Disclosure: This post contains affiliate links and we may receive a referral fee (at no extra cost to you) if you sign up or purchase products or services mentioned. As an Amazon Associate, I earn from qualifying purchases.

In my post a couple of weeks ago, A Month-Long Panama Trip for 3 for an Unbeatable Price of Less than $1,500!, a reader named Ian asked in the comments what our expenses in retirement have been – both in the U.S. and while we lived in Panama.

It was a good comment because he hit the nail on the head. I sometimes give a ballpark on what our bucket strategy is allowing us to spend each year… but I really haven’t gone in-depth on what our actual expenses in retirement have turned out to be.

And while I mentioned in my reply to Ian that I’d put it on my list for future posts sometime down the line, it made more sense to address it now. We just ended 2022 a little bit ago, so why not strike while the iron’s hot?!

This turned out to be a much bigger endeavor than I anticipated, but once done, we were surprised by what we found … check it out!

Ugh… here’s the problem…

When I initially started this post, I thought I’d have it written in a relatively short amount of time… pull a few numbers regarding our expenses in retirement from Mint, pretty it up with some nice pie charts, and call it day.

Yeah, not so much.

In actuality, this has become sort of a nightmare for me that’s taken way more time than it should.

Why was it so hard to figure out these numbers? Several reasons actually…

◈ I switched from Quicken to Empower (formerly Personal Capital) around the beginning of our retirement. Then when we moved to Panama, I decided to use Mint as well specifically for tracking our expenses. The reason for this is that we had to pay for a lot of things with cash there and Empower doesn’t allow manual entries.

So we’ve had earlier data logged in Quicken, some years in Empower, and some in Mint. That by itself made it a little more of a headache to pull out the needed data.

As a side note, I’ve been very happy with our current setup over the past few years. Empower is excellent for tracking and helping to manage investments, retirement goals, etc. Mint is better for budgeting and tracking expenses. The combination of the two is easy and free so no complaints about that.

◈ I don’t normally keep track of our spending the “normal” way. We get a “paycheck” each year and that’s what we have to spend. Sometimes there’s additional income or unique twists, but what we see is essentially what we get. If we’re sticking to that, is it a big deal to track everything more? More on that later in this post, but apparently the answer is a big fat “yes.”

◈ We have business accounts in the mix. Route to Retire is one, but we also had our LLC for our rental properties and my LLC for book publishing. Other than Route to Retire, I’m slowly sunsetting the other businesses since I no longer have any rental property and I haven’t published a new book in years.

Regardless, I follow the cardinal rule and keep everything separate from each other as well as from our personal accounts. Each LLC has a business credit card and a business checking account in which all transactions are done.

However, when I draw owner funds as a paycheck, that money might go to our personal checking, savings, or other investments. Because I’m not staring at our spending with a microscope, this additional money in those accounts can sometimes make things appear to look rosier than they might be.

In other words, our frugality tends to drive our spending and our subsequent actions. We keep our spending down (or so I thought) and I’m regularly looking at all our balances in Empower. So when I see that we have extra money we’re not spending that could be put to use elsewhere with a better opportunity (like Series I Savings Bonds), then I make that move.

It’s a simpler way to manage our money that might not work for a lot of people, but it seemed to be working for us. All that to tell you that that’s why pulling together these numbers was a big project.

To give you an idea, I blew most of a day trying to pull old Quicken data from 2019 that required me to install my old Quicken 2017 software on our MEDIA computer since I use a Chromebook for day-to-day use.

That computer’s running Windows 11 and I couldn’t get Quicken 2017 working right on it even messing with the compatibility settings. So then I spun up a Windows 10 virtual machine using VirtualBox, which isn’t hard but it just took some time to do. Once that was running, I installed Quicken on it and was having the same problem… ugh.

By evening, I stumbled across a Quicken thread in the forums where I realized this is a problem for anyone trying to install Quicken 2017 on a new computer. I applied a workaround that was mentioned successfully and got everything working… except the data in there wasn’t helpful for this post anyway. Ugh again.

In the end, I got what should be relatively accurate numbers though not perfect. 2021 and 2022 were easy – I just had Mint show us what we spent. But then I found that Mint wasn’t including the cash transactions in the reporting for whatever reason, which accounted for a large portion of our expenses while living in Panama. So I needed to do some spreadsheet ninja work to get those in there… more time spent.

2019 and 2020 were an even worse mish-mosh of fun since Mint couldn’t present the data I wanted for those earlier years. This was partly because I had accounts that weren’t added to Mint until later in 2019 (with the lookback only being a few months) and also because of how Mint was handling these cash expenses.

So I went about it a different way… more spreadsheet fun. I had to mash together transactions from Mint as well as our old bank account statements. And yes, I keep a digital copy of every single statement we’ve had over the years – banks, credit cards, utilities, etc. It’s all nicely organized as well so I can easily find what I need.

I can’t even tell you the amount of work that all this took to do though from start to finish. However, now that it’s done, the numbers should be relatively accurate as to what our expenses in retirement look like.

So let’s get to it!

What does our year-over-year spending look like?

Let’s not waste any more time and see what our annual expenses in retirement were for over the past four years…

| 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|

| $45,835.21 | $51,135.81 | $54,950.98 | $56,289.39 |

These numbers did surprise me a little bit. They’re higher than I thought they’d be but there were also a lot of big and unique things going on throughout:

• 2019 was my first year of retirement. That summer we sold everything we owned and moved to Panama… not something most folks will do in their lifetime!

• 2020 was the start of something unique – what the heck was it? Oh, yes, a minor little thing called a pandemic. That summer we made the most of things, bought a used SUV for $12,000, and spent 40 days traveling across the country. It was truly amazing… but not cheap!

• 2021 was probably the most normal of our retirement years. We were still living in Panama and the pandemic was still alive and well but we were just doing our thing and enjoying our time. If we had stuck around, I think our expenses in retirement would be in that same ballpark most years. Bear in mind, we were living more upscale on that money in Panama than we could ever do here in the U.S.

• 2022 was the year we moved back to the U.S. from Panama. First off, we took our time coming back with a bus ride to Costa Rica and then spending almost two weeks in Mexico. Once we got back, we took another massive road trip – this time for 31 days. Then we got an apartment and had nothing so we needed to buy furniture and a whole lot more. Additionally, I went on a week-long expensive fishing trip to Canada and we squeezed a week-long cruise in. What a busy year and costly to boot!

Because of the train wreck in tracking for 2019 and 2020, I’m going to just let those die by the wayside. It wouldn’t be worth my time and effort to try to break everything down within those years… we’ll just call them lost causes! 🙂

However, here are the category breakdowns for 2021 and 2022…

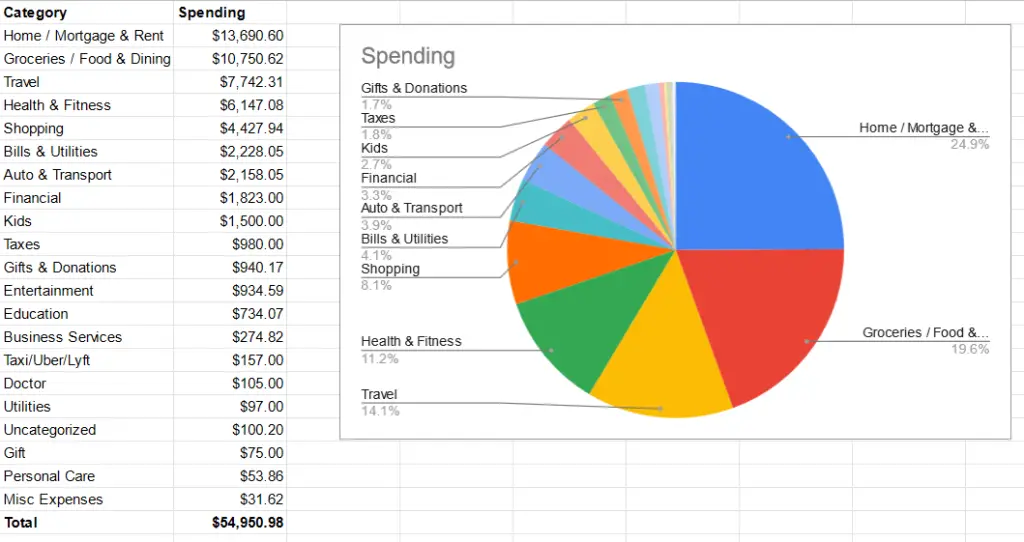

Category breakdown for our 2021 expenses in retirement

Because of Mint’s goofy problem with dealing with cash transactions, I exported the data to a CSV file, brought it into Google Sheets, and then added in the cash transactions. As I mentioned, we had a lot of these cash expenses while living in Panama so they were necessary for the data on our expenses in retirement to be accurate.

However, that export also separated out my spending subcategories from the general categories. So what you’re seeing is broken out a little more than I’d like, but it still lets you see where our spending was going…

As with most folks, housing is where most of our spending occurred… though not too shabby, right? We had about a month and a half near the end of the year when we ended our apartment lease and headed back to the U.S. for the holidays. When we came back to Panama in 2022, we moved right into a new apartment. That saved us a month of rent!

Food was our second largest expense (another non-surprise). Note that restaurants and groceries are lumped together. We’ll attribute that to me not tagging everything 100% correctly in Mint.

Travel was the biggest of our non-essential expenses in retirement during 2021. We did beach vacations in Panama. We traveled back and forth to the U.S. to visit friends and family. A lot of the costs were also for our 2022 travel to Mexico – flights and hotels that we booked in advance.

On top of all that, every time we had to fly into the U.S., we had to get COVID PCR tests. Those used to cost us $120 for the 3 of us each time (we did that 3 times in 2021)! I included those in travel because that was part of the cost of flying then.

It’s crazy to see that we spent all that money on travel even on top of all the travel rewards we’ve been taking advantage of over the past few years. We were busy!

“Health and Fitness” includes our dental visits and our ex-pat health insurance premiums. My monthly gym membership in Panama is included, too.

And then there’s “Shopping.” Because I haven’t been heavy into budgeting, I usually just lump most of the shopping that we do (non-grocery) into this. This could be shopping at places like Walmart or Target (or Conway in Panama), ordering merchandise online, buying clothes, etc.

The biggest purchase for 2021 in that category was my new cell phone. I replaced my 4-year-old phone with the Samsung Galaxy S21 5G and my daughter got her first cell phone, which was my old Samsung Galaxy S8.

We also bought a new PC for me to set up in the U.S. as our media center PC. We had one in Panama but I sold it there and just bought a new one in the States.

On that note, those are things you don’t see in these numbers. This is our spending for the year and that’s it. I do take into account when we returned something to a store but any income is not included like selling the PC in Panama to help pay for the cost of a new one.

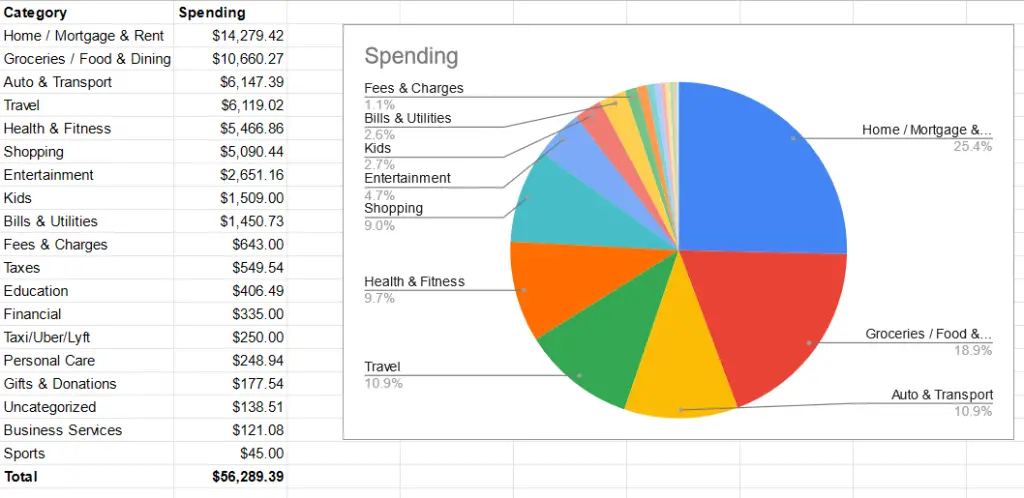

Category breakdown for our 2022 expenses in retirement

On to our spending in 2022…

As you’d expect, the big 3 (housing, food, and transportation) top our list. Like 2021, groceries and dining out are combined here. The same goes for housing expenses being lumped in with “Mortgage & Rent.” I need to step up and be a little stricter on my categorizations in Mint!

Because we had our second massive road trip (this one for 31 days) during which time gas was, of course, at an all-time high, our auto costs were high.

2022 was another big year for travel for us…

- We spent An Epic 2 Nights in the Jungle at Rambala Jungle Lodge

- We spent a few days at the beach

- Traveled to Mexico for almost 2 weeks (though the flights and resort were paid for in 2021)

- Took a monster road trip (hotels, dining, etc.)

- Flew to North Carolina to pack up all the furniture we bought from a friend to bring back to Ohio

- I went on an amazing 8-night fishing trip in the bush of Canada

- We went on a 7-night Caribbean cruise

The “Health & Fitness” category includes our ex-pat insurance premiums for half the year and then our premiums on the ACA now that we’re back.

“Home” and “Shopping” are categories I’m not surprised to see higher in our 2022 expenses in retirement since we moved back to the U.S. with nothing. We did get a ridiculous amount of good stuff from our North Carolina friend who moved to Panama and sold us everything she left behind. That was part of the cost.

However, when you’re starting from scratch, there will always be some things you need to bring everything to your comfort level. So there was some spending there as well.

Wait, isn’t that more than you planned on spending each year?

Uh, yeah!!!! A lot more than I was expecting to see!

The plan was to spend somewhere between $40k-$50k in retirement – adjusted for inflation as we go. In my head, $45k was what I anticipated as our sweet spot.

This was based loosely on the 4% rule but still being more conservative where possible, which would likely put us closer to 3.5%. Not so much here!

Now, in my defense, we didn’t know what our expenses actually would be while living in Panama… and then we lived a much more “affluent” lifestyle than we needed to. And, of course, the pandemic caused unexpected changes in our spending (i.e. the humanitarian flight we took back to the U.S.) and opportunities like traveling for pennies on the dollar.

But it’s a lot of money… and more than I thought we were spending. I don’t regret a moment of it since we did so many cool things and created so many amazing memories.

We went full throttle and took advantage of cheap and uncrowded travel during the pandemic we probably could never have done otherwise. It really was incredible.

And it was no harm, no foul.

The small amount of income I bring in from this blog (a little over $7,500 in 2022 and even less each year before) helped bridge the gap between the money we had allocated to spend and what we actually spent. We have a set amount to spend each year due to our bucket strategy which gives us around $50k each year (again, adjusted for inflation). That money goes into our savings account where it’s funneled throughout the year to our checking account. So any additional income through this blog or Lisa’s side jobs or us selling things around the house just gets added to the pot.

Obviously, it would be nice to save that excess money but it’s not been the end of the world either. We were still able to put away $20k into Series I Savings Bonds between 2021 and 2022 and continue to sock away some more money into Faith’s 529 plan. I contributed some money to a Roth IRA that I have for Route to Retire as well.

However, I don’t want to be counting on income from this blog or anything else to cover our spending… that should just be gravy. Earning a little bit of money from this blog is a bonus and it’s nice to see after several years of not making anything on it. My hourly rate averages out to be around $5.76/hour so there’s no doubt that money isn’t why I do this. But I don’t want it to be a job that we’re dependent on either to cover our expenses in retirement.

So it’s time to re-evaluate and figure out what we need to change. Most likely we’re going to need to cut back on some of the non-essential big luxuries (like traveling so much). That’s not to say that we’re going to cut out travel by any means but the rock-bottom bargains are gone now anyway so we’ll just want to be a little more deliberate in our planning.

Right now, we have a month-long trip to Panama booked for this summer that we got for a steal and a vacation with Lisa’s side of the family to Pawleys Island, S.C. booked for the fall. I’m also still working on getting us a cruise for next-to-nothing (don’t worry, I’ll write about it if I can make it happen!) but that’s not booked yet.

In other words, we’re far from depriving ourselves – we likely won’t be traveling every month or two like we had been doing though. Also, since we’re not going to be traveling back and forth to Panama a few times a year anymore, that’ll save us some good $$$!

Additionally, we’ll see if other money comes our way. Lisa might get a job just because she wants that routine and social aspect. I’m still trying to figure out my path and if it makes money, that’s just a bonus that I’m not counting on.

What I find the most interesting though is thinking about it this way… we spent less than $57k each of these years without really restricting ourselves. We jam-packed everything we could into the past 4 years. I wouldn’t say that’s a cap on the most we could spend if we had more money (living on a cruise ship anyone?), but it certainly goes to show that we’re doing a heckuva lot for what some might consider a modest amount.

Just pulling back a little on our spending shouldn’t be too hard and should bring us to a level more in the expected comfort zone.

So Ian, thanks for commenting about this recently – knowing what our actual expenses in retirement are is critical. We’ve been spending more than I thought, but it hasn’t been a problem and we’ve created some amazing memories. We’ll taper back on some of the non-essentials going forward though to get our numbers more in line.

And although it was a lot of work to compile these numbers, that won’t be a problem anymore. I learned some things about Mint that I need to handle differently so tracking our spending will be tremendously easier now. It doesn’t hurt that we aren’t spending so much in physical cash anymore either!

Finally, I’ll be keeping a better eye on our expenses in retirement each month. I don’t think we need to budget necessarily but we do need to be conscious of what we’ve spent each month through diligent tracking.

What do you think, dear reader – is our spending a problem? What would you do differently?

Plan well, take action, and live your best life!

Thanks for reading!!

— Jim

Even though you are a little bit disappointed/surprised by the amount you spent, I think you’ve done fantastic! You even bought a car in there 😱. I wish I was organized enough to even pull the numbers 🙈. Knowing your commitment, I’m sure you’ll pull expenses in to where you want them, but regardless you have given Faith memories most kids never experience 😊. That’s worth something money can’t even buy.

Thanks, Kathy – no regrets for sure! Now it’s just a matter of making sure that we don’t do anything that we do regret down the line! 🙂

Well, it appears you’ve done very well managing your finances in retirement. It shows serious discipline and perhaps delayed gratification, which are great traits for your daughter to be witnessing. If I were to guess, she will do great with her finances too, which is an unforeseen bi-product of your financial journey. Great Job!

Thanks, Jim – she’s a good kid. She’s been exposed to a lot of cool stuff that most kids haven’t (like living abroad) – here’s to hoping that this opens her mind up to know there are other possibilities out there other than the de facto. 🙂

The spending is only a problem if you think it is. Definitely wouldn’t pass on the activities you did – it is why you checked out early. Funds for the “excess” spending can be earned pretty easily with a part time job if you want to.

Quicken was a nice program – too bad Intuit didn’t like it. Mint is a little clunky for my taste. I find it hard to get a clear picture because money sent to savings account gets muddled with other expenses. But as long as we don’t spend more than our monthly check, all is good.

Yeah, Quicken was awesome but just got stuck in the 90s. Mint’s pretty good and it’s hard to complain about it for the price.

But you’re doing it right – if you’ve got a monthly check coming to you that’s not going to end and you’re spending less than that, nice work!

If I were you I would not beat myself mentally for this kind of spending. You were happy to spend on experiences and enjoyed it. I also think it would be to exhausting to travel every month. Then you would need a vacation from vacation and your FIRE life is already a vacation to begin with, LOL.

OTOH, I’m financially conservative and I think I would feel nervous with 4% spending, but that’s just me. I think we have oversaved and we still have one W-2, but we will be paying for college expenses fairly soon and for 2 kids, so I am optimistic that we oversaved, but I must also be cautious. We never spent more than $60k for a family of 4, but we will have 8-10 years of college spending between two children.

For curiosity about your trip to Panama, do Americans need any special vaccinations to visit that country? Do you plan to rent a car or take buses to visit different parts of the country? The pictures of Panama look beautiful and I wouldn’t mind to travel there but I wouldn’t want to be stuck in the city and I’m not sure how confident I would be to drive there.

Thanks.

Haha, I was drained from traveling so much last year, which is pretty funny, but it was also fantastic! 🙂

I think it’s great to be financially conservative as long as it doesn’t stop you from doing what you want to do. It’s also cool that you plan to cover your kids’ college as well – that’s a wonderful gift that will hopefully start your kids’ financial future off right.

There are not any required vaccines for Panama but they do recommend getting certain ones (here’s a list). We got up to date on most of these when we first visited just to be safe though (I think I got 3 shots and Lisa and Faith got 2). It’s a wonderful place to visit and driving is actually not bad there… except in Panama City. Panama City is like New York City but even a little crazier and busier. But if you’re visiting a place like Boquete, you’d likely want to fly into nearby David and wouldn’t necessarily even need a car then anyway. The taxis are cheap and they’re all over the place (they’ve even started Uber in David). But you could always rent a car at the David airport, too.

Last year was my first year of a mini-retirement. I don’t have an end date, so it may be retirement. We used YNAB to track expenses, and I was pleasantly surprised to find we came in just under my SWAG for the year.

This year, I expect to spend more, because we will travel more.

You should not feel bad about creating memories and spending more than you originally planned. It sounds like you have a firm grasp on your finances and won’t let your spending get out of control.

Congrats on the mini-retirement, Topher – I hope you’re enjoying it! And congrats even more on coming in under your numbers – that’s a real bonus!

Yeah, spending more than expected hasn’t made me feel bad because of the memories like you mentioned and because we still didn’t spend more than we had put aside for the year… we just were spending additional income that came in as well. We’ll just keep a better eye on things from here on out.

Enjoy your traveling this year!

LOL! Your yearly expenses look like my monthly expenses!

Add me to the list that thinks you’re doing a great job with expenses. I remember my first three/four years of retirement when money issues were pretty sketchy. Once I hit 62 and SS kicked in, things got a lot clearer. Up until that point, I felt like I’d said or done something inappropriate at work & you sent me home w/out pay! 😀

That’s interesting to hear that your first few years were a little “sketchy”, Rich – I didn’t know that. Also, I can’t imagine you ever saying or doing anything inappropriate in a workplace environment [please note sarcasm 😉 ].

I don’t Jim — It looks like pretty frugal living to me! We spent like $90k this year, and I was trying hard to keep our spending down. Really hard!

I don’t know how you do it, but your annual spending puts ours to shame.

You might be more frugal than me in most areas, Mr. Tako – heck, you don’t even rock phone service except when traveling! 🙂 From what I read on your site, my bet would be that your housing costs are what makes the big difference. But you’ve got “baller money” so enjoy… and just leave a couch open and ready for me to crash on the next time I’m passing through that way! 😉