Disclosure: This post contains affiliate links and we may receive a referral fee (at no extra cost to you) if you sign up or purchase products or services mentioned. As an Amazon Associate, I earn from qualifying purchases.

Today is the anniversary of my last day of work six years ago. At the end of the workday on December 31, 2018, I became free in a sense. That was the day my early retirement began.

If you’ve dreamed about early retirement for a while like I did leading up to this, there’s a little surprise in store that you might not know… It’s not going to be exactly the way you envisioned.

That’s because when we daydream or fantasize about something we want, we tend to focus only on the perfect scenario. We think we know what we want and that dominates anything else that could possibly be a part of it.

Well, guess what – it’s not all peaches and cream. Just because you’re in early retirement doesn’t mean all your responsibilities disappear. You still have to do your laundry, pay the bills, and raise your kids if you’ve got any. Life goes on and there will always be good days and bad days.

Here’s the cool news though… it’s still pretty freaking awesome!

I wouldn’t trade my early retirement for anything. The freedom to dictate how each day will flow is such a blessing. But I also think it’s important to share how the past 6 years of “not working for the man” have gone without wearing rose-colored glasses. Here’s what I’ve learned throughout my early retirement.

Money isn’t everything… by far

Let’s start by talking about money. We all like money, right?

Financial independence in and of itself is an indescribable feeling. There’s a tremendous sense of power in knowing that you are no longer captive to the need to make money to survive. I wake up every day in amazement (still!) that we’re in a position to be able to do what we want (within reason) and when we want to do it.

Money does not buy happiness, but boy, it does take a huge weight off your shoulders so you can pursue it a lot easier!

And remember, just because you’re financially independent doesn’t mean you need to dive into early retirement. If you truly love what you do… keep at it! There’s no law that says you can’t work once you have enough money just because you don’t need to anymore. Financial independence gives you that strength though to be able to leave it if something happens down the line where you suddenly can’t or don’t want to continue working at your current job.

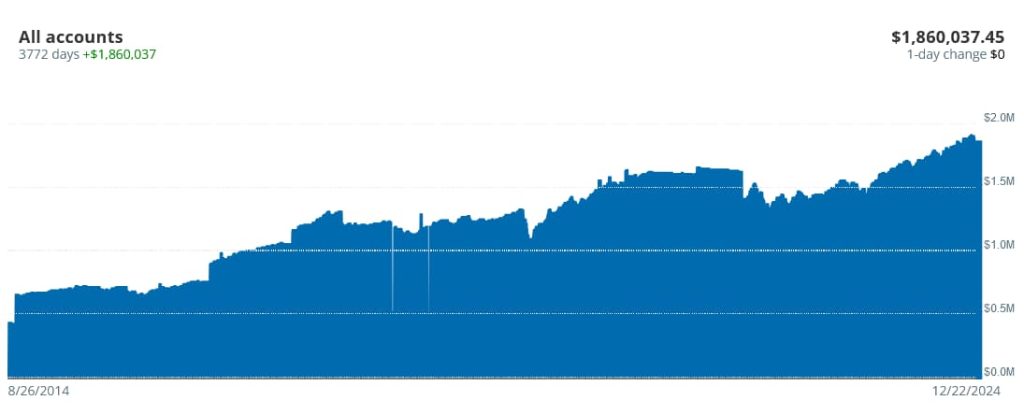

When I left my job, we had a net worth of around $1.1 million. I’ve been tracking my net worth and investments since 2014 with the Empower Dashboard. It’s free and comes with some amazing tools to help you view your asset allocation, see the hidden investment fees you’re paying, run different case scenarios on your portfolio for retirement, and more. It’s hard to believe it’s free – it’s an awesome tool to use. You can sign up for a free account with Empower here if you want to check it out.

I’ve also been taking those numbers from my Empower account since 2017 and sharing them on my Net Worth page every month if you want to see how we’ve been doing.

Here’s the deal, when we retired, we had planned expenses of around $40-45k/year. The crazy thing is that this was sort of an educated guess. We were moving to the country of Panama and we could only guess what our expenses would be there.

Was a net worth of $1.1 million enough for us to live off of for the rest of our lives? Maybe. Maybe not. But I felt trapped at work and really wanted to be there as my daughter grew up, so we went for it. Worst case, I could always get a part-time job later to fill in the gaps if needed.

After 6 years of early retirement, I learned a few things…

We’ve been extremely fortunate with money.

The market has continued to push ahead strongly since I retired. Even after withdrawing all that money for our living expenses every year, our portfolio has outpaced our spending, and our net worth has been over $1.9 million recently (it’s at around $1.86 million as I type this).

And considering we’re getting closer to the tail end of our greatest chance of sequence of returns risk, we might be able to safely increase our yearly “allowance.” I’ll probably spend a little time in 2025 re-evaluating our numbers and looking at a new safe withdrawal rate for the future.

It’s funny that we’ve been taking out around $50k/year from our portfolio since it hit around $1.25 million right after I retired. That’s a 4% withdrawal rate. But considering how well the market’s been doing over these years, we can evaluate starting over and bringing down our withdrawal rate to something extremely conservative like 3.5% while yielding a bigger paycheck every year (say $75k/year).

Pretty cool, right?

The sequence of returns is one of the biggest determining factors of how your portfolio will do over the long run. It’s also a crapshoot. You never know how the stock market is going to perform for the first 5-10 years of your retirement, but I’m very excited that it’s done so well for us. A real bonus for us is if it were to continue on that path for at least a few more years, but I won’t get my expectations up.

A little extra money never hurts!

I started this blog in 2015 as a bridge for something to do in our early retirement. It’s worked well. I enjoy it and it does provide a little income. For 2024, I’ll have made about $5,000. It’s not very much, but it’s “free” money for doing something I enjoy. I’m sure if I put more time into it, I could drive up the revenue, but I don’t want a full-time job.

In the meantime, Lisa has done a few side jobs here and there and has just started subbing at our local school district. She has the flexibility that she can do it when she wants and it doesn’t affect all the travel we do. And again, it’s a little extra fun money coming in.

It’s nice to do some fun jobs where money isn’t really the driving factor. This additional income is a bonus nonetheless and helps us splurge a little more in our early retirement life.

We spend more than expected

We’ve done a lot of cool things and that costs money. I’ll talk about that shortly, but we’ve been spending around $50-55k per year. That’s a lot more than the $40-45k/year we anticipated. Luckily, that’s not a problem. Between our safe withdrawal rate and a little extra money coming in, we’re in great shape.

Overall, money hasn’t been a problem for us in these 6 years of early retirement. We do what we want (and more!) and we’re still in a comfortable spending range.

We’re still a little careful and I still keep more of an eye on things than is probably necessary. However, it’s still tremendously less time than when we were in the accumulation phase.

I’m happy that we pulled the trigger when we did. I could have worked longer to add more to the pot, but how much is enough? One of the biggest problems with working just a little longer is “one-more-year syndrome.” I wrote about that in an article called “How to Get Up the Nerve to Retire” on the ESI Money blog shortly before my retirement.

There’s no doubt in my mind that I pulled the trigger at the right time. I wouldn’t trade the time that I’ve gotten to spend with my wife and daughter over the past 6 years for anything.

Living the life you want to live

If you think about life in early retirement, you might have dreams of sipping on Piña Coladas on the beach for the rest of your life. In reality though, if you did that all day every day, you’d probably end up bored to tears within a mere week or so. Those couple of weeks would be great though! 😉

But that doesn’t mean you can’t change your life dramatically regardless.

We’ve taken the reins in our early retirement life

We’ve done some crazy, awesome things since I started early retirement…

- We lived in Boquete, Panama for almost 3 years

- We traveled throughout the U.S. in an RV for 8 months

- We now have plans to travel for almost a third of the year

These are some major events that we couldn’t have easily done while I was still working. And even though we had planned to move to Panama right after I had retired, I don’t think we could have imagined all these cool things we’d be doing.

The important lesson is that you truly do control your own destiny. And early retirement gives you even more flexibility to make even more changes to help seer that ship.

I would say that the lives we led before early retirement were pretty much on par with a lot of folks. But once we made the move to Panama, everything changed. That opened our eyes to realize that we have the power to do some cool things we might not have imagined before.

Since then, stepping out of our comfort zone has been a valuable part of early retirement.

And it would be silly not to mention how credit card travel rewards have changed so much for us. I already talked about how we’re doing so many cool things in early retirement and a lot of them wouldn’t be possible without all the free travel we get through credit card rewards. If you’re not taking advantage of this, you’re leaving a crazy amount of money on the table.

I use the free site, Travel Freely, to track all my cards and bonuses and help us determine the next card to go with and it works great. You can read more about that in my post, The #1 Best Way To Track Credit Card Rewards.

The past 6 years have been fantastic. I’m not saying that every day is perfect – we all have garbage days. But as a whole, we’ve done some awesome stuff and have been to some amazing places. Early retirement didn’t give us that. It gave us more flexibility to do these things, but it was a change in mindset that made it happen.

Who knows what’ll be in store for us over the coming years?!

Chasing unique and fun experiences and challenges

As I said, the move to Panama opened our eyes a little. So other than the longer-term events, we started finding other cool things we could do, things like…

- Starring in a House Hunters International episode

- Spending two nights sleeping in a jungle lodge

- Taking a bus from Panama to Costa Rica (we did this twice!)

Additionally, I’ve done some things on my own, too:

- Hiked up Volcán Barú

- Appeared in a couple of Kiplinger articles, a Business Insider article, various podcasts, websites, and a popular YouTube video for Modern Aging

- Stepped out of my comfort zone and went on an 8-night fishing trip of a lifetime in Canada

- Became an extra for the new Superman movie coming out next summer

The new teaser trailer recently dropped for the Superman movie and it looks good…

I’m even more excited about it now (and hopefully, I end up making the cut!).

In a nutshell, life is what you make of it and we’re not wasting our precious years and not trying out new things. Some things we’ve loved and would do again in a heartbeat and others not so much. But you get great memories regardless, and it’s the only way to find some unique experiences that you truly enjoy.

Figuring out yourself and finding happiness in early retirement

Do I need a job for [whatever reason floats your boat]…

A lot of folks tend to equate their job to “bad” and early retirement to “good.” I know – I was in that camp. I didn’t have blinders on to think that you suddenly leave your job and everything’s perfect. But I did think that my life would improve after leaving work.

And I was right… though that’s not the case for everyone. Some people miss work for whatever reason – the structure, the social aspect, avoiding boredom, feeling they’re contributing to something, etc. There’s absolutely nothing wrong with this at all, but luckily, I’m not in that camp.

I was fortunate. I had this blog to continue writing as a nice bridge into retirement. On top of that, I continue trying new things in early retirement like learning to code in Kotlin and improving my Spanish speaking through courses, apps, podcasts, videos, etc.

Plus, I’ve been so much more active now. I promised myself that when I left my job, I’d get fit… and I did. For the first handful of years of early retirement, I was consistently doing resistance training 5 days a week. I cut that down to 4 days a week earlier this year just because it was taking up too much of my time. That seems to be the perfect balance for me.

I still need to work on the cardio side of things though. Running’s not my bag (plus my knees aren’t as good as they used to be). I do try to walk a couple of miles 3-5 times a week but that’s not getting my heart rate up enough. So, this is something I want to work on.

As a bonus, I quit drinking in September of 2022 – that’s well over 2 years now! And we’ve been eating fairly healthy over the past several years, too. We’ve still got some work to do on that front (stupid ultra-processed foods tasting so delicious!), but we’re doing pretty well regardless.

The point is that I haven’t been bored in early retirement. Thinking back over the past 6 years, there was just one single day when I was like, “Hmm, I really don’t have anything to do today.” You know the cliche about being busier in retirement than when you were working? Yeah, that holds true in my case, which is a great thing! The biggest difference is that now I’m busier with more things that I enjoy doing (though there are always the chores you don’t love mixed in there, too).

Have I found happiness and purpose?

Happiness has been the easier side of the equation in early retirement. Leaving my career took such a weight off my shoulders that immediately made me feel free. I spend ridiculous amounts of time with my family (maybe too much!) and we’ve done so many unique and amazing things that it would be hard not to be happy.

Obviously, early retirement doesn’t fix everything. There will always be down days in life whether you’re working or not, but in general, I’m extremely happy. Life is good, my friends!

But, and this is a big old but, I had a rough patch… a really bad rough patch. My first three years of early retirement were fantastic, but I had an extremely tough time adjusting back to life in the U.S. when we moved back from Panama. It hit in late summer of 2022 and I just became so lost and depressed like I had never been before.

I had never heard of it, but my good friend Fritz from The Retirement Manifesto pointed out that I might have reverse culture shock. After digging into it more, that had to be a lot of what was going on. Regardless, it took me around 6-8 months to work my way out of that well… and I hope to never be there again!

So aside from that strange exception, I’m very happy and I believe that early retirement has been a big part of amplifying my happiness.

Not everything‘s perfect, but life’s not meant to be perfect. It’s all about enjoying the ride the best you can.

But what about purpose and meaning?

Those are a little harder for me to get my arms around. For whatever reason, I always imagined that I’d go into early retirement, figure some things out, and find my true purpose in life.

It was actually driving me a little crazy for a while because I couldn’t figure out what my higher purpose was. I even read some great books on the subject. Here are a few I found helpful:

Keys to a Successful Retirement – by Fritz Gilbert

Didn’t I just talk about this guy a few paragraphs ago??!

A New Earth: Awakening to Your Life’s Purpose – by Eckhart Tolle

The Happiness of Pursuit: Finding the Quest That Will Bring Purpose to Your Life – by Chris Guillebeau

All three of these books are really good and worth checking out. I also read Man’s Search for Meaning by Viktor E. Frankl, but that one just didn’t wasn’t very helpful for me.

Things like these books and some other digging around set me on a course to find my purpose through various ideas. What I ended up doing was creating the Ultimate Bucket List and Next Chapter Matrix. These have been extremely helpful in all sorts of ways in my life. You can get a free copy of these and some of my other cool spreadsheets just by jumping on my mailing list, too! Here’s the hookup…

Regardless, I still didn’t feel like I was where I needed to be. Something was still missing.

And then something interesting happened recently.

My friend Jordan Grumet from the Earn & Invest podcast reached out to me for a favor. He asked me to read his upcoming book and possibly write a review on it. Fine, no biggie, I’ll check out the book and see what I think.

He sent me a PDF preview copy of it and I popped it on my Kindle Paperwhite because reading on the Kindle is so much better, IMHO! And I eventually got around to reading it.

The book is called The Purpose Code. I didn’t really have any expectations either way. Jordan’s a good writer and I enjoyed his last book, Taking Stock, but I had nothing to go off on this since it wasn’t even out yet.

Folks, I gotta say, this book was exactly what I needed. It was like Jordan was in my head trying to lead me down the right path. One of the most important pieces I took away from this book is that purpose isn’t just about finding that grand platform to stand on – that one driving force. It’s also about smaller purposes that make some of the biggest differences in life.

That might not make a lot of sense in how I’m paraphrasing it, but his words somehow “fixed” my brain. I feel tremendously better about where I’m at now in finding a sense of meaning.

I’m a little early in even mentioning this book since it’s not out until January 7, but here’s the link to The Purpose Code where you can pre-order a copy today.

As a side note, I’ve been reading quite a bit in early retirement and that makes me quite happy in and of itself. I used to love reading when I was younger and then things eventually got in the way. Now, though, I read for a half-hour to an hour almost every night… and it’s glorious! Maybe I’ll do a post to talk about some of the great books I’ve been reading sometime soon!

This is how life in early retirement has been going for me over the past 6 years. Each of these topics is going to be personal to your values so don’t look at what I’m doing and feel the need to try to do everything the same. Heck, a lot of folks wouldn’t even dream of leaving work in the first place!

It’s important to understand that each of the areas I talked about is different for all of us. Maybe you need more money or maybe you need less. Maybe you already know your purpose or maybe you’re completely lost. And possibly, you haven’t even mapped out what you want to do in early retirement, or perhaps you’ve got the next 10 years all strategically mapped out.

Regardless, early retirement is what you make it and for me, it’s been an awesome 6 years and we’re really just getting started! I’m excited to see how things continue throughout the years!

Plan well, take action, and live your best life!

Thanks for reading!!

— Jim

Wow, did you really mention me twice! Blushing. I’m reading The Purpose Code, agree it’s perfect for you (especially Chapter 6). I’m writing a review to align with the Jan 7 launch. Great post, always interesting to learn how others manage the retirement transition, a fascinating time in life!

Haha, you deserved three mentions but I’m already too long-winded as it is! 😉

Happy New Year, Fritz!!

Hi Jim, was reading the post from 2023 where you created the excel spreadsheet about things you love. You mentioned that you enjoy excel a lot (which I do also – I am a spreadsheet junkie), so if you have never checked this out, you might enjoy this website and the emails sent.

My Online Training Hub – http://www.myonlinetraininghub.com

You subscribe and get emails with really cool tips, tricks, shortcuts for excel. I have learned a lot from them.

Thanks, Vic – I bookmarked it to check out later!

Thanks Jim for the post and your contributions to the FIRE community. It’s easy to forget that this amount of freedom is so unusual and we need a community to help us evaluate our own lives.

We’re definitely in a position to be thankful for, that’s for sure. And I appreciate all your feedback you always provide, too!

Have a great New Year, my friend!!

Thanks for another great post Jim. I have a few more years before I’m ready to pull the plug on work life but so happy to have such great resources such as this blog. I got a late start and have had some minor setbacks but have made great progress over the past 4 years thanks to this community.

Thanks for the kind works, Tracy! So glad to hear you’re kicking some butt and getting closer to reaching your next starting line. You’re gonna love it!

Have a great New Year!!

Jim, great article. greatly appreciate the frankness and your willingness to share insights that others may hide with FI and RE.

Thanks, Nadeem – I appreciate that. I don’t think it’s right to just talk about the good stuff. There’s absolutely no doubt that early retirement has been a true blessing for me, but just like anything it’s not perfect. I would want to hear the whole story if I were the reader so that’s what I try to share.

Have a happy New Year!!

As part of the first Gen X crew, I’ve been making my own money since the age of 15, the past 20 in high stress, start up , sales leadership roles.

This article was great for me, I’m thinking 62 and trying to get ready over the next 30 months.

I’m glad I found this article and will subscribe

Thank you

JC

Hey, that’s great to hear, JC – good luck on the planning. I hope you find the next chapter in life to be truly rewarding!

Congratulations! I’m very happy for you and your family. You have to enjoy life while you can. The book sounds interesting. I haven’t read a personal finance book in years, but this one might be helpful.

I haven’t had a lot of struggle with purpose, though. Keeping busy has been enough so far. Raising a kid is high stakes already. If RB40Jr turns out well, it’d be a huge accomplishment.

Thanks, Joe! That’s fantastic that you haven’t fallen down the hole of feeling a lack of purpose – it’s a frustrating place to be. Jordan’s book was definitely helpful in changing my thoughts on this idea, which helped me tremendously.

I’m with you on raising a kid. There’s an innate duty to put your child on the right path in life to find their own happiness. I’m betting that we both end up feeling like we did pretty well once they’re older! 🙂

Nice article Jim, agree with a lot of the views and points.

I had similar issues to you in 2022 (retired around 2018 like you) and since then have re-entered the workforce since I still liked growing our wealth and the comfort of a paycheck.

I was wondering, looking at your graph, how much of an impact the net worth had seeing it go from $1.7m at start of 2022 down to $1.3m over those first 6 months? Did it have any impact on your psyche?

Thanks, Joe, and that’s great that you went back to work after retirement for your own wants rather than it being a necessity.

Great question on the net worth change. Didn’t bother me at all. In fact, I had to look it up to see the drop because I don’t even remember it. I’ve got faith in the 4% rule of thumb (even though we’ve taken out less than that each year). I also have things structured so that we have at least 5 years of our annual expenses outside of equities. That means that even if things went completely south in the market for several years, we wouldn’t need to sell a penny. And if things continued to be sour for so long, that gives us plenty of time to adjust our plans if necessary. We could even go back to work part-time if needed. I doubt it would get to the point where we need to make that decision, but we could if needed.

Honestly, it’s always great to see our new worth increase and I enjoy seeing that when I update it for the website each month. But there will be times when it’s down, too, and I’m fine accepting that. I just update my net worth and then move on with life and forget all about it.

For folks that don’t like that idea, there’s nothing wrong with continuing to work and bring in some extra money. Hopefully, it’s on your own terms though and you enjoy it.

Hope that helps!