Disclosure: This post contains affiliate links and we may receive a referral fee (at no extra cost to you) if you sign up or purchase products or services mentioned. As an Amazon Associate, I earn from qualifying purchases.

Updated: 08/27/25

We’re closing in on the end of my 7th year of early retirement. I was fortunate enough to run my last day on the hamster wheel on December 31, 2018.

At the time, I had a plan and was confident it would work (though there’s always that tiny bit of self-doubt!). Fortunately, it’s worked better than we could have expected, thanks in part to retiring at a time when the stock market has continued to climb with only a few dips over the years. With every passing year, the worry about the sequence of returns risk continues to go down.

So, we’re now in an even better position than when we started, and I feel absolutely blessed… but that doesn’t mean plans don’t change.

When we started our early retirement, we were able to do our best to maximize ACA subsidies alongside the Roth IRA conversion ladder as part of our plan. Life was good, and so were the enhanced premium tax credits we were getting as part of our Affordable Care Act (ACA) health insurance. Every year, do the math at the end of the year, do a Roth conversion accordingly, and then just rinse and repeat.

Well, it’s like the saying goes, “The only constant in life is change.” Times change, so you need to adapt or you’re going to be swept away.

The two big changes for us that my crystal ball is showing are:

- Those enhanced premium tax credits are going to sunset at the end of 2025 (unless a completely unlikely step-in from Congress changes that).

- Our daughter is just about to start her sophomore year of high school (still homeschooling). That means she’s getting closer to starting college, joining millions who are inundated with student loans and needing to come up with a good chunk of money up front, now called your Student Aid Index or SAI (previously the Expected Family Contribution).

So, I could either just roll my eyes, accept these circumstances, and move on… or I can come up with a new plan to “fix” both of these problems as best I can.

Yeah, you probably guessed – I’m all about adapting and trying to turn things in our favor.

I was so confident in our new plan that I had recently spent a lot of time writing a blog post about it… but then I suddenly had to pull back the reins on publishing it. I thought I had figured out an easy way to maximize for ACA subsidies and for the FAFSA/SAI as an early retiree.

The problem was that as I dug deeper into things, I stumbled onto a massive problem – a major complication that took me by shock and almost ruined my big plan.

So I’m going to tell you about what we had planned for the next handful of years to optimize for ACA subsidies and FAFSA/SAI, the huge issue that crushed my blueprint, and the new tentative plan to do our best to compensate for this issue. Of course, if you have any thoughts or knowledge on this subject, I’d love to hear ’em!

As a side note, this post will also serve as Phase 2 in helping our daughter get through college with the least amount of debt possible. The first post was Phase 1: Powerful Strategies to Earn College Credits While Homeschooling.

Some quick background to get you up to speed…

I’ve been fortunate to be an early retiree (retired at age 43, seven years ago). Years ago, I had a fantastic CFP until he moved to an AUM-only model, which wasn’t what I needed. Anyway, he had helped tweak our long-term financial plan, and our portfolio has continued to grow faster than our spending over the years, which has been great.

We’re a household of three:

- Little old me rocking it out at 50 years old now.

- My wife, Lisa, who refuses to get out of her forties… your time will come, woman!

- Our daughter, who’s now 15 and in her sophomore year of high school.

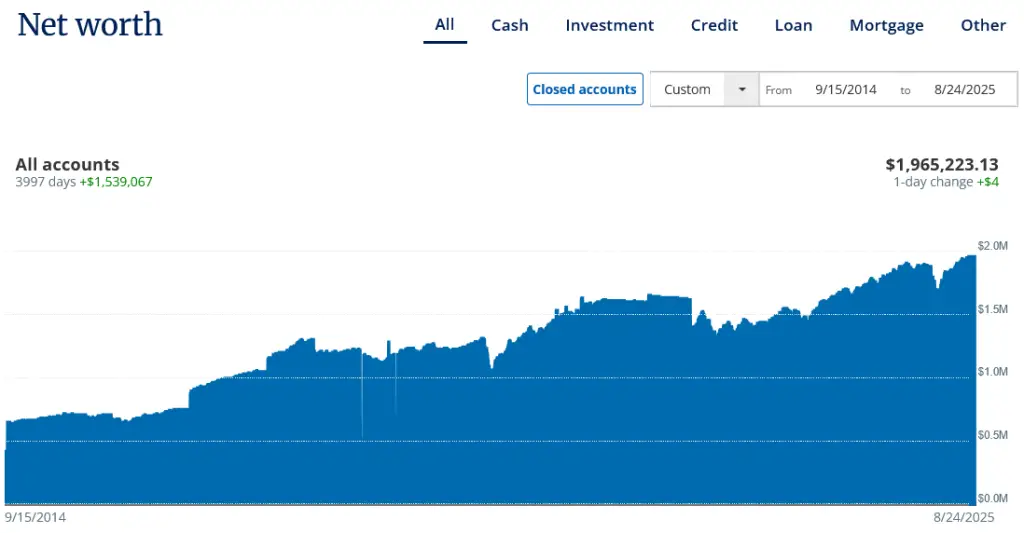

Our current net worth is holding steady at more than $1.9 million. We keep getting close to that fancy-pants $2 million mark – almost there!

I’ve been keeping track of our net worth and our investments with the Empower Dashboard for close to 10 years now. It’s free and I’ve never found anything easier and better. You can check out Empower here if you’re looking for a great way to do the same.

We sold our house in 2019 before we moved to Panama and have rented ever since. I have no desire to own again. I love being able to make a call when there’s an issue and the ability to wrap up a lease and move on when we want to (which we’ve done several times already).

So, while that means we don’t have to be a part of the argument over whether or not to include your home equity in your net worth, it does mean we’ll never have a paid-off residence, so rent will always be part of our cost of living.

Our portfolio/bank accounts basically break down like this:

| Traditional IRA accounts (rolled from our old 401(k) plans) | $1.2 million |

| Roth IRA accounts | $625k |

| Taxable brokerage account | $30k |

| HSA account | $60k |

| Online savings | $25k |

| Checking account | $2,500 |

The majority of our portfolio is in my rollover IRA (from my old 401(k) account), which currently has a value of over $1.1 million. We’ve been doing a Roth IRA conversion ladder since my first year of retirement in 2019. While those conversions have been baking for their rolling 5-year timeline before we can withdraw the funds penalty-free, we’ve been using money from our savings and taxable brokerage account to fund our expenses (which amounts to ~$60-65k/year).

We’ve been able to take advantage of the enhanced ACA subsidies for our healthcare with current premiums of about $330/month for the three of us. Yeah, you read that right – that’s the total for all three of us. Not too shabby, right?

In the meantime, our daughter is a sophomore in high school this year. She’s still homeschooling and wants to finish high school while continuing that route. She’s also planning to do some dual enrollment classes over the next few years until she graduates. I talked about this in my post Phase 1: Powerful Strategies to Earn College Credits While Homeschooling.

As of now, she wants to attend North Carolina State University after graduation. However, she’ll probably get some of her core requirements out of the way with community college first. To help with this (and to get us out of the Ohio winters!), we’re likely moving to North Carolina by the spring of 2027. That will make us NC residents (you need to be there 1 year to qualify) so she’ll be able to get in-state tuition when she starts college in the fall of 2028.

We’ll also be applying for North Carolina’s C3 program in the spring of 2028, which should mean auto-acceptance into NCSU. Thanks to Justin at Root of Good for reaching out and turning me onto that one! One of the requirements, though, is that she would need to get her Associate’s from a NC community college first, so she’d do that for a couple of years before attending NCSU.

The FAFSA lookback period is the “prior to prior year” (I’m not making that phrase up!). So with our daughter planning to start college in 2028, the first year that the FAFSA is going to be looking at is 2026. That means that any money changes I want to make beforehand need to be done by… well, this year. Yikes!

Life goes on… and the massive snag in the process I didn’t know about

We’re now entering an interesting time in our lives with

- Extended ACA subsidies expected to end at the end of this year

- Our daughter is starting her sophomore year of high school with FAFSA look-back years starting next year.

Planning for these changes is a little tricky. Essentially, I want to do the following:

- Maximize for FAFSA/SAI for our daughter’s college plans.

- Maximize for ACA subsidies.

- Ensure we have enough money to live off of over the next several years.

Three simple bullet points – how hard can it be, right?

The struggle with trying to do all of these originates from a few factors:

- Any money moves we make from 2026 through 2030 will affect our daughter’s FAFSA eligibility.

- We want to keep our income as low as we can to get the maximum ACA subsidies. However, we need to have at least ~$35k/yr in income to safely ensure we don’t fall into Medicaid territory. So that more than likely means a Roth IRA conversion of $35k/year to meet that minimum.

- We’re about to start doing qualified Roth IRA distributions each year to cover our annual expenses. We don’t have enough money in our savings/taxable accounts to cover our expenses over the next 4 years to allow us not to take Roth distributions during this time.

Initially, I anticipated us being in great shape with the $35k/year in Roth IRA conversions over the next 4 years. That would keep our income low, but not too low, and we would satisfy everything we needed and live happily ever after. Ah, life is good.

The big surprise to me though was finding out that, although Roth IRA distributions don’t count as income with the ACA subsidy formula, they DO count as income for FAFSA/SAI. Wait, what?!!

Essentially, I had anticipated that all the money in our Roth IRA was sheltered from most everything. I just naively expected that taking the money out would not affect anything we did… kind of like how it doesn’t count as income for ACA subsidies. But I was badly mistaken, and having those Roth IRA distributions count as income is a real kick in the shins.

That sort of took the wind out of my sails because we’re now looking at a lot more money counting as income every year for FAFSA/SAI. Instead of being “poor on paper” with just the $35k Roth IRA conversion each year, we would also have a Roth IRA distribution of around $60k-65k to cover our expenses. In other words, instead of just having a $35k/year income stream for FAFSA/SAI, that idea makes it look like ~$100k. Ouch.

The new and sort of improved plan

I’ve been struggling to figure out a solution to this. I’ve worked with a few of the different AIs for hours upon hours in trying to figure out the best way to do things. I also spent time correcting the AIs when they gave out blatantly wrong information. These AI tools can be extremely useful and powerful, but only if you know enough to keep them in check.

I don’t think there’s a great way to explain this, but I’m gonna do my best. Not a ton has changed, but here’s the general idea of my “the best I could figure out to do right now” plan:

- Take advantage of the next few months to make our money moves since this is the last year not affected by the FAFSA/SAI lookback.

- Clear out the money from our daughter’s taxable brokerage account. We’ll blend that into our spending money for now and track the growth of that “loan” from her so we can pay it back later. That will eliminate all countable assets for our daughter for FAFSA/SAI.

- Clear out the remainder of our own taxable brokerage account. We don’t have a lot left in it anyway. That’ll leave us with just our checking/savings and retirement accounts being counted for assets. Most of the FAFSA applications we do will be later in the year, too, so those accounts should be about 3/4 of the way empty by that time each year since I fill them at the beginning of each year for our spending money.

- Do a qualified Roth distribution of everything we can pull with no penalty right now in order to lessen the distribution amounts needed during the years FAFSA looks at. Assets affect the FAFSA/SAI a lot less than income, so it’s better to do it now and have it sit versus draw it as an income distribution later. Unfortunately, we’re at the beginning of the ladder rungs that are marked as qualified, so we only have about $105k we can take out right now without penalty. Every year hereafter, there will continue to be some money we can take out.

- Use the money from the taxable accounts and the bigger Roth distribution from this year first. Then we’ll try to smooth out the ride for the next four years to keep the distributions as low as we can.

- Ensure we do the smallest amount possible on Roth IRA conversions each year to aim for the maximum ACA subsidies we can get without slipping into Medicaid territory. I’m guessing that should be about $35k/year. These count as income for both the ACA subsidies and on the FAFSA/SAI numbers.

- Do a Roth IRA distribution each year to make sure we have enough money to live off of. These count as income for just the FAFSA/SAI numbers and not the ACA.

- Put a new plan into action after the FAFSA look-back years have passed.

- Since we’re switching to such small Roth IRA conversions over these years, that really messes up our Roth IRA conversion ladder. Living off the $35k/year that’ll be available in 5 years after each isn’t the direction we want to go.

- Instead, we’ll plan on utilizing a combination of those small Roth IRA amounts from the ladder, plus we’ll likely start 72t SEPP distributions for the 5-year minimum. As we get closer and know exactly where we stand, I’ll work the formula backward to determine the starting pile of money needed to equal (therabouts) what we want from the distributions for those years. Then I’ll roll that amount into a separate IRA to use for the SEPP distributions.

Hopefully that wasn’t too confusing. Here’s a simplified schedule of the plan…

| Year | Event | Amount | Affects |

|---|---|---|---|

| 2025 | Last year that doesn’t affect our FAFSA/SAI calculations | ||

| Clear out our daughter’s savings and taxable brokerage accounts | |||

| Clear out our taxable brokerage account | |||

| Roth distribution (all qualified $) | $105,000 | FASFSA/SAI | |

| Roth IRA conversion | $50,000 | FASFSA/SAI / ACA | |

| 2026 | Affects FAFSA/SAI in 2028 | ||

| Roth distribution | $25,000 | FASFSA/SAI | |

| Roth IRA conversion | $35,000 | FASFSA/SAI / ACA | |

| 2027 | Affects FAFSA/SAI in 2029 | ||

| Move to North Carolina to establish residency | |||

| Roth distribution | $55,000 | FASFSA/SAI | |

| Roth IRA conversion | $35,000 | FASFSA/SAI / ACA | |

| 2028 | Affects FAFSA/SAI in 2030 | ||

| Roth distribution | $40,000 | FASFSA/SAI | |

| Roth IRA conversion | $35,000 | FASFSA/SAI / ACA | |

| File First FAFSA/C3 (uses 2026 data) | |||

| Our daughter starts community college (Year 1) | |||

| 2029 | Affects FAFSA/SAI in 2031 | ||

| Roth distribution | $40,000 | FASFSA/SAI | |

| Roth IRA conversion | $35,000 | FASFSA/SAI / ACA | |

| Our daughter starts community college (Year 2) | |||

| File Second FAFSA (uses 2027 data) | |||

| 2030 | First year that doesn’t affect our FAFSA/SAI calculations again (assuming she graduates in 4 years) | ||

| Roth distribution | $75,000 | FASFSA/SAI | |

| Roth IRA conversion | $35,000 | FASFSA/SAI / ACA | |

| Our daughter starts at NCSU (Year 1) | |||

| File Third FAFSA (uses 2028 data) | |||

| 2031 | |||

| Roth distribution | $75,000 | FASFSA/SAI | |

| Roth IRA conversion | $35,000 | FASFSA/SAI / ACA | |

| Our daughter starts NCSU (Year 2) | |||

| File Fourth FAFSA (uses 2029 data) | |||

| 2032 | … and beyond | ||

| Our daughter graduates NCSU | |||

| Roth distribution | $35,000 | ||

| Roth IRA conversion | $35,000 | ||

| 72t SEPP distribution | $40,000 |

I wish I could take out more as Roth IRA distributions in the first couple of FAFSA-counted years because she’ll most likely be attending community college and those costs are so much more manageable. Even without any financial aid, the community colleges in the C3 program seem to range from $2,000 to $2,800 per year for North Carolina residents.

Unfortunately, I’m not going to have access to enough qualified dividends that baked for the 5 years necessary for the conversions until later. In 2025, 2026, and 2027, I’m completely depleting the Roth accounts of the money I can pull out without penalty each time.

So for the time being, it looks like our income for the FAFSA/SAI years will be in the ballpark of:

- 2026: $60k

- 2027: $90k

- 2028: $75k

- 2029: $75k

While these aren’t crazy high numbers, they will have a much more significant effect on her financial aid than they would have been if Roth IRA distributions weren’t part of the equation. Income isn’t the only component in determining your AGI for FAFSA, but I haven’t figured out any allowed adjustments for our situation (yet!) that we could use to bring these numbers down much, if at all.

I haven’t determined if qualified Roth IRA distributions also count against you for North Carolina’s C3 program. However, the program focuses on applicants from low-to-moderate income households up to $110,000, so we should be good on that front either way. Hopefully, she’ll get into that program to at least guarantee acceptance into NCSU when the time comes.

An epiphany to make it tremendously better

After writing this post, I continued to dwell on the subject and then I looked at things from a different angle. That helped me come up with what will hopefully turn out to be a great idea.

I can’t think of a way to control the money we have coming in on the Roth IRA distribution side of things – we need money to live from. Heck, even if we got *gasp* jobs to bring down the Roth distribution numbers, we’d still have the income from the jobs, making it not much, if any, better.

We could spend less so we wouldn’t have to take out as much with the Roth distributions, but we’re already living relatively lean. I’m sure we could cut some corners, but it’s not like we live too extravagantly right now. And even if we did, it wouldn’t make a significant difference overall.

In other words, I think the Roth IRA distributions are what they are.

But… what about the Roth IRA conversions? We’re planning to do $35k in conversions each year just to avoid falling into the Medicare zone with the ACA. Seems reasonable enough.

However, I started to think, “What if we jump off the ACA for health insurance?”

That would allow us to skip doing the Roth IRA conversions completely – that’s $35k removed from our income just like that!

The idea of going off the ACA sounds a little scary at first, but we wouldn’t be rolling naked (thought I’d use that phrase to conjure up a nice visual). Instead, we’d look at joining a health sharing ministry. We did that for a short while after I first retired and before we moved to Panama. It worked well enough.

It’s not perfect and there are some downsides, but it does the job (hopefully). And I honestly don’t really care about how the FAFSA/SAI numbers play out for our daughter’s time at community college. At ~$2,500/year, that’s easy peasy. NCSU is where it matters – that’s where we’re talking big money (maybe ~$30k/year with room and board).

So the new thought is to keep following most of the plan I talked about before, but then in 2028-2029 (the years that will count toward our daughter’s 2030-2031 NCSU years), we’ll go a different route.

For 2028-2029, we’ll bail on ACA health coverage, sign up for a health sharing ministry, and not do any Roth IRA conversions. That will bring our income for FAFSA/SAI down to around $40k each year for 2028 and 2029.

I ran this through some of the SAI calculators and that should give us a negative SAI or close to it. That’s huge! That will also kick up her Pell grant eligibility dramatically. That’s a big deal since that doesn’t need to be paid back at all.

And we can just plan our 72t SEPP distribution numbers accordingly for after the FAFSA/SAI years.

This was a big eureka moment and I feel like I can breathe again. My goal is to help our daughter graduate without being crushed in student loan debt, and this should be the key to most of that.

The one element to consider with all of this happens to be the same thing I mentioned at the beginning of this post – times change and you need to adapt.

I can’t say what the FAFSA/SAI formulas will be in a couple of years. I don’t know if the Roth IRA conversions will even count later. I don’t know how the ACA will be structured then. I also don’t know how the health sharing ministries will work then – there might be even better solutions (or worse).

And, of course, our daughter could change her mind about where to go to school, or she may decide not to go at all. The tuition can and will change. Maybe North Carolina’s C3 program changes or disappears.

There’s no way to have a plan and expect nothing to change… but at least we have a game plan based on what we know today. And then we’ll adapt as needed.

In the meantime, I try not to put all our eggs in one basket. Some of my other random thoughts:

- For planning, I initially had in my head a single Roth IRA distribution each year for our annual spending. However, to optimize for our FAFSA/SAI numbers, it’s probably much more prudent to do it in amounts that ensure we end with close to nothing in our checking/savings for the FAFSA application and then do another distribution for the remainder of the year after that’s complete.

- Our spending could change. We might be able to make some slight changes along the way (spending a little less one year so we don’t need as much from Roth IRA distributions the next, for example). With us toning back the travel plans a little throughout the next few years, that could make a difference.

- Our daughter’s starting dual-enrollment classes soon to knock out some of the time/costs in college.

- She’s most likely going to do community college for what she can for her core requirements.

- Our daughter does well in school. We’ll be pushing her to go after as many grants and scholarships as possible – for grades, our income level, and any other opportunity possible.

- We’ll dig into any grant programs offered by North Carolina.

- Additionally, we’ve got a small amount (very small) in her 529 plan of about $32k.

This plan is far from being written in stone, and I’m certainly open to suggestions. What do you think?

Here are the posts I’ve written so far on our strategy to keep our daughter’s college costs low:

• Phase 1: Powerful Strategies to Earn College Credits While Homeschooling

• (Phase 2:) The Surprising FAFSA/SAI and Roth IRA Conflict that Almost Sabotaged Our Financial Aid Plan

The next area I hope to add to this (Phase 3) will focus on grants and scholarships.

If you enjoyed this post, consider hopping onto my email list. I’ll keep you in the loop when new posts come out, and I’ll even send you a bunch of cool and useful spreadsheet freebies just for signing up. Come on… you know you want to!

Plan well, take action, and live your best life!

Thanks for reading!!

— Jim

What are the incremental costs if she doesn’t fall into those programs???? This data would help the reader understand the importance of your post. Eg. Reg CC tuition in NC, regular NCSU tuition,

What if she gets scholarships? How does that impact?

Hi, Phil – I purposely didn’t dive too deep into the specific costs just because it’s such a moving target, and since it’s so early, it’ll change even more. Instead, I wanted to focus more on just saving as much as possible through the FASFA application and driving the SAI number as low as possible.

Regardless, I believe the rack rate with room and board for NCSU would run around $30k/year, but once an SAI number is established, what the school offers as its cost can be completely different.

The community college costs are much easier – I did mention that one in the post:

The next phase of this project will be to focus on grants and scholarships that she can hopefully knock out some/most of the remaining costs with. I’ll write more about that phase once we get a little closer and I know more about what the ins and outs are for those.

Why don’t you consider simply doing 72t SEPP of $60k per year (or whatever your annual spend is) and forgo Roth conversion and distributions during the 4 year period? Yes, it locks you in until 59.5 but you are spending that amount annually anyway so I don’t think it’s that much of a risk. You should also contribute to HSA and withdraw in 2026-2029 as needed since HSA distributions don’t count as income.

I just verified and 72(t) SEPP distributions are considered income for FAFSA purposes as well so that’s kind of half a dozen in one hand. 🙁

But your HSA idea is interesting. Distribution for reimbursement for medical expenses is not treated as income (they are for non-medical expenses). We’ve only got a little over $12k we’ve accumulated receipts for, but it’s still something. That wouldn’t take us far and I’d hate to utilize that instead of letting it continue to grow tax free, but it’s still something to keep in our back pocket.

Thanks for the ideas, Elaine!

Sorry I wasn’t clear in my comment but 72t distributions are definitely considered income. My suggestion for you was to recognize 72t distribution income instead of converting Roth and distributions from Roth.

Contributing to an HSA each year will also reduce your Fafsa income. If your goal is $40k income, then take $48,550 72t distribution and make $8,550 HSA contribution. Then supplement in 2026-2029 with the money you took out in 2025 and HSA money.

I think I see where you’re going with this and I’m liking it (the HSA contribution is genius, especially since they’re opening that up more for ACA plans in 2026), but I think there’s still a stumbling block. The HSA distribution would still count as income unless it was used for medical:

https://fsapartners.ed.gov/knowledge-center/fsa-handbook/2023-2024/application-and-verification-guide/ch2-filling-out-fafsa

And then I just learned this bit of news, too:

https://www.forbes.com/sites/troyonink/2016/03/31/hsa-contributions-help-your-tax-bill-but-hurt-your-childs-college-financial-aid/

That’s just as surprising to me as Roth distributions counting as income on the FAFSA. Not so good. Who’da thunk it?! 😂

Wait, I didn’t read your post but will go to do it especially after seeing now in the comments that you’re based in NC now?!? Lol, it proves my point of one of the reasons a lot of families move to NC which is great education for the price they pay.

NCSU has a great campus though for some kids appears to be secluded as compared to UNC nearby. The rack price was also a tiny bit higher there for the 1st time two years ago. I didn’t check last year since my kiddo got into UNC and LOVES it. OTOH, based on our financials we didn’t get any goodies despite having a GPA of 4.62, being active, club president, many AP classes, etc. I think pumping the message that you must be a super great student to qualify for scholarships is more for the benefit (or a business proposition by) of all these influencers on YU, TikTok, CollegeBoard, and tutors because the financial situation of the family is THE deciding factor most of the time, but if you can appear poor and the kid is very high performing academically, then yes, it’s a great chance you’ll reap some good rewards. However, in our case, I still wouldn’t have wanted to not save just so we can brag we don’t need to pay $100k over 4 years.

ETA: I’m also curious how exactly this CC to college transfer works. I continue reading such superficial statements on the internet but somehow they fail to mention that either the student has to be VERY proactive or be lucky to meet a great study counselor at a CC who can help the student to set up a list of classes to take that will 95-100% transfer to the university for their needed undergrad degree. There are some risks to presumed savings when going to a CC and then transferring to a university.

– Student might change mind about the studies they wish to pursue;

– Not all credits will be accepted;

– University can come up with new ideas for more classes to take to reach the wanted degree;

and the bottom result might be that the student may end up needing an extra year or even 1.5 years to accomplish. Yes, it will be still cheaper overall perhaps but then you need to weigh if spending more time but less money is really savings.

But the transfer opportunity to colleges from CC for kids born in 2008-2012 or even 2013 will be much better IMO due to the baby birth cliff at the time and this is nationwide problem, not only in NC. So colleges are already preparing as of this year. They are accepting more freshmen (aka front loading revenue) and increasing the cap of accepting CC transfer students due to the shortage of students in a few short years, especially considering the hostility of the current government to allow international students.

I’m far from an expert in this area, Debby, but my wife and I have been in the weeds with Homeschooling for College Credit. My understanding though is that as long as the college you’re doing dual enrollment classes with is regionally accredited (which is no longer a formal thing but it is still in practice), then the credits should be a lot more straighforward in transferring over. Here’s a quick link on that: Types of College Credit for Homeschool Students

But yes, it’s very important to check with the university you plan on attending to determine what would or wouldn’t transfer over.

Our daughter will be sticking with core requirements so those should hopefully transfer over pretty easily. Fingers crossed! But we’ll dig into the specific classes before she starts taking these in 2026.

I’ll happily take the transfer opportunity you’re talking about with younger kids (our daughter falls in that camp). It’s become a lot harder to justify college in recent years with soaring prices far exceeding what it takes to pay the schooling back. So if we can get her through it without a crazy amount of loans, I’ll consider that a huge win! 🙂

It depends on the state you live in. In Ohio if you get an associates you automatically have to be accepted into any of the state schools and the the general educations requirements are met. Different programs might have some different requirements. I did CC transfer back in 1988 and was 2 at CC and 2 at university. Both my kids did CC to university. The youngest got his associates in high school and took him 3 yrs to get his engineering degree (his last semester was only 6 credits).

Jim, great post we will be hitting this phase soon as well. We are based in FL and several programs that will help reduce the cost of instate education (bright scholars, AICE program) that we are setting up to take advantage for. regardless the research you’ve done is extremely helpful. I wonder how rental income plays into it. On paper rental income is reduced by deductions. I wonder if you could purchase rental property to compensate yet not increase income calculations. just thinking as I type.

Here’s part of what one of the AI’s says about that one, Nadeem:

Good thought though!!

I’m so glad to be done with all this! Just graduated by youngest in May. We never did a FAFSA as we wouldn’t have gotten any money and didn’t want loans. Both got credits in high school, graduated community college and finished by commuting to a state school. They both still got some scholarships without filling out the FAFSA. The 32k you have in the 529 would have covered either of my kids to get their degree. We have enough 529 money that we we will be funding our kids Roth IRA’s for the next 5 years. So debt free and money for their retirement is the ultimate win. My advice is to avoid the room and board. It is at least half the cost. The experiences we had as kids aren’t the same as the ones today. Both my kids said they were happy not living on campus. They are boys so that might make a difference. Get an apartment or house nearby and let her commute would be my advice. If not, hope she gets enough money in scholarships to cover it.

You did it the right way, Scott – nailed it! I’m hoping to come out ahead with this and possibly still have a little in the 529 to convert to a Roth later, too. My goal is to expect the worst and try to hit everything from all the angles (daul enrollment, community college, Pell grants, scholarships, etc.) so that hopefully we can make it happen. That’s good to know on the room and board. I would bet that our daughter would want to live off campus somewhere anyway, especially if she does community college beforehand, but I’d rather factor it in just to be conservative.

Appreciate the scoop!

Hi Jim, I’ve been playing mental gymnastics on similar topics as well. Here are some other ideas…

1. On medical, pair a “Direct Primary Care” physician service with a monthly fee and use a healthshare or catastrophic only coverage. Note: Starting in 2026, you can use HSA dollars to pay your Direct Primary Care monthly fee.

2. For your daughter, get medical coverage from the college. We had good success from the AHP insurance.

3. Outside the box idea. Buy an affordable condo in North Carolina this year. You could treat that as prepaid rent and reduce your expenses in the future.

Good Luck. I have also had good success using ChatGPT to work through these issues.

I’ve been excited for DPC services to grow for a couple of years now. That’s something I’d like to move to hopefully in the near future anyway. That’s interesting that you’ll be able to use HSA funds to pay the monthly costs. I’ll need to dig into that some more!

It’s funny you mention medical coverage while at college. I just saw something about that as I’ve been digging into this whole mess more and more. That’s another one I’ll need to make sure we’re on top of in a few years. Of course, you never know, things could change completely by then, but still good to plan for.

I’m with you on ChatGPT – I’ve spent countless hours talking to it Gemini, Copilot, and Perplexity on this stuff. They’re all extremely helpful in coming up with great ideas and plans – as long as you don’t take everything they say to heart. They’ll say something and then I’ll say, “Wait a minute, I thought that it doesn’t work that way anymore. Can you check the internet to verify?” Then it’ll come back and be like, “Oh, yeah, you’re right – sorry about that!” I like to take my questions and copy and paste them across multiple AI tools so that way I can kind of ensure that they’re all in unison about things.

I’m actually surprised you aren’t looking to house hack. Some people buy properties for their kids to live in, rent out some rooms and sell it when they are done. Kinda like when you bought a camper and car for a big trip and liquidated it when you were done but on a bigger scale.

That’s an interesting idea, Scott. Maybe that’s something to dig into as we get a little closer and we’re sure that’s what she wants. That said, I’m pretty happy to be out of the house ownership game – both as a real estate investor or for a personal residence. It’s pretty liberating to have fewer complications in life (man, I’m getting old! 😉 ).

one more thought Jim. Don’t be too critical of the idea you won’t have a paid off house. Our Raleigh home is paid off. But it isn’t really ours. The taxman hits us every year (20% more last year, too), our insurance has increased 100% in 2 years (currently shopping and will likely decide to triple our deductibles) and neither is really optional. At least the non-optional HOA is staying manageable. We are seriously considering selling and renting with the dividends our house value could generate.

Oh, don’t get me wrong – I know the downside of not having a paid-off house and I’m just fine with it. 🙂 I think we might actually come out further ahead regardless. But it’s something I still mention just because I want to make sure others have an idea that housing is part of our annual expenses.

That stinks on all these costs rising lately for home-owners. Clark Howard was just talking about that a couple of weeks ago and how it’s getting to the point in several parts of the countries where home-owners just can’t afford these crazy rising costs anymore (insurance, property taxes, repairs, etc.). I’m lucky because I’m content with apartment living, but even renting a house would be a-ok with me. Good luck on what you decide to do! Pros and cons to both, as I’m sure you’re well aware.

Hi Jim,

Here are a few contrarian thoughts to consider in no particular order:

1.) What is the premise for wanting to be on ACA vs. Medicaid? If you could get income low enough for Medicaid, would Medicaid in the state you plan to live in meet your needs for 4 years? Do you have some extra funds in an HSA to meet things Medicaid may not cover? I bring this up because many FI-ers aim for ACA over Medicaid and I am not 100% sure….that is likely because my state (New York) has awesome expanded Medicaid that saves families far more than ACA with a lot of choice of providers.

2.) Here is another method to reduce your income. Hire your daughter as a w2 employee (before she is 18) and 1099 after. You divert income to her (she can have up to (fact check me here) 12k income without lowering her Pell eligibility. THEN she saves her income in a Roth. She can withdraw from her Roth for higher education expenses with no income tax or early withdrawal penalty.

The reason to pay her as a w2 before she is 18, is she can be exempted from paying payroll tax on her income from a family business. Then 1099 later so she can write off extra expenses…home office, mileage and so on.

3.) If you go HSA route through ACA…max it out of courses….lowers income but allows you to spend from the HSA if you need to.

4.) Part-time work MAY be extra beneficial IF you can keep income low….I would look up the thresholds for earned income tax credits with 1 kid, HEAP, SNAP and Savers Credit. Push you may need part time work to qualifiy for Medicaid in 2026 and on.So…you could do an extra lean 4 years to capture extra fafsa/Pell grants for your daughter and get the deal sweetened with extra tax incentives or other benefits.

5.) Another way to have more cash without more taxable income would be to purchase an income property. I believe I recall you may have been a landlord in the past. Now…income property in NC may be more challenging than in OH or NY (lots and lots of multiunit up here)…..but if you picked on up and paid cash for it upfront….the income you would receive yearly, would be offset to a good degree by the depreciation of the unit(s) that you do no live in. AND….if you lived in 1 unit (and the building had no more than 4 units) the building would be considered a home by fafsa, NOT an “asset”.

If you applied multiple tactics… let’s say you picked up a part-time gig for 40k a year

40k earned income

No income tax…too low

All revenue from this blog is paid to Hope, and she can add it to her Roth and pay for her own college supplies

Max Pell/Fafsa

Medicaid for health insurance (no costs there)

Make 18k in rent but only pay tax on 0-6k after depreciation and write-offs.(Maybe return of contributions on Roth now to pay off some or most of a home?)

Lean travel for 4 years…mostly revolving around where you have points/great deals.

Get 1-2 “mid” cards personally for points a year and then 1-2 premium business cards.

MAYBE get extra tax returns from earned income tax credit, American Opportunity Credit, HEAP or SNAP.

If you dont pull from Roth/IRA….could qualify for the Savers credit….check on look back periods though. That is a “free” 1k for saving 2k…for you AND your spouse. Possibly Hope too…not sure if that credit applies to students.

Could still be pulling 60k cash with rent and tax returns, discounted travel, and little to no healthcare costs. With the free/heavily discounted healthcare and if your lucky trace amounts of SNAP/HEAP. Best of all…max benefits for Hope for 4 years and if she’s lucky…a little left over money in her Roth. Once you are past her FAFSA

The Root of Good guy pulls that level of income off somehow…..and it would only be for 4 years. Something to think about.

Lots of homework for you lol.This is the fun stuff though!

Hi, Will – thanks for your thoughts! Here are some of mine…

1) I’m not an expert in the area of Medicaid but I know that it’s no picnic either. To even qualify, I believe you’d need to spend down most of your assets first, which negates the entire point of having saved for early retirement. Plus, you’re generally more limited in your choice of providers and plans and unfortunately in a lot of areas, you might receive a lower quality of care.

2) I actually already do this sometimes for Route to Retire. But just remember that Route to Retire isn’t bringing in the big bucks. This year will probably have revenue of just $5k… not a ton I can do with that right now. I could always do a SEP or solo 401(k) though to reduce income if needed.

3) I’m definitely excited about this new change in the law for bronze plans in the ACA. This is an area we’ll probably be jumping on regardless.

4) I’ll dig into this some more!

5) Haha, yeah, I’m done with this one. I had a duplex and a rental house and I learned a lot and know all the benefits of real estate you can use to your advantage, but I’m out, Jack! 🙂

Much appreciated on all of this. I’ll dig into some of these things a little more. I think we’ll be in pretty good shape as long as I’m very conscious and intentional how we proceed over the next few years.

PS Big fan of Justin’s (Root of Good). My thinking is that if I move close enough to him in NC, maybe some of his magical personal finance skills will rub off on me! 😉

1.) You are correct, there are asset test but commonly, primary residence and retirement accounts are exempt. Here in NY they also exempt a vehicle per person and “household goods”. THEN a couple filing a joint return can have 43k in assets. So the main issue would be …do you have substantial assets in a brokerage account. If so…one option COULD be….buy a house cash.

The devil is in the details here….but I would look up what NC is like in terms of asset tests, income tests and exemptions. As for “limited options” if you move and have to get new doctors anyway….its only modestly more inconvenient to ask if each doctor you call accepts Medicaid. Also…I sometimes think this is overstated. I have asked all my current doctors, specialists and dentists…..and EVERYONE of them takes Medicaid. Primary, kids dentist, my dentist, cardiologist, psychologist, optomologist and so on. Sometimes, the unknown seems more uncertain than it truly is. Not advocating to go on Medicaid… that’s a personal decision for your family….but advocating to truly learn what that would look like and lay out the details in front of you (or in a spreadsheet).

2.) I totally hear you. IF you decide more part-time work could be the most advantageous during the FAFSA years…could always ramp up….offer coaching, white-label content for financial planning firms or other “fun work”. If ya make too much….but more high-cost credit cards with perk or pay your daughter more and encourage her to save it in a Roth.

3.) While I LOVE HSA options in bronze plans/catastrophic plans …the con of that law is fewer to no HSA in silver plans or gold.

4.) 100% dig in. I PERSONALLY look at working part-time while the kids are in college as a means to allow my wife to retire earlier (she will retire at 49, I will work part-time and retire 55-57 sometime). If we both HAD to full retire….would likely be 53-54. So the added benefits will lower the sequence of return risks as she retires. If i am still getting purpose and satisfaction from work….AND can balance a lower work load of 20 hours a week + 8 weeks off a year….I may keep working past 57.

PLUS….the extra nest egg/cashflow will allow me to more securely gift to my young adult kids (Die with Zero style). Instead of 5% gifts on a starter home….gift 15% (plus their own 5%) so they can afford a 15 year mortgage and wont have PMI. Ensure they have 0 undergraduate debt. Roth/HSA contribution matching from mom/dad starting when they have earned income and lowering my match each year from 18-25 to encourage consistent savings. Spending on weddings. Gift 5% on their first family home (if they choose to get a family and want to move to a better school district). Pay for the AirBNB on family reunions and stuff like when they are young adults.

I enjoy his blog very much for considering what is possible. It is sometimes hard to wrap my head around living off 35-50k….but he has done it for a very long time AND travels…a lot.

Great feedback – thanks, Will! I’ll look into all of this some more to see if any of it makes sense for us. Much appreciated!