Disclosure: This post contains affiliate links and we may receive a referral fee (at no extra cost to you) if you sign up or purchase products or services mentioned. As an Amazon Associate, I earn from qualifying purchases.

3 years. That’s what this blog post marks… three years of blogging on Route to Retire.

3 years. That’s what this blog post marks… three years of blogging on Route to Retire.

For new bloggers, this might sound like a long time. However, I look at some of the others out there who have been doing this for over a decade – like J.D. Roth at Get Rich Slowly or J. Money at Budgets Are Sexy. It’s then that I realize I’m still somewhat of a rookie in the blogosphere.

I’ve consistently posted a minimum of once a week (haven’t missed a week yet!) and I’ve seen a steady increase in both readers and blog income.

On last year’s anniversary, I talked about what I’ve learned about blogging. That seemed to help a lot of newer bloggers out.

This year, I thought I’d take the opportunity for my “blogiversary” to create a blog post about what the community’s helped me to learn about personal finance over these past few years.

You see, blogging turned out to be an eye-opening opportunity that I wasn’t expecting.

I started Route to Retire with the intention of helping teach newbie investors what I knew about personal finance. Hell, I knew more than most people I talked to on the subject so why not share the wealth?

That’s still my intention, of course. However, the amount of knowledge in this community made me quickly realize how little I actually knew about the subject.

Sure, I knew the basics of saving and investing. I could tell you why a company match makes your 401(k) so important or the advantages of a Roth IRA. But although that can help you get on track, there are so many facets of personal finance that I didn’t know.

Of course, you know what they say – “You don’t know what you don’t know!”

The personal finance community opened up my world. I now spend good chunks of each day reading and learning from other blogs. Oh, and the podcasts! There are some truly awesome personal finance podcasts out there – yeah, I’m talking to you, Choose FI!

I enjoy studying and learning this stuff. After all, this kind of material can get us to financial independence a lot quicker. It can also help us to live another 40 to 50 years without working another 9-5 job if we don’t want to.

Although I’ve learned more than I can possibly fit in a blog post, I’ll hit on some of my favorites…

Keeping it simple with index funds

A couple of years ago, I decided to get a second opinion on my finances and talked to a fee-only financial advisor. He looked everything over and was pretty satisfied with most of the direction we were going.

However, he said (and I’m slightly paraphrasing), “What the hell’s going on with your Roth IRA?”

It was a good question. It was just a mish-mosh of stocks I had bought along the way because I like the companies and “thought” they’d do well. Not exactly the most strategic of investing strategies.

I did get lucky on a couple – I bought Amazon at $67/share and that’s currently trading at around $1,600/share! Too bad I only have a dozen shares.

I’ve since cleared out this mess of stocks, although I did keep Amazon and couple others – you gotta have a little bit of fun!

The biggest catalyst for my change though was after reading the Stock Series from Jim Collins… truly life-changing. Jim was able to make me easily understand why it just makes sense to go with index funds. He doesn’t complicate it and just tells it like it is.

Thanks, Jim! A major portion of our portfolio is now in VTSAX.

Stupid expense fees!

A lot of bloggers push their readers to sign up for Empower (formerly Personal Capital). There are two reasons for that:

- It pays a pretty good penny for every signup referral you get.

- It really is awesome – and free!

I use it to manage my investments and to take advantage of some of the tools they provide like the Retirement Planner and Investment Checkup.

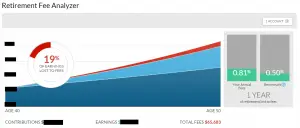

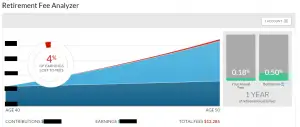

However, the biggest value it’s provided to me so far was with their Retirement Fee Analyzer. With the click of a button, I realized just how much I was paying in fees in my 401(k)… they certainly love hiding that info, don’t they?!

I determined a couple of years ago that I should expect to lose over $65,000 in fees in just a ten-year period!

I made some changes in my 401(k) that took me barely any time and then re-ran the tool. Now I’m projected to spend just over $12,000 in fees over that same period… amazing!

So yes, I want you to sign up for Empower (formerly Personal Capital), but not just because I get a few bucks to this site up and running, but because you need the information it provides.

And if you don’t want to use my affiliate link, just go there directly and signup. It’s free for you either way and can save you some major dollars like it did for me!

Portfolio allocation – a rebalancing act!

Another thing I’ve learned over the past three years or so is the importance of figuring out a portfolio allocation you’re comfortable with between stocks, bonds, cash, etc. and then sticking with it.

That was another “a-ha” moments I had while reading the Stock Series.

By keeping our portfolio simple and rebalancing once or twice a year, you’re positioning yourself to be selling high and buying low… that’s what you want!

When stock prices are high, it moves the percentage of your stock holdings higher than you initially set. Rebalancing lets you sell some stock while it’s at a higher price and buy bonds at a lower price.

The reverse is also true. When stocks are down, your bond allocation becomes higher. Rebalancing then lets you buy more stock at lower prices.

Simple concept, but just reading it, made me go, “Ah, now I get it!”

Know your numbers with rental properties

Some of you know from my recent blog post that we sold my first rental house. It did produce a little bit of income, but not what it should have.

However, a number of years after I had bought that first property, I stumbled onto BiggerPockets… game changer!

Between their fantastic forums and Josh and Brandon doing hundreds of deep-dive podcasts, I sucked in the knowledge like a sponge!

One thing I really learned was understanding the numbers better. If you buy a property simply based on the rent covering the mortgage and expecting to have some $$$ leftover, you’re setting yourself up for trouble.

The BiggerPockets Rental Property Calculator is great for doing your projected numbers and not forgetting anything. You’ll know if you should investigate the property further or what your offer should be to reach a certain ROI.

I also picked up an understanding of some rules of thumb like the 2% (or sometimes 1%) Rule and the 50% Rule. Comprehension of simple ideas like this can save you time and frustration.

The knowledge I gained from them helped me to confidently buy a duplex in 2016 that is generating a very solid cash flow.

The 4% rule… of thumb?

The 4% rule basically states that you can live off a portfolio by taking out 4% every year (adjusted for inflation every year thereafter) and have about a 95% chance of not running out of money.

This seems to be one of the most debated topics in relation to FIRE in the personal finance community.

The critics can whip up a smart blog post telling you that the study was based on 30 years and might not support a FIRE lifestyle of 40, 50, or 60 years.

Plus, the research assumed a growth rate in the market that guys like Jack Bogle predict isn’t likely to happen over the next decade. Tremendously low interest rates are also throwing off the likelihood of the 4% rule working.

Additionally, it’s based on specific allocations of stocks and bonds. If you stray from those allocations, that can throw off your own financial future (should history actually repeat itself!).

The proponents though will tell you that if you’re retiring early in your 30’s or 40’s, for example, you’re probably not going to be sitting on your butt all day long. You’ll likely find a passion that will end up bringing in some kind of supplemental income.

Besides that, if you have a little flexibility and spend a little less in bad times, you’ll be just fine.

Personally, I like the idea that some folks in the personal finance community like Paula Pant at Afford Anything have said. And that’s to consider it a rule-of-thumb instead of a rigid rule.

It’s not perfect, but it can help give you a good gauge of where you should be heading. And if that scares you too much, consider lowering your withdrawal rate to something lower like 3 to 3.5% for some added breathing room.

This is why I love the PF community. Being able to read a blog post here or there routinely debating the different sides is informative. It helps us as readers make a more educated decision on what will work best for our individual circumstances.

Sequence of returns risk… yikes!

Michael Kitces‘s blog post on Understanding Sequence Of Return Risk and Big ERN’s The Ultimate Guide to Safe Withdrawal Rates helped me understand what the rate of returns risk was and why it’s critically important to your retirement. This can coincide perfectly with the 4% rule and planning for FIRE like I just talked about.

The idea is that if you retire during a bear market, your withdrawals from your portfolio can draw too much principal at the beginning. That can crush future growth and cause you to run out of money before you’ve planned to… not good.

This understanding has helped me to prepare for our FIRE date at the end of 2019.

Following ideas that guys like Fritz at the Retirement Manifesto have talked about, we’re building a bucket strategy.

The most important part of this is that we’re stashing some cash to carry us during the first 2-3 years if needed. This could be imperative in the event of a market downturn, particularly if it happens right about the time I quit my job.

In pursuit of tomorrow, don’t forget about today

The biggest lesson this community has taught me though is not to get too sucked into everything.

With each new blog post I read, I became more and more obsessive about things. I wanted to cut every spending corner I could to move up our FIRE date. That’s how much I wanted to be done making the donuts.

The problem is that I was making myself miserable. All I focused on and talked about were ways to up our game.

I’m surprised Mrs. R2R stuck around with me throughout that time!

Then, at some point last year, Paula Pant at Afford Anything had a podcast that was like a shot in the arm. It was called How to Spend Less, Earn More, and Grow the Gap and it was the wake-up call I needed.

In fact, it affected me so much that I wrote a whole blog post about it – Paula Pant Kicked Me Where It Hurts.

In a nutshell, she made me realize that I shouldn’t trade today’s happiness for tomorrow’s.

I’m truly excited to quit my job at the end of 2019 and move to Panama, but I’ve since lightened up on my laser focus.

Everything’s now automated and in place to reach our date. The rest of the money we’re left with should be to have a little fun and enjoy today.

I’m actually writing this blog post on a plane with my wife and daughter on the way to Texas. We’re visiting my brother and sister-in-law for a few days.

We lined up a Caribbean cruise for late October and have all kinds of family fun planned for the summer – camping weekends, cabin trips, and an amusement park visit.

I’m still frugal and likely always will be, but I’ve learned not to deprive myself so much.

I hope you found this blog post to be interesting or even helpful. Thank you personal finance bloggers and readers for making the past three years so great! Here’s to the next three years!

Thanks for reading!!

— Jim

Congrats on 3 years Jim, that’s a pretty long time for a blogger and definitely puts you in pretty rare company! And no matter how long any of us have been investing, blogging, or trying to optimize life, we all still have things to learn from each other

Thanks! That’s one of things that makes this community so great – the different perspectives to help each of us determine what’s best for our own situation.

— Jim

Wow, I’m mega impressed with your three years blogging – well done on sticking it out through the bad times and good times.

Enjoy your holiday in Texas, and that Caribbean cruise sounds awesome!

Thanks, Ms ZiYou! Keep going and you’ll hit the 3-year mark before you know it! 🙂

Definitely looking forward to that cruise – not sure if it’s a given from my ocean view tied to my site, but cruises are my favorite vacation!

— Jim

Congratulations! 3 years is a great accomplishment.

It seems like if you make it over a year, then you can keep going for much longer.

I like the last lesson too. You have to enjoy the journey. It’s not good to put off everything.

Thanks, Joe! That last lesson is probably the most important (at least it was for me). Totally agree about that first year being the mark on a make-it or break-it point for most folks.

— Jim

Congrats on three years and nice summary. I’ve learned so much from blogs including yours. Thanks!

Much appreciated, Doc!!

— Jim

Congrats on reaching three years!

Thanks, SRGO!!

— Jim

It’s a big accomplishment Jim. Congratulations and I hope you celebrate many more to come. Tom

Thanks, Tom!

— Jim

Congrats on 3 years, Jim!

Thanks, Amy!

— Jim

Three years of blogging is equivalent to about 10 years of normal life, right?

A cruise in October? you are coming to FinCon, right? Are you taking the cruise to Cuba that PoF is on?

That sounds about right!

Of course, I’ll be at FinCon – I need to blow you off to talk to Jim @ Wallet Hacks again! 😉

Yeah, that cruise to Cuba with PoF sounds fun, but this is one in late October. Somehow, we got a nice discount for an 8-day cruise that’s going to run us only $1,500 for all three of us… and not on a Carnival cruise! I heard you’re retired – wanna bring the fam and come with us?

— Jim

I’d love to but my wife has put the kabosh on cruises for awhile — that’s why we now go to islands (Grand Cayman last January and probably again next year.)

You’re just nervous I’d push you off the boat!

— Jim

Congrats on three years! I got into blogging figuring I had a lot to share and over the last 2.5 years have learned way more from this community than I’ve imparted on others.

So happy to have you as a part of the list of resources that I use to better myself. Keep rolling, Jim!

The feeling’s mutual, Chris!

— Jim

Nice lessons. And 3 years of blogging is nothing to sneeze at. Most blogs don’t make it past a year. Keep up the great work.

Thanks, Jason – much appreciated!

— Jim

Congrats, “little brother” (turns out my blog was born a month before yours!). 3 years, without a missed week, is a major commitment. Congrats on The Grit.

Thanks, Fritz – happy belated on your blogiversary!

— Jim

This truly awesome, especially as a new blogger myself and personal finance junkie. Seeing your experience as someone much further down the line is eye opening.

The lesson that stuck with me the most is not trading tomorrow’s happiness for today, that is something i can sooo relate to. Even though our target FI date seems so far in the future, i’m learning to pace myself a little to enjoy more special moments with my family, even if it might cost a little bit of money.

Thank you for sharing! Cheers!

Thanks, so much, HLT! It’s funny how the most important finance lesson isn’t even focused on making or saving more money! 😉

— Jim

Congratulations on three years! I imagine it wasn’t easy but I’m sure it was worth it! ??

Thanks, Scott! If you stay consistent, then once you get past the first year, it really becomes a regular part of your life.

— Jim

Wow I have only been blogging several months … but the truths you highlight … ring true for me too … good practical advice … reflection is a good way to look and be thankful for what is going well, and thinking about how one can make things even better is the other shoe 🙂 Michael CPO

Much appreciated, Michael – these yearly posts are definitely a good opportunity for reflection for sure!

— Jim