Disclosure: This post contains affiliate links and we may receive a referral fee (at no extra cost to you) if you sign up or purchase products or services mentioned. As an Amazon Associate, I earn from qualifying purchases.

It’s been a few weeks since my last post. I think I’m starting to get into a nice cadence that I’m enjoying a little more.

I still really love writing for Route to Retire, but after 10 years, I decided earlier this year that it was time for a lighter rhythm. It didn’t make sense to keep holding myself to some self-imposed, arbitrary schedule, especially with all the other fun things I’ve been keeping myself busy with lately.

So although I’m not setting a strict schedule anymore, it seems like I’ve been releasing a couple of posts a month for the most part… I’ve been happy with that and hopefully you are, too!

With all that said, we’ve got some big and long travel plans coming up very soon, and I’m probably not bringing my laptop. I don’t want to worry about writing and instead want to focus on being in the moment. So I wanted to try to get something out now since that means I probably won’t be posting again until – yikes – maybe December!

We just hit a really cool net worth milestone, which makes this a great opportunity for this writing. Plus, why not share the other things that we have going on lately, right?

A new, super-cool net worth milestone

We’ve all heard that money isn’t everything and money can’t buy happiness. I do believe these adages to be absolutely true. You can find plenty of people who are crazy wealthy and still miserable.

Regardless, money does have the power to grant you financial independence and give you more time for experiences. I find that to be one of the most important facets of money because those experiences are what help create so many lasting memories, and that, I do believe, is something that can be a link to happiness.

We hit a huge net worth milestone back in 2017… $1 million. I honestly couldn’t believe it. I consider us to be a pretty regular couple and hitting a number like that was kind of hard to fathom.

But it didn’t really change things for us. That’s because, in all actuality, it’s just some arbitrary number. While super cool, it didn’t put us where we needed to be yet to do what we wanted to do.

However, the next big net worth milestone came in 2018 when our net worth reached $1.2 million. Although it doesn’t carry the simplicity of a round number like $1,000,000, this net worth milestone was much more important. Not just because it was a bigger number, but because it was our financial independence number.

This was the number that allowed me to retire from my management career in IT at the end of 2018 at the ripe old age of 43. That was the trigger that gave me the ability to spend time with my wife and our daughter as she grew up over the past 6 (almost 7) years.

We didn’t waste those years either. As I reflect on the memories we’ve had so far (with more to come!), I always tell Lisa and Faith, “We’ve really done some cool s@#t!” I mean, how many people can toss out there that over the past handful of years they’ve done stuff like:

- Retired at age 43!

- Sold everything we owned and moved to a foreign country (Panama) for a few years

- Starred in an episode of House Hunters International

- Spent two awesome nights in a lodge in the middle of the jungle

- Hiked up an active volcano

- Was interviewed in multiple podcast interviews, a cool YouTube interview, two Kiplinger articles, a Business Insider article, a Fortune article, and a Forbes article

- Did an 8-night fishing trip of a lifetime in northern Quebec, Canada

- Traveled the U.S. in an RV for 8 months

- Got to be an extra in the new Superman movie (and even made it into a few scenes!)

- Taken a ton of great vacations all over the place, PLUS 6 cruises since 2019… and two more cruises to come this year, and one more in 2027!

That’s just a partial list and I feel like there’s still so much more to do!

To me, this is unbelievable and something I never dreamed possible. We’re very blessed to be able to do this, but the big thing is that we are doing it. The money is one thing, but I like that we’re stepping out of our comfort zone and trying different things. I don’t want life to pass us by, and I want to do cool things that we can have booked to look forward to, enjoy doing, and then reminisce about later.

And this isn’t something we could have done without the money to buy us financial independence. We still don’t spend an excessive amount of money each year (currently around $50-55k per year all in, including housing expenses), but having the time to do these kinds of things has been the key.

So, yes, that $1.2 million net worth milestone turned out to be a big one for us.

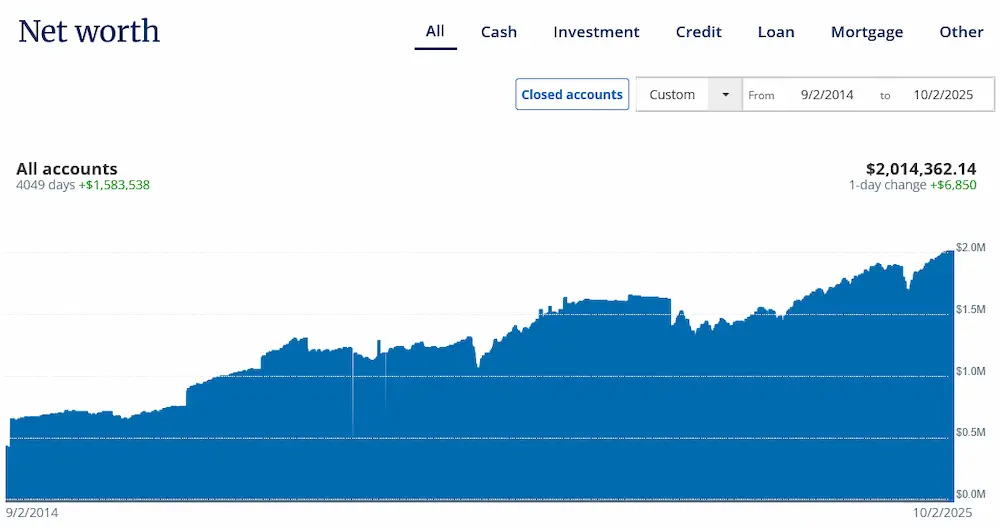

But here’s where it gets interesting. Recently, we hit an even bigger net worth milestone – one that I honestly just didn’t anticipate happening… we hit a $2 million net worth.

I guess that technically makes us multi-millionaires. What the what??!!

I use the free Empower Dashboard to track all my accounts and my net worth automatically. That’s where this screenshot comes from – it’s nice to just be able to log in at any given time and see where we stand financially. If you haven’t tried Empower, it’s worth it – it’s hard to beat, free, and it works extremely well!

Last week, on October 1, I got to add that to my net worth page on this site. And as I type this, we’re still barely at that level, but that’s out of our hands and up to the stock market. By the time you read this, that may or may not still be the case, but that’s still pretty crazy for me to see nonetheless.

What’s funny about this to me is that this new number gives us some flexibility to actually increase our spending if we want. But, in an effort to keep our daughter from being saddled with a lot of school loans, we’re actually planning to keep our spending the same over the next 4 years to maximize her financial aid. Maybe a little funny, right?

Because of that, we’ll be leaving more cash in the market, which means there’s a chance that our portfolio could possibly swing up even further over those 4 years. If that happens (obviously, no guarantees), we’ll be in great shape to ramp up our spending after that. Time to start dreaming!

Who would have thunk it? Compounding truly is magic, folks! Save and invest what you can and let compounding handle things from there.

Now, there’s also a chance of the market going the other way, but I think we’ve done well enough with our sequence of returns risk that even if the market dropped by 40%, we’re still in a great position. And with the bucket strategy we put in place several years ago (thanks for introducing me to that bit of genius, Fritz!), we can weather a handful of bear market years without needing to sell a single share of stock at depressed prices.

I’m a happy camper. A $2 million net worth milestone wasn’t in our plans. Nevertheless, it’s something I’m extremely grateful to see. We’ve been very fortunate to be in the position we’re in and I absolutely don’t take that for granted.

We can still handle roller coasters!

A couple of weeks ago, we decided to head to Cedar Point for the day. If you’re not familiar, Cedar Point is probably one of the greatest amusement parks in the world, and it’s only an hour and a half drive from us. So it was a little weird that we hadn’t been there since 2019.

With our daughter now 15, trips to places like amusement parks together are probably nearing their end. In fact, she had already been to Cedar Point early this summer with another friend – how dare she go without dear old Dad?! 🙂

But she was excited regardless. We waited until the day before to buy the tickets to see if the weather would cooperate. With a high in the low 70s and no rain planned, it was hard to lose!

Buying tickets online from their site saves a stupid amount of money versus paying at the gate. It was going to be $55 per ticket, which wasn’t too bad. But then I got irked at the $35 charge they wanted for parking there… yeah, I said it — 35 freaking dollars for parking. Ain’t that a sham?

I won’t bore you with all my research, but in the end, I bought us all season passes that are good for the rest of this year, plus all of 2026. It’s a bigger initial cost at $125 each, but they include free parking. The thinking was that just going a second time means we come out ahead.

We decided that since next year isn’t going to be too big of a travel year (though we’re still going to Hawaii for 2 weeks and a week at a beach house in Pawleys Island, South Carolina), we’ll do a couple more trips to Cedar Point. We’ll try to go at least one weekday in the spring while the kids are still in school and maybe do the same in the fall. Additionally, that gives Faith the opportunity to go with her friends next summer whenever she wants.

More importantly, we’ve still got it! We rocked it out on a lot of roller coasters while there. I worked out an “optimal” strategy for our visit and it actually worked. We started at the back of the park with the most popular roller coasters they have before it got busy. Then we slowly worked our way toward the front of the park, continuing with the less popular coasters and rides as the crowd built up throughout the day.

We got there right before the park opened at 11:00 AM (end of season hours), and once it did, we rushed back to Top Thrill 2, the tallest roller coaster in the world, which usually has a 2-3 hour wait time. We waited 45 minutes.

This ride was insane. This is the first time I’ve ever felt uneasy on a roller coaster. I have this YouTube video (Cedar Point’s, not mine) starting at the part where I struggled (about 50 seconds in). That couple of seconds when you’re completely vertical over 400′ in the air hanging there staring at the ground is, well, a little terrifying…

Then we went to the newest roller coaster there, Siren’s Curse, and waited another 45 minutes and knocked that out. This might be the best coaster I’ve ever been on. It’s smooth, fast, and exhilarating – just a super-cool coaster!

Then we hit the Millennium Force with maybe a 25-minute wait, which has been my favorite roller coaster since it opened in 2000. I still love it, and I think I rank it just a smidge below Siren’s Curse now, but it’s so close – they’re both awesome!

After that, we knocked out all the other coasters and rides that were on our list. This was probably the most efficient and fun trip to Cedar Point I’ve ever had. We spent more time riding and less time waiting, and we were able to hit everything we wanted (ten or so coasters plus a few other rides). That’s never happened for me in a single day before. And we left at around 6:30 PM – we did all this in about 7 ½ hours… not too shabby!

Funny that we knew our limits, though. I’m 50 now. I used to love spinny rides, but I learned a few years ago, I can’t do those anymore. The last time I rode the Spider at an amusement park, I was out of commission for hours. And Lisa knows she can’t do jerky rides anymore, so she stayed away from those.

That worked out well, too. We rode some coasters together, some were just me and Faith, and some rides were just Faith and Lisa.

Such a fun trip! And as icing on the cake, Lisa hooked us up and made us meals the night before for breakfast, lunch, and dinner. We had breakfast on the way, went out to the car for lunch (and some nice A/C!), and then had dinner on the ride back – all without spending crazy money at Cedar Point or on the road… probably a lot healthier, too!

Upcoming travel

I’ve already talked about this before, so I’m not going to dwell on it, but I’m excited about the guys’ weekend getaway coming up here shortly. It’s just going to be me and my closest high school friends in a VRBO in Kentucky.

Why Kentucky? Just because it’s central to where everyone’s living nowadays. This should be a lot of fun since it’s rare for us to get together, but when we do, we just fall back into the routine of laughing and busting each other’s chops. There’s some good hiking where we’ll be, too, so that’s a bonus.

The only downside is that when I get back, I only have three days before we leave for our big 38-night trip in Europe. That’s the one where we pulled off some crazy magic and it’s costing us only $3,200 for the whole trip, rather than the $25k price tag it would have cost us otherwise.

But, if that’s the worst downside, I guess life’s going pretty well!

We’re all really looking forward to this one. None of us has been to Europe before, so this will be a new adventure across the board. We’ll be spending the most time in Italy and Spain, but we’ve got two cruises that will be taking us to other countries as well.

On a related/unrelated note, Lisa and I just got done watching The Twisted Tale of Amanda Knox. Wow, this was a fantastic miniseries (8 episodes) based on the true story of Amanda Knox and her wrongful conviction in the murder of Meredith Kercher in Perugia, Italy. This was one of those shows that keeps your heart racing throughout. And the acting was great all-around, but Grace Van Patten is spectacular as Amanda Knox. Add that to your list to watch!

I remember when all this was going on for real – it was a media mess in both the U.S. and in Italy.

Anyway, that kind of brings some slight “what ifs” about going to Italy! 🙂 Nah, that’s not something we’re worried about, but it’s still a little disheartening.

We don’t get back from Europe until around Thanksgiving, so we’ll be jumping right into the holiday season.

After that, we get a little break until our two-week Hawaii trip in February. But we have some expiring airline miles and a hotel credit that we’re talking about packing into a couple-day trip somewhere before Hawaii. Anyone have some ideas on a good, quick, inexpensive trip somewhere in January?

So with a rocking-high net worth, showing some roller coasters who’s boss, and some exciting travel plans about to start, we’re having a great time. Life is always going to be full of ups and downs, but I’m hoping this “up” sticks around for a while! 😉

If you enjoyed this post and want to join in on the fun, why aren’t you on my mailing list? I’ll keep you in the loop when new posts are released, and I’ll also send you a selection of really cool spreadsheet freebies as a welcome gift. Look at all these goodies…

- Recurring Expenses Spreadsheet

(discussed in This Bad-@#$ Expenses Spreadsheet is My Gift to You) - Credit Card Rewards Tracker

(discussed in Travel Rewards – 12 Free Flights Earned in 9 Months!) - Portfolio Rebalancing Spreadsheet

(discussed in Portfolio Rebalancing: Get Your Asset Allocation in Line) - HSA Unreimbursed Expenses Tracking Spreadsheet

(discussed in Using Your HSA for Retirement – How to Track It Easily and Efficiently) - Roth IRA Conversion Ladder Calculator

(discussed in The Roth IRA Conversion Ladder Dilemma) - Alcohol Tracker

(discussed in Alcohol Tracking – I Spent Hours Creating This Spreadsheet I Hope to Use Very Little) - Next-Chapter Matrix / Bucket List

(discussed in Creating Your Dream Life: The Ultimate Bucket List Blueprint) - Upcoming Credit Card Bills Tracker

(discussed in My Game-Changing Spreadsheet to Track Upcoming Credit Card Bills) - Roth IRA Funds Available Now

(discussed in Roth IRA Withdrawals for Early Retirees: Tracking What’s Accessible Now)

Hope to see you there!

Plan well, take action, and live your best life!

Thanks for reading!!

— Jim

Congratulations!

Both for ten years of retirement and for nearly doubling your net worth in that time. Had you continued to work instead of retiring, how do you think that would have changed things?

I wish I had luck with “money”, other than the bad luck I have with it. I can invest any sum of money, only to watch it disappear in an instant. My Dad was an investment genius. He had the Midas Touch (similar to you) but was cursed with poor luck with real estate. I have managed to do pretty well with real estate, but I suck at investing money in stocks, bonds or anything in that venue.

Gracias, mi amigo! That’s an interesting question, but I’m sure we would have had an even bigger nest egg. I was pushing about 60% of our income into saving/investing, so if I had continued doing that (or more!) over the past 7 years of retirement, I could only imagine how big that pot would be. That said, I wouldn’t trade it for the world. I’ve loved every minute of early retirement and the time I got to spend with my family, especially being around while Faith grew up. We have enough so I think we did it just right! 🙂

Funny enough, you were one of the big motivators for me in the rental property world. In the end, it wasn’t for me, but I appreciate all your help in figuring that stuff out. With the other investments like the stock market, early retirement was what pushed me to figure that stuff out. That was just a matter of continuing to save/invest as much as we could and then learning more and more about the mistakes we were making and optimizing from there. I’m sure a little luck came into play along the way as well.

Hope you’re doing ok, Rich!

Did you just put the words “genius” and “Fritz” right next to each other? 😉

Glad to hear that Bucket Strategy is helping reduce your anxiety over the “roller coasters” of life (see what I did there?). Enjoy your trip to Europe. The first time is always the best, embrace every moment of it!

Haha, the ironic part is that I used to always tell everyone that I’m the genius (particularly with technology)! 😉 Yes, learning about the bucket strategy from you made a huge difference in our financial plan and makes me sleep a lot better at night with that in place.

Looking forward to Europe and focusing on being in the moment rather than thinking about writing. Super excited!

I hope you like it here in Italy! I live close to Rome, and I am from Venice.

Feel free to write me if you need any tips or ideas!

Oh, that’s so cool, Sabrina – Venice was a place on our list that we wanted to check out, too, if we had more time. Next time around, you’ll be hearing from me! 🙂

I don’t do roller coasters anymore. The spinny stuff was even earlier. Witches Wheel and The Monster got me. I’m glad my boys go with my wife as she loves coasters. They got passes last year for $99. Then they add Fast Pass so they can ride as much as possible.

I’m happy the market is up but the dollar is being devalued so everyone is going into hard assets like stocks, gold and silver. So in the end we are keeping up with inflation. Season CP passes up 25% 🙂

Haha, those spinny rides ruined us old fogies, Scott! I’m gonna hang in on the coasters for as long as I can though – I love those more anyway. That’s awesome that the family goes and rides ’em all. I’m still not sure how I feel about the Fast Pass, for me specifically. I know we could afford it, but at the same time, I hate that it’s kind of a middle finger to everyone else in line. I actually jotted some notes down about that last week for a blurb in a future post. And that has nothing to do with the people that buy it like your family – just a psychological thing with me where I would feel like a jerk with it. I need to stop overthinking everything! 🙂

Yeah, that’s crazy that season passes jumped 25%! Here, I thought we were getting a great deal, but it wasn’t as great of a deal as your family crushed it with. Nice job!

Bravo! You have been very generous to share your methods and techniques for investing in stock market, which has helped a lot of people out. You always have a lot of useful tips about money and other things, which makes the Route to Retire an interesting read.

Appreciate the kind words, David, and I’m glad it’s been helpful! 🙂

My wife would love those roller coasters. I’m not a huge fan, though. I’ll go with her, but I don’t have to like it. My son is older so maybe he can take my spot. Have a great trip in Europe and congratulations on hitting the $2 million milestone. That’s awesome. Being an investor is way better than being a worker.

I like the “I’ll go with her, but I don’t have to like it.” 🙂 Yeah, roller coasters aren’t for everyone.

Thanks for the congrats… you’re right about that – I’d rather be an investor any day!

Congratulations on reaching the 2mill milestone. Compound interest is indeed the 8th wonder of the world. Enjoy the travels and the holidays!

Thank you – much appreciated! Enjoy your holidays, too!