Disclosure: This post contains affiliate links and we may receive a referral fee (at no extra cost to you) if you sign up or purchase products or services mentioned. As an Amazon Associate, I earn from qualifying purchases.

It seems that more and more folks in the FIRE (financial independence / retire early) community are jumping on the bandwagon of bashing the idea of early retirement… because early retirement now somehow conveys a negative connotation.

I even heard some of my favorite hosts talking about this recently on a very popular podcast. The message was basically that early retirement is bad and if you don’t like your job, early retirement isn’t the answer – find a job you enjoy instead.

And I’m ok with this to a point. If your life revolves around work and you like it that way, go for it. And if that’s you and you just don’t like your sh*tty job, then yes, by all means, start working toward finding a career that gives you more satisfaction.

However, the part that frustrates me is that your job doesn’t necessarily define what you need out of life. In many cases, more time is what you’re after. And, in order to gain that extra time, early retirement very well might be the right answer for many folks.

Why early retirement was my goal… and it wasn’t because of a sh*tty job

I’ll admit it, my almost 20-year career in IT didn’t excite me in the later years as much as it did when I first started… but I didn’t hate it by any means. The company was good, I enjoyed most of my co-workers, and my boss (the owner) always took care of me and treated me well.

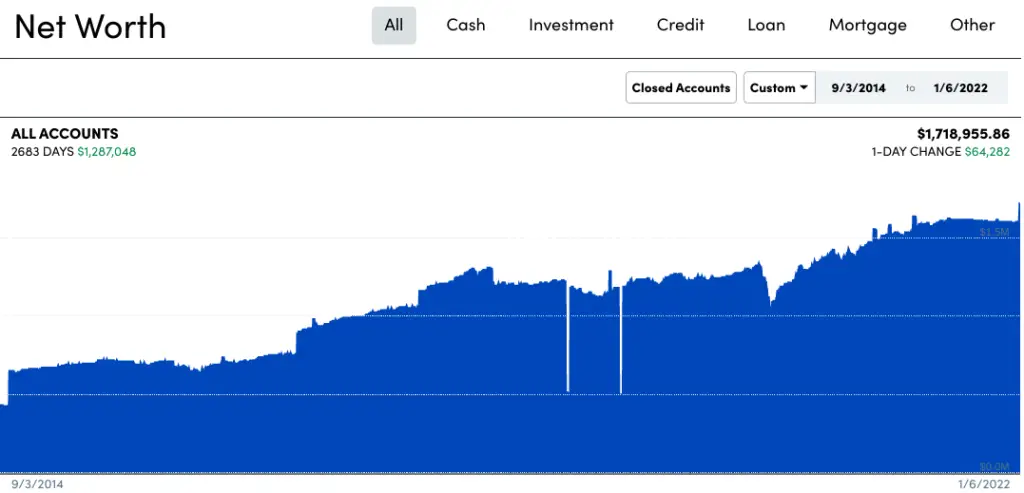

The good paycheck and benefits didn’t hurt either. The match from the 401(k) plan came out to be around 35% per dollar per year with no cap (up to the federal max). That helped me become a 401(k) millionaire and has catapulted our net worth to over $1.7 million…

As a side note, this screenshot was taken from my Empower (formerly Personal Capital) account. If you’re looking for an excellent way to aggregate all your financial institutions in one place, this is a great solution. It’s easy, free, and they offer some amazing tools and analyzers to help you manage your money. I love it! You can sign up for Empower free from here.

It wasn’t all peaches and cream though. Middle management generally comes with more stress than almost any other position in a company. But I was good at what I did, I cared about the company and the employees, and we had a lot of fun times.

So if my job itself wasn’t the problem, what was?

In short, the lack of free time and the desire to be with my family was my conundrum.

Once we had our daughter back in 2010, I slowly started to hate that my job took time away that I could be spending with her as she grew up. And that became somewhat of a feeling of contempt toward my job.

I didn’t hate the job itself – any full-time job would have been to blame for my angst. I essentially needed more time each day and early retirement was the solution I didn’t even know was possible until I stumbled on Joe Udo’s Retire by 40 site years ago.

That was my main reason to chase financial independence and why I wanted early retirement. So that’s exactly what I did and was I able to leave my career on 12/31/18. Since then, life has been an awesome adventure with my family – moving to Panama, a 40-day road trip, and just being together in general.

There’s no inherent laziness in early retirement for me, but honestly, I don’t consider some laziness a bad thing if that’s what you’re after.

Look, I’m not saying early retirement is for everyone. But the reality is that for some folks, having that extra time to spend with their kids can be invaluable. I wouldn’t trade this for the world. Who knows – maybe one day when she’s older I’ll go out and get another job (a low-stress job if anything!).

But right now, I’m so happy with all this extra time I’ve gained. I try not to waste a minute of it. Not only do I get to spend so much more time with my family than I ever could have before, but I’m able to do so many other things as well.

I’m now physically fit (I’m about to hike up a volcano, for Pete’s sake), I’m continuing to learn a foreign language, we’ve been able to live in and enjoy a beautiful country, and I also get to spend a fair amount of time writing on Route to Retire.

On top of all that, I have flexibility in life now, which is truly not emphasized enough. The ability to do what I want and when I want is truly amazing. I don’t think life could get any better!

So you need to have kids to justify early retirement?

Nope. I don’t think that’s the case at all. I know plenty of folks without kids (or their kids are grown and moved out) who have retired early and relish every minute of it. My friends, Steve and Courtney, for example, don’t have kids. They retired in 2016 and 2017 in their 30’s and cherish their days as much as we do.

I also know people who love what they do and wouldn’t be happy fully retiring. Work is their lives and they wouldn’t have it any other way. Not my cup of tea, but to each their own.

And I know a few people who are retired and are just miserable to be around. From what I’ve seen, these are usually folks who’ve always defined themselves by their work-life, they don’t have many hobbies, or are just never happy regardless. That’s a rough spot to be in.

The point is that everyone is different and every situation is different.

There’s nothing wrong with not wanting early retirement to be part of your life. But there’s nothing wrong with seeking early retirement either.

Early retirement shouldn’t just be defined as a solution for those who dislike their jobs. Just because you decided that you didn’t want to be in the regular day-to-day workforce doesn’t mean that you hated your job so you decided to leave.

It can mean that and that might not necessarily be the right answer (time will tell). However, early retirement can also be a great opportunity for those looking to explore life further than they could with a regular job in the way.

Maybe the reason is to spend more time with your family and your kids while you can. Or maybe it means exploring the world. Perhaps the reason is to take some time to discover new interests, try new things, and even make some money along the way.

Wait? Did you just say “make some money”? You can’t do that – you’re retired!

Oh, boy. Yeah, this discussion is one that gets sloshed around all over the place, but it’s ok to make money while you’re retired. In fact, I would bet that a fairly decent percentage do.

Whether that’s from a side hustle, building a small business, or even doing some part-time work just to fill the day, that’s ok. Early retirement is a chance to regroup and determine what makes the most sense for you and making a little money along the way is still absolutely acceptable.

I’ve shared my story. I love every minute of early retirement and being able to watch my daughter grow and understand different aspects of the world. I’ll always be grateful for being able to be such a larger part of her life.

The three of us have gotten to spend so much time together and done so many cool things together as a family. And, of course, all that time together is destined for us to drive each other batty sometimes. But I wouldn’t trade it for the world. I wake up every day feeling blessed and amazed at our life.

And then, I take advantage of some of that extra time in my life to learn Spanish, work out, and work on this awesome blog that you should be subscribing to if you’re not already…

Did you sign up? Come on… what do you have to lose?

I do make a little money on this blog as well through advertising and recommending products and services that I use and/or truly value. I love writing posts for this blog and it’s surprisingly fun to make some money for doing something I enjoy. Last year, it was only around $5k – not a ton of dough, but still pretty cool to get in return for doing what I like.

Life really is great and a lot of fun right now. I don’t miss working – not because I hated my job, but rather because I love having the freedom of extra time more.

Time changes things…

Time will change the landscape of my days though.

Faith will get older and continue on with her life. She’s 11 and I know the clock is ticking until she’s done with hanging around us so much.

Lisa could hate spending so much time with me as Faith gets older (please, how could that be possible?!).

I’ll eventually be done learning Spanish. We might get bored with traveling so much and the road trips.

Life is always changing and I’ll adapt as it does. If new interests present themselves, I’ll explore them. Right now, I have a list of things I want to try that I just don’t have the time for yet.

As time passes, we’ll see what happens. I’ll do whatever strikes my fancy – and that’s the beauty of the “financial independence” part of FIRE. Work becomes no longer mandatory but optional if desired.

Lisa plans to go back to doing some part-time work when we move back to the U.S. in the spring. Maybe someday I’ll want to do the same (not high on my list right now for sure!).

For now, though, the “early retirement” part of FIRE has been exactly what I needed. It’s given me the gift of time – not necessarily freedom from a job – but freedom to be able to savor every day of life far more than I could have before.

Although it’s easy to blame a mismatched career for those wanting to retire early, that’s not always the case. The reason I needed out so much is that I felt this calling to be able to be with my daughter as she grows up… and my job was getting in the way of that time.

Early retirement isn’t a bad thing. Though it might not be for everyone, escaping a sh*tty job isn’t the only reason why someone would want to go down this path. I know because I’m living proof of that.

Do you think early retirement is just a way to get out of a job you hate or do you think the freedom can be invaluable to a person?

Plan well, take action, and live your best life!

Thanks for reading!!

— Jim

It’s an over-used phrase, but the point you’re making IMHO is to retire “To” something rather than “From” a Sh&++@ job. In your case, it’s time freedom. In mine, it was full-time life in the mountains.

Decide on your dream. Then, get out and live it.

Amen to that, Fritz! Figure out what suits you best and make it happen. It’s like I end my posts with… “Plan well, take action, and live your best life!”

Good stuff. However I will challenge the concept that middle management has the most stress. Not in my line of work. When I managed eight people I had the lowest amount of stress. When I managed 250 it went up, a lot. When I managed over 700 people it went off the chart. Pretty much the same job each time but the higher I rose the more I interfaced with the CEO and the other C-suite angels. As far as I’m concerned, mo people mo problems! And the bigger your bosses, the bigger ******** they tend to be.

That’s fair, Steveark – I was biased and speaking on my own experiences throughout a few of those middle management positions… always a pain in the butt! That makes sense though as the number of employees you managed grew, so would the stress. I’m guessing you’re not missing that aspect of your working career! 😂

This really resonates with me. I don’t hate my job. But I will stop doing it the moment I no longer have to trade my most valuable assessment, time, for money. 51 more weeks until my time belongs to me.

That’s fantastic, David – congrats and get ready for opening up a new realm of possibilities in life!!

You don’t need to justify it. Just because some others are changing their tune doesn’t mean you should. I think everyone should aspire to financial independence. Whether it means retirement, sabbatical, taking a lower paying job, starting a business, moving to a nicer area etc. Having financial freedom to control your own destiny reduces stress. The idea of returning to a “normal job” where they will so generously give you 2-3 weeks off per year… blech…. If others want on the hamster wheel that is fine. I’ll watch with amusement.

I agree with not needing to justify early retirement… for myself. But, there are a lot of readers who might be in a similar situation as I was and might be unsure about pulling the trigger. I want them to realize that it’s ok to get out. However, if they just want to retire because of a job they don’t like, that might not end well. There needs to be life outside of work and the old cliche of retiring “to something” does apply. But as you’re saying, folks should work toward financial independence regardless and figure out what will transpire after that. 🙂

I’m going to be that guy that sees it both ways. It’s my job, which gets shittier as my industry evolves, that MAKES me value my time more. So part time work that takes me off a faster and faster gerbil wheel is what I will retire too. I like work, but the kind of work I like is getting scarce.

I appreciate you being so transparent with your numbers!!

Sounds like you’re already on track with a plan, Douglas! Cutting back to part-time work is a great way to bridge the transition to determine if you like some of that newfound freedom you get. I wish you the best!

Wait… you mean some folks actually like their jobs? That’s crazy talk! (just kidding)

For me it was actually a string of terrible jobs… but I don’t really use the word “retired” to describe myself. For me, Financial Independence (the FI part of FIRE) is the part that’s truly important. Gaining that freedom opens up so many doorways in life.

Once you’ve reached that point, what you choose to do with your time becomes completely open ended. Some people might choose to retire, others might support a cause, pursue a hobby, or even stay gainfully employed at a W2 job. To each his (or her) own.

Absolutely – the FI part is the most important. It’s not all about the money in life, but financial independence has the power to open up a lot of new doors to happiness.

Nice…money versus time. I recall reading Retire by 40 and one of his lines was: “when you have your dream job, you don’t spend a lot of time dreaming.”

I like that! Joe’s a smart guy and really helped me realize that early retirement was even a possibility. Leave it to him to come up with a great quote like that one! 😂

I’m with you, Jim. And your retirement sounds a lot like how my husband and I wish to spend ours!

As an aside, we are currently planning our transition to semi-retirement, when we hope to spend 4-6 months of the year slow traveling in places with a lower cost of living, and spend the rest of our time living and working in our home city. (And yes, Panama is on our list!) I’ve been trying to find a budget/cashflow template for such a lifestyle and haven’t found one yet. I’ve created a couple but feel like there are things I’m not thinking about.

Do you know of any such resources? Thank you!

Sounds like you guys are planning a lot of fun, Cynthia! We don’t really budget too much here – our spending seems to stay relatively consistent so it’s just not something I tend to put a lot of focus on. I use both Mint though to track our spending and Personal Capital to track our investments.

For something more hands-on with budgeting, you might want to check out the incredible spreadsheet bundle that I just discussed in a recent post, “Doing Your Own Taxes and Planning… or Die Trying!” . This thing is absolutely amazing for taking control of your finances and can help you manage your cash flow as well.

Other than that, I used to use Quicken for my finances and that worked well but it’s become pretty dated over the years. Although I haven’t used it before, You Need a Budget (YNAB) is supposed to be a great product for budgeting.

Hope that helps!

Thanks so much, Jim! I currently track all of our expenses with my trusty spreadsheet with some help from Mint. I guess I’m just curious about how to accurately gauge how your typical expenses might change when moving from destination to destination. I fear getting to a new city with a proposed monthly budget and then realizing it’s next to impossible. But as my husband adlibs on the classic proverb, “Fortune favors the prepared.” So I’ll just keep collecting info of what other people spend and where, and hope that I get it close enough, haha.

Yeah, that’s definitely a tough one. When we moved to Panama, we had to just make an educated guess on what our expenses would be. Unfortunately, I had guessed an amount lower than what it actually costs us to live here. Fortunately, we had retired with a budget as if we’d be living in the U.S. though so we were ok.

It’s a tough feat to be able to determine expenses in another country before living there. My advice… aim higher than you think. That way you’ll be covered. If you aimed too high, you’ll have extra money for fun.

Good luck!

Jobs get old after awhile. I had one get old in six months but had to stretch it out to 18 months. Other jobs never get stale.

That’s true – some people find a job they love and can stay there forever… those are the lucky ones. I liked my job but the time I needed to be with my family was more valuable and that’s why I left.