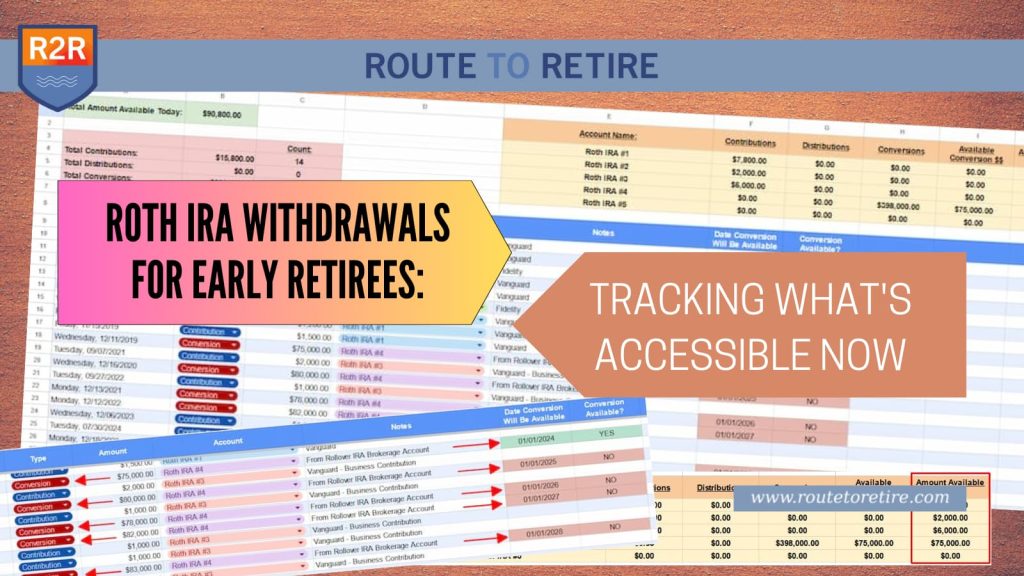

Roth IRA Withdrawals for Early Retirees: Tracking What’s Accessible Now

I retired at the age of 43 at the end of 2018 so I could spend more time with my family and choose how I want to spend each day. It’s been amazing so far and I’m looking forward to the years to come. Strangely, you need this thing called “money” to be able to pay for your expenses in life. They getcha coming and they getcha going, don’t they?! 😉 Fortunately, we were prepared for that and socked away […]

Roth IRA Withdrawals for Early Retirees: Tracking What’s Accessible Now Read More »