Disclosure: This post contains affiliate links and we may receive a referral fee (at no extra cost to you) if you sign up or purchase products or services mentioned. As an Amazon Associate, I earn from qualifying purchases.

I’ve been meaning to write about what you need to do to protect your credit for a while now. It’s such an important topic, but it seems to be something that’s glaringly overlooked by many.

I noticed that anytime the subject comes up in conversation (yeah, I’m a blast at parties!), most folks have no idea about it or what to do.

That can be a huge oversight since just a few simple steps can aid in preventing financial identity theft and help protect your credit.

Hopefully today I can help you understand why you need to take these precautions and what you need to do to make it happen.

Don’t worry, it’s pretty painless and won’t take up much of your time at all to do!

Why Do You Need to Protect Your Credit Anyway?

If you don’t already know, there are three major credit bureaus in the U.S.:

Credit bureaus exist to provide creditors and lenders information about you to help them make decisions on whether you’re a good candidate for credit cards, loans, etc.

The problem is that inherently they build up quite a profile on all of us with a lot of sensitive information… like it or not. That’s some information that you definitely don’t want to fall into the wrong hands… oops, too late!

One of the biggest concerns that you need to have with this is that if someone gets a hold of your information (that same information from the Equifax breach or any of the other hacks that occur all too often), they can now apply for credit as if they’re you.

This is where identity theft becomes a huge issue. Someone can apply for a credit card as if they’re you, have it mailed to a virtual mailbox somewhere, and then run up thousands of dollars on it without you even knowing. The same could go for a thief applying as you for a personal loan of some big money – none of which you’ll ever see.

These are just a couple of quick examples but it can get much worse. Whether or not you’ll be on the hook for the money is only part of the problem though. Financial identity theft is huge and getting it straightened out is an exhaustive nightmare that could take years to bounce back from.

This isn’t something that’s unlikely to happen to you either – the numbers of identity theft cases are prevalent:

“According to the Aite-Novarica Group, 47 percent of Americans experienced financial identity theft in 2020.”

— Insurance Information Institute, Inc.

47%!!!! That’s almost half of Americans in a single year! If you haven’t experienced identity theft yet and you’re still not doing anything proactively, your time is likely to be soon.

So hopefully you now understand why you need to protect your credit. The next question is how to protect your credit.

You’ll be happy to know that you can get on top of fixing this target on your back in three easy steps…

Step #1 to Protect Your Credit: Monitor it for changes

Although step 2 is going to be the most important to protect your credit, I want you to start with this one. You’ll see why once we get there.

The first thing you want to do is to monitor your credit. I’m not talking about weeks or months after the fact either. You want to be notified right away anytime there are changes to your credit that are important to know.

This way, if there’s a hard inquiry on your credit or a new credit card added under your name, for example, you’ll be alerted. If it’s something you recognize, no problem. But if not, this is a fast way to identify potential fraud or identity theft so you can nip it in the bud.

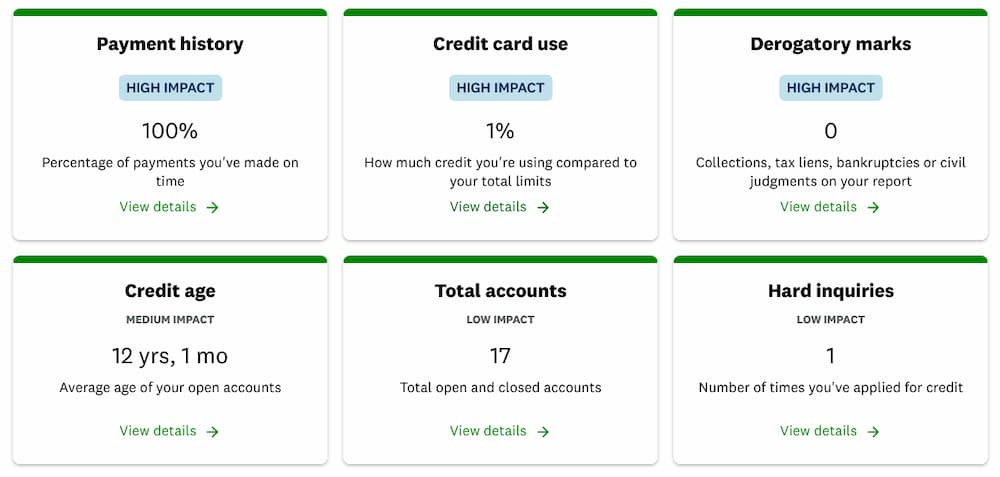

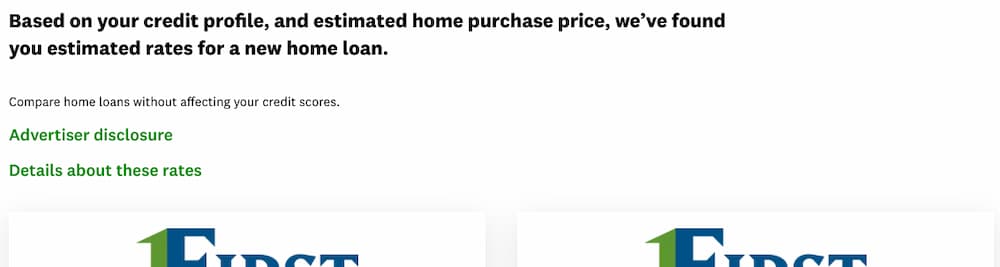

There are plenty of pay-for options and there are a few free options, but none are more well known than Credit Karma.

Credit Karma offers free credit scores, reports, and other insights. They also analyze your credit profile to make product recommendations to save money (if interested).

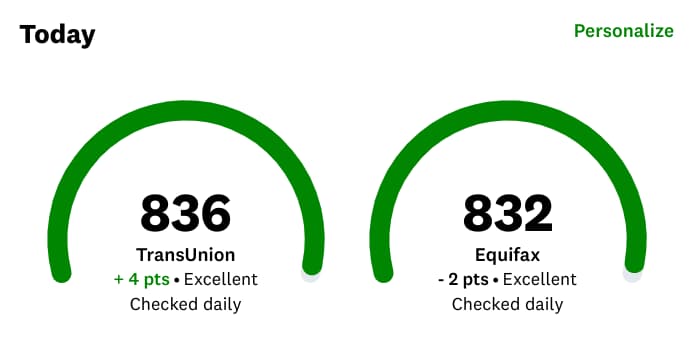

But the most important part of this is the credit monitoring which is also free. These alerts will notify you if anything important changes on your TransUnion credit report. That’s the biggest key to spotting financial identity theft.

So why is Credit Karma free? As Investopedia puts it:

“Credit Karma gives you a free credit score and credit report in exchange for information about your spending habits. It then charges companies to serve you targeted advertisements.”

— Investopedia

In other words, you’ll see recommended credit cards to apply for and other personalized ads when you’re on their site (or in the app). Personally, I consider this a small price to pay to help protect your credit. Besides, everyone already knows to go to my recommended credit cards page whenever they want to sign up for a new credit card!

I’ve had Credit Karma accounts set up for both me and my wife for probably at least a decade now and I appreciate the ability to stay on top of our credit profiles.

As an added benefit, the site lets you view your credit scores and credit reports. These can be invaluable tools in knowing where you stand with lenders and if there’s any misinformation about you that could be hurting you when you need to apply for credit. We’ll talk more about credit reports shortly.

You can sign up for Credit Karma for free (my favorite word!) right here with this link.

As a side note, Credit Karma gets its information from Equifax and TransUnion. You can view your scores and reports from Equifax and TransUnion and the credit monitoring alerts are for anything that changes on your TransUnion report. It does not pull information from Experian though, so you’re getting info from 2 out of the 3 behemoths in the industry to help protect your credit.

Also, know that they’re happy to send you all sorts of other emails/alerts as well. You can customize what you get by going into “Profile & Settings” and choosing “Communications & Monitoring.”

Step #2 to Protect Your Credit: Freeze It… and that’s not the same as locking it!

I consider this step to be even more important than the first step. However, to open a Credit Karma account, you’d have to thaw your credit first, so I thought I’d save you a step and have you do that first.

Now that you have your Credit Karma account (you did do that, right?), let’s work on setting up credit freezes for your accounts.

Probably the most valuable thing you can do to protect your credit is to freeze it. It prevents anyone from accessing your credit report. And without that, the likelihood of a financial institution dishing out a new credit card, loan, or whatever is next to nothing.

Essentially, no one will be able to get new credit under your name while your credit is frozen… including you. That’s the type of security you want to have in place.

The strange thing though is that only 10% of people have frozen their credit.

Two things to note about freezing your credit:

- It does not prevent any current lenders from working with your credit. Any current accounts you have in place will continue to operate as they normally would. Only new credit that is being applied for is blocked.

- When you do want to apply for new credit (whether it be for a new credit card, loan, or signing up for something like Credit Karma), you can simply thaw your credit freeze temporarily while the check is being done. After it’s done, it can go back to being frozen.

But Jim, isn’t that a pain in the @#$ if I want to apply for a new credit card or some type of loan?

Not at all. The credit bureaus have streamlined the process making it much easier to temporarily thaw your credit.

And the nice thing is that you put in both a start and end date so that means you don’t need to remember to go back in to re-freeze it… it’ll happen automatically after your end date.

If you’re a follower of this blog, you know that we love our travel rewards over here. I’ve written a bunch of articles about how we’ve saved thousands upon thousands of dollars with free or next-to-nothing travel:

- The #1 Best Way To Track Credit Card Rewards

- The #1 Easy Way We’re Getting the Southwest Companion Pass

- Our Travel Perks Are Drying Up and That’s Big $$$!

- Free Nights – We’ve Had 5 at Hilton Hotels Recently

- We Got Turned Down for a Credit Card… Ok, Four!

- Travel Rewards – 12 Free Flights Earned in 9 Months!

But to make this happen, we need to open new credit cards periodically… and that means our credit can’t be frozen when we apply.

So is this a hassle to do?

Not really. Right before I apply for a new card, I log into all three credit bureaus and thaw my credit (or my wife’s, depending on whose turn it is) for a couple of days. it probably takes me about 10-15 minutes total to do that.

So yes, it tacks on a few extra minutes a few times a year, but it’s absolutely worth it for the security. When you protect your credit, you’re getting so much more peace of mind. That makes this minor inconvenience a no-brainer.

But Jim, I already have a lock on my credit – isn’t that the same thing?

Nope. Understand this, the credit bureaus also make a ton of dough by preemptively selling off your information to financial institutions so they can solicit you… wonderful, right?

The problem for them came into play though when the federal government mandated the bureaus to permit credit freezes for individuals. That’s great to protect your credit, but now they can’t sell off your info and make all that extra money.

So they ended up coming up with the idea of a credit lock. And they’ve made sure to make it as convenient as possible for you to choose to do that instead of a credit freeze. Don’t do it. The locks are not governed by federal law and the credit bureaus can continue to sell off your information to financial institutions.

Ok, Jim – your push to “protect your credit” makes sense and seems easy enough. Now, how do I do it?

The easiest way to do your credit freezes is online. Here’s where to go for the big 3 bureaus:

Each one will walk you through what you need to do to get it set up. Know that they’ll try to push you on doing a lock instead of a freeze – stick with the freeze.

Be aware that this first time around, you’ll need to verify yourself with some personal sensitive information like your name, social security number, date of birth, address(es), etc. This is necessary to prove that you’re you and is only needed this first time to set up your accounts.

Once your accounts are all frozen, sleep tight knowing you did a good thing to protect your credit. From here on out, anytime you need to apply for new credit, you just log in to the bureau(s) site and set your start and end date for a “thaw.” Don’t choose “unfreeze” as that will just remove the freeze permanently. The thaw takes effect either immediately or within just a few minutes.

If you want to stay extra secure, you can always ask the lending institution which bureau(s) they use to run their credit check and just thaw those. That got to be a hassle for me, so now I just thaw them all for a few days while applying.

NOTE: Be aware that there are other players in the credit bureaus game like Chex Systems and Innovis, but the big three (Experian, Equifax, and TransUnion) should be your main focus. If you’re really concerned and decide later to take it further, you can explore freezing your credit with these other two bureaus or even some of the others out there.

Step #3 to Protect Your Credit: Check your credit reports routinely

If you knocked out steps 1 and 2, you’re miles ahead of most folks… congrats!!

But there’s one more thing you’ll want to do to help protect your credit – check your credit reports regularly. Yeah, I know…borrrrring!

It is boring, but the good news is that it’s quick and easy to do. I check ours every year by going to AnnualCreditReport.com. This is the only site that is authorized by the federal government and provides a free report to you once a year (though right now you’re able to get the reports every week if desired).

The site will ask you some questions and then pass you off to each of the bureaus that you select to get your report. You can download each generated report if desired.

Your mission is to protect your credit by reviewing each report and making sure that you don’t see anything out of the ordinary. Some of the most important things to look for:

- Check that there aren’t any odd names, addresses, employers, etc. on there that you don’t recognize.

- Go through each line of credit to decipher what it is and again, make sure you know what each one is.

- Ensure the status and payment history of each account are accurate.

If you find anything inaccurate in your report, work to get it corrected:

“To dispute an error on your credit report, contact both the credit reporting company and the company that provided the information.”

— Consumer Protection Financial Bureau – How do I dispute an error on my credit report?

You’ll want to do this routinely. As I said, I check my report and my wife’s annually but feel free to do it more often if desired. If you’ve completed the first 2 steps then there really shouldn’t be any new surprises on these credit reports in future years.

My recommendation is to either put it in your calendar as a routine event. If you have a digital calendar like Google Calendar or Outlook, you can just make it a recurring event to happen every year. If not, maybe tie it to a day you’ll remember – like every Halloween for instance.

And finally, know that you can also see your Equifax and TransUnion credit reports anytime you want in Credit Karma (you did create your account, right?). It’s free and convenient – love that mix!

That, my friends, is it. Yes, there are other small ways to help protect your credit and prevent financial identity theft. But if you knock out these three steps, you’re 99% of the way there and should be able to sleep much better at night.

Give yourself a high five for knocking out one of the easiest things that most people don’t do!

Plan well, take action, and live your best life!

Thanks for reading!!

— Jim

Hi Jim, just thought I’d let you know that my AVG anti virus wouldn’t let me in to your Credit Karma links. Not sure what that’s about, but thought you might want to know. Thanks for a great letter! Rick

Hi Rick – appreciate the heads up! You should be able to go directly to the site at https://www.creditkarma.com. When I find a product or service I like using that I think’s worth recommending, I try to establish a partnership because, well, why not? 🙂 But if it’s not working for you, I’d still rather you be able to get it directly than me needing to get credit for it and earn a few cents! 🙂

Thanks for letting me know and hope you find it useful!

Hi Jim, I followed your advice and froze my credit at the big 3, but with Transunion I went along with True Identity which is associated with them and locked my credit instead of freezing it. Should I try to get rid of that account and go back and freeze it instead, or just let it go?

I would make that change, without a doubt, Rick. With the lock, you have two big problems:

Nice job on taking the right steps!

Very useful post! Thank you. I had my identity stolen years ago, by a thief using a low tech method. He got my social from a doctor’s office I had visited, along with many others. Then he submitted a tax return in my name before I had filed. Between subpoenas I had to keep track of for court dates that kept getting postponed, and trying to get my real tax refund, it took well over a year to straighten out. I froze my credit and have an IP pin provided by the IRS for my tax return now, but your explanations of everything were enlightening, and hopefully will spare a lot of people the hassle of identity theft. My experience was mild compared to other stories I’ve heard!

One other thing I do which I think is helpful… Each of my credit cards are set up to notify me (by text) whenever even a penny is charged whether using a card or online without one. Because these notifications are instantaneous usually (some cards take a day or so), I can easily remember what the charge is for, or, if it wasn’t me, I’m immediately alerted that there is a problem and can contact the card issuer. Again, thanks for a very useful post.

Ugh, what a nightmare – sorry you had to go through that, Carol! Great idea on the credit card notifications. I have that setup for my debit card but not my credit cards – I might need to do that with them as well.

Good info and very important. Have had mine frozen for years now.

With that said when my dad passed away I had to help my mom close all his accounts and open a few cards for her. She started having some issues, not with credit, but with people opening checking accounts and other odd ball debit accounts in her name. She would get account notices and new cards in the mail. When that happened I helped her freeze the big 3 accounts along with Chex. Some banks use the Chex system to verify info but there are still a lot that don’t. It obviously freaked out my mother who is in her mid 80’s. Luckily she has a sound mind and we were able to get things taken care of. Imagine losing a spouse then have this kind of stuff happen to you…. Very stressful for her. It is real important to protect the elderly as they are easier targets.

Ugh, that’s so infuriating – sorry your mom (and you) had to go through this but glad to hear that you got it sorted out. The penalties for these sorts of things need to be much more severe for these thugs.

Thanks Jim, I’ve heard of Credit Karma, but haven’t done any in-depth research, and it’s been more than 2 years since I’ve checked my credit report….Eeek! I’ve gotten a real estate loan in the last year, so I dont think its bad but I do need to put an annual reminder on my calendar like you said. Great and informative post, thanks!

Hey, Jim – yeah, the calendar reminder is nice to just take it off your plate until it’s time. Check out Credit Karma – I’ll think you’ll love it. It makes staying on top of things outside of your annual calendar reminder a cinch (and it doesn’t hurt that it’s free!). 🙂