Disclosure: This post contains affiliate links and we may receive a referral fee (at no extra cost to you) if you sign up or purchase products or services mentioned. As an Amazon Associate, I earn from qualifying purchases.

If you’ve delved into the FIRE community even slightly, you’re probably already familiar with the shrine that is Vanguard. The Vanguard Group is an investment/brokerage firm out of Pennsylvania that manages over $4 trillion in assets.

If you’ve delved into the FIRE community even slightly, you’re probably already familiar with the shrine that is Vanguard. The Vanguard Group is an investment/brokerage firm out of Pennsylvania that manages over $4 trillion in assets.

Eh, who cares? All the big brokerages manage big dollar assets like that.

True, but Vanguard’s different from the other firms out there in that Vanguard is structured as a mutual company.

What that means is that it’s a private company where the owners are actually the clients themselves. In other words, if you’re a Vanguard customer, you’re also a part owner of the company.

That’s part of the reason people love this company. This isn’t to say that the other big brokerages don’t have your interests in mind.

However, with the exception of Fidelity (which is privately owned), the other “big-boy” companies have to put their shareholder interests front and center as well.

The Birth of Index Funds

Although the idea of index funds came about in the 60’s, John Bogle is credited with creating the first index fund that individuals could invest in.

Bogle founded the Vanguard Group in 1974 and created the First Index Investment Trust on December 31, 1975.

If you’re not familiar with index funds, the idea is fairly straightforward. Index funds buy and sell groups of stocks by following a set of rules. Those rules might be for tax optimization or maybe socially good companies, for example.

However, the index funds most of us know of are the ones that follow a particular stock market index. They might track the S&P 500 or the Dow Jones Industrial Average, for example.

Investment firms and even a lot of investors generally do not look very highly upon these funds with their reasoning being average returns. However, between the higher-costs and the mistakes stock-pickers tend to make in actively managed funds, those average returns often turn out to be greater with index funds.

Because index funds are automated to track a stock index, they don’t have the overhead of “professionals” needing to manage them. That keeps the cost of them down – big time. And that cost can be a dramatic drag on your portfolio.

The other great thing about index funds is that you’re spreading your risk across possibly hundreds or thousands of stocks instead of having all your eggs in one basket. That also means you don’t have to spend all your time analyzing different stocks.

Much to the disdain of the financial industry, index funds are becoming more popular than ever.

Well Hello, Vanguard Funds!

When I opened my Roth IRA back in 2005, I needed a place to open my account. I just picked an institution that sounded good because I wasn’t well versed in what I was doing back then.

At that time, it was Ameritrade (before they became TD Ameritrade). Before we continue on, know that I haven’t had any major issues with them over the past 12 years.

In fact, since that time, I opened a taxable account with them and a then Roth IRA for my wife.

So why make the move?

Well, over the past few years, I’ve continued to learn (haven’t we all?!). Although I’ve had a couple lucky guesses on a few stock picks (I’m talking to you Amazon and Google!), I realized that this wasn’t the smartest play.

These so-called “index funds” seemed a much smarter way to go. Of these funds, the prize of the wild seemed to be Vanguard Total Stock Market Index Fund Admiral Shares (VTSAX).

You get the stock diversity in that it tracks the market as a whole and has an expense ratio of just 0.04% (as of 04/27/2017). That’s incredible!

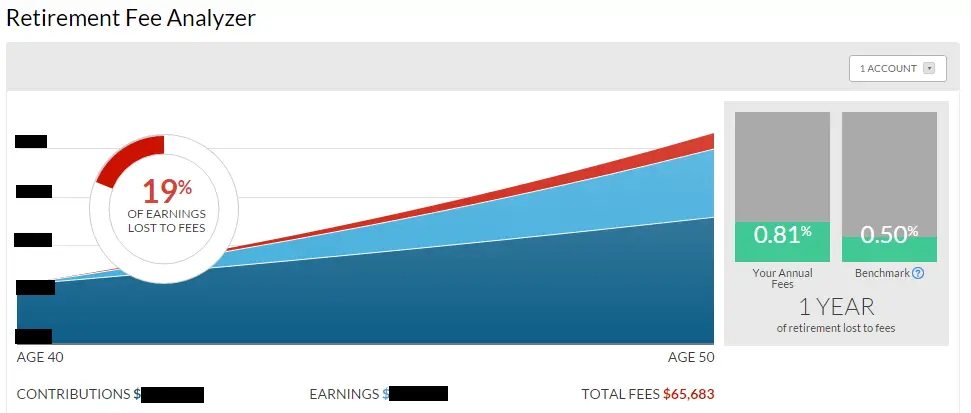

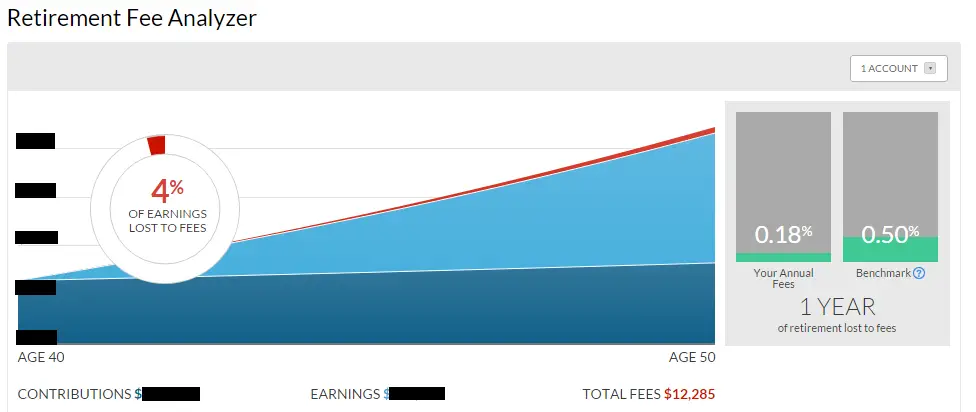

And if you think expense ratios don’t make a big difference in your portfolio, I would recommend signing up for a free account at Empower (formerly Personal Capital) and checking out the Retirement Fee Analyzer. I changed my investments around after seeing this and that should save me over $50,000 in fees alone over a ten-year period.

Before…

After…

That’s astounding to me! If you don’t already have an account, take a few minutes and make that happen.

So yes, 0.04% is fantastic and I wanted in. Only Vanguard can sell VTSAX as a mutual fund though. However, Ameritrade can sell the equivalent ETF, which is the Vanguard Total Stock Market ETF (VTI).

I wasn’t thrilled with the idea until I found that TD Ameritrade had a special program that allowed you to buy many low-cost ETFs commission-free… and VTI was on the list.

So, I slowly started moving a good chunk of our portfolios to VTI.

The TD Ameritrade Swindle

In the meantime, I thought to myself, “Hey self, why don’t you just move everything to Vanguard and get rid of Ameritrade altogether?” Sometimes I’m smart like that.

So I made a call to Ameritrade and they let me know that wouldn’t be a problem but they charge $75 to transfer your account out. Um, so you guys are those jerks that charge a buck to close an account just because you can, huh?

Ok, so you’ll make a couple hundred bucks on me closing my accounts, but is it worth it when I tell friends and family to go elsewhere so they don’t get trapped at TD Ameritrade as well?

That initially stopped me from doing the transfer and I even thought about just leaving $1 in each account and transferring the rest to dodge the fee, but you know what – screw ’em. I would rather pay it and be done with ’em rather than remain a hostage. Reminds me so much of one of my favorite scenes from “A Bronx Tale” (don’t play this if foul language offends you!)…

Besides that, I like the idea of being with a company where I wouldn’t have to worry as much about some hidden fees being slipped in somewhere. I can’t say I have that same confidence in Ameritrade.

The Route to Retire Swindle

Mrs. R2R left her job a couple months ago and started working for herself.

Because of that, we had her 401(k) plan hanging out there… and that’s when I got a little smarter.

TD Ameritrade offered a $300 bonus to roll over your 401(k) into an IRA there. Hmm, interesting.

After the wheels started turning, I opened an account and rolled her account into an IRA there.

Seems counter-intuitive to open yet another Ameritrade account, right?

Maybe, but we got our $300 and we’re now in the process of moving it right back out and over to Vanguard along with our other accounts.

So, their $300 bonus will cover the cost of moving all four of our accounts over ($75 x 4).

Maybe it was a little more work on my end, but it still feels like a win to me!

A Pain the Butt

I’ve never changed brokerages before, but here’s what I’ve learned so far… it’s a pain in the @#$! It’s easy to open an account at Vanguard – as I’m sure it is with other institutions.

The hard part comes with the transfer though. Plenty of paperwork to fill out (probably also the same everywhere).

But then you need to sign it. This may or may not be the same with all brokerages, but Vanguard requires you to sign it at a financial institution that participates in the medallion signature guarantee program.

Never heard of it?

Me neither. If you’re familiar with a notary, you know that their job is just to witness you sign a document. They don’t really care what it is – all they care about is seeing you sign the doc.

Well, the medallion signature guarantee adds a little more to that. First of all, had to find one that provides this service and not all banks or credit unions do.

Once there, the guarantor needed to understand the documentation to ensure you fill everything out correctly. This is because they are accepting liability for forgeries. This adds a little bit of time (not too bad, but still longer than just notarizing a document).

Then you mail everything into Vanguard and wait. And wait. And wait.

I’ve just finished one account transfer so far and the whole process took a good two to three weeks.

Not the end of the world, but still a pain in the butt considering we live in an electronic world! One down, three to go!

Just in Time!

So how funny is this? As I’m in the middle of writing this post, I get an email from TD Ameritrade…

Dear Valued Client,

We’re happy to announce that we are expanding our commission-free exchange-traded funds (ETFs) trading program, nearly tripling the number of available funds to 296. Since you’re currently enrolled in the commission-free ETF trading program, we want to be sure you have all the details so you can determine how these changes can meet your investing needs.

Anytime a big corporation is happy to announce something, you should already know you’re probably about to get screwed.

Such is the case here. As the email goes on, I learned that they are eliminating all Vanguard ETFs from their list of commission-free trades.

The change takes place on November 21, 2017, so I’m getting my accounts out just in time!

See ya later TD Ameritrade – hello, Vanguard!!

Who’s your brokerage? Do you love ’em or hate ’em?

Thanks for reading!!

— Jim

I am with Fidelity, primarily because that is the primary vendor for my employer, aside from TIAA-CREF, but I get to still invest in some Vanguard funds. I am happy with Fidelity and for my Roth IRA I do Fidelity’s version of VTSAX, which is the FTSVX. Good luck on the move.

I hear Fidelity’s very good and FSTVX has a nice expense ratio! Nice one!

— Jim

I love, love, love the fact you used the TD bonus to pay the transfer fees to Vanguard! Screw’em if they can’t take the joke. 🙂

I also went through the process of moving all my investment accounts to Vanguard. Vanguard is definitely the way to go!

Yeah, I feel better just knowing that my money is in a “better” place… and if TD Ameritrade wants to inadvertently pay for the transfers, all the better!

— Jim

I love vanguard! All my investment is in vanguard funds and ETF

Nice! I have a feeling that in the money world where people know what they’re doing I’m in the minority not having been with Vanguard right out of the chute.

— Jim

I love that scene in a Bronx Tale! Sometimes it pays to be rid of something!

I love that you took their promo to pay for your release – every one of our accounts is at Vanguard with one exception… you guessed it, my wife’s Roth. And it’s at TD Ameritrade! Time to get going.

I actually thought A Bronx Tale was a very good movie, but it only made $17.3 million at the box office. But yeah, that scene about it costing a small amount to be rid of something always stuck in my mind.

Is it on your radar to move your wife’s Roth or has TD Ameritrade worked well for you guys?

— Jim

It’s definitely on our list of to do’s – but it takes a bit of time so it keeps slipping. 🙂

We’re spread between a few brokerage houses currently. I expect you’ll see more of these transfer fees as these companies try to combat brokerage churning. There’s a whole group of people that move brokerage houses regularly for the bonus kind of like credit card churning. Companies can often transfer in kind so no selling needed and extra money to the actor. I don’t do this myself as it seems like a lot of effort to manage my funds movement. But it at least might shed some light on why.

I didn’t realize that people move brokerages for bonuses… that seems like a real pain to do! Hopefully this will be the only move I ever have to make. 🙂

— Jim

RTR,

My stuff is in a few different accounts. Fidelity mostly for retirement accounts. TDA for taxable. I’ve been happy with TDA for more than 15 years, but I was not happy about losing access to VTI and other no-fee funds! Fidelity has been fine, but I’m considering trying Vanguard with my 401k that i need to transfer. If I like it, I’ll move the Fidelity stuff.

-RBD

I hear Fidelity is very good and has some comparable options of their own to offer. I’ll be curious to hear what you end up doing in the long run.

— Jim

Welcome to the party! 🙂

Haha, I’m a late bloomer to the money-nerds way of doing things! But I’m here now, baby!!

— Jim

We have a few different accounts due to work sponsored plans, IRA accounts, and taxable accounts. We do business with Vanguard, Schwab, and Fidelity. They all offer low-cost index funds and ETFs. If I had to select my favorite, it would be Vanguard. It is amazing that they manage $4T in assets now.

Those three seem to be the brokerages that offer the best value to most folks (strictly based on what I heard). It’s good to hear you having accounts at all three and choose Vanguard as your favorite… helps me feel I’m making the right choice!

— Jim

Both Fidelity and Vanguard are very good. I’ve been with Fidelity for years, and haven’t had any issues with them. Plenty of investment options.

That seems to be what I’ve heard out there. Since I’m leaving TD Ameritrade though and have to pick one, I’m hoping Vanguard lives up to the hype! 😉

— Jim

My employer account is in Vanguard and my Wife’s uses Fidelity. I like both brokerages a lot as a matter of fact and think their product offerings are pretty nice. Low cost index funds are hard to beat.

I love the move you made using the bonus to pay off the transfer fees. Way to stick it to them on the way out the door.

You are right about one thing. Converting investment brokerages, banks, or anything for that matter sucks and is a huge pain. They know how big of a pain it is too and make it that much harder by slapping a fee on you. But nice job persevering and seeing the plan through!

Bert

Thanks, Bert – I just mailed in the paperwork for my next account today. It’s definitely a pain in the butt, but I’m fighting my way through it!

I’m glad to hear that Fidelity has some good offerings. It sounds like they might be a really good choice out there as well!

— Jim

Currently with Fidelity, which is who our SEP IRA is set up through with my wife’s company. Overall I am happy with them, but have been thinking about switching to Vanguard. Fidelity does have some decent Index fund choices.

Interesting to hear, Nick – what’s making you consider switching?

— Jim

VTSAX is the bomb. I started using it for a ROTH IRA at the end of 2014 and I’ve had a 12.9% return. Big fan of vanguard!

Awesome to hear, CreditCage – with the market being up as a whole, that’s definitely inevitable. Personally I’d actually prefer it to be down right now just because I’m not pulling money out yet and I’d rather be buying low.

— Jim

I am with you! My investments are now 97.5% at Vanguard and 2.5% with USAA. I am very lucky that my previous employer switched to Vanguard for our 401K. Once I learned more about Vanguard, everything pretty much went there! I feel lucky and pleased with the results, the interaction and the overall structure they offer! I am preaching Vanguard to anybody I know!

That’s awesome, Ricardo! I finally got both my accounts moved over… now onto my wife’s!

— Jim

You’ve inspired me to finally move everything over. I had Scottrade (which is now TD Ameritrade), and have been reading too many PF blogs that recommend it. I’ve had a Vanguard 401k through a previous employer, and have never had a problem…I was just lazy!

Glad I was able to give the nudge on this, Moses! It’s a little bit of work moving, but I just feel better knowing that I’m now at a company I have the highest regard for.

— Jim

It’s too bad you’re misinformed on some of this stuff. The $75 transfer out fee is for a transfer of your account, not for closing the account, so keeping $1 in there wouldn’t have done much good. In my experience, every firm, old 401k’s, brokerages, etc. charge a transfer out fee. USUALLY the new place should have reimbursed you that fee for earning your business. So if Vanguard didn’t offer this, there’s biff #1. Vanguard funds are great in a passive type strategy– pluck your account in an index fund and you’re rolling. If you want more strategy or want to get into stock buying and selling, I suggest another firm as my experience with Vanguard was super tough. Their trade execution is horrible. I’m not in a place where I need active management, but if one does, Vanguard misses the mark on this one too. Best of luck to everyone out there– felt like another perspective should be shared. There will always be those that want the cheapest of the cheap and forgo value just to get it. People are that way with everything they do, cars, safety, other various products. If that’s you, try Robin Hood too… I’ve heard they trade for free. Vanguard is good at a few things, but they certainly aren’t the Ayatollah of investment firms like the article tries to convey.

Hi T – appreciate the opinion. I think that for most of my readers (and probably most folks in general), index funds are the smart move. Sure there are different strategies out there that may come out ahead, but for the average investor, they’re not going to execute them successfully and index fund investing will probably put them light years ahead. That said, I think we agree that for low-fee index funds, Vanguard is a solid option (Fidelity being another).

I’ve been with Vanguard for a year now (this post came out in 2017) and I’ve been very happy that I made the move. To each his own, so if you’re happy with some of the other brokers out there, that’s fantastic. I like that there are a number of choices out there – everyone wins in the long run with that.

Good luck to you!

— Jim

Over the last 5 years, my wife and I have moved our various accounts into Fidelity. In each case they paid us a bonus for bringing new money in. Well, until last year. Last year and the year before, we moved money out as well: to pay for our living expenses as we are now FIRE. Since we moved money out and in, no bonus :(. Oh well, it was good while it lasted; I think we got over $2,000 in total bonuses!

Wow, that’s the way to do it, Kevin! Nice job!

— Jim

I just did this very thing. Had in individual brokerage account at TD Ameritrade. About $8500 in it. The main reason was that with such a small number of stocks(about 10) for that amount of money, I could not get the diversification that a Vanguard mutual fund could offer. So I just transferred to Vanguard and did the set it and forget it method John Bogel recommended.

Love it! Nothing better than keeping it simple and just letting your investments do the work for you with some good diversification across the market.

— Jim