Disclosure: This post contains affiliate links and we may receive a referral fee (at no extra cost to you) if you sign up or purchase products or services mentioned. As an Amazon Associate, I earn from qualifying purchases.

I’ve got mixed feelings about the power of AI (artificial intelligence). Privacy can start blurring quickly and the bad guys will continue leveraging AI to be exponentially worse than before.

But… AI is helping to do some amazing things. The one area that keeps me fascinated is the world of medicine. AI is helping to detect cancer better, provide better risk prevention, and improve surgical outcomes. I wouldn’t be surprised to hear about cures for diseases that seemed like they would never be alleviated (Parkinson’s, Alzheimer’s, etc.).

As a side note, I have zero worries about AI taking away all the jobs. Some jobs will change for sure, but I think we’re just going to have a shift in what the jobs will be, and I would bet we’ll actually see more jobs in an AI world.

But the power of AI in our own lives can be profound, too. When used properly, you can solve a ridiculous number of issues that creep into your life by leveraging AI rather than going at a problem on your own.

If you’re still “Googling” how to solve a problem, you’re doing it wrong. That’s the method in which you spend hours searching and picking different pieces of info from different websites, only to have a semi-complete answer. Instead, just give an AI chatbot the details about your specific issue and get your complete answer tailored exactly to your problem. Just like any site, though, don’t go trusting it 100% – always double-check what you get back.

I now offload so much of my problem-solving to AI and it’s been a fantastic asset in my day-to-day life. And we’re finally at a point that I feel comfortable in taking things to the next level.

So this year, I did something different. I decided that leveraging AI as my helper while doing my taxes would be a good move… and it was.

It wasn’t as much of a headache to do my taxes (though it was still a pain) and I got done feeling confident with my tax return. That’s a win for sure!

The problem… and a pretty darn good solution!

I use TurboTax to file my taxes every year (though I did switch to a CPA for a while). One day, I may switch to another online alternative or go back to a CPA, but for now, TurboTax does the job well enough for me.

The problem is that it seems like every year we have a couple of weird nuances to our taxes that creep up. And I don’t always feel comfortable with how I answer those oddball questions in TurboTax.

For instance, this year we did our first Roth distributions. Because we’re under 59½, we have to ensure our t’s are crossed. I know the result is that there shouldn’t be a penalty for our situation, but getting there on the taxes could be a different story.

It’s those types of more unique things that always seem to come up. I get through them every year and I haven’t been audited yet 😂, but am I doing it right or getting the most money back that I should be?

That’s where leveraging AI is extremely useful. By working carefully (more on that later) with the chatbots, you can get your questions answered so much more easily than trying to search the internet and then browsing individual websites. But more importantly, the answer can be tailored to your specific situation if you tell the AI the details about it.

It’s important to note that AIs can hallucinate. They seem to do that much less than they used to, but it still happens. What I like to do is copy and paste my questions between AIs to see if they both give the same answer. That’s beneficial in other ways, too, because a lot of times, you get two different approaches to the same problem.

And sometimes, if I get two completely different answers to something that’s either one way or another, I’ll say…

Another AI answered this same question with…

[Here’s where I put the response from the other AI]

Do you or disagree with this? Does this change your answer at all?

So, which AIs do I use? It depends on what I’m trying to find an answer to, and my favorites change periodically as each continues to improve in different areas.

Currently, I use Perplexity when I have a more straightforward question, maybe something like, “What are the 2026 tax brackets?” Perplexity generally searches the internet and provides citations when responding, so I find it’s a good AI for these more factual types of questions.

I did get the Pro version of Perplexity for free for a year with my old Samsung Galaxy S21 phone, so that’s a bonus. If you’re a Samsung Galaxy phone or tablet user, you can check here to see if it’s still valid (it looks like it’s still good as of now).

If I need help with writing a script or other programming, Claude blows me away. It seems to run circles around the others with how good it is. I just use the free account for Claude.

Generally, though, I rely on ChatGPT and Google Gemini for most things and go back and forth between the two (or give them both the same questions). I have a free account with ChatGPT, and for several years, nothing could beat ChatGPT’s answers. I still think it’s the best of the best for helping you figure things out, but Google has finally gotten there to provide some stiff competition.

With Gemini 3, these two AIs have become my go-to companions for help. Aside from those straightforward questions that I give to Perplexity and the coding with Claude, everything else goes to Gemini and ChatGPT.

I bought a Google Pixel 10 Pro phone last year to replace my old Galaxy phone. It was my first time leaving the Galaxy world, but I’m glad I did – I absolutely love this Pixel phone. The bonus was that it came with a year of Gemini Pro, so I have that plan instead of just the free plan until later this fall.

I generally just use the websites for access to the AIs, but they all offer apps for your phone if you prefer that.

Leveraging AI for questions and reassurance

So, how did leveraging AI help with doing my taxes?

The first was with questions. For instance, here was a question I fed to Gemini:

ABC Company has always paid me through PayPal and has always issued me my 1099-NEC through example.com. After not receiving my 1099-NEC yet (it’s now xx/xx/2026), I reached out to ABC Company and they said:

“It looks like you receive payments via Paypal. Paypal should have issued the 1099 in this case. You will want to review the 1099 you received from Paypal.”

That doesn’t seem right to me and I checked in PayPal and don’t have any 1099s in there. Any thoughts on what’s going on?

Fair question, right? Gemini then responded with some changes that have come about:

This is a common “reporting gap” that happens when tax laws shift. Based on the current tax rules for the 2025 tax year (filing now in early 2026), both ABC Company and PayPal are likely technically correct, which leaves you without a form but still responsible for the taxes.

Here is exactly what is happening:

1. Why ABC Company didn’t send you a 1099-NEC

ABC Company is following IRS regulations that instruct businesses not to issue a Form 1099-NEC for payments made via a Third-Party Settlement Organization (TPSO) like PayPal.

- The Logic: The IRS wants the payment processor (PayPal) to report the income on a 1099-K to avoid double-reporting the same income.

- The Result: Once ABC Company sends the money to PayPal, they consider their reporting obligation “handed off” to PayPal.

2. Why PayPal didn’t send you a 1099-K

This is where the confusion lies. For the 2025 tax year, the “One Big Beautiful Bill Act” (passed July 2025) restored the previously higher reporting thresholds, overriding the lower $600 threshold that was planned.For Tax Year 2025, PayPal is only required to send you a Form 1099-K if you met BOTH of these criteria:

- Gross payments exceeded $20,000

- AND you had more than 200 separate transactions

The “Gap”:

If you earned, for example, $15,000 from ABC Company via PayPal, you fall into a loophole:

- ABC Company won’t send a form because they paid via PayPal.

- PayPal won’t send a form because you didn’t hit the $20,000/200 transaction trigger.

- Ohio State Tax: Since you are in Ohio, the state follows federal thresholds (unlike states like Massachusetts or Vermont which have a strict $600 limit), so you won’t get a state form either.

What You Should Do

Even though you didn’t receive a physical form, the income is still taxable and must be reported.

- Don’t wait for the form: It likely isn’t coming.

- Use your own records:

- Log in to your ABC Company Dashboard and go to Payments > History. Download the CSV for 2025.

- Alternatively, run a report in PayPal for “ABC Company” payments from Jan 1, 2025 – Dec 31, 2025.

- File normally: Enter the total gross amount on your Schedule C (or wherever you normally report this income). If your tax software asks if you received a 1099, you can simply answer “No” and enter the income manually as “General Business Income” or “Gross Receipts.”

This was a big awakening and good to know. I ended up just entering the income separately on my Schedule C, but how would you know this kind of information otherwise without a CPA handling it for you? Did you guys know this?

And then, sometimes you just need a little reassurance. One example of this was that with our FAFSA/SAI strategy for our daughter’s college in a few years, we pulled out everything we could without penalty from our Roth IRAs in 2025. This was the first year that we did a Roth distribution. If you’re not aware, you can pull out your contributions (not your earnings) from a Roth IRA penalty-free at any time.

One of the freebies that I give away for joining my mailing list is a spreadsheet to track how much money you can take out penalty-free as an early retiree. That’s the same spreadsheet I used in my calculations when we did our Roth distributions in 2025.

PS You can get that and a heckuva lot of other goodies just as a thank you for signing up for my mailing list…

- Recurring Expenses Spreadsheet

(discussed in This Bad-@#$ Expenses Spreadsheet is My Gift to You) - Credit Card Rewards Tracker

(discussed in Travel Rewards – 12 Free Flights Earned in 9 Months!) - Portfolio Rebalancing Spreadsheet

(discussed in Portfolio Rebalancing: Get Your Asset Allocation in Line) - HSA Unreimbursed Expenses Tracking Spreadsheet

(discussed in Using Your HSA for Retirement – How to Track It Easily and Efficiently) - Roth IRA Conversion Ladder Calculator

(discussed in The Roth IRA Conversion Ladder Dilemma) - Alcohol Tracker

(discussed in Alcohol Tracking – I Spent Hours Creating This Spreadsheet I Hope to Use Very Little) - Next-Chapter Matrix / Bucket List

(discussed in Creating Your Dream Life: The Ultimate Bucket List Blueprint) - Upcoming Credit Card Bills Tracker

(discussed in My Game-Changing Spreadsheet to Track Upcoming Credit Card Bills) - Roth IRA Funds Available Now

(discussed in Roth IRA Withdrawals for Early Retirees: Tracking What’s Accessible Now)

So stop wasting time and jump on the list…

Anyway, we withdrew all the money from our Roth accounts we could penalty-free in 2025. But when I was going through TurboTax, it told me we had taken out too much and would be penalized…

“We were unable to lower your tax bill

Since you didn’t use the money for a special situation that qualifies, we couldn’t help you reduce the amount of extra tax you have to pay.

Based on your entries so far, your extra tax bill is $1,xxx, or 10% (25% for a Simple IRA) of the money you took out. This number may change as you add more info to your return.”

Wait, what??? Why?

The problem was that TurboTax had me enter in all our contributions from previous years… except 2025. There was a Roth contribution of just over $3k that I had made at the beginning of 2025. With the distributions, we had pulled out almost everything but left a little wiggle room. Well, apparently, we were still just over $1k too much.

I knew the problem was that it didn’t count the 2025 contributions. So I asked Gemini, and sure enough, I was right. Here’s a snippet of what I got back…

Yes, your 2025 Contributions DO Count

You are correct that your 2025 contributions ($1,xxx + $1,xxx = $3,xxx) count towards your basis and can be withdrawn tax-free.

- The Problem: You cannot enter these in the “Prior to 2025” box.

- The Fix: You must ensure these are entered in the “Deductions & Credits” section under Traditional and Roth IRA Contributions. Once entered there, TurboTax will automatically add this $3,xxx to your “Basis” pile.

- The Result: This will lower your taxable amount by $3,xxx, saving you roughly $3xx in penalties immediately.

And that was accurate. When I entered the info there and then went back to the distribution, TurboTax wasn’t reprimanding me anymore. That’s silly that 2025 contributions couldn’t be entered with the rest, but it still worked out and the power of leveraging an AI helped give me the reassurance I needed (and told me where to get it fixed).

These were just a couple of the scenarios I ran into that the AIs helped me with in filing our taxes this year. That helped reduce a lot of the fun frustration I seem to bump into in most years.

Uploading a readacted PDF for help

This was the next level of things that I hadn’t done before. Sure, leveraging AI with questions is one thing, but sharing tax information? Yikes!

That might make some of you cringe, but here’s one example of what I did with this year’s return. For the past handful of years, I’ve filed a tax return for our daughter. Although it’s not required, she was making small amounts of money from modeling that we contributed to a Roth IRA. Filing a tax return helps document the earned income in case there are any questions later.

However, because she’s our dependent and we’re on the ACA for healthcare insurance, her tax return becomes relevant and her MAGI is needed to complete our return. The problem is that determining your MAGI isn’t always the most straightforward… start with your AGI, but then add this or that back in or sometimes this, and don’t do it this way if it’s for the MAGI for the Premium Tax Credits for the ACA, blah, blah, blah.

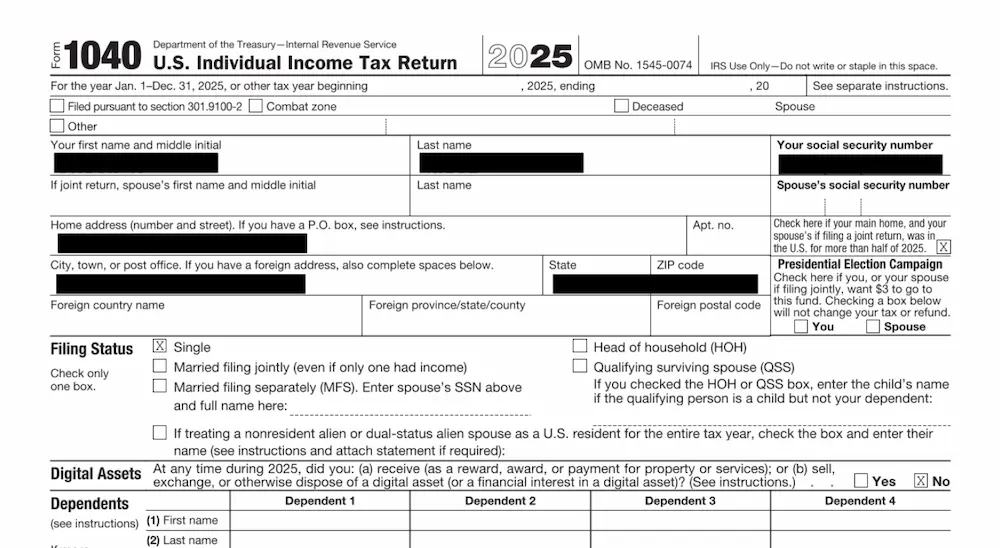

Yeah. I was pretty sure I had the right number, but wanted to be certain. So I took the PDF file of her 1040 with Schedule 1, C, and D and then redacted (blacked out) all personal information throughout:

I uploaded that PDF to Google Gemini and asked:

I’m working on a tax return for a friend and they need the MAGI from their child’s 2025 tax return. I’ve attached the tax return for the child. Can you calculate the MAGI on this?

Note: Notice that I said that I was doing this for a friend. That’s a little trick I use so the AI doesn’t store information that it thinks is about my family.

And it responded with:

Based on the tax return provided, the Modified Adjusted Gross Income (MAGI) is $xxxx for most standard tax purposes (such as IRA contributions or education credits).

However, if you need the MAGI for the Premium Tax Credit (marketplace health insurance), the amount is $xxxx.

Here is the breakdown of the calculation based on the document:

- Adjusted Gross Income (AGI)

The starting point for MAGI is the Adjusted Gross Income found on Form 1040.

AGI (Form 1040, Line 11b): $xxxx

- Common Adjustments (Add-backs)

To determine MAGI, you typically add back certain deductions and income exclusions. Based on Schedule 1, none of these apply to this return.

It had more to say, but you get the idea.

That was all I needed. The number it came up with was the same number I had come up with, but it clarified the “why” for each part and that was tremendously helpful.

Mission accomplished!

I did another where I uploaded a redacted copy of our daughter’s Vanguard – Consolidated Form 1099. She had a brokerage account that we cleared out in 2025 (again, part of our ACA/FAFSA strategy), and I was a little confused about how to handle the 1099-B information, given how Vanguard’s consolidated form lays things out.

Gemini was able to walk me through the specific numbers to enter and exactly where to put them in TurboTax… couldn’t have been easier!

Walking the line on convenience and privacy

Now, let’s talk about the big concern here… the level of privacy. This is going to be an area where some of you are like “no biggie – I’ve got nothing to hide”, others are like “these big tech firms already know too much about us – I’m not sharing any more!”, while some folks fall in the middle.

I’m somewhere in the middle on this. The level of help I got is worth its weight in gold… but I’m still careful about the specifics of what I share with an AI.

Whatever your feelings are on this subject is up to you – I don’t judge! But if you do decide that leveraging AI in your life is worth it, here are a few tips I’ll share:

- You can always set your AI preferences for what works for you. For instance:

- Perplexity has a setting for “AI Data Retention allows Perplexity to use your searches to improve AI models. Turn this setting off if you wish to exclude your data from this process.”

- Gemini lets you auto-delete its history after x number of months or not keep a history at all.

- ChatGPT has “Improve the model for everyone” settings that you can toggle on/off.

- And there are several other options regarding privacy in each of the AI settings.

- Most AI chatbots work without an account. So if you don’t care about it tracking your history, you can use them without creating an account. Or you can use incognito/private mode in your browser to take it a step further.

- Redact any documents you upload. This one’s important. Know that just adding a regular black rectangle over words in a PDF editor isn’t sufficient – those shapes can be removed. It’s imperative that you use a tool specifically meant to redact the information. I used the “Blacken PDF” tool in the free offline version of PDF24 Creator on Windows, but there are plenty of other options.

The struggle with this is that the more the AIs know about you, the more customized personal answers they can respond with. For example, sometimes I might ask ChatGPT or Gemini a question about some nerdy self-hosting stuff I’m working on. Because it knows information about me, it might respond by also taking into account previous chats we’ve had. That’s good because I don’t need to repeat how I have things set up or anything. It also takes these ideas into consideration if I forget to mention an important detail but it remembers it from an earlier chat. That’s really nice.

But that’s up to you to determine your level of comfort with the privacy factor.

As for me, I’m considering redacting a few past returns, uploading them to the AIs and having them tell me what I did right or wrong. They could also tell me what I could be doing to minimize my tax liability in the future. In other words, leveraging AI to be my own tax advisor.

That’s a big stretch on my own level of comfort, though, so who knows if I’ll actually do that. Would you?

Most importantly, another year of filing taxes is officially done!

Plan well, take action, and live your best life!

Thanks for reading!!

— Jim

Game Changer Jim!!! I’m helping my daughter complete her income taxes for 2025. She is eligible for the American Opportunity tax credit but the HRBlock software was only giving her $1023 credit instead of the full $2500 and I couldn’t confirm the reason. Taking your advice, I plugged in numbers for my “friend” into ChatGPT and it confirmed the HRBlock was correct and provided an excellent explanation. In summary, “my friends” tax liability (not enough income in 2025) was not high enough to receive the full tax credit. Awesome post Jim. I’ve already leveraged your advice. Thanks a ton..

Jim – excellent article. Earlier this year I used the chatbots to estimate what amount could be withdrawn from brokerage accounts to stay within the zero percent long term capital gains threshold. Because I receive social security and taxable dividends, estimating this is less than straightforward to calculate. I tried five different programs but in the end Gemini worked best. The programs also showed me the process so I could learn it and confirm the results. I felt so confident that this year I did not use an accountant to prepare ny returns saving $800. I hope others experiment with these new tools to manage their finances. Thanks!