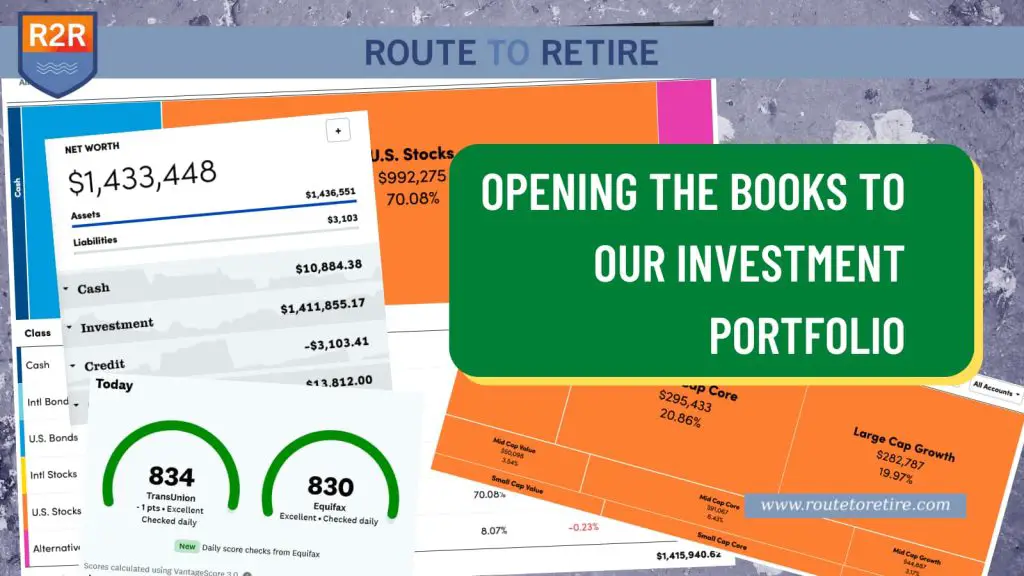

Opening the Books to Our Investment Portfolio

Ah, how time flies! In February 2019, I wrote a post called The Breakdown of Our Net Worth Savings & Investments that detailed our investment portfolio at the time. As you’d expect, it broke down all our assets and liabilities and gave a good snapshot of our financial picture. This was just a couple of months after I had retired from the corporate world so it gave us a pretty good baseline to start our retirement. But holy schnikes – […]

Opening the Books to Our Investment Portfolio Read More »