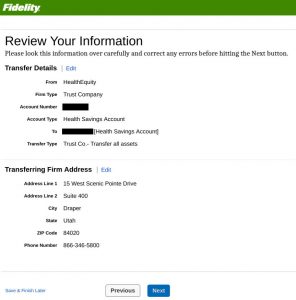

Here’s the important part – ensure you enter in the right information and details on the account you’re transferring your assets from…

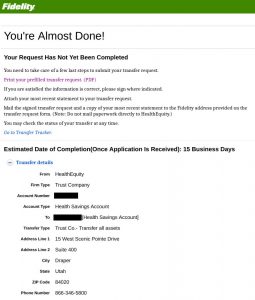

And, in the words of Fidelity, “You’re Almost Done!”…

The “Almost Done” part of the process…

This process seemed easy enough. The part I wasn’t anticipating is that you have to print the document off and sign it. Why are we still printing things in 2019?!

The good news is it’s really that simple. Everything you just filled out throughout the account creation is on the PDF that you print.

The bad news is that I haven’t owned a printer in about a decade. So I went to the library and printed it there for the low, low cost of 15 cents!

I verified the info on the form, signed it, stuffed it in an envelope using the address they provide, and dropped it in the mailbox.

Time to wait…

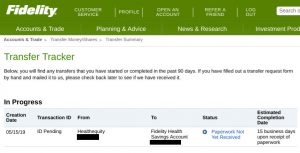

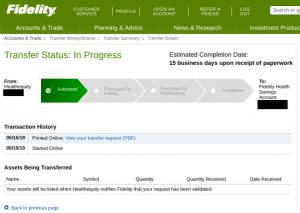

Fidelity provides a way to keep an eye on the transfer to see how it’s coming along…

To get to that page later was a little confusing, so here’s a direct link in case you need it.

And that’s it, right? Now we just wait…

Well, that is until HealthEquity comes back and gives you a little bit of homework to do…

HealthEquity… ticking me off like most big financial institutions!

I knew this before I started the process at Fidelity, but HealthEquity charged me a fee of $25 to close my account. It’s ridiculously stupid that these big financial institutions are allowed to get away with kind of crap, but they’ve got us by the @#$%^ in most cases, don’t they?

If you remember, I had a similar situation when I left TD Ameritrade and moved everything to Vanguard, but I was able to creatively work it out so I didn’t have to pay a dime.

The other small wrinkle with HealthEquity was that they emailed me and said that I had to sell my investments before they would transfer my account over.

Um, ok, but wasn’t that exactly the whole point of this account transfer? Can’t they just liquidate the account and transfer it over?

No? Fine… whatever.

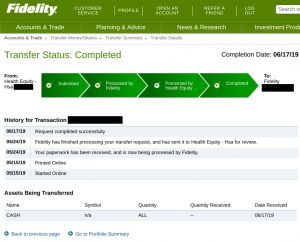

I logged in and sold all the investments in my account so everything went to cash in the account. After that, they finished the transfer to Fidelity.

All-in-all, it took a total of a month and one day for the process to be 100% complete from the time I opened the account at Fidelity until everything was transferred. Not a big deal considering I spent maybe an hour or so of work on my end to make it happen.

It cost me $25 to close my old account and a little bit of work on my end, but I’m glad I did it. I’ll recoup that cost pretty quickly by not paying the monthly junk fee. Plus the zero expense ratio funds I have the money invested in making it an even better deal.

In case you’re wondering, I invested the entire $27k in the Fidelity Zero Total Market Index (FZROX).

I’m happy with my HSA making money for me with no fees for the foreseeable future. Well worth the small amount of effort!

Do you have a health savings account? Are you happy with your investments, fees, and custodian of the account?

Thanks for reading!!

— Jim

Duuuuude. Thank you!! After reading this post I just went through the process myself and it took less that 20 minutes (I’m an existing Fidelity investor very easy). Didn’t know that Fidelity offered HSA so thank you for making me aware and listing all the steps. Cheers!!!

You’re the perfect candidate for that being an existing Fidelity customer. Glad that worked well for you, Joel!

What HDHP did you pair this with?

I’m planning on moving to Panama, but want the option to get care in US if I get cancer, otherwise I’ll pay for Panamanian care.

Hi Robert – you don’t have to pair it with an HDHP plan unless you’re planning to contribute more to it. Right now, it’s just sitting and growing. Assuming we start to bring in some more income through this site and other projects I’d like to try my hand at, then we’ll look at if it makes sense to pair it up with an HDHP so we can start contributing again.

Congrats on the plans to move to Panama – it’s beautiful here! Currently, we have expat insurance through IMG Global with the same strategy as you. Plus, it’d be good to have if you visit the U.S. and something like a car accident should happen while there.

As a side note, if you haven’t been down to Panama to figure out the ins and the outs, where to live, etc., I’d strongly recommend doing a trip with Jackie from Panama Relocation Tours. She’s a phenomenal resource and can help make the transition so much easier.

Jim, I just moved my HSA account to another provider and after comparing options and fees, decided to go with Lively (totally online process, no printing required 😉 ). Just wondering if you looked at other HSA administrators? I found a site with a great comparison chart of the top 10 or so HSA administrators, and looked closer at a few before making the final decision. I don’t remember if Fidelity was one of them, but I would assume so. It was helpful to see the fee comparisons and other parameters side-by-side. I actually had a couple different companies in mind to go with originally, but after seeing more options, I was glad I took a closer look.

Hi Julie – Lively was actually the other administrator I had considered when I had dug into the different providers. I can’t remember what made me choose Fidelity over them, but it was probably the zero expense ratio funds. Regardless, I’ve heard nothing but good things about Lively. Smart idea to comparison shop the different companies!

Interesting reading and excellent advice! I have been pursuing a similar strategy with our HSAs, and even maxed my self-directed one out before contributing to retirement in years past. Your post might just get me to stop waiting on Vanguard and go with Fidelity. My providers (hsaresources, selectaccount, hellofurther) have been hitting me with junk fees for years.

Since there is no earned income requirement do you plan to continue funding your HSA in retirement?

Hi Steffan – yeah, I was hoping Vanguard would jump into the game, too, since all my investment accounts are there, but I didn’t want to wait. Right now, I believe they’re getting their toes wet by working with HealthEquity to provide HSA plans to employers, but they won’t let you move over an account otherwise.

I definitely would love to continue funding the HSA, but with us moving to Panama, we’ll just have expat insurance (that’s a good thing!). Once we get settled and the blog continues to generate more income, I’ll start digging into the details on if that can work as a high deductible plan that qualifies for HSA contributions.

Depending on the deductibles for your expat plan, it doesn’t look like it takes much to qualify, at least at a high level. Unless there is some implicit requirement that it be domestic?

https://www.healthcare.gov/glossary/high-deductible-health-plan/

“For 2019, the IRS defines a high deductible health plan as any plan with a deductible of at least $1,350 for an individual or $2,700 for a family. An HDHP’s total yearly out-of-pocket expenses (including deductibles, copayments, and coinsurance) can’t be more than $6,750 for an individual or $13,500 for a family. (This limit doesn’t apply to out-of-network services.)”

My wife and I are a few years behind you, looking at Panama, Costa Rica and a few other options, so hopefully we’ll face some of the same questions soon enough.

Thanks for the info, Steffan!

Thanks for this article! I didn’t know Fidelity offered an HSA option (I checked Schwab and Fidelity a while ago and didn’t think either offered one.) Since I’m already a Fidelity customer, this is far more convenient not to mention cheaper.

Rollover from HealthSavings.com to Fidelity is in progress!

Perfect! Hope the move goes smoothly for you, Mike!

Good evening

I have invested about $3500 into HealthEquity HSA. Could I request my employer to transfer new HSA money direct to Fidelity or i’m stuck with HealthEquity for now? If I cant transfer, then should I invest with HE HSA even though the management fee is 0.3%, not including the expense ratio fee of the investing stock

Hi Nhat – you’re stuck with what your employer offers you for an HSA custodian as far as funding it goes. You do have some other options though. Here’s a good article explaining a few choices – Unhappy With Your Employer’s HSA? Here’s How to Move It.

Thank you!!

Hi, I’m also looking to transfer my old HSA from HealthEquity to Fidelity. I initiated on the Fidelity end yesterday and see there’s a section for a “medallion signature guarantee”. From my research fidelity does not require this but do you know if HealthEquity does? Thanks in advance!

Hi Nathan – I didn’t need to do the medallion signature guarantee when I did the process. Usually, that’s required when securities are in a physical certificate form, but when going through a broker (like you are) that’s not usually needed. You can check with Fidelity to be sure, but I’m going to guess that you don’t need to do it.

Hi! This was a great resource as I made the exact same transition from HE to Fidelity! How has your experience been w. Fidelity? Any fund changes you’ve made? I also was pretty annoyed at the investment threshold BS that HE pulled to keep a chunk of change hostage. Thanks for putting this together!

Yeah, I’m glad that ties have been cut with Health Equity. Fidelity’s been fine – all quiet which is just the way I like it! I still have everything in Fidelity Zero Total Market Index (FZROX) and it’s obviously had a good run since. It’s worth a little over $36k right now so no complaints here.

Have a great 2021, Scott! 🙂

Hi Jim, thank you for the blog post. Are you still holding FZROX in your portfolio? I’m considering it as it has no fees. However, this comparison thread is giving me doubts https://usefidelity.com/t/fidelity-zero-fee-funds-here-are-the-pros-and-cons/145

Others are saying that the 0 fee fund is just a marketing tactic to attract new investors. What are your thoughts? Thanks again.

Hi Jason – yes, my entire HSA is still 100% in FZROX. It’s a zero-fee fund that they’re not making any money on so, yes, absolutely, it’s a tactic to try to bring in new investors to hopefully buy some of their other investments. Fidelity is a great company regardless and if I was interested in buying other funds as well, I’d have no problem with that (though all my other investments are at Vanguard). However, an index fund with 0 expenses beats out the same index fund elsewhere that has fees attached any day in my book.

Thank you for this resource, it was helpful last year when I transferred funds from HealthEquity to Fidelity (and again today when I submitted a transfer to get my annual employer’s contribution over to Fidelity).

One thing I wanted to point out is that Fidelity has improved this process, and there is no longer any requirement to print anything. Instead you just sign on the screen using the mouse (or finger if it’s a touchscreen). So that would save a trip to the library and 15 cents 🙂

Glad it was helpful, Gordon, and thanks for the update on their process. Good to know they’re simplifying things a little! 🙂

Hi Gordon, I believe you have answer a question I had. My understanding is that you transferred the amount you had available at your HSA employer account to Fidelity and kept the employer account opened to keep contributing to it plus your employer match and then you transfer the yearly amount to Fidelity. Please, would you be kind enough to confirm that my understanding is correct? Thank you in advance.

Yes, that is correct.