Disclosure: This post contains affiliate links and we may receive a referral fee (at no extra cost to you) if you sign up or purchase products or services mentioned. As an Amazon Associate, I earn from qualifying purchases.

Being aware of opportunity can be extremely valuable in building your nest egg.

This doesn’t mean veering from the path – sticking to your investment plan is highly important to growth. You put the money in (broad-based index funds for this guy) and then just leave it alone to do its thing… with some regular rebalancing once or twice a year.

But what about taking advantage of higher returns for the short term?

As early retirees, we get our annual “paycheck” every January, which needs to last the year for us. That’s a decent amount of cash that we keep in our online savings account and slowly funnel to our checking account over the year.

I’ve been happy to see savings rates going up over the past several months, but is that enough? Should we be content with that and just leave it alone?

There is no right path for everyone. What makes sense for one person might not make sense for another. Each of us is in different stages of life with various goals and distinct comfort levels regarding risk and return.

Regardless, I like to continue to find new ideas that could help us squeeze out higher returns where we can. Just because you don’t know what you don’t know doesn’t mean you shouldn’t strive to know. Read that sentence a few times over!

I just spent what probably amounted to 5 minutes last week to give us higher returns on our idle cash that we’ll need in the very near future.

Curious? Read on, my friend!

As a reminder, I’m not a financial advisor, a CPA, or anything cool like that. I’m just a guy who found his way to financial independence and shares his thoughts here. It’s not advice, so don’t just blindly follow what I’m doing. Do some investigation and talk to a professional if you don’t understand what you’re doing.

Setting expectations… “properly” getting higher returns for the short term ain’t gonna make you rich

Dang, first I build you up with a nice intro and then beat you back down as soon as we get rolling… what the heck?! Then I go tossing words around like “properly” as if that’s supposed to mean something.

Here’s the scoop… there are a million opportunities to make big money. If you’ve got a lot of cash, those “opportunities” with much, much higher returns will find you.

The problem is that the return usually has a nice sliding scale with risk. In almost all cases, the bigger the return, the more risk you need to take to have a shot at that return.

If you have cash that you’re not relying on and want to do some riskier investing, that’s up to you. Personally, I’ve learned that trying to beat the market is generally a fool’s game, but maybe you feel differently.

Regardless, the cash you’ll need in the short term shouldn’t fall under this umbrella. Any money you’re counting on using within the next few years shouldn’t be invested in anything with high or even medium risk – it should be saved. Investing always involves some level of risk and they call it “risk” for a reason – putting the money you need in that position can be a life show-stopper if things don’t go the way you hope.

Instead, I’m talking about finding ways to squeeze out higher gains without risk (or very little of it) on the money you’ll need or could need soon. Wherever this money goes should come out later with a little bit of a reward.

And by a little, that’s the whole point. You’re not going to safely make big money on your savings over a short duration. The goal is just to try to get a little bit more money without too much hassle.

Why am I sitting on over $55k of idle cash?

As early retirees, we have a system in place to keep most of our money growing to garner some of those higher returns. Then there’s a smaller portion of our money in shorter-term lower-risk investments. And finally, we have an even smaller portion ready for us to spend on our expenses.

This is the bucket strategy that I talked about in my recent post, Opening the Books to Our Investment Portfolio.

As part of this system, we end up moving one year’s worth of money to our Ally savings account at the beginning of each year. That money is then slowly moved to our checking account throughout the year for spending.

The system has worked well so far but that also means that we have a lot of cash that we’re sitting on at the beginning of each year. We just got our annual “paycheck” at the end of 2022 (BSCM matured), which accounted for about $55k. I then moved it to Ally, which currently has an APY of 3.3%.

That’s not too bad, but can we do better?

I think so but we need to be careful with this on two levels:

- We’ll need this money before the year is up so it can’t be put into anything that will lock it away for more than around 6 months.

- Since this is short-term and the money we’re living off of, we don’t want to do anything risky with it.

I decided to take a little over $25k of that money and see if I could find something.

A few ideas on higher returns

Finding short-term, low to no-risk opportunities with higher returns isn’t something that’s going to provide too many exciting options. Here are just a few:

• Online savings accounts – Even though this is something I’m already been using, I want to mention it because too many folks are still using savings accounts at regular bricks and mortar banks. That’s like throwing money away – most of the big banks are paying pennies instead of dollars in interest. It’s like they’re just spitting on you and laughing all the way to the… well, you know.

Right now, most of the big banks (Chase and Bank of America, for instance) are offering a paltry 0.01%. Wells Fargo is somewhat better (but still laughable) with a rate of 0.15%.

Now compare that to online banks. Ally is offering 3.3%. That’s 330 times higher than Chase and Bank of America!! And some of the online banks are even over 4% right now!

Please do me one favor – check your bank or credit union to see what APY you’re getting on your savings. If it’s not at 3% or higher, I implore you to open an online savings account. They’re easy to open, usually without minimums or fees, and they offer the same FDIC insurance that you’re getting with your current bank. The difference is that they don’t have the cost of operating branches (branch buildings, employees, etc.) so they can offer much more appealing interest on accounts.

You can find a list of online savings accounts and their rates at Bankrate.

• Series I Savings Bonds – You can read more about these in my post, Getting a 7.12% Return With Series I Savings Bonds, from back in November 2021. They’ve gone up as high as 9.62% since then and they’re currently offering a rate of 6.89% until it resets after April of this year.

This has been a good deal for over a year now. There are some minor downsides though. One is that you’re limited to $10k per person per year (though there are a few ways to boost that a little higher).

You also lose the last 3 months’ interest if you pull the money out before 5 years. And you can’t pull the money out at all no matter how many times you say “pretty please” until at least one year passes.

That last one is why this option wouldn’t work for us. We’ll need the money sooner in no more than 6 months so we needed a better choice. If you have money sitting idly that you won’t need for a year though, this a something you should definitely consider.

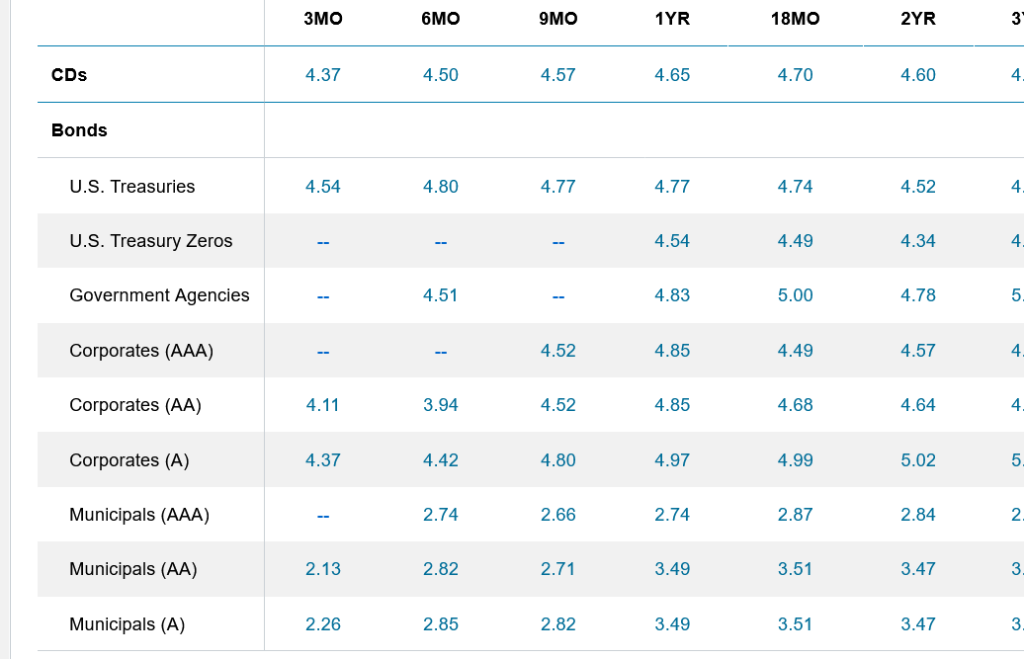

• CDs – No, no, not the music compact discs that became huge in the ’90s, but rather certificates of deposit in the financial world. We’ve taken advantage of the higher returns from CDs in the past, but recently, Clark Howard talked about why this might be a good deal.

First off, know that probably everyone in my life rolls their eyes every time I start a conversation with the words “Clark Howard said…”

It’s a phrase I’ve uttered way too many times (or maybe not enough!). But why are those words something relevant to my conversations?

It’s because The Clark Howard Show is the one podcast that I listen to every single episode, 5 days a week. I’ve listened to Clark for probably a couple of decades now through his old TV show and now through his podcast. If you’re not listening to Clark for practical advice you can absolutely use in your life, you 100% should be.

So when Clark started to talk about the current CD rates and why they might make sense right now, he was speaking my language. He talked about how interest rates should start to become a little steadier for the most part. He’s projecting that the APY increases we’re seeing with the online savings accounts are likely to be getting near their max for a while as well.

His thought was to look at locking in the higher returns on CDs now while you can.

And that was exactly what I planned on doing with my “spare” $25,000 until I stumbled across another option… U.S. Treasuries.

I pushed $25k into U.S. Treasuries

Let’s start with this:

I strive for a balance between effort, risk, and return.

Managing our portfolio of investments is something I spend a little time on. With currently over $1.3 million at risk, even little swings make a difference. The effort needed can be a little more, but the return is a lot greater. That said, I keep things fairly simple so it’s not too time-consuming.

I use Empower (formerly Personal Capital) to help manage my investments and that’s made it tremendously easier. Being a free service doesn’t hurt either!

On the flip side, I could pursue things like the bank offers that come in the mail to get maybe $350 after opening an account there, doing some bill pay or whatever, and keeping it open for a handful of months. No risk and the return is pretty high considering it doesn’t cost you any money.

$350 is nice… but for the time and effort involved, it’s not worth the effort for me. That’s fine if you enjoy it, but it’s just not a good use of my own time.

I’m in a situation here where I have to remember to weigh the balance of effort, risk, and return with the short-term money as well. $25k is a good chunk of money, but squeezing out higher returns than the 3.3% I’m already getting for around a 6-month duration is going to be tough… especially if I don’t want it to require a lot of effort.

So here’s what I did. Our savings is at Ally and our checking is at Schwab. The accounts are already connected since I do automated transfers from Ally to Schwab every month for our monthly paycheck.

I checked the CD rates at both places and they were higher at Schwab. Also, part of the deal with Schwab is that our checking account comes with a brokerage account that has been sitting idly since we started with Schwab when we were moving to Panama.

Schwab was offering CDs at 4.5% for 6 months… perfect! I could put our $25k in there for 6 months and then move it back to Ally in the summer once it matures to use for our spending for the second half of the year.

But wait… what’s this? U.S. Treasuries for 6 months offering 4.8%?

Honestly, I didn’t even know much about U.S. Treasuries but after some quick digging, this seemed to be a no-brainer. Higher returns than the CDs and one of the safest investments out there.

That’s an extra 1.5% over the 3.3% we’re getting at Ally. And it’s a low-effort change to get in and out of later since I have an account there and my Ally and Schwab accounts are already connected.

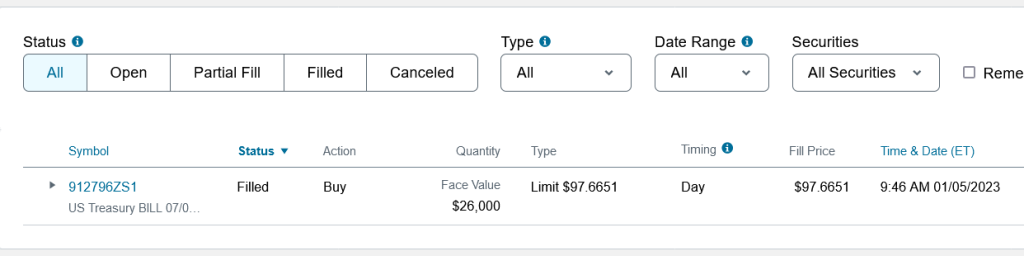

I took a couple of minutes and moved $25k from our Ally savings to Schwab checking. The next morning, it had already been transferred and I took another minute to move that money (plus a little change) from our Schwab checking to our Schwab brokerage account.

With a few more clicks, we now owned $26,000 in U.S. Treasuries for the low cost us $25,392.93…

The exact Yield to Maturity that I got it for was 4.821%. That comes out to be $607.07 in interest when it matures on 7/6/23.

After that date, I’ll be able to move that money right back into Ally and hopefully be all set with a little extra cash.

Is it worth it?

Seems like a worthwhile deal, right? But there are a couple of considerations to keep in mind.

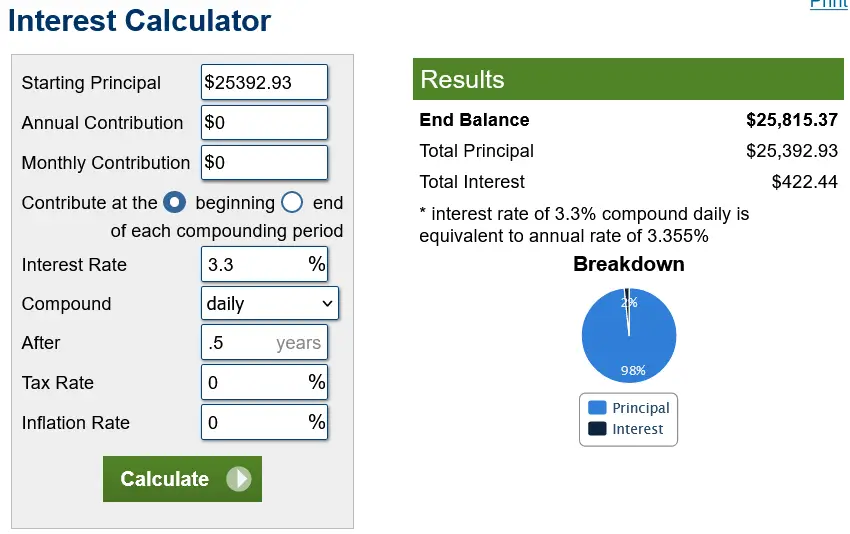

1) It really doesn’t amount to much. If this was long-term or for a lot more money, that extra 1.521% would be exciting. But, here’s what we would have had if we left the money sitting in the Ally savings account instead…

$422.44 over the same 6-month period.

The U.S. Treasuries are securing us a return of $607.07. In other words, and here’s the big letdown… this is going to amount to $184.63 more than we’d get if we had just left it alone at Ally. Yeah, it’s not anything exciting enough to write home about.

2) That win over leaving it in Ally isn’t set in stone. That roughly $185 is with the assumption that interest rates don’t change at Ally and I’m sure they will, at least somewhat. If they go down, I’ll feel like a genius. But they could also continue to rise and nullify the entire point of this move.

So, it seems kind of blah overall.

But remember when I mentioned earlier that I strive for a balance between effort, risk, and return?

This took all of 5 minutes to do to get what may amount to around $185 extra money. That math would put my hourly rate at $2,220!

So, for 5 minutes of work, yeah it was worth it. Funny enough, it took me longer to calculate what the difference in returns would be between this investment or just leaving it at Ally than it did to just make it happen! ?

Chasing returns isn’t going to be a huge game changer (unless you’re dealing with some serious money or a longer amount of time). But considering I likely made us almost $200 in a matter of minutes, I think it’s time well spent.

I’m considering this an experiment. If it works out, this could be something I investigate looking at various options like this every year. If it doesn’t work out though for some reason, no harm, no foul.

The key though for readers is to know that there are some decent (not stellar) places to get a little bit of return on your short-term cash. And the longer you can leave it, the bigger the potential for reward.

What do you think? Have you found ways to get higher returns for little to no risk on any cash you’ll need in the short term?

Plan well, take action, and live your best life!

Thanks for reading!!

— Jim

Great post, we’ve done all the same things! Emergency fund at Marcus online bank for 3.3%, I-bonds to the max in Aug. 2022 and Jan. 2023 for 9.x% and 6.x% (can’t remember the deets right now), a 1-yr CD thru Schwab for 4.8%, and 6-mo T-bills thru TreasuryDirect (done at the same time as our 2023 I-bond purchases) for 4.8%. This effectively ladders our cash for various purposes, diversifies our exposure (even though it’s all guaranteed, there are hassles involved if any were to fail), and gives us decent returns for virtually no risk. It’s taken me way longer than 5 mins to research and implement it all, but I’m pretty happy with the outcome! And now that’s it all set up, replicating it as needed for “rollovers” should be easy.

That’s fantastic, Lisa – nailing it!! That last part about having it all setup now will make it so much easier now… love it!

Yep, we’re doing the same thing. Hard to justify a bank CD with Treasury rates where they currently are. And like you said, they are easy to buy – and you can convert them back to cash on the secondary market if needed. (You’ll probably take a small hit on that due to market fluctuations, so this would only be a last resort for us). Finally, proceeds on Treasuries are not subject to state income taxes, so for those of us in high-tax states it’s a plus!

If any of your readers are interested in how specifically to buy these, here’s a link to a good blog post that walks you through all of the steps. I used it myself and found it to be very helpful.

https://thefinancebuff.com/treasury-bills-cd-money-market.html

Yeah, I definitely like that we can pull the money out if needed (hopefully, not!). Thanks for the link! I bookmarked it to check out later – it looks really thorough!

I just bought our iBonds for 2023, we also maxed out 2021 and 2022 but we have no need to spend any of it so the restrictions aren’t a problem. We are paying cash for $400K of land and vacation house we are having built so we have been having to raid much of our cash buckets for that. We normally only pull about $100K out of investments each year for living expenses which is simple and easy to manage. Pulling an additional $400K out over a twelve month period is a little more complicated since we have a mix of IRA’s, ROTH’s and taxable brokerage accounts as well as CD’s, I Bonds, money market and high yield savings accounts. I’m kind of treating it like it was a rollover to a Roth, but it’s rolling into the cost of land and construction instead of into another account. But it is accomplishing a similar result in terms of paying tax now at a lower rate than when we reach the age for RMD’s.

That does sound a little complicated pulling the money from that mix of accounts. But just think, when it’s all done, you’ll have a vacation home for us to visit you! 😉

Simplify your life. Don’t push the one year of funds to Ally and then to bank each month (13 transactions, lower yield). Instead, leave in your investment account in vanguard vmfxx 4.22% current yield (which will increase with Fed decisions). Transfer every 3 months to bank or when needed (4 transactions, higher yield, no locks/ increasing yield). PS no charge for the advice.

Very nice suggestion, Phil, and I appreciate the freebie! 🙂

I use savings sub accounts for expected future expenses:, a replacement car, home repairs, and our own escrow for tax and insurance. Found out a similar thing – using Treasury Direct I roll savings into 2 or 4 week notes to beat the MM rates at Navy Fed or the online Pentagon Fed account. Keeps the savings available almost instantly for about a 1.5% boost in interest with no state taxes. Can roll it over automatically, but haven’t done that yet.

Squeezing every bit of juice out of that lemon. Hey, $200 bucks pays a couple of bar tabs, right?

Love it! Haha, I did quit drinking though so I’m going to need to find another use for the $200! 😉

It’s unfortunate the ‘system’ is set up to reward consumption instead of saving. Having money in a big bank is a losing proposition, in most cases their interest rates don’t even keep up with the inflation rate of eggs! You might try to negotiate with your bank to see if they can up their interest rate a bit, we were able to do that and get 2.75%. That said, our bank is a smaller local institution, which may make a difference. Great post Jim!

That’s interesting that you were able to get the interest rate up with your bank (albeit a local bank)… goes to show that everything’s negotiable!

I like trying new investment vehicles with small amounts of money, initially; when I understand all the pros and cons of the investment, then I feel more comfortable investing larger sums. You are being paid $185.00 for your efforts, and received knowledge on top of that!

Great point, David, and I agree 100%! It would be a little more stressful if I was diving into a 7-figure investment without knowing the ins and the outs.

Does seem like a paltry return for a lot of work.

Maybe getting a better cell phone plan ala Clark Howard would net you more return.

Not having to pay a thing is like making more tax free income.

Haha, we’re already on great cell phone plans – I’m now on Mint Mobile and my wife and daughter on Visible. That said, this literally took me just a few minutes to do so it’s not too bad of a return for 5 minutes of time. It’s also reassuring to learn that the vehicle I have my money in was already good (but just got slightly better).

This post and people’s responses are very helpful for those of us either too busy or too lazy to investigate options which are often right under our noses, we all learn from one another. Thanks

I love the comments in these posts as well. I don’t claim to be an expert but rather just share what I find that works and doesn’t. Hearing others’ perspectives and thoughts is beneficial to everyone, including me. 🙂

I do the same with T-Bills for my emergency cash with Vanguard, but with a bit shorter maturity: 17-weeks. You bought 26-week 912796ZS1 T-Bill with 4.812% Investment rate (issue 01/05/2023, maturity 07/06/2023), I did similar, but for 17-week (912797FE2, issue 01/17/2023, maturity 05/16/2023) with 4.820% Investment rate. This way I hope in May 2023 to reinvest the money again, but probably even with bigger rate…

Smart, Alex – love it!

Not bad for 5 minutes! We’ll have to keep that in mind when we have a bigger cash position. For now, we put our cash in I bonds since we don’t really need it yet.

That’s the way to do it! I wish we had a little more cash that we don’t need in the near future so we could put more into those as well, too!

I feel like I’ve discovered some sort of virtual money mirror. I was saving towards 2 years worth of cash for my retirement bucket at 3.3%. I want the money to be liquid with yield. I ended up putting it in FZDXX. A money market fund at Fidelity yielding 4.3%. It’s linked to my bank account and I took will use it as my yearly paycheck of 100k. I’m all for smart and simple, and this seems like maybe both. My bond money is in a 3 year Treasury and CD ladder that’s ‘only’ paying 4% and in VMFXX in my 401k at 4.4%. I’m good with all that. I may lock that VMFXX money into a Treasury or CD if rates keep rising. Love this blog!

Glad you’re liking the blog, Jeff! Nice job on squeezing the juice to get a little more yield on your money. It’s crazy to see these money market funds at the brokerages offering these competitive yields. When I re-evaluate options in the future, I have a feeling something like VMFXX be the way to go for me as well to avoid locking the money up.

Great post! Another way that investors can increase their yield is by selling their shareholder voting rights. Monetizing votes can be a good way to generate passive income, especially for folks who don’t already use their votes. I’d recommend checking out Shareholder Vote Exchange. It takes just a few minutes to start earning and I’ve signed up myself.

Interesting – I never knew that was a thing – thanks for the heads up, Charles! I’ll dig into that some more, but that makes me a little nervous. I’d actually rather not vote at all than allow the possibility of the corporation themselves having an opportunity to buy up those votes themselves.

At first I thought the same thing too, but then I realized that the company (i.e., management) implicitly gets your support when you don’t vote. Abstaining is closer to voting for management than it is to voting against them.

I think a market for trading the votes could actually create more competition/accountability. Also might make people think twice when voting, which is probably good. I’m a pretty passive investor so it makes sense for me, but to each their own.

Keep up the great work Jim!

Now, that you say that, that does seem to ring a bell. I’m going to dig into that some more – that could make a lot of sense then. Great tip – thanks, Charles!