ETFs vs Mutual Funds… Why I’m All-In on ETFs

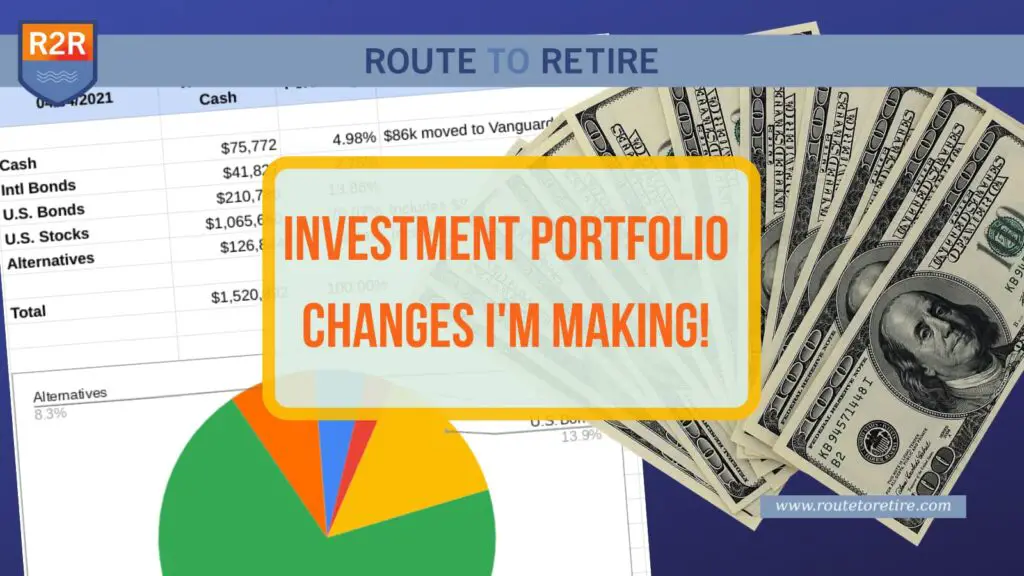

In my last post, Opening the Books to Our Investment Portfolio, I broke down our entire portfolio. This included every holding and the values of each (rounded slightly just for security). This turned out to be a pretty popular post and generated a little bit of fun discussion – both in the comments and through email several email conversations I had with readers. One fair comment was about why I choose to buy the Vanguard ETF VTI instead of the […]

ETFs vs Mutual Funds… Why I’m All-In on ETFs Read More »